304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,205/MT(plus taxes) which remains as last week. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,245/MT(plus taxes) which remains as last week.

304/2B: The average price of 2.0*1240*C (mill edge) of Hongwang in the Wuxi market is US$2,115/MT(plus taxes) which is US$2/MT higher than last week and the rising percentage is 0.07%. Besides, the average price of 2.0*1240*C (mill edge) of Hongwang in the Foshan market is US$2,110/MT(plus taxes) which increases by US$5/MT compared with last week and the increasing percentage is 0.20%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,080/MT(plus taxes) which increased by US$17/MT compared with last week and the rising percentage is 0.76%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,065/MT(plus taxes) which is US$18/MT higher than last week and the increasing percentage is 0.84%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,925/MT(plus taxes) which is US$12/MT lower than last week and the decreasing percentage is 0.39%. Moreover, the average price of 316L/2B 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,975/MT(plus taxes) which remains as last week.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,780/MT(plus taxes) which is US$11/MT lower than last week and the decreasing percentage is 0.36%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,810/MT(plus taxes) which remains as last week.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,135/MT(plus taxes), and the tax-inclusive average price of the Foshan market is US$1,125/MT(mill edge). Both of the price remain as last week.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,080/MT(plus taxes) which is US$8/MT higher than last week and the increasing percentage is 0.70%. Besides, the tax-inclusive average price of the Foshan market is US$1,080/MT(mill edge) which remains as last week.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,305/MT(plus tax), which is US$71/MT higher than last week and the rising percentage is 5.36%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,285/MT(plus taxes) which increases by US$79/MT compared with last week, and the rising percentage is 6.03%.

LME nickel cut down US$500. Surprisingly, the stainless steel price remains.

In a glimpse, it turns to October’s end. The nickel market stops increasing until several days ago when it has begun to drop. Last Friday (Oct 23rd), the LME nickel closed at US$15,600/MT which cut down US$195. In the recent three transaction days, it has decreased by US$450. The Asian side keeps declining till now, which dropped by US$90 within one day.

One week ago, LME nickel boosted, and the steel mills stopped selling to push up the price. But the stainless steel spot price didn’t increase at all. People think it is because of the week's demand. This time, LME nickel has cut down by US$500 and stainless steel remains, which is beyond people’s expectations. Why can the stainless steel resist the decrease?

The real demand would buy and the stock is not stacked.

Lately, some traders told us that the price has been stable. Products with special specifications are rare, which maintain at a good price. Therefore, many downstream buyers who have real demand on hand have to buy the products despite the price.

Besides, steel mills have controlled the stock quantity. The stainless steel spot products can not fully supply to the market. Sheet products are partly out of stock, boosting up a higher price of the products.

As for the manufacturers, the order volume is considerable in October. However, there are more high-price resources in the market, so the traders are unwilling to reduce the price to increase the sale.

304 remains the price. Some reduce US$8/MT.

On October 26th, in the Wuxi cold rolling market, the 4-feet mill-edge product price of Delong and Chengde maintain at US$2,060/MT-US$2,070/MT (US$2,130/MT-US$2,135/MT in 2.0slit); that of Yongjing is around US$2,090/MT (US$2,155/MT in 2.0 slit). In the hot rolling market, EST and other private-owned steel mills reduce the 5-feet product price to US$2,060/MT.

The hot rolling product has increased before, so the decrease of this time is a drop from high, but the steel mills keep pushing the price mainly. An opinion is like: because the new hot rolling resources are coming to the market, people won’t reserve the products anymore, and naturally, the price will decline.

The short-term trend of nickel, however, remains bearish.

In the second half of October, the World Bureau of Metal Statistics (WBMS) released the latest report, showing that in 2020 from January to August, the global nickel supply surplus reaches 45 thousand tons, while in 2019, the global nickel supply was in shortage for 27.6 thousand tons. Compared with the LME nickel inventory report at the end of 2019, in the latter August 2020, it is 85.4 thousand tons higher. Chinese demand is recovering, but from a global perspective, it still fails to recover from the pandemic, resulting in the nickel supply surplus.

What’s more, presented by the custom data, in September, the nickel ore imports to China is around 6.209 million tons which increases by 2.463 million tons compared to that in August. The imports from the Philippines are 8.4882 million tons which are 2.1041 million tons more than that of August. The imports from the Philippines do not decrease during the pandemic, which reduces the pressure on China’s nickel ore supply.

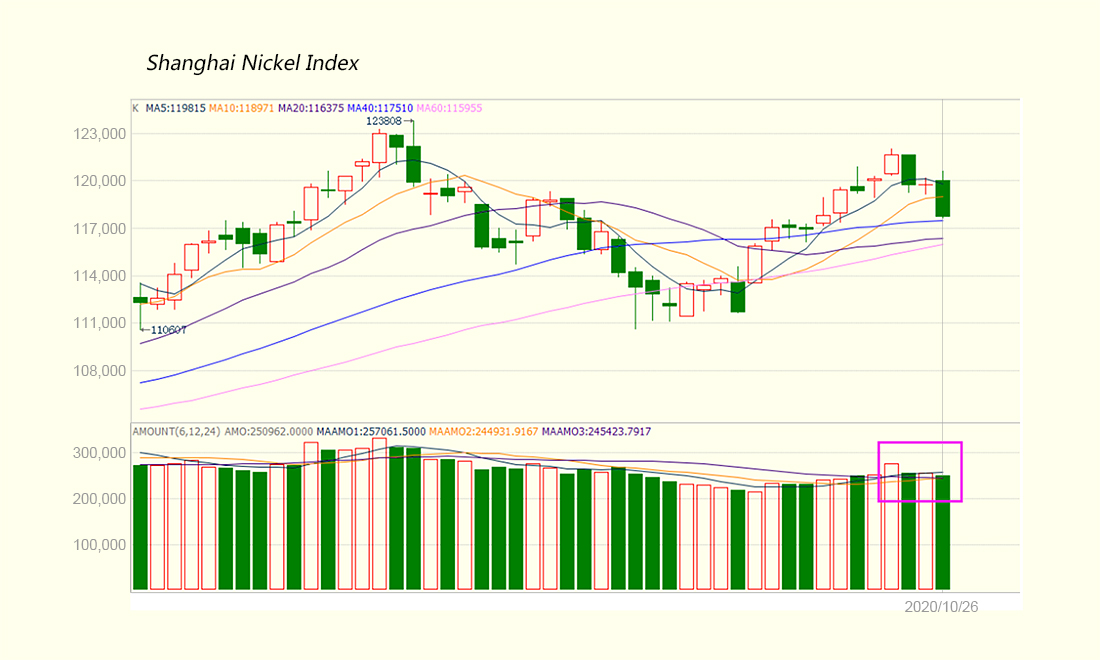

Therefore, in a short term, the nickel market is bearish. The price reduces from high. In the Shanghai Futures Exchange, the short investment keeps withdrawing from the nickel market and more withdraws in the profit. Compared with last Wednesday, the Shanghai nickel positions have decreased by more than 24,000 plots.

Summary: At the end of October, the bearish situation is only a short time of thing. The inventory pressure on stainless steel is little, manufacturers are busy, and traders are in delivery and finish the payment.

Nickel ore spikes to 60%! Inventory is intense.

In 2020, a sudden epidemic stirred the whole world. In this epidemic, people's life and industries have undergone great changes. Recently, as reported, international shipping containers are in short, and the price has soared nearly three times!

This is because of the pandemic, the international logistics capacity declines, which has led to a sharp increase in container ship freight rates, and the freight rates of the US West route have increased nearly three times from the beginning of the year.

Many exporters complain that since May this year, shipping prices have been rising. It is difficult for them to book a container in many shipping routes, which puts much pressure on the logistic cost.

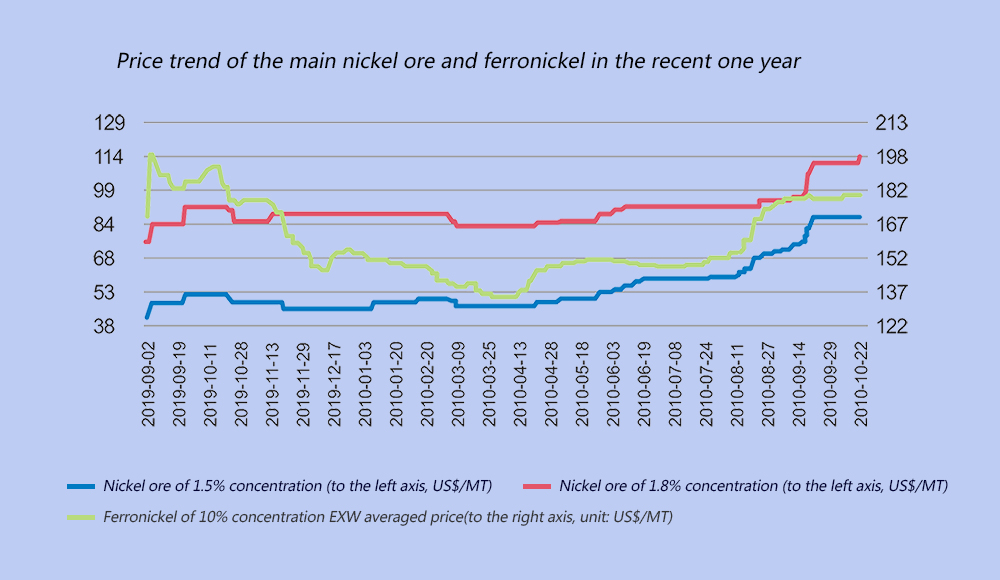

The cost increase also happens in the recent ferronickel market. The Philippines, the largest nickel ore importer to China, it will enter the rainy season. At that time, the difficulty of transporting nickel ore will further increase, and factors such as the epidemic and the increasing freight, have become the important clues for the recent increasing nickel ore price.

With the climbing nickel ore price, the cost of Chinese ferronickel production is also increasing. Compared with the same period of last year, the CIF quotation of the nickel ore of 1.5% concentration increases by 60%.

In October 2019, the CIF price of the nickel ore of 1.5% concentration was US$47/MT, but now the price has increased to US$75/MT.

However, the price of ferronickel does not keep up with the nickel ore price. On the contrary, while in October 2019, the high ferronickel EXW price was US$193/nickel, the current price decreases to US$180/nickel. Compared with the same time in the last year, the profit margin of ferronickel producers squeezes greatly.

Shortly, Chinese ferronickel producers will face greater pressure. On one hand, the nickel ore price keeps increasing due to the lower imports from the Philippines; on the other hand, the expansion of ferronickel imports from Indonesia has suppressed domestic prices of ferronickel.

According to the customs data, in August, the ferronickel imports to China are 291.9 thousand tons, increased by 9.31% compared with that of last month, and 101.65% higher than that of August 2019. There is a prediction that the ferronickel imports to China in September increased and then it will decline slightly in October.

From the perspective of domestic high-nickel iron production, as the cost of nickel ore has risen sharply, some small and medium-sized factories with tight nickel ore resources are less active in production. In the middle of this month, all four production lines of a high-nickel iron factory in Inner Mongolia have stopped producing.

Currently, the large-scale ferronickel factories have sufficient ore inventory, and the production in the fourth quarter will run as usual. In general, due to the increasing price of nickel ore and quantity of imported ferronickel, the growth rate of the Chinese high-grade ferronickel has slowed down. However, the freight and nickel ore prices will increase. Therefore, the Chinese ferronickel price is less likely to decrease. In a short time, it is predicted to increase.

-------------------------------------------------------------------------Stainless Steel Market Summary in China------------------------------------------------------------------------