304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$1,810/MT(plus taxes) which is US$43/MT lower than last week and the declining percentage is 2.21%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,845/MT(plus taxes) which is also US$43/MT lower than last week and the declining percentage is 2.16%.

304/2B: This week, the average price of 2.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$1,665/MT(plus taxes) which is US$37/MT lower than last week and the declining percentage is 2.09%. What's more, the average price of 2.0*1240*C(mill edge) in the Foshan market is US$1,665/MT(plus taxes) which is US$26/MT lower than last week and the declining percentage is 1.46%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,625/MT(plus taxes) which is US$31/MT lower than last week and the declining percentage is 1.82%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,660/MT(plus taxes) which is US$31/MT lower than last week and the declining percentage is 1.78%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,645/MT(plus taxes) which is US$51/MT lower than last week and the declining percentage is 1.79%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,695/MT(plus taxes) which is US$51/MT lower than last week and the declining percentage is 1.75%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,415/MT(plus taxes) which is US$31/MT lower than last week and the declining percentage is 1.21%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,445/MT(plus taxes) which is US$39/MT lower than last week and the declining percentage is 1.46%

201/2B: This week, the average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,020/MT(plus taxes) which is US$24/MT lower than last week and the declining percentage is 2.33 %. Besides, the tax-inclusive average price of the Foshan market is US$1,005/MT(mill edge) which decreases by US$34/MT compared to last week and the declining percentage is 3.31%.

J2, J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$965MT(plus taxes) which is US$23/MT lower than last week and the declining percentage is 2.33%. Besides, the tax-inclusive average price of the Foshan market is US$955/MT(mill edge) which decreases by US$36/MT compared to last week and the declining percentage is 3.64%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,055/MT(plus tax), which is US$37/MT lower than last week and the declining percentage is 3.39%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,060/MT(plus taxes) which decreases by US$36/MT compared to last week and the declining percentage is 3.25%.

Opinion|| What is the market like in April?

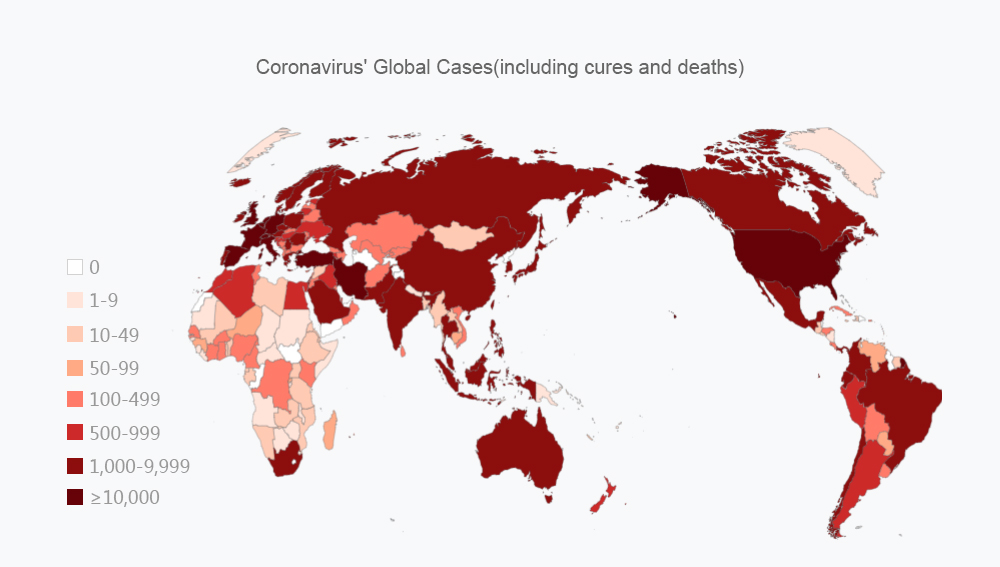

The stainless steel market has trapped in the mud for a month and contemporarily it steps in a stable stage. In March, according to the market feedback, the transaction looks satisfying. However, April when the pandemic spreads in European and American countries, and the descending international financial state, leaves a question mark to us.

1. How does the short-term stability come?

For now, the base difference between the stainless steel futures and the stainless steel is narrowing. The base difference is decreasing by 43, adjusted from -100~-129 to -57~-86. It is a sign that the stock price is getting close to the futures price, thereby the stainless steel market relieves and enters the stable stage.

Besides, maintenance comes after damage. Thanks to the good transaction effect, the stainless steel stock volume lowers, as well as the reason that the price of raw material rises, different factors interact, creating a plateau for the stainless steel market.

2. The pandemic is a two-fold sword.

For the stainless steel market, the pandemic is a two-fold sword. Firstly, the Southeast Asian countries lockdown affecting the raw material import, which results in the boosting price of raw materials. For example, because some ports in the Philippines lockdown, the importing volume must be cut down. It is predicted that in March, the import of nickel ions leaves only around 1.2 million and 1.3 million tons which are 50% less than that in the same period of last year.

For the nickel supply, it is difficult to catch up with the demand for producing, so the nickel ions are beneficial. So far, most of the ion suppliers have not shipped the order yet.

Meanwhile, the profit margin of ferronickel drops from 9% to 2%. The record low of the ferronickel profit margin marks from 2016 to 2017 when the profit was -15%. The cost is no longer the evidence and support of profit margin. The biggest challenge that domestic ferronickel suppliers face is the domestic market. Nevertheless, the overseas competition also compresses the domestic suppliers, because the cost advantage of Indonesian ferronickel is 50% over Chinese ferronickel cost.

The other effect of the pandemic is the descending downstream demand for stainless steel. All the overseas orders are shrinking. The bad news about a crewman of Maersk is affected by the COVID-19, which is an evidence of the weakening power of the delivery and leads to less purchasing willingness. During this time, it is difficult to accept new orders, and most suppliers are digesting the former order.

The other effect of the pandemic is the descending downstream demand for stainless steel. All the overseas orders are shrinking. The bad news about a crewman of Maersk is affected by the COVID-19, which is an evidence of the weakening power of the delivery and leads to less purchasing willingness. During this time, it is difficult to accept new orders, and most suppliers are digesting the former order.

3. Better contemporary demand≠ Continuous demand afterwards

Many manufacturing centers have better sales record in March compared to last year. The factories are running overload, and some products of the specific specification are in shortage, but we shall realize that these are orders from February and March. The actual demand is not showing until the second half of April.

According to the first season of 2020, the Chinese stainless steel flat steel consumption volume is approximately 4.021 million tons. In April, the stainless steel flat steel output is predicted to be 1.758 million tons. The monthly average consuming volume is 1.34 million tons. If the actual consuming volume takes the 1.34 million tons as a reference, it means that 418 thousand tons of stock is unable to digest. Maybe this will be the end of the declining stock.

4. The price change is no longer based on the cost.

Roughly, it is estimated that the cost of 304 is around $1,645/ton, while the cost of hot-rolled 201 and J2 is $890/ton. Considering the cost, the prices of 304 and J2 seem to have dropped to the bottom line.

However, more opinions agreed that the stainless steel price trending is determined by the balance between the actual output of mills and the downstream purchase. Like the new arrivals this year, the cold-rolled 304, has been put for ten thousand tons of volume every month into the market by Delong, Guangdong Yongjin, which is a huge challenge for the market to consume.

On the other hand, the stainless steel industry is facing a dilemma when the supply-side reform is just beginning. If it were in the past, when the price decreased too much, the mills would have stooped production until the supply shrinks to regain the balance between demand and supply.

However, the mills are not giving up the market, and their strategy is quantity premium. Thus, since the cake is not getting bigger in the short term, the price will be compressed below the cost of some mills who will choose to exit the market. Therefore, the increase of price cannot be foreseen according to the cost theory.

5. Where does the uncertainty lie?

From the perspective of the industry, the market seems to decline. Although the order of the second half of March consumed part of the stainless steel stock, whether the consumption will continue in April, we never know.

From a bigger point of view, the global risk is underlying. The US stock trending is similar to the 1929 US Recession that the stock dropped from the highest point. Though there were some small rises, it could not stand and kept falling.

Under this circumstance, considering the effect of the industry is not enough. It is a time of community when every country is in connection, so when we make decisions, it is better to pay attention to the global trend.

Also, there is an opinion that the declining price can promote the consumption of stainless steel. The infrastructure and QE are also boosting the market. Besides, the orders that are affected by the pandemic are arranged after June. Although the raw materials are limited now, but at least they come in a time order.

6. How to get it through?

Due to the imbalance of the cold and hot rolling prices this year, the cold rolling enterprises are in a difficult situation currently. The cold-rolling producing enterprises can only produce multiple series and multiple specifications to differentiate their products, trying to fill up the equipment as much as possible, to maintain production capacity, and reduce manufacturing cost.

The pandemic of 2020, the whole industry is striving to make a living in this winter-like spring. To think it positively, and believe that the spring will eventually get back. This April, we need each other help and support more than ever!

-------------------------------------------------------------Stainless Steel Market Summary in China----------------------------------------------------------------