304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,165/MT(plus taxes) which is US$13/MT lower than last week and the declining percentage is 0.58%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,205/MT(plus taxes) which went down by US$13/MT compared with last week and the decreasing percentage is 0.57%.

304/2B: The average price of 2.0*1240*C (mill edge) of Hongwang in the Wuxi market is US$2,095/MT(plus taxes) which is US$22/MT less than last week and the declining percentage is 0.99%. Besides, the average price of 2.0*1240*C (mill edge) of Hongwang in the Foshan market is US$2,065/MT(plus taxes) which decreases by US$38/MT compared with last week and the decreasing percentage is 1.73%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,015/MT(plus taxes) which decreased by US$41/MT compared with last week and the declining percentage is 1.91%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,030/MT(plus taxes) which is US$28/MT lower than last week and the decreasing percentage is 1.29%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,895/MT(plus taxes) which is US$18/MT lower than last week and the decreasing percentage is 0.57%. Moreover, the average price of 316L/2B 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,925/MT(plus taxes) which increases by US$3/MT and the rising percentage is 0.09%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,750/MT(plus taxes) which is US$44/MT lower than last week and the decreasing percentage is 3.28%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,780/MT(plus taxes) which remains as last week.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,095/MT(plus taxes) which is US$1/MT lower than last week and the declining percentage is 0.13%. Besides, the tax-inclusive average price of the Foshan market is US$1,090/MT(mill edge) which decreases by US$4/MT compared to last week and the decreasing percentage is 0.40%.

J2, J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,040/MT(plus taxes) which is US$3/MT less than last week and the decreasing percentage is 0.28%. Besides, the tax-inclusive average price of the Foshan market is US$1,045/MT(mill edge) which decreases by US$4/MT compared with last week and the declining percentage is 0.42%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,155/MT(plus tax), which is US$22/MT higher than last week and the rising percentage is 1.94%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,150/MT(plus taxes) which increased by US$15/MT and the rising percentage is 1.29%.

Breaking news: Circuit breaker fell in Indonesia. Mills intervened 304 price.

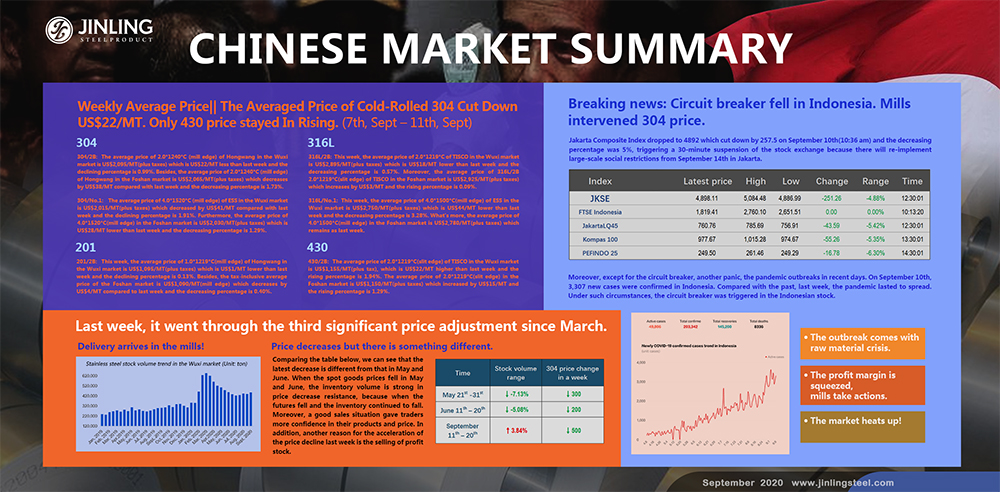

Jakarta Composite Index dropped to 4892 which cut down by 257.5 on September 10th(10:36 am) and the decreasing percentage was 5%, triggering a 30-minute suspension of the stock exchange because there will re-implement large-scale social restrictions from September 14th in Jakarta.

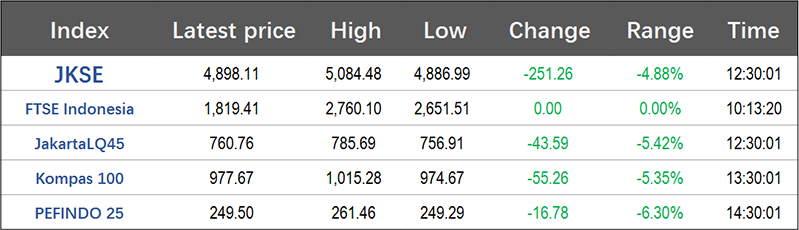

Moreover, except for the circuit breaker, another panic, the pandemic outbreaks in recent days. On September 10th, 3,307 new cases were confirmed in Indonesia. Compared with the past, last week, the pandemic lasted to spread. Under such circumstances, the circuit breaker was triggered in the Indonesian stock.

The outbreak comes with raw material crisis.

If the pandemic can not be controlled in the coming days, it will cause uncertainty to the production of ferronickel.

Another uncertainty is the nickel ore.

Since last week, the price of nickel ore was still rising rapidly. So far, the external quotation of 1.5% concentration nickel ore has risen to more than US$65/MT, and some quotations were as high as US$67/MT. The mainstream ore price has risen by US$4-5/MT.

The nickel ore price increased, the spot goods of high ferronickel is difficult to find. There is news saying that, Recently, some steel mills failed to purchased enough high-nickel iron as raw materials, resulting in the production of 300 series stainless steel failed to meet expectations.

The dispute in the raw material is ongoing. However, for now, the stainless steel price is going down, another opinion goes like: the mills will definitely stress the ferronickel price to decrease to protect the profit margin. Also, the profit of the ore is quite substantial for now, so the decreasing possibility is high.

The profit margin is squeezed, mills take actions.

Taking the current US$175/nickel of ferronickel, the production cost of hot-rolled 304 is US$1,995/MT, sharing the same price of the opening price of hot-rolled in Tsingshan. It is evident that the stainless steel price has reached a cost defensive position.

On this joint, it is foreseen that all steel mills will unite to guard the price.

The sudden drop led to a panic in the market. The quotation of 304 cold-rolled products decreased to US$1,960/MT. Steel mills started to control the volume to maintain the spot price of 304 cold-rolled.

Last Thursday, Delong issued a notice, requiring that the products should not be sold below the specified price. Even earlier, Tsingshan has already notified this. Therefore, under the strict "price control" by steel mills, the price trend is stable.

The market heats up!

The decrease in September surprises everyone. Inventories, costs, and stainless steel demand have not shown a significant drop; the only worry is that after November, the nickel supply and demand situation will gradually ease, and the external market long position begins to cash out which results in a decline. The long position begins to cash out, triggering a drop in nickel and stainless steel prices.

Last week, it went through the third significant price adjustment since March.

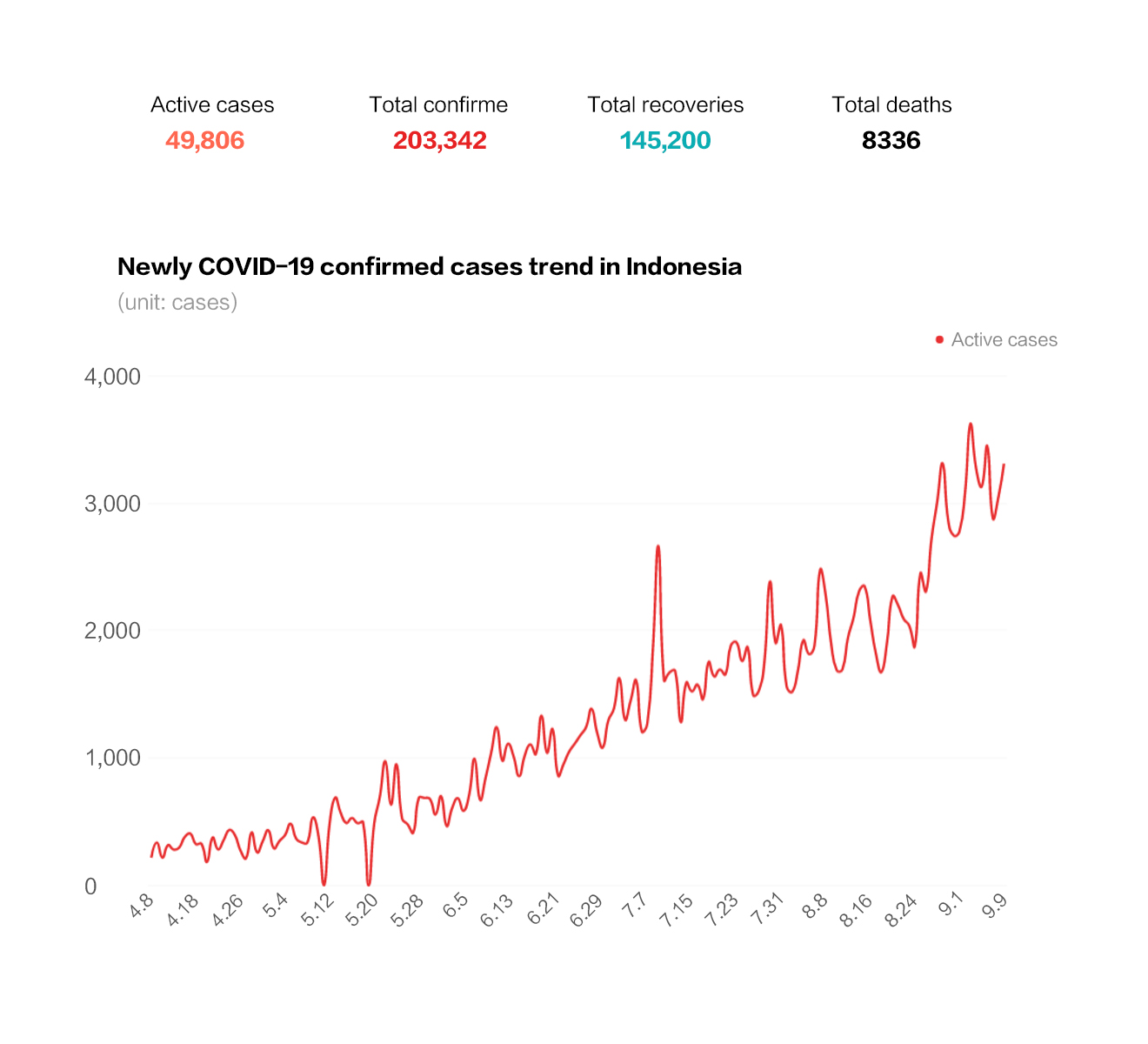

The price of 304 dropped the greatest, but the new delivery also arrived quickly. After five months, in the Wuxi market, the stainless steel inventory shows an obvious rising trend for a week. How come?

Delivery arrives in the mills!

There is always a saying that the new arrivals come when the price is decreasing. The feedback from the market seems strong evidence of the words. Last week, the new arrivals became more in the Wuxi market.

In early September 2020, the stainless steel inventory in Wuxi was 450,900 tons, increases by 16,700 tons and 3.84% from the end of August. Cold-rolled product inventory increased by 3.42% month-on-month;

Last week, resources arrived are generally, Tsingshan hot rolling 300 series, Yongjin cold rolling 300 series, 200 series 300 series of Chengde, and cold rolling 200 series of Baosteel Desheng.

It’s worth noting that the market arrival resources are “fresh” resources that have just been ordered. It took less than 10 days to place an order since September, and the resources have already arrived on the market!

Price decreases but there is something different.

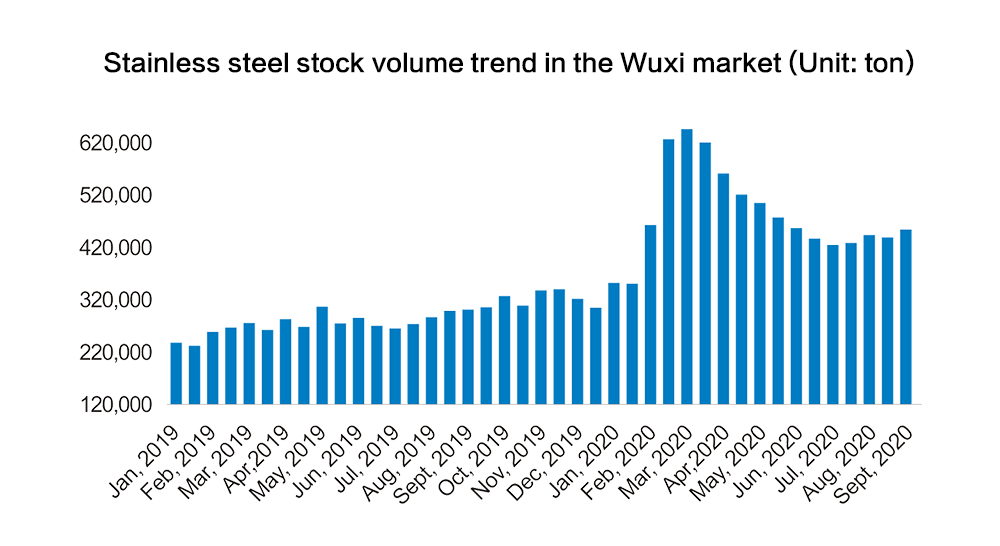

The trend of stainless steel of this year is quite clear to people. After the overall rise in March, the price has experienced two obvious decreases. One is from May to June, the price corrected to decrease by 7.7%. Another is this time in September. So far, the futures price has decreased by 8.6% from the highest price.

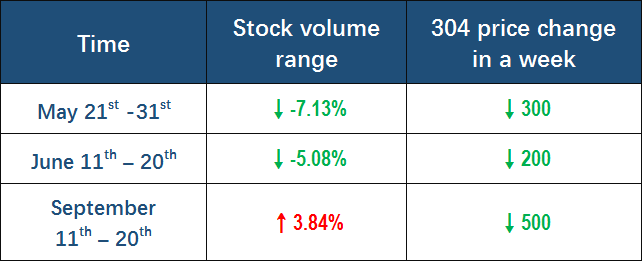

Comparing the table below, we can see that the latest decrease is different from that in May and June. When the spot goods prices fell in May and June, the inventory volume is strong in price decrease resistance, because when the futures fell and the inventory continued to fall. Moreover, a good sales situation gave traders more confidence in their products and price. In addition, another reason for the acceleration of the price decline last week is the selling of profit stock.

Summary:

From the current point of view, the delivery speed of steel mills in September has accelerated, and the stainless steel production in September is already at a high level, so the current rising inventory indeed causes concerns. After all, the market has been crying for stockout for so long, and steel mills have suddenly promoted their deliveries, which leads a shock to the market.

--------------------------------------------------------------------Stainless Steel Market Summary in China--------------------------------------------------------------------