304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$1,985/MT(plus taxes) which is US$55/MT lower than last week and the declining percentage is 2.57%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,020/MT(plus taxes) which is also US$55/MT lower than last week and the declining percentage is 2.51%.

304/2B: This week, the average price of 2.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$1,865/MT(plus taxes) which is US$46/MT lower than last week and the declining percentage is 2.31%. What's more, the average price of 2.0*1240*C(mill edge) in the Foshan market is US$1,840/MT(plus taxes) which is US47/MT lower than last week and the declining percentage is 2.39%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,760/MT(plus taxes) which is US$49/MT lower than last week and the declining percentage is 2.61%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,805/MT(plus taxes) which is US$43/MT lower than last week and the declining percentage is 2.39%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,895/MT(plus taxes) which is US$23/MT lower than last week and the declining percentage is 0.74%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,950/MT(plus taxes) which is US$23/MT lower than last week and the declining percentage is 0.73%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,575/MT(plus taxes) which is US$32/MT lower than last week and the declining percentage is 1.14%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,615/MT(plus taxes) which is US$29/MT lower than last week and the declining percentage is 1.03%.

LH/2B: This week, the average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,095/MT(plus taxes) which is US$1/MT lower than last week and the declining percentage is 0.13%. Besides, the tax-inclusive average price of the Foshan market is US$1,085/MT(mill edge) which increases by US$4/MT compared to last week and the rising percentage is 0.37%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,135/MT(plus tax), which is US$12/MT lower than last week and the declining percentage is 1%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,145/MT(plus taxes) which decreases by US$4/MT compared to last week and the declining percentage is 0.38%.

Focus|| Global market was way too difficult last week.

Last week, the global finance and commodity market plummet as the Covid-19 epidemic spreads over the world. US shares met up with its worst week since the 2008 financial crisis, which dropped 12% approximately.

Meanwhile, the commodity market also got panic attacked. Crude oil has fallen 30% from its high point, LME nickel has decreased by over US$ 1,000, and SS2006 has also slumped more than US$143, as well as the drop of stainless steel futures and spots, is over US$143. The stainless steel futures market has been extremely panicking.

Soaring US$400! The market is bouncing this week.

The market has come to a long-lost burst-out. This week, commodities have been re-bounced. Domestic black ore has increased by more than 5%. LME nickel has risen prominently over US$400. SS2006 has added up US$29 to around $1,735. For what reason did the sluggish market become lively?

Strong calls for the Federal Reserve to cut interest rates

Last Friday, US President Trump expressed the expectation that the Federal Reserve to intervene in the market as soon as possible to cope with the stock and economy influenced by the epidemic. For now, some experts estimated that the GDP of the US in the second and third season will be in zero growth.

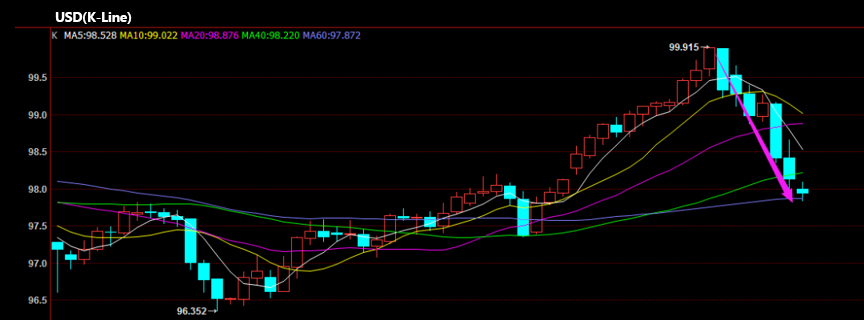

The market calls for lower interests to Federal Reverse. The financial giant Goldman Sachs Group indicates that Federal Reverse will downturn the interest rate for 50 base points and suggests cooperating with other central banks. This is the second adjustment to the anticipation of Federal Reverse's decision in cutting interest by the Goldman Sachs Group in three days. Having the anticipation of the lax global monetary policy, the US dollar index has experienced a downward trend in the short term. The market ushered in a sudden rebound, and the commodity prices were pushed up by the bullishness.

Investment in construction in China is enlarged to stimulate the future demand

Recently, under effective epidemic prevention and control, plans and policies are executed down from central government to local governments, which are to ensure to complete the annual social-economical goal of this year. Many ministries and commissions, such as the National Development and Reform Commission, the Ministry of Transport, and the National Energy Administration, have expanded effective investment, speed up approvals, tenders, and intensify efforts to promote project resumption and orderly and continue to optimize the rolling project library.

Futures soar up. Stainless steel spot trading goes ideally

LME nickel and stainless steel futures were both increasing. LME nickel went up for US$400 and SS2006 futures also increased by US$21. In the state of low futures price, more investment is thrown into the market, expecting to support the prices go up.

It led to a positive spot market. Many stainless steel traders said that “transactions and inquiries are good”, and “trucks are choking on the entrance of the warehouse ”.

Taking 304 as an example, many businesses have the pressure of large inventory. The price of regular products keeps dropping every day. However, products like the thick plate with the specification of 1.18/1.48/1.98 are still rare in the market.

-------------------------------------------------------------------Stainless Steel Market Summary in China--------------------------------------------------------------------