304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,415/MT(plus taxes) which is US$1.15/MT less than that of last week, and the decreasing percentage is 1.15%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,460/MT(plus taxes) which decreases by US$30/MT, and the decreasing percentage is 1.13 %.

304/2B: The average price of 2.0*1240*C (slit edge) of Hongwang in the Wuxi market is US$2,200/MT(plus taxes) which is US$50/MT lower than that of last week, and the decreasing percentage is 2.12%. Besides, the average price of 2.0*1240*C(slit edge) in the Foshan market is US$2,215/MT(plus taxes) which cut down by US$11/MT, and the decreasing percentage is 0.46%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,235/MT(plus taxes) which decreased by US$48/MT compared with last week and the declining percentage is 2.04%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,275/MT(plus taxes) which decreased by US$34/MT compared to last week, and the decreasing percentage is 1.42%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,375/MT(plus taxes) which decreased by US$12/MT compared with last week and the decreasing percentage is 0.34%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,350/MT(plus taxes) which remains as last week.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$3,185/MT(plus taxes) which is US$28/MT lower than last week and the decreasing percentage is 0.82%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$3,210/MT(plus taxes) which decreased by US$12/MT compared to last week and the decreasing percentage is 0.36%.

201/2B: This week, the average price of 1.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$1,335/MT(plus taxes) which is US$12/MT less than last week and the declining percentage is 0.91%. Besides, the tax-inclusive average price of the Foshan market is US$1,335/MT(mill edge) which is US$11/MT lower that last week and the decreasing percentage is 0.80%.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,280/MT(plus taxes) which is US$2/MT lower than last week and the decreasing percentage is 0.12%. Besides, the tax-inclusive average price of the Foshan market is US$1,260/MT(mill edge) which decreases by US$20/MT and the decreasing percentage is 1.58%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,580/MT(plus tax), which is US$14/MT lower than last week and the decreasing percentage is 0.86%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,580/MT(plus taxes) which decreased by US$14/MT and the declining percentage is 0.86%.

The tax rebate of stainless steel might be reduced or canceled.

It has been overwhelming in the stainless steel market about the tax rebate issue—— China will reduce the exporting tax rebate rate to limit the export volume of rebar and HR coil.

What if the stainless steel export rebate to be reduced or canceled, what is going to happen to the whole stainless steel industry?

Macroeconomy:

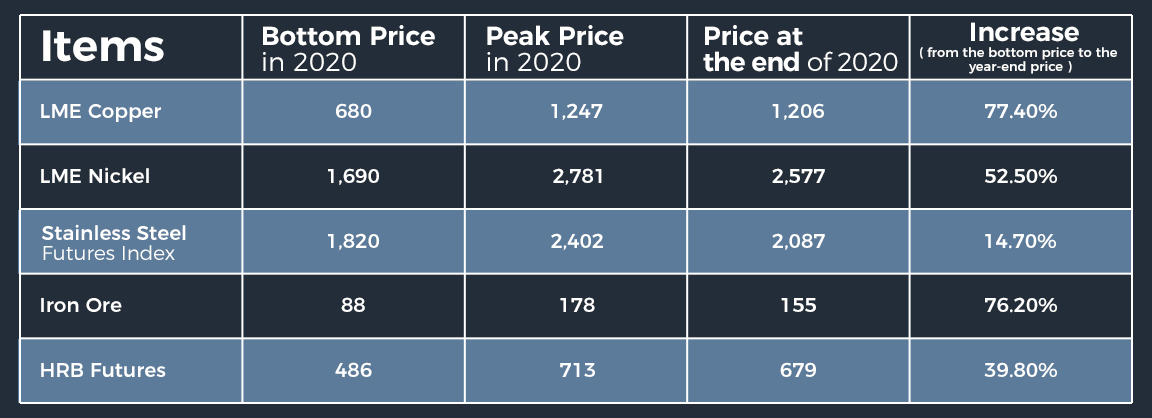

Covid-19 hits in 2020 and affects the world. Major global economies have launched a large number of loose stimulus policies. Driven by the financial force, commodity futures have a frantic rise in the market, and some have even reached historical highs.

Except for the capital force, Beijing also encourages domestic demand to boost the market from the gloom. As the demand gets higher, the prices of raw materials and products also increase. However, the sharp increase in the raw material cost is not a welcoming sign to China’s market. Raw material has always been of large demand in China, typically, iron ore. As the largest consumer of iron ore in the world, China relies much on importing from other regions. More than 80% of the iron ore has to be imported to support the production in China. The large rise in the iron ore price boosts the production cost of Chinese manufacturers. If this situation lasts, all the profit will go to the international giants, instead of the Chinese manufacturers.

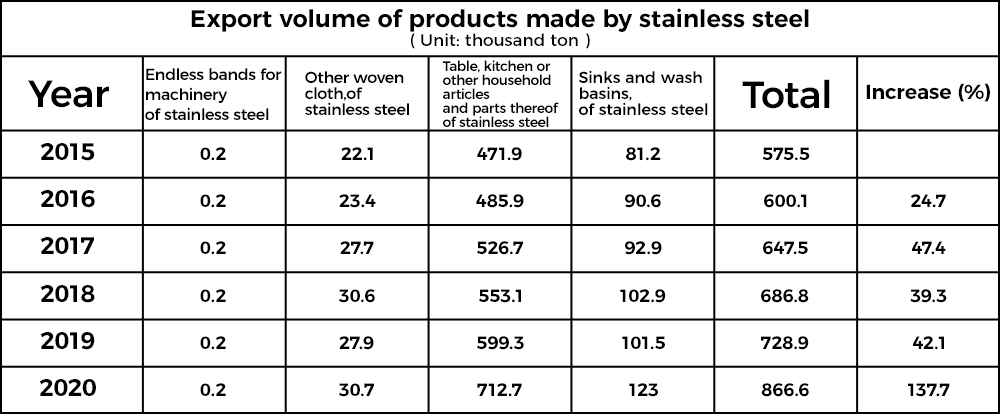

1.The export of stainless steel and the products of stainless steel in China from 2015 to 2020

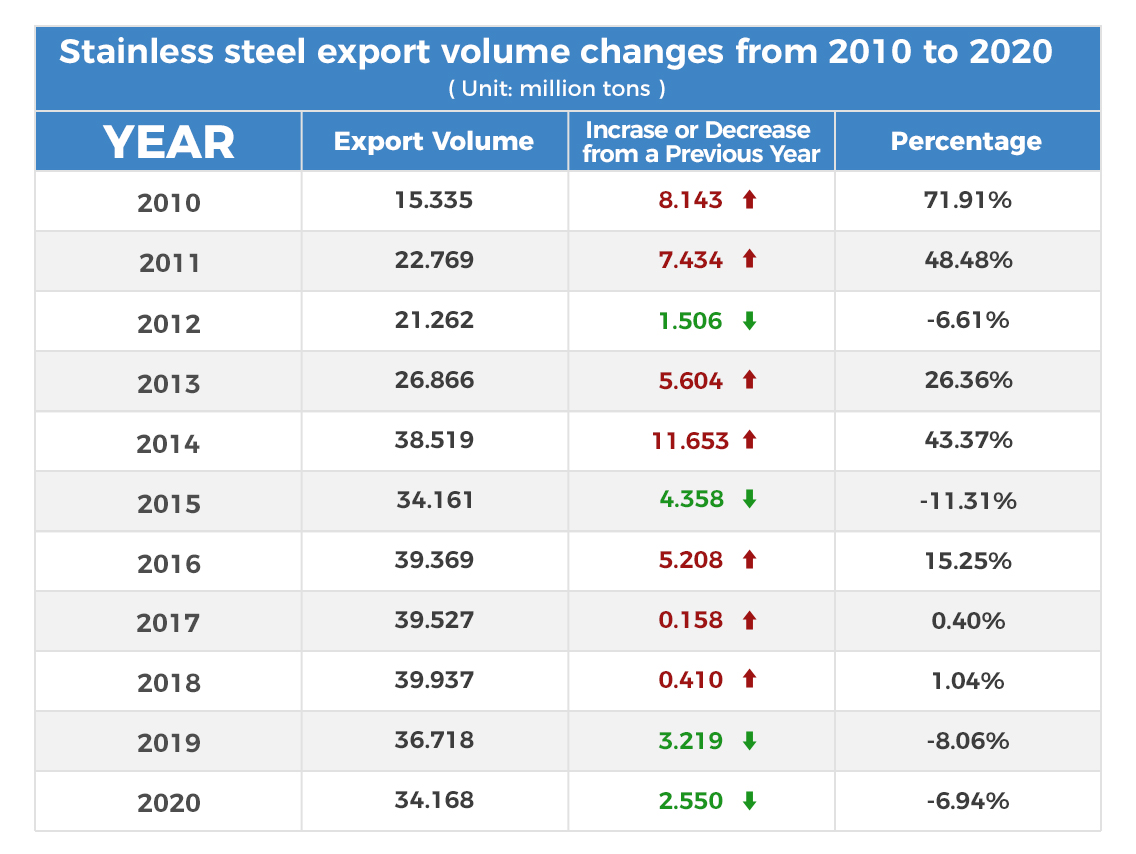

From 2010 to 2020, China’s export volume was in a large increase, but since 2019, the export volume has shown a declining trend, while the stainless steel products have been increasing year by year. From this side, the tax rebate issue will have a greater influence on the stainless steel product manufacturers.

2.If the stainless steel export rebate to be reduced or canceled, how will the stainless steel price react?

From a short-term view, the issue will bring a large effect to the steel market, because the purchasing cost of the abroad buyers will increase and the foreign purchase preference will reduce as well. The decrease in the export volume will return to China’s market, which means that the extra volume used to be consumed by the abroad market will leave for China’s market to consume. The increasing steel supply in China must bring down the steel price.

But in a long run, Chinese steel mills will no longer take the abroad market as their priority and they won’t increase production as their only goal. This though also meets the goals(carbon neutrality and peak carbon dioxide emissions) of the government. The decrease in tax rebates will force the steel mills to relieve the overcapacity. When the steel mills and the manufacturers reduce the export volume and turn more to the domestic market, the capacity will become stable and keep a balance between production and consumption, which will boost the stainless steel price.

As for all the steel mills in the world, the action in China that the tax rebate on steel export might be decreased or canceled means that the stainless steel coil and some products “made in China” is no longer a byword of low price. Therefore, the stainless steel producers in Japan, Korea, India, Vietnam, and other Asia Pacific countries will have larger competitiveness in price.

3. Cutting tax rebate rate down is of large possibility.

News released that the government will have actions about reducing the tax rebate rate on steel export recently. Once the action is announced, it will be closer to execution. Steel, stainless steel, and stainless steel products are all affected. How many will the rate be cut down to? 3%, 5%, 6% are all possible. Moreover, it is not impossible that some materials of steel and stainless steel, and stainless steel products will cancel the tax rebate.

201 will still remain at high; 304 will increase; the production of 430 has arranged to June.

It is unusual that steel mills want to increase the stainless steel price. But why? Will their actions work?

201: Cost is high. Steel mills remain the price.

The production cost of steel mills is still high. Influenced by the price of iron ore recently, the low ferronickel is high in price. The price of 201 scraps is affected by the stainless steel, and 201 is facing insufficient supply. The raw materials of 201 production in April basically was defined in March, and the cost is high. Therefore, steel mills are unwilling to reduce the price.

Supply and demand:

For now, steel mills have realized that the 201 inventory volume is high, so they have reduced the investment in the market. A giant mill even wants to produce 30 thousand tons of carbon steel in April, which is a positive sign to the 201 market. As for the demand side, 201 stops decreasing in price and tends to maintain. With this trend, the downstream buyers begin to purchase. The processing of the flat products is busy, showing that the demand for 201 is towards good.

With the profitable products consumed and the increasing price by the steel mills, the market tends to stop decreasing the price and it shows a trend to increase. But the major factor to the changing price is whether steel mills will decrease the delivery volume to the market or not.

304: Resources are in steel mills. The pressure on market stock is alleviating.

Last week, the inventory of 300 series in the Wuxi market kept increasing, but the new arrivals mostly belong to the steel mills, while the inventory of traders is decreasing wholly because the market is in a state of alleviating the inventory. In a short time, the pressure of selling off will be eased.

Besides, from the perspective of cost, the raw materials used in production now are bought from the previous one or two months when the raw materials were expensive. Combined with the stainless steel price now, most steel mills are in a status of cost over price. Therefore, in the future market, people have a strong expectation towards a higher price.

However, it is possible that in the later time, the supply like the nickel ore from the Philippines and ferronickel from Indonesia will reduce the cost and thereby reduce the stainless steel price as well.

430: Supply and demand head well. The production is arranged to June.

Raw material supply:

In March, the high chrome production in Inner Mongolia decreased by about 20-30 thousand tons. But in Shanxi, Sichuan, Guizhou, and Hunan provinces, more factories begin to work and so the production volume is increasing and there will be more in the following time. In March, the production of the month is about 470 thousand tons which increased less than the increased percentage in February.

April is a key period of the bidding process and a major factor that affects the future price trend of high chrome. Until April, when the high chrome factories begin to work, the price of high chrome is predicted to rise. After April, the power rationing policy will become loose, so there will be more large-scale furnaces working. We calculate that, from March to April, there are 8 factories ready to work.

The point is that after the first-phase power rationing stops in Inner Mongolia, the production of high chrome will increase in April. Affected by the increasing production in April, it is of large possibility that the purchasing price by the steel mills will maintain.

Summary of 400 series:

The supply of 400 series increases. The former inventory of Tisco increases by about 2.5 thousand tons, which gives heavy pressure on the factories and other sellers. However, the buyers have a reserved attitude towards purchasing. Although traders turned better in the transaction, from a broader view, the transaction was plaint.

Recently, the abroad demand for home appliances has been strong. Before February, some factories said that the orders have already been arranged for June. When it comes to the second season, the construction in China recovers, so the industry is optimistic about the demand.

Because the inventory is high now and buyers are not so engaged in buying, the price of 430 is to be decreased in a small range probably. We predicted that the decreasing range shall be around US$8-US$16/MT. The price might fall at US$1,555/MT –US$1,570/MT.

Summary:

The price of raw materials does not show an obvious trend to decrease, which means that in April, the production cost of steel mills is still high and so steel mills are unwilling to cut down the price. For now, people mostly are lack confidence to buy because the overall price is decreasing. The market is rather bland now, although steel mills have given several increasing-price announcements. Let’s wait and see whether the future actions of steel mills will support the price to rise.

-----------------------------------------------------------------------------------------Stainless Steel Market Summary in China----------------------------------------------------------------------------------------