304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,205/MT(plus taxes) which is US$6/MT higher than last week and the increasing percentage is 0.26%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,245/MT(plus taxes) which went up by US$6/MT compared with last week and the increasing percentage is 0.26%.

304/2B: The average price of 2.0*1240*C (mill edge) of Hongwang in the Wuxi market is US$2,115/MT(plus taxes) which is US$8/MT higher than last week and the rising percentage is 0.34%. Besides, the average price of 2.0*1240*C (mill edge) of Hongwang in the Foshan market is US$2,105/MT(plus taxes) which increases by US$59/MT compared with last week and the increasing percentage is 2.7%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,065/MT(plus taxes) which increased by US$32/MT compared with last week and the rising percentage is 1.5%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,045/MT(plus taxes) which is US$6/MT lower than last week and the decreasing percentage is 0.28%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,940/MT(plus taxes) which is US$12/MT lower than last week and the decreasing percentage is 0.39%. Moreover, the average price of 316L/2B 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,975/MT(plus taxes) which remains as last week.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,790/MT(plus taxes) which is US$14/MT lower than last week and the decreasing percentage is 0.46%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,810/MT(plus taxes) which is US$3/MT lower than last week, and the decreasing percentage is 0.1%.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,135/MT(plus taxes) which is US$12/MT higher than last week and the increasing percentage is 1.1%. Besides, the tax-inclusive average price of the Foshan market is US$1,125/MT(mill edge) which increases by US$40/MT compared with September.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,070/MT(plus taxes) which is US$12/MT higher than last week and the increasing percentage is 1.1%. Besides, the tax-inclusive average price of the Foshan market is US$1,080/MT(mill edge) which rises up by US$6/MT and the increasing percentage is 0.56%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,245/MT(plus tax), which is US$40/MT higher than last week and the rising percentage is 0.10%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,215/MT(plus taxes) which increases by US$32/MT compared with last week, and the rising percentage is 2.6%.

Stainless Steel Production Will Cut and Increase the Price. Is it a new driven force to a higher 304 price?

“Due to the pandemic, world steel production and demand both decline during this year. Stainless steel manufacturers reduce the output but in China, with the economy recovering, steel production and demand are on a rise. The Chinese stainless steel production takes about 60% of the global stainless steel production”, an expert states.

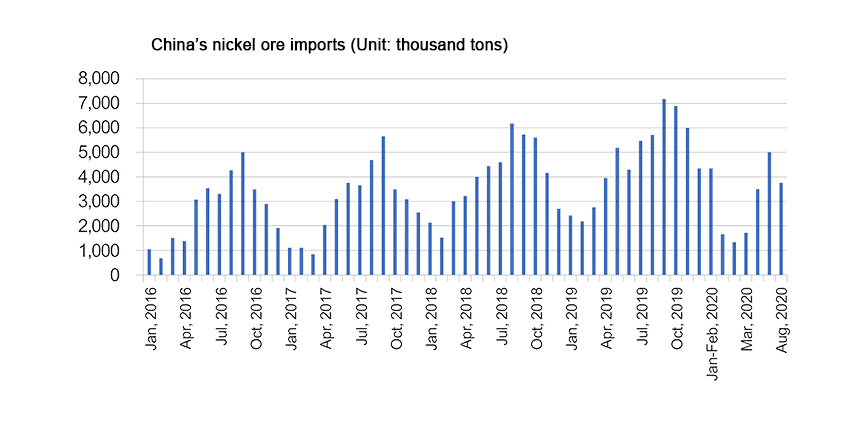

However, currently, China's major raw materials for stainless steel production of nickel and chromium are highly dependent on imports. Among them, more than 80% of nickel ore is imported from other countries and regions; restricted by domestic conditions, almost all chrome ore relies on imports. That is why domestic resources of the stainless steel industry are weak and vulnerable, which are easily influenced by the international environment.

Since the National Holiday, the LME nickel has increased by US$750/MT and the rising percentage reached 5.1%. How can the raw material be in this trend?

The rainy season in the Philippines is approaching leading to decreased domestic nickel-iron production soon.

As the major supplier, The Philippines where it will enter the rainy season later this month. The rainy season will last to May in the next year. During this time, part of the local nickel ore producing areas will shut down and cease production. Therefore, domestic nickel ore imports will decrease, which will maintain or even boost the nickel ore price.

According to the ferronickel factories, at present, the Chinese nickel ore inventories in many ferronickel companies are low. If to maintain full production of ferronickel, nickel ore inventory can only support 1-2 months of production. Moreover, some ferronickel plants may plan to reduce production in the later period.

Stainless Steel Spot Market:

Steel mills control the price and volume. 304 stock product price remains.

Recently, people complain about the week's transaction because the steel mills are unwilling to sell. Less flow of goods in the market make the price maintained.

Take 304 in the Wuxi market as an example, the 4-feet mill-edge product of Delong and Chengde is US$2,070/MT (US$2,135/MT in 2.0 slit edge) and there is a discount of US$8/MT if the transaction is concluded. As for Yongjin’s 4-feet mill edge product, it is US$2,090/MT (US$2,155/MT in 2.0 slit edge). The price of the hot rolling product is as almost high as that of the cold rolling product. The 5-feel mill-edge product of Ess and GQJS is around US$2,070/MT.

Raw Material|| Can the importing ferronickel make up the vacant of domestic raw material?

Although many Chinese-funded enterprises have built ferronickel plants in Indonesia, Tsingshan and Delong still dominate the raw material market. In early October, Yashi Indonesia Investment Co., Ltd., a subsidiary of Zhenshi Holding Group in Tsingshan Wedabe Industrial Park, was the fourth Electric Furnace has successfully put into production. At the end of the year, the Wedabe Industrial Park will realize the operation of 12 ferronickel production lines, Tsingshan will complete 48 ferronickel production lines. In the second phase of Indonesia's Delong project, 9 submerged arc furnaces were put into operation at the end of September. During the second phase, 10 lines are expected to be put into production in October, after which it will maintain the progress of adding 1-2 new production lines every month.

However, most of the ferronickel from Tsingshan and Delong Indonesia will be used locally, and the amount of ferronickel flowing to China is unlikely to increase greatly. The increase in Indonesian ferronickel supply may be limited. We can see shortly that considering the cost and the supply of raw materials, the stainless steel mills have been quoting steadily, and the willingness to reduce the prices is low. For traders, they are unwilling to lose money because the cost is high. Thus, the recent stainless steel market is very stable.

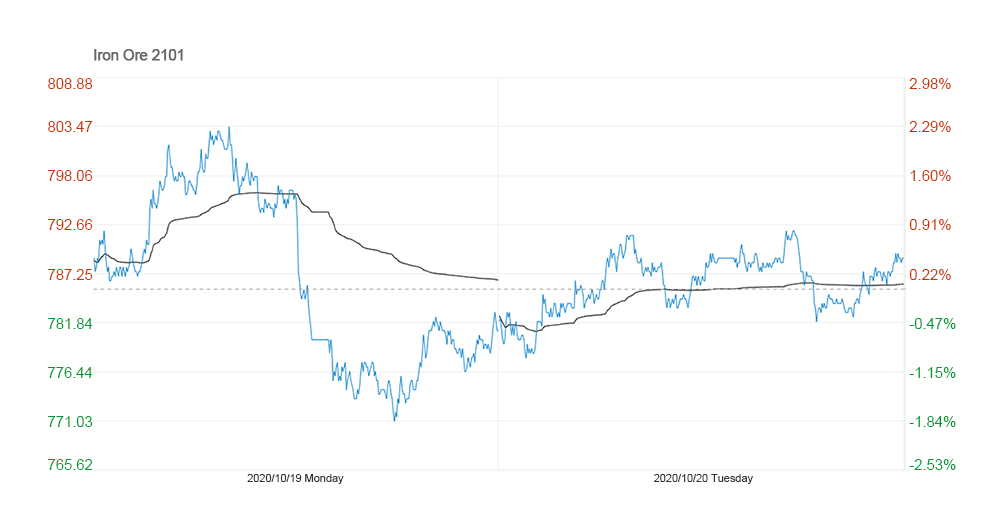

The GDP growth of the third season is not as good as the expectation, affecting the market attitude.

As the Chinese bureau released the GDP growth of the third season which YoY increased by 4.9%. Although compared with that of the second season which is 3.2%, the growth of the third season enlarged, it still lower than the prediction of HSBC (5.4%) and the overall expectation (5.5%). After the data released, China’s stock market and the commodity market dived. The closing price of Shanghai and Shenzhen stock indexes dropped by nearly 1%; the ferrous metals all turned from their morning surges to declines, and iron ore futures plunged by about 4% from their intraday highs.

The plunge in the domestic commodity and the stock market affected the nickel price, which showed a downturn during its rising price. Besides, the weak stainless steel futures negatively influenced the nickel market.

Looking at the recent trend of stainless steel futures, when the price climbs up to the US$2,249, the shorts are willing to take the initiative to enter the market. This is mainly due to the fact that the spot price is very limited when it is rising, and the discount rate narrows. When the price difference is reduced to less than US$46/MT, it will remain at a relatively low level. Many short funds are willing to take the initiative to sell out, which leads to continuous pressure on the price to prevent the nickel price to keep rising.

Generally, as the supply of nickel ore is expected to shrink significantly, the price of nickel ore will continue to maintain or increase. The factors boosting the nickel price is still strong, so nickel will keep its price at this stage. Considering the impact of the rising stainless steel futures price and the weak macro market, LME nickel may decrease in a short time but it will go up after that.

----------------------------------------------------------------------------------------Stainless Steel Market Summary in China---------------------------------------------------------------------------------------------------