304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,100/MT(plus taxes) which is US26/MT lower than last week and the declining percentage is 1.14%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,140/MT(plus taxes) which is also US$26/MT lower than last week and the declining percentage is 1.12%.

304/2B: This week, the average price of 2.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$2,015/MT(plus taxes) which is US$33/MT lower than last week and the declining percentage is 1.52%. What's more, the average price of 2.0*1240*C(mill edge) in the Foshan market is US$2,005/MT(plus taxes) which is US33/MT lower than last week and the declining percentage is 1.53%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,900/MT(plus taxes) which is US$51/MT lower than last week and the declining percentage is 2.51%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,950/MT(plus taxes) which is US67/MT lower than last week and the declining percentage is 3.16%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,020/MT(plus taxes) which is US$51/MT higher than last week and the declining percentage is 1.56%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,060/MT(plus taxes) which is US$51/MT lower than last week and the declining percentage is 1.54%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,780/MT(plus taxes) which is US$50/MT lower than last week and the declining percentage is 1.65%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,825/MT(plus taxes) which is US$46/MT lower than last week and the declining percentage is 1.49%.

LH/2B: This week, the average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,105/MT(plus taxes) which is US$14/MT lower than last week and the declining percentage is 1.27%. Besides, the tax-inclusive average price of the Foshan market is US$1,095/MT(mill edge) which is US$6/MT lower than last week and the declining percentage is 0.52%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,165, which remains unchanged from last week. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,155/MT(plus taxes) which maintains the same level of last week.

With a Sharp Drop of 20% on Nickel Price, A Mill’ s Output Dropped Half

A giant ferronickel mill reduced half of the output

It is reported that a giant high-nickel iron producer in Shandong had three ore furnaces were in maintenance last Friday and now rumor has it that there are about ten ore furnaces in its two factories have stepped into maintenance as well.

For now, there is various news about the decreased output of the factory. To sum up, the main reason is that due to the high inventory, the mill implements the plan to maintain and reduce its output gradually, of which the percentage is estimated to be 40%~50%, and the maintenance term will probably prolong to later Chinese New Year.

Similarly, except for the Shandong mill, ferronickel mills in Inner Mongolia and Jiangsu also have information about their maintenance plan. But to a further understanding, actually it is still unknown whether there is a maintenance, the two relating mills are still in normal production now.

Over 60,000 tons of high-nickel iron will be affected

If the high-nickel iron factories overhaul at the same time, it can be foreseen that the output of high-nickel iron will reduce in a large percentage.

According to the high nickel iron production scale of the Shandong manufacturer, the output of high-nickel iron is closed to 150,000 tons per month. Based on the reduced output proportion, it is estimated that the high-nickel iron monthly output will decrease by more than 60,000 tons.

As for the two plants of Inner Mongolia and Jiangsu whose regular monthly output surpasses more than 20,000 tons respectively, their monthly outputs reach around 50,000 tons in total.

Although the saying about the overhaul of the high-nickel iron plants has not been clarified yet, it is almost certain for the mills to reduce output and remain the price because of the negative reasons of large stainless steel inventory, weak needs, unclear price tendency, decreased output, increased high-nickel iron imports and a sharp drop of nickel price.

Domestic high-nickel iron market supply highly rose

Analyzed from the supply side of high-nickel iron, with the increased output in Indonesia, since September, domestic imports of Ferronickel has risen significantly. According to the customs data, ferronickel imports to China were up to 208,100 tons which is the highest in recent years, 43.73% higher than August and increased by 110.34% compared to September in the last year.

October ferronickel imports to China declined to 168,800 tons which is 18.86% less compared to September and the year-on-year increase reaches 85.83%.

Domestic ferronickel output has been at a high level in the recent two months. According to the statistics, except for the giant mills like Tsingshan Group and Baosteel Desheng, domestic main manufacturers of high-nickel iron produced more than 410,000 tons. Even after the output of October dropped by nearly 30,000 tons, the amount remained high at over 380,000 tons which is higher than the annual averaged level.

Ferronickel price was down by US$37/ nickel

However, the bad thing comes in companions. More supply was provided from the ferronickel market, less need was inquired from the downstream. It is said that some suppliers were noticed by a giant mill in Jiangsu to stop supplying raw materials in November and the exact time of the next supply is still pending, for which the output of stainless steel will cut half as the previous estimation. Zpss and Ess have a maintenance plan in December as well.

Affected by the decreasing nickel price recently, high-nickel iron was compressed, whose DTD price (plus tax) was down to about US$150/nickel.

Due to these negative factors, the recent high-nickel iron price has gone all the way down. Since early September, high-nickel iron EXW has declined from US$186/nickel to US$149/nickel, which decreased by US$37/nickel and the declining percentage is 19.92%.

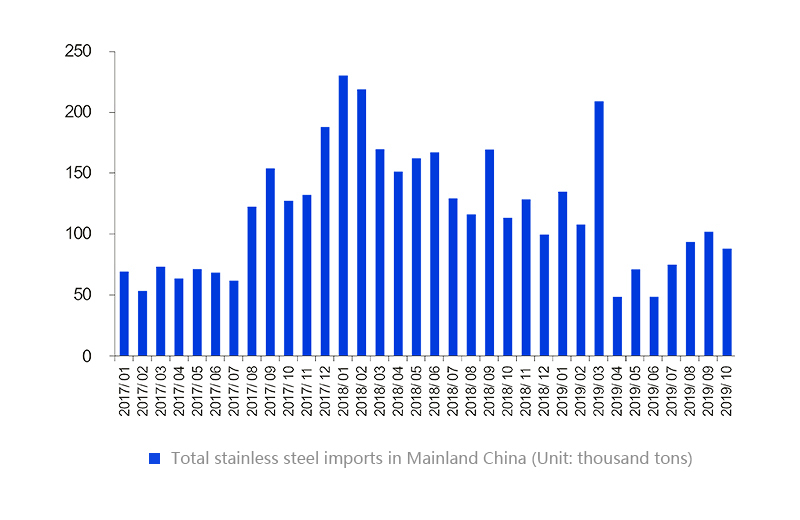

DATA|| October Stainless Steel Imports to China Decreased by 14%

In October, stainless steel imports to China were 87,600 tons which were 14,000 tons less than September and the declining percentage is 13.7%; it decreased by 26,000 tons year on year and the declining percentage is 22.8%.

From January to October of 2019, stainless steel imports to China amounted to 973,000 tons which lessens 654,000 tons year on year and the decreasing percentage is 40.2%.

Total stainless steel imports in Mainland China (Unit: thousand tons)

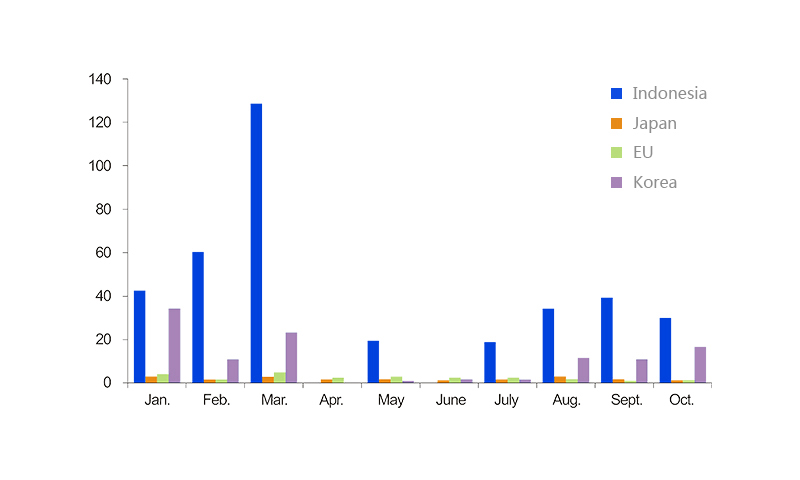

Imports of products involving in anti-dumping remains low

In October, imported from Indonesia, products involving in anti-dumping reached 30,200 tons, including 30,000 tons materials for processing, that imported from Korea was 16,600 tons, from EU was 900 tons, form Japan was 1,200 tons.

Imports to China of Stainless Steel Products involving in Anti-dumping (Unit: thousand tons)

----------------------------------------------------------------------------- Stainless Steel Market Summary in China----------------------------------------------------------------------------