304/2B:The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$1,895/MT(plus taxes) which is US$3/MT less than last week and the declining percentage is 0.14%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,935/MT(plus taxes) which is also US$3/MT less than last week and the decreasing percentage is 0.14%.

304/2B:The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$1,835/MT(plus taxes) which is US$13/MT lower than last week and the declining percentage is 0.66%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,810/MT(plus taxes) which is also US$23/MT less than last week and the decreasing percentage is 1.18%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,760/MT(plus taxes) which decreased by US$27/MT compared with last week and the declining percentage is 1.44%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,790/MT(plus taxes) which is US$7/MT less than last week and the decreasing percentage is 0.38%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,655/MT (plus taxes) which dropped US$20/MT compared with last week and the decreasing percentage is 0.69%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US $2,710/MT(plus taxes) which is US$6/MT less than last week and the declining percentage is 0.20%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,490/MT(plus taxes) which is US$18/MT less than last week and the decreasing percentage is 0.69%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,515/MT(plus taxes) which is US$6/MT less than last week and the declining percentage is 0.21%。

201/2B: This week, the average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,055/MT (plus taxes) which is US$1/MT less than last week and the decreasing percentage is 0.13%. Besides, the tax-inclusive average price of the Foshan market is US$1,050/MT(mill edge) which decreases by US$40/MT compared to last week and the decreasing percentage is 1.23%.

J2, J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,000/MT(plus taxes) which is US$7/MT higher than last week and the rising percentage is 0.71%. Besides, the tax-inclusive average price of the Foshan market is US$990/MT(mill edge) which decreases by US$10/MT compared with last week and the declining percentage is 1.0%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$995/MT(plus tax), which is US$13/MT higher than last week and the rising percentage is 1.30%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,005/MT(plus taxes) which increased by US$6/MT and the rising percentage is 0.57%.

Boosting $64/MT, a good start for June.

April of 2020 was a month for bouncing back and May had a strong beginning but it got feeble in the latter May. In May, the base price of private-own enterprise rose from $1,730/MT to $1,815/MT. Until now, the price drops back to $1,785/MT. During this time, the largest increase reached $99/MT, but now it returns to an increase of $64/MT.

The speculation has gone; hot money is leaving.

Watching back the last month, the price trending of May is a platform stage after a round of rising. Except for the influence of COVID-19 in Indonesia, the reducing nickel production, and the upward stock price, the price was not fluctuated and affected much by other news and event. Thus, the speculation came to an end, so as the hot money. The transaction volume of the stainless steel futures and stock declines compared with that during the speculation term.

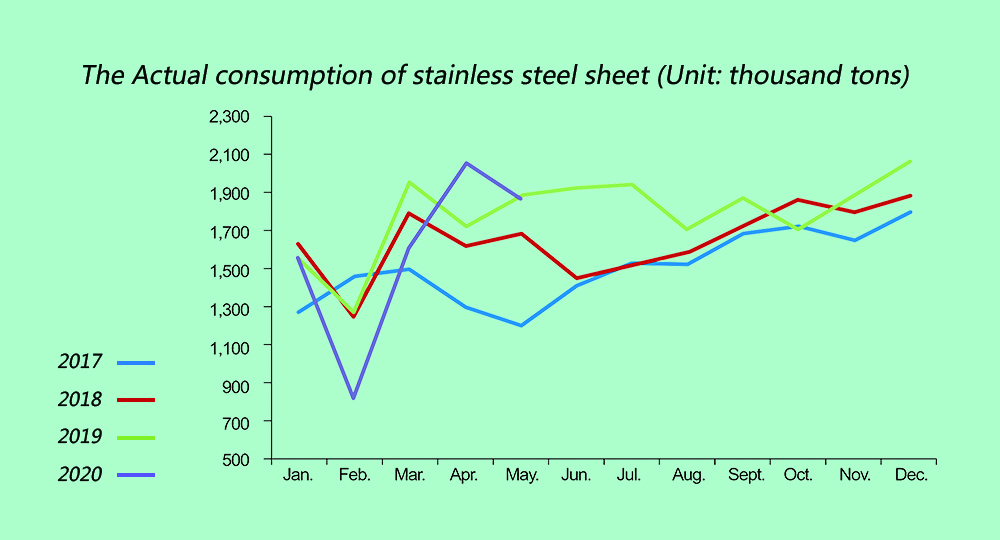

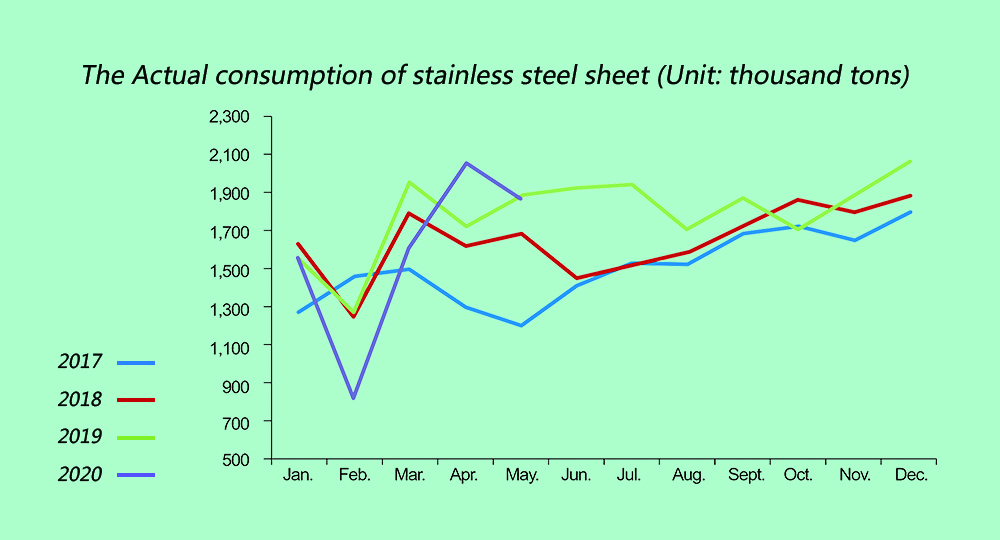

Deep down to the transaction volume, of Shanghai Futures Exchange stainless steel stock index contract made deals of 705 thousand in April and in May, this number decreased to 629 thousand. The stock transaction volume in May shared the same tendency. In April, the actual consuming volume domestic stainless steel sheet is 2,050 thousand tons, whereas, in May, the figure fell to 1,879 thousand tons.

The consumption volume set a new highest in April compared with the same period of 2019, but it decreased by 0.4% in May. Due to the inventory accumulation of the downstream buyers in March and April, the consumption volume climbs after the epidemic spreading in China. From January to April, the consumption volume of sheet sank 7.2% compared with the same period of last year.

Will the contradiction between supply and demand be reconciled?

In May, the action of accumulation reduced, and the later demand weakened. The May futures sold out in just one week, and the June futures orders took almost a month. From the perspective of the consumer driving force, the downstream demand is declining.

During April and May, the stainless steel market had been in a state of consuming inventory which means that the demand is larger than supply, but the speed is slowing down.

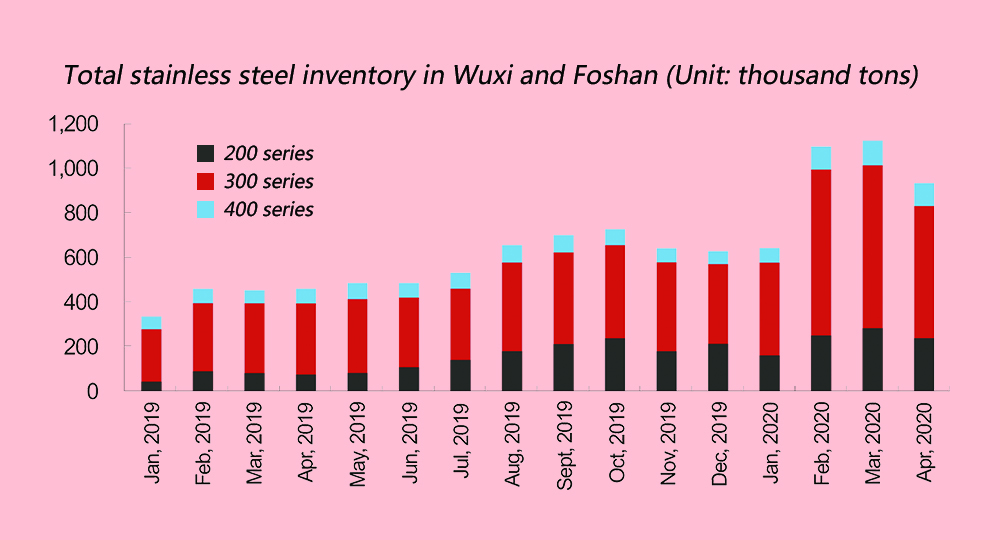

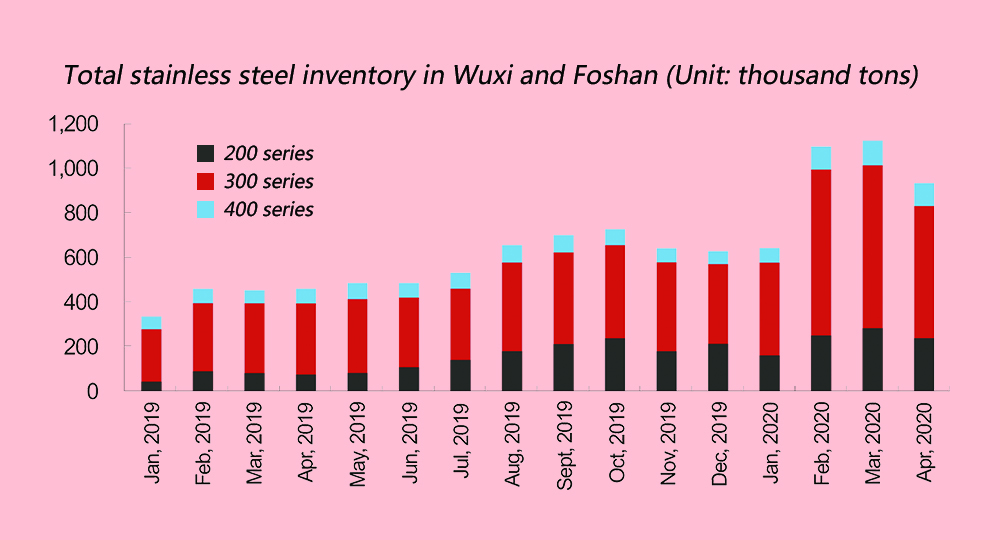

Analyzed based on the inventory of Wuxi and Foshan, the inventory of April decreased by 17% and in May, it continued to decrease by 8.5%, but the declining speed leveled down. Since it has been consuming the inventory, the stainless steel price remains high.

This will come to an end at last. From the perspective of demand and supply, a challenge is proceeding in June. It is predicted that the total supply of stainless steel sheets in June will reach 1,970 thousand tons. Because exports have been declining over the years in June, it is expected to fall by 2-3 million tons from May. If calculated based on consumption in May, the decline in inventories in June will continue to slow, and it is expected that the two places will decrease by 39,000 tons.

Note: Consumption of May is an estimated data.

As for the inventory in June, it locates at a comparatively low position which is close to the inventory of January of this year.

Will the consumption of June be the same as that of May? Seeing from the past years, consumption is affected a lot by the subjective factors.

To analyze based on the stock, the stock of May dropped by 62 thousand tons compared with April. In June, only when the stock falls 39 thousand tons, can the consumption of June maintain as May. From this angle, the inventory consuming speed is also reducing. Therefore, it is of a large possibility that the demand in June will be worse than May, and with the weak consuming force, the inventory may overstock.

Will the cost support the price at a high level?

The cost is another point to be focused on. In June, the bidding price of ferronickel given by the mills is $235/nickel, and the ferrochrome bidding price is $920/50 base ton. Thus, the cost of 304/2B(of 2.0mm in thickness) in June is $1,885/ton. With this price and cost, as long as the inventory remains, the cost will maintain the price at high.

In June, the cost of Tsingshan's futures---- the hot rolled and cold rolled are respectively $1,720/toon and $1,770/ton. The cold-rolled 304 costs of the trading system in June range from $1,735/ton to $1,785/ton. As the base price of the private-owned enterprise is close to the market price, it is a sign that the profit take is less. The trade will be placed at a subtle equilibrium period.

When the price is increasing, the cost is a driven force for the price to go up. This is effective when combined with subjective positivity. But when the price drops, people are panic, the contradiction between demand and supply will take place and the cost will drop as the price decreases.

Chromium is the most stable at cost and price in June. In April, the import of chromium fell, and the domestic ferrochromium companies were struggled to stay profitable, which kept the price high. Therefore, in June, 400 series will be of the most stable cost and rise in price. The supply of 400 series will reduce in June because Tisco will cut supply and Jisco will be in maintenance. The price trending of 400 series is estimated to be opposite to that of 300 series.

The cost of 300 series, from the point of ferronickel, is weaker than the stainless steel price trending. With the ferronickel delivery of Indonesia Vidal Bay Park back to China, the supply chain of ferronickel is worsening. On the other hand, the ferronickel bidding price is in a downturn. For example, having purchased ferronickel, Tsingshan is in a waiting period. In this section, the cost of 300 series is inferior to 400 series.

Stainless Steel Market Summary in China.

304/2B:The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$1,835/MT(plus taxes) which is US$13/MT lower than last week and the declining percentage is 0.66%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,810/MT(plus taxes) which is also US$23/MT less than last week and the decreasing percentage is 1.18%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,760/MT(plus taxes) which decreased by US$27/MT compared with last week and the declining percentage is 1.44%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,790/MT(plus taxes) which is US$7/MT less than last week and the decreasing percentage is 0.38%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,655/MT (plus taxes) which dropped US$20/MT compared with last week and the decreasing percentage is 0.69%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US $2,710/MT(plus taxes) which is US$6/MT less than last week and the declining percentage is 0.20%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,490/MT(plus taxes) which is US$18/MT less than last week and the decreasing percentage is 0.69%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,515/MT(plus taxes) which is US$6/MT less than last week and the declining percentage is 0.21%。

201/2B: This week, the average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,055/MT (plus taxes) which is US$1/MT less than last week and the decreasing percentage is 0.13%. Besides, the tax-inclusive average price of the Foshan market is US$1,050/MT(mill edge) which decreases by US$40/MT compared to last week and the decreasing percentage is 1.23%.

J2, J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,000/MT(plus taxes) which is US$7/MT higher than last week and the rising percentage is 0.71%. Besides, the tax-inclusive average price of the Foshan market is US$990/MT(mill edge) which decreases by US$10/MT compared with last week and the declining percentage is 1.0%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$995/MT(plus tax), which is US$13/MT higher than last week and the rising percentage is 1.30%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,005/MT(plus taxes) which increased by US$6/MT and the rising percentage is 0.57%.

Boosting $64/MT, a good start for June.

April of 2020 was a month for bouncing back and May had a strong beginning but it got feeble in the latter May. In May, the base price of private-own enterprise rose from $1,730/MT to $1,815/MT. Until now, the price drops back to $1,785/MT. During this time, the largest increase reached $99/MT, but now it returns to an increase of $64/MT.

The speculation has gone; hot money is leaving.

Watching back the last month, the price trending of May is a platform stage after a round of rising. Except for the influence of COVID-19 in Indonesia, the reducing nickel production, and the upward stock price, the price was not fluctuated and affected much by other news and event. Thus, the speculation came to an end, so as the hot money. The transaction volume of the stainless steel futures and stock declines compared with that during the speculation term.

Deep down to the transaction volume, of Shanghai Futures Exchange stainless steel stock index contract made deals of 705 thousand in April and in May, this number decreased to 629 thousand. The stock transaction volume in May shared the same tendency. In April, the actual consuming volume domestic stainless steel sheet is 2,050 thousand tons, whereas, in May, the figure fell to 1,879 thousand tons.

The consumption volume set a new highest in April compared with the same period of 2019, but it decreased by 0.4% in May. Due to the inventory accumulation of the downstream buyers in March and April, the consumption volume climbs after the epidemic spreading in China. From January to April, the consumption volume of sheet sank 7.2% compared with the same period of last year.

Will the contradiction between supply and demand be reconciled?

In May, the action of accumulation reduced, and the later demand weakened. The May futures sold out in just one week, and the June futures orders took almost a month. From the perspective of the consumer driving force, the downstream demand is declining.

During April and May, the stainless steel market had been in a state of consuming inventory which means that the demand is larger than supply, but the speed is slowing down.

Analyzed based on the inventory of Wuxi and Foshan, the inventory of April decreased by 17% and in May, it continued to decrease by 8.5%, but the declining speed leveled down. Since it has been consuming the inventory, the stainless steel price remains high.

This will come to an end at last. From the perspective of demand and supply, a challenge is proceeding in June. It is predicted that the total supply of stainless steel sheets in June will reach 1,970 thousand tons. Because exports have been declining over the years in June, it is expected to fall by 2-3 million tons from May. If calculated based on consumption in May, the decline in inventories in June will continue to slow, and it is expected that the two places will decrease by 39,000 tons.

Note: Consumption of May is an estimated data.

As for the inventory in June, it locates at a comparatively low position which is close to the inventory of January of this year.

Will the consumption of June be the same as that of May? Seeing from the past years, consumption is affected a lot by the subjective factors.

To analyze based on the stock, the stock of May dropped by 62 thousand tons compared with April. In June, only when the stock falls 39 thousand tons, can the consumption of June maintain as May. From this angle, the inventory consuming speed is also reducing. Therefore, it is of a large possibility that the demand in June will be worse than May, and with the weak consuming force, the inventory may overstock.

Will the cost support the price at a high level?

The cost is another point to be focused on. In June, the bidding price of ferronickel given by the mills is $235/nickel, and the ferrochrome bidding price is $920/50 base ton. Thus, the cost of 304/2B(of 2.0mm in thickness) in June is $1,885/ton. With this price and cost, as long as the inventory remains, the cost will maintain the price at high.

In June, the cost of Tsingshan's futures---- the hot rolled and cold rolled are respectively $1,720/toon and $1,770/ton. The cold-rolled 304 costs of the trading system in June range from $1,735/ton to $1,785/ton. As the base price of the private-owned enterprise is close to the market price, it is a sign that the profit take is less. The trade will be placed at a subtle equilibrium period.

When the price is increasing, the cost is a driven force for the price to go up. This is effective when combined with subjective positivity. But when the price drops, people are panic, the contradiction between demand and supply will take place and the cost will drop as the price decreases.

Chromium is the most stable at cost and price in June. In April, the import of chromium fell, and the domestic ferrochromium companies were struggled to stay profitable, which kept the price high. Therefore, in June, 400 series will be of the most stable cost and rise in price. The supply of 400 series will reduce in June because Tisco will cut supply and Jisco will be in maintenance. The price trending of 400 series is estimated to be opposite to that of 300 series.

The cost of 300 series, from the point of ferronickel, is weaker than the stainless steel price trending. With the ferronickel delivery of Indonesia Vidal Bay Park back to China, the supply chain of ferronickel is worsening. On the other hand, the ferronickel bidding price is in a downturn. For example, having purchased ferronickel, Tsingshan is in a waiting period. In this section, the cost of 300 series is inferior to 400 series.

Stainless Steel Market Summary in China.