304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,055/MT(plus taxes) which is US44/MT lower than last week and the declining percentage is 2.00%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,090/MT(plus taxes) which is also US$44/MT lower than last week and the declining percentage is 1.96%.

304/2B: This week, the average price of 2.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$1,965/MT(plus taxes) which is US$43/MT lower than last week and the declining percentage is 2.03%. What's more, the average price of 2.0*1240*C(mill edge) in the Foshan market is US$1,975/MT(plus taxes) which is US39/MT lower than last week and the declining percentage is 1.85%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,820/MT(plus taxes) which is US$79/MT lower than last week and the declining percentage is 3.95%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,880/MT(plus taxes) which is US60/MT lower than last week and the declining percentage is 2.95%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,950/MT(plus taxes) which is US$60/MT lower than last week and the declining percentage is 1.86%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,995/MT(plus taxes) which is US$51/MT lower than last week and the declining percentage is 1.57%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,645/MT(plus taxes) which is US$131/MT lower than last week and the declining percentage is 4.44%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,700/MT(plus taxes) which is US$111/MT lower than last week and the declining percentage is 3.71%.

LH/2B: This week, the average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,085/MT(plus taxes) which is US$14/MT lower than last week and the declining percentage is 1.29%. Besides, the tax-inclusive average price of the Foshan market is US$1,080/MT(mill edge) which remains unchanged from last week.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,150/MT(plus tax), which is US$13/MT lower than last week and the declining percentage is 1.09%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,145/MT(plus taxes) which decreases US$11/MT compared to last week and the declining percentage is 0.98%.

Decreasing output of series 300 hits the lowest point for the recent 9 months

The cost of production keeps at a high position because of the downside stainless steel price and raw materials of higher prices, giving rise to the weakness in mills productivity. In November, some mills finished maintenance and recovered to produce, resulting in slightly increasing output of stainless steel flat crude steel. Moreover, with the momentum for more products at the end of a year, the output of stainless steel flat steel will keep increasing, typically series 400.

Slightly increasing output from November to December

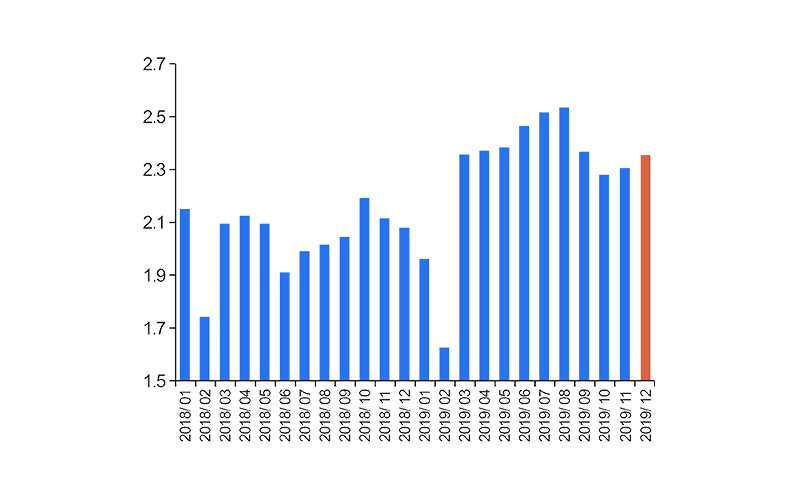

In November, the output of stainless steel flat crude steel was about 2.3 million tons which increased by 19,000 tons compared to last month and the increasing percentage is 0.8%; year-on-year increased by 182,000 tons and the increasing percentage is 8.6%

Output of the stainless steel flat crude steel(unit: million tons)

In December, the output of stainless steel flat crude steel is estimated to increase by 64,000 tons compared to last month and reach 2,364,000 tons, which the increasing percentage will be around 2.8%, increase by 284,000 tons year on year and the increasing percentage will be 13.7%.

Supply of series 300 reduced again!

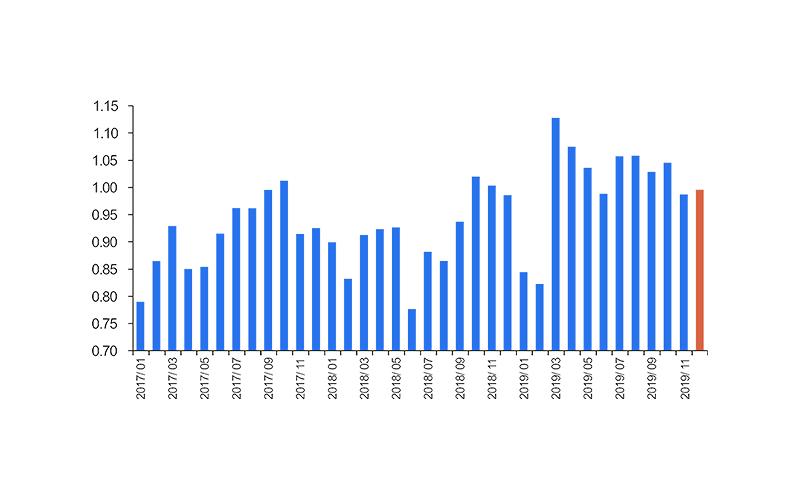

With series 300 produced less by some mills, in November, the stainless steel flat crude steel of series 300 was around 984,000 tons in output, which is 57,000 tons less than last month and the decreasing percentage is 5.5% and decreased 18,000 tons year on year and the declining percentage is 1.8%.

Output of the series 300 stainless steel flat crude steel (unit: million tons)

Due to the weakness in stainless steel industry, it is estimated that in December, the output of stainless steel flat crude steel will increase by 80,000 tons compared to last month and reach 992,000 tons whose rising percentage will be 0.8%; it will increase by 7,000 tons year on year, which rising percentage will be 0.7%.

After 3 consecutive decreases, the output of series 200 is recovering!

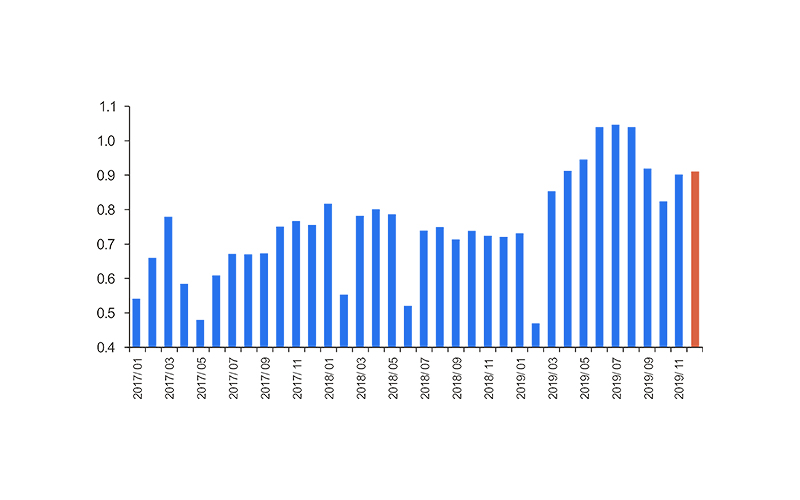

After the maintenance of some mills, in November, the output of series 200 stainless steel flat crude steel stopped declining for three months and started to increase, which increased by 61,000 tons and reached 898,000 tons compared to October, which the increasing percentage was 7.3%; year on year increased by 174,000 tons and the rising percentage was 24.1%.

Output of he series 200 stainless steel flat crude steel (unit: million tons)

Since some mills are back to produce, it is estimated that the output of series 200 will keep increasing in December. The output of stainless steel flat crude steel will be about 905,000 tons which will be 7,000 tons more than November and the rising percentage will be 0.8%; year on year increase by 185,000 tons and the rising percentage will be 25.7%.

The output of series 400 will be increase largely!

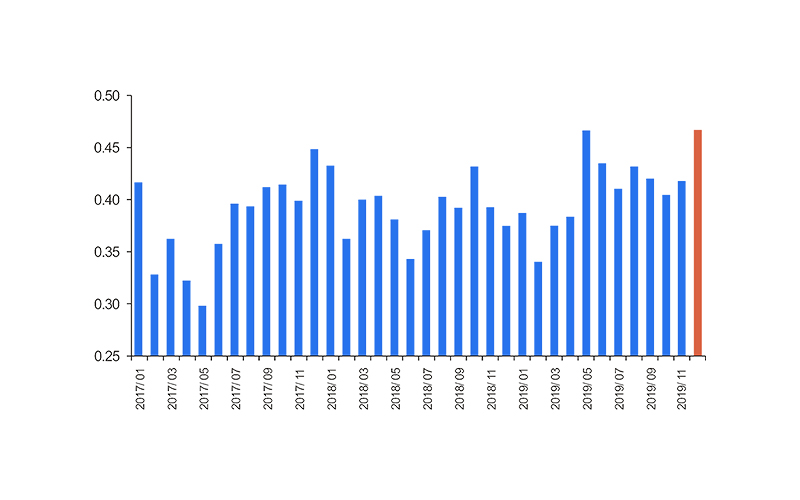

With the production of series 400 is enlarged by some mills recently, in November, the stainless steel flat crude steel of series 400 is around 418,000 tons in output which is 14,000 tons more than November and the rising percentage is 3.5%; year on year increases by 26,000 tons and the rising percentage is 6.6%.

The output of the series 400 stainless steel flat crude steel (unit: million tons)

Some mills finished maintenance and recovered to produce, which can foresee that the output of series 400 in December will increase significantly. The output of flat crude steel will be about 467,000 tons which will increase by 49,000 tons compared to November and the rising percentage will be 11.8%; year on year increases by 93,000 tons and the rising percentage will be 24.8%.

High carbon ferrochrome|| Price dropped to less than US$857, but it does not stop.

On 6th December, the domestic ex-factory price of high carbon ferrochrome dropped by the US$7-14/base ton. The price of high carbon ferrochrome from all production places has dropped by US$29-36/50base ton last week. The major quotation fell to the US$821-857/50base ton.

In December, the bidding purchasing price of high carbon ferrochrome offered by the main mills dropped by US$57/50base ton and reached about US$857/50base ton. It is said that the failure to meet the expectation of the purchasing amount further weakened the price of high chromium.

Tsingshan Group set the purchasing price of high carbon ferrochrome at USD857/50base ton (plus tax and delivery to factory), delivered in Tianjin Port, which is US$23/50base ton and US$57/50base ton lower than November purchasing price. The delivery deadline is before 10th January 2020. ( Due to the large rising range of shipping price at the end of a year, the Tianjin Port price has changed from US$20 to US$23 for the moment.

Baosteel Desheng set its purchasing price of high carbon ferrochrome at US$857/50base ton(plus tax and delivery to factory) in December, which is lessened by US$57/50base ton in constant purchasing compared to November.

The root cause of the declining price of high chromium lays in the lax market supply. According to data, in November, the output of domestic high chromium rose to more than 540,000 tons, peaking at the newly highest for the recent years.

Another reason leading to the lax supply of high chromium is the higher import. According to customs data, the ferrochrome import to China increased by 40.18% compared to November, which rose to 265,300 tons.

However, analyzed from the point of downstream need, many mills are in maintenance and reduce production, resulting in a sharp decrease in the high chromium need which is much less than the supply of high chromium, leading to a downside price.

It is reported that there has been a low price of US$800/50base ton given by some northern producers because of the tight budget at the end of a year. Moreover, the price of chrome ore is falling along with the declining price of ferrochrome, which lessens the production cost of ferrochrome. In the short term, the state of high chromium will maintain at a low price.

---------------------------------------------------------------------------------------------Stainless Steel Market Summary in China----------------------------------------------------------------------------------------------------------