304 drives all the way up!

304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$1,795/MT(plus taxes) which is US$27/MT higher than last week and the rising percentage is 1.46%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,835/MT(plus taxes) which is also US$27/MT more than last week and the increasing percentage is 1.43%.

304/2B: This week, the average price of 2.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$1,730/MT(plus taxes) which is US$74/MT higher than last week and the rising percentage is 4.28%. What's more, the average price of 2.0*1240*C(mill edge) in the Foshan market is US$1,735/MT(plus taxes) which is US$80/MT more than last week and the increasing percentage is 4.63%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,670/MT(plus taxes) which is US$68/MT more than last week and the increasing percentage is 4.05%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,690/MT(plus taxes) which is US$60/MT higher than last week and the rising percentage is 3.54%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,595/MT(plus taxes) which is US$1/MT lower than last week and the declining percentage is 0.05%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,650/MT(plus taxes) which is US$1/MT lower than last week and the declining percentage is 0.05%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,410/MT(plus taxes) which is US$31/MT higher than last week and the rising percentage is 1.22%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,425/MT(plus taxes) which is US$25/MT more than last week and the increasing percentage is 0.98%

201/2B: This week, the average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,005/MT(plus taxes) which is US$18/MT higher than last week and the rising percentage is 1.78%. Besides, the tax-inclusive average price of the Foshan market is US$1,000/MT(mill edge) which increases by US$26/MT compared to last week and the increasing percentage is 2.73%.

J2, J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$955/MT(plus taxes) which is US$16/MT higher than last week and the rising percentage is 1.89%. Besides, the tax-inclusive average price of the Foshan market is US$950 /MT(mill edge) which increases by US$32/MT compared to last week and the increasing percentage is 3.53%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,020/MT(plus tax), which is US$10/MT lower than last week and the declining percentage is 0.94%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,030/MT(plus taxes) which decreases by US$11/MT compared to last week and the declining percentage is 1.03%.

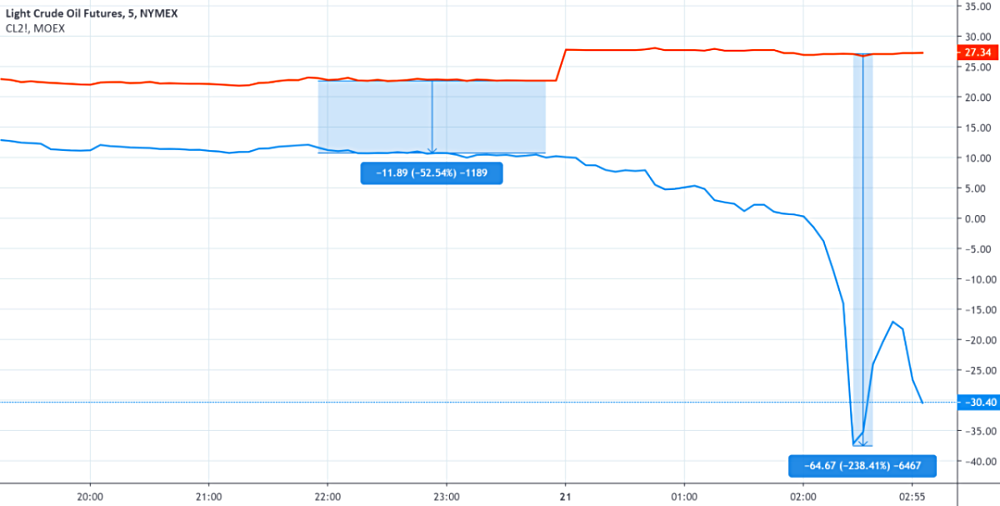

Crude oil price is subdued, quickly decreasing by 300%. Does the increase in stainless steel prices come to an end?

We are all witnessing this historic event again.

On April 21st, the price of crude oil futures dropped sharply below zero.

Shocking the global market, in May, the US light crude oil futures prices knocked of 300%, ending at $-37.63 per barrel. It is the first time that the US crude oil price drops below zero.

What a historic scenario!

With only four months of 2020, we have witnessed four circuit breakers kicked in and the crude oil price below zero.

Why does the crude oil price drop below zero?

For this time of the plunging crude oil price, some analysts regard the main reason for the limited storage room for the product, which led to a squeeze flow. The buyers of crude oil mainly are refineries and airlines that need transactions of substances, but the space of oil storage is scared. Therefore, they don’t transfer the commodities through the stock, so the long sellers can take the opportunity to suppress the short-sellers.

Meanwhile, rumor has it that the boosting price of stainless steel futures is also the result of the market corner.

According to the market, the main stainless steel mills have accepted the order till June. When it comes to the joint moment in June, the mills will not have many resources to take part in the transaction, so the long-sellers will take the advantage to drive the price and boost the stock.

However, after the significant increase in price, it will bring out the concern of the downturn price.

The benefited capital ran out after the futures price increased.

Judged by the main futures contract of stainless steel, on April 22nd, it increased by $46 to $1,840/ton which is the biggest point rise of the price rebounding term. After that, the price went in the opposite direction, offsetting all the increase. The position decreased by 2400 shares in the short term. A majority of capital ran out, forcing large stress on the stock.

Moreover, compared to the trending of LME and the stainless steel futures, the increasing tendency of stainless steel seems to be more stable and stronger. Although the ore is lacking, the LME has the biggest increase of only 8.9% since April while the stainless steel has the largest increase of 11.8%. As long as the price goes back, the stainless steel futures price must have a greater need for descending.

The cash commodity is rising in price, but why people step back?

With the price increase, the mill-edge base price in the Wuxi market on April 22nd was $1,760/ton. Can you tell whether it is cold-rolled or hot-rolled only based on the base price? After ESS kept quoting high on the hot-rolled materials, now the base price of hot-rolled thin material tends to be $1,770/ton. Will we witness the cold and hot rolled price upside down again?

In these two days, the inquiries, transactions, and processing are worst than last week. The prices rise along with the OOS of hot-rolled materials, limited production of mills, etc.. Some people are not afraid of the increasing price but they are out of stock.

As for the future stainless steel market, most opinions believe that the underlying risk is still high. March transaction shows well because of the accumulation of January and February. However, the pandemic is still out of control over the world, which affects the export greatly. It is difficult to digest the inventory relying merely on the domestic demand.

Besides, the prices of LME and stainless steel futures both return low after the large increase. The capital that has benefited ran out, which force stress on the stock and suppress the market to a certain extend.

---------------------------------------------------------------Stainless Steel Market Summary in China------------------------------------------------------------------------------