304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,205/MT(plus taxes) which is US$76/MT higher than that of last week, and the increasing percentage is 3.26%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,250/MT(plus taxes) which increases by US$76/MT, and the increasing percentage is 3.2%.

304/2B: The average price of 2.0*1240*C (mill edge) of Hongwang in the Wuxi market is US$2,090/MT(plus taxes) which is US$102/MT higher than last week and the increasing percentage is 4.65%. Besides, the average price of 2.0*1240*C (mill edge) of Hongwang in the Foshan market is US$2,095/MT(plus taxes) which increases by US$109/MT compared with last week and the increasing percentage is 4.72%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,040/MT(plus taxes) which increased by US$104/MT compared with last week and the rising percentage is 4.84%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,050/MT(plus taxes) which increases by US$99/MT compared to last week, and the increasing percentage is 4.6%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,000/MT(plus taxes) which rose by US$118/MT compared with last week and the increasing percentage is 3.67%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,035/MT(plus taxes) which increases by US$99/MT compared with that of last week, and the increasing percentage is 3.05%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,825/MT(plus taxes) which is US$134/MT more than last week and the increasing percentage is 4.41%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,870/MT(plus taxes) which increased by US$134/MT and the increasing percentage is 4.35%.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,225/MT(plus taxes) which is US$40/MT more than last week and the rising percentage is 3.25%. Besides, the tax-inclusive average price of the Foshan market is US$1,235/MT(mill edge) which increases by US$43/MT and the increasing percentage is 3.48%.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,190/MT(plus taxes) which is US$48/MT higher than last week and the rising percentage is 4.01%. Besides, the tax-inclusive average price of the Foshan market is US$1,205/MT(mill edge) which rises by US$57/MT and the increasing percentage is 4.72%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,415/MT(plus tax), which is US$25/MT higher than last week and the rising percentage is 1.71%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,365/MT(plus taxes) which increased by US$20/MT and the rising percentage is 1.45%.

Alarm! Is the sharp increase reaching the edge?

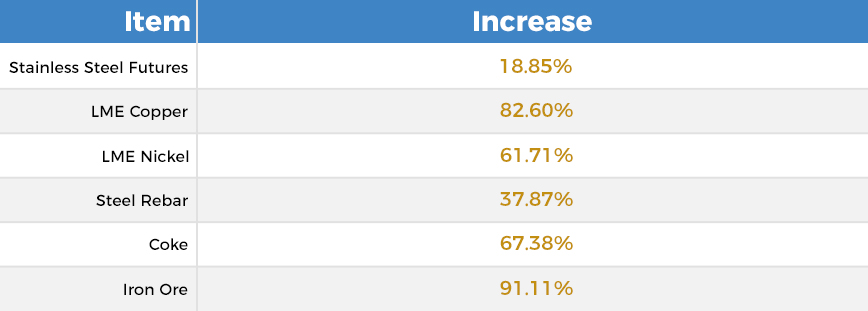

Lately, the commodities have been increasing. The commodities of black products in China increase greatly. The iron ore futures rushed over ¥1,000/MT(US$155/MT), the coke futures is closing to its historic highest point; the non-ferrous copper bounced back, LME copper reached its summit in the recent eight years , and LME nickel is closing to US$19,000/MT which is the highest price of last year. As for stainless steel futures, compared to the low price of November, it has bounced back by almost 8%.

The graph below is about the present prices and the increasing percentages compared to the lowest prices during this year.

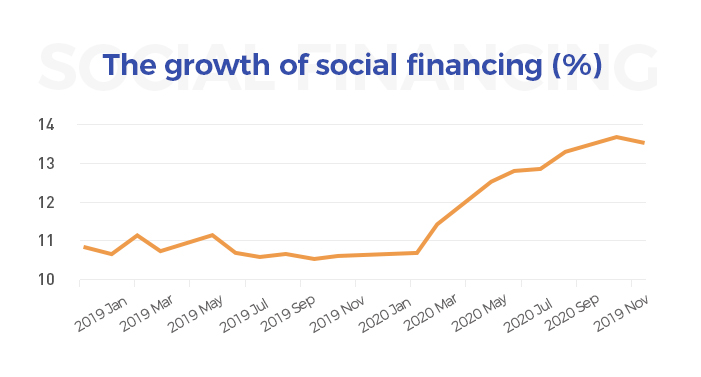

However, this increase in commodities is not a good sign for everyone. Lately, an international financial organization alarmed that as a measure of total credit growth, the growth rate of total social financing amount began to decline in November. In November, the growth rate of domestic social financing decreased from 13.7% in October to 13.6%, it is the first deceleration since the outbreak of the epidemic this year.

China's credit cycle is likely to peak ahead of schedule, plus some of the stimulus policies will withdraw in the future, demand is risking a downward trend, which will have a significant negative effect on commodities.

Many people in the industry share a concern about this increase because it reminds them of the domestic stimulus worth four trillion in 2008, which led to that the market fluctuated exaggeratedly.

An economic stimulus worth 4 trillion resulted in a roller-coaster-like commodities market.

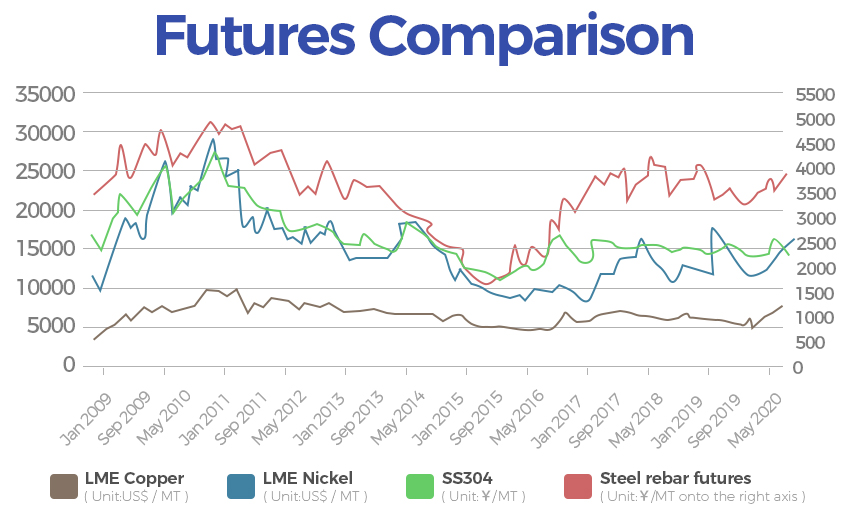

Throwing back to the historic issues, the US subprime mortgage crisis in 2008 is particularly outstanding. It started in July 2007 and broke out in September 2008, and finally evolved into a financial crisis affecting the world.

Influenced by the crisis, the economy in China also declined at a fast pace showing the falling export volume. To deal with the risk, in November of 2008, Beijing initiated ten measures to expand the domestic demand and maintain the economic development in a steady increase. According to the calculations at the time, the implementation of these ten measures would require an investment of about 4 trillion yuan (about US$621 billion in the current exchange rate) by the end of 2010, also named as "four trillion plan" in the market.

After the policy was launched, the entire commodity started a crazy rising pattern in 2009, and the whole rising trend basically continued until July 2011. During this period, the steel rebar futures was highly increased by 39%; the cumulative increase of LME copper was as high as 206%. Nickel has risen by 120%; stainless steel spot prices have risen by 40%.

The graph below shows the comparison between the increase during the QE (Quantitative Easing) in 2009 and 2020.

After the boosting factors, the commodities market had stayed in a bearish trend. What’s worst, LME nickel and steel rebar futures even fell down to their historic low price.

Some experts believe that when the global pandemic is still worsening, the market demand is restraint largely. But at this point, the commodity market increases which is against the overall market trend and the reason is that the QE policy is applied globally. For now, the fast increase in price also means that the commodities are quicker to close to the edge. Once the monetary policy goes tight, probably, the commodity market will end up with a continuous bearish trend for a long time just as in 2008.

China’s Central Economic Work Conference also announced that fiscal and monetary policies will be normalized next year(meaning that the policies will be gradually eliminated), but the easing policy will not exit the market in a rush, but after the unconventional easing policy has completed its mission, it will withdraw in the future.

TIPS:

A recent report by the World Metal Statistics Bureau showed that the global nickel market was oversupplied from January to October 2020, and the output was 63,700 tons higher than the apparent demand. But in 2019, the global nickel market was in a shortage of 27.6 thousand tons. The contrary of the recent two years evident that the global nickel market has been in weak demand, so the sharp increase of nickel owns to the investment and speculation.

Again! Increased by US$62/MT-US$78/MT. 430 production was limited.

Recently, the stainless steel market has been abnormal and declining, but only 400 series has kept in a boosting mode.

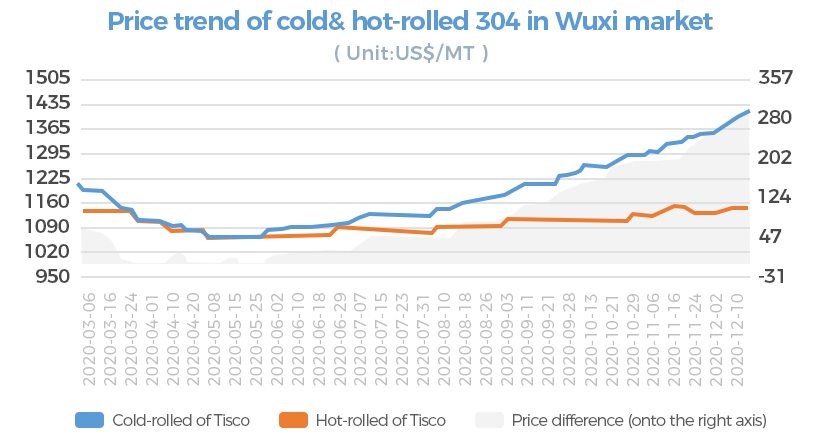

The price difference between the cold-rolled and hot-rolled products reaches US$311/MT!

Generally, in the first half of 2020, the market was in a downward tendency because of the various pressure from world issues. The cold-rolled products were sensitive to the market changes while the hot-rolled products reacted bluntly, making the cold-rolled and hot-rolled prices were closer and even equal to each other. In the second half of 2020, begun by the maintenance of TISCO, the market has gone through a boosting trend for 6 months.

-----------------------------------------------------------------------------------------------------------Stainless Steel Market Summary in China-----------------------------------------------------------------------------------------------------------