304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$1,910/MT(plus taxes) which is US$63/MT higher than last week and the rising percentage is 3.22%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,950/MT(plus taxes) which is also US$63/MT more than last week and the increasing percentage is 3.15%.

304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$1,860/MT(plus taxes) which is US$65/MT higher than last week and the rising percentage is 3.42%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,855/MT(plus taxes) which is also US$50/MT more than last week and the increasing percentage is 2.61%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,795/MT(plus taxes) which is US$39/MT higher than last week and the rising percentage is 2.09%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,805/MT(plus taxes) which is US$34/MT more than last week and the increasing percentage is 1.85%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,695/MT(plus taxes) which is US$46/MT more than last week and the increasing percentage is 1.64%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,730/MT(plus taxes) which is US$40/MT higher than last week and the rising percentage is 1.39%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,535/MT(plus taxes) which is US$70/MT more than last week and the rising percentage is 2.66%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,560/MT(plus taxes) which is US$73/MT higher than last week and the rising percentage is 2.73%

201/2B: This week, the average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,055/MT(plus taxes) which is US$30/MT more than last week and the increasing percentage is 2.92 %. Besides, the tax-inclusive average price of the Foshan market is US$1,050/MT(mill edge) which increases by US$24/MT compared to last week and the increasing percentage is 2.36%.

J2, J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,005/MT(plus taxes) which is US$26/MT higher than last week and the rising percentage is 2.63%. Besides, the tax-inclusive average price of the Foshan market is US$1,005/MT(mill edge) which increases by US$19/MT compared to last week and the rising percentage is 1.88%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$990/MT(plus tax), which is US$3/MT higher than last week and the rising percentage is 0.26%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$990/MT(plus taxes) which remains as last week.

Raw Material|| Knocking off $200, the nickel price drops below $12,000/MT, threatening the stainless steel price of $1780/MT.

Last week, LME nickel crumbled again, decreasing by $235, closing at $11,820/MT which is the price before this increasing tendency. Within four transaction days, the price has dropped $690, making people been bearish on the stock.

The nickel price has been weakening. The price difference between nickel and high-nickel iron is narrowing.

Nickel futures continued to callback recently. On Friday, the price of domestic nickel stock maintains at around $12,980/MT. Compared to the declining percentage of nickel, domestic nickel stock price will fall to $12,790/MT( close to $235 per 1% of nickel content), which is equivalent to the domestic high-nickel iron price which is also near $235/nickel. This drop eliminates the situation that the nickel stock price had been higher than the high-nickel iron.

The nickel price keeps dropping. Why does the ferronickel price stay bullish?

The reason is that nickel belongs to the global financial system which is influenced by the outer elements. Although the epidemic is under control in China, things in the world are still getting worst. The big economy entities are facing a recession and many end-users of nickel are stuck in lockdown. From the global perspective, people are bearish on nickel, so the price trending is gloomy.

On the other hand, after the nickel bean(raw material of nickel) is adopted in the deliverable grades which are approved by the Shanghai Futures Exchange, the situation of pure nickel in shortage will be relieved. The risk of the market corner in Shanghai Nickel Market will be much lower and reduce the speculation by the long position.

When the domestic giant mills are purchasing nickel on a large scale, the domestic price is rising. The latest purchasing price reaches $235/nicel (price to the factory, tax inclusive).

Affected by the epidemic, in April, Philippine nickel ore and Indonesian ferronickel once suspended supplying to China. However, China is poor in ferronickel and nickel ore resources. With the epidemic spreads and aggravates in Indonesia, some newly added ferronickel production line is to be postponed and the recovery of supply takes a long time. Therefore, the domestic ferronickel price has been strong.

Besides, thanks to the former increase of stainless steel prices, the mills recover from the narrow profit margin, which improving their production enthusiasm. We predicted that in May, crude steel will rise to 2,311.36 thousand tons in production which is 5.6% more than last April. The demand for ferronickel will stay positive and keep boosting the domestic ferronickel price.

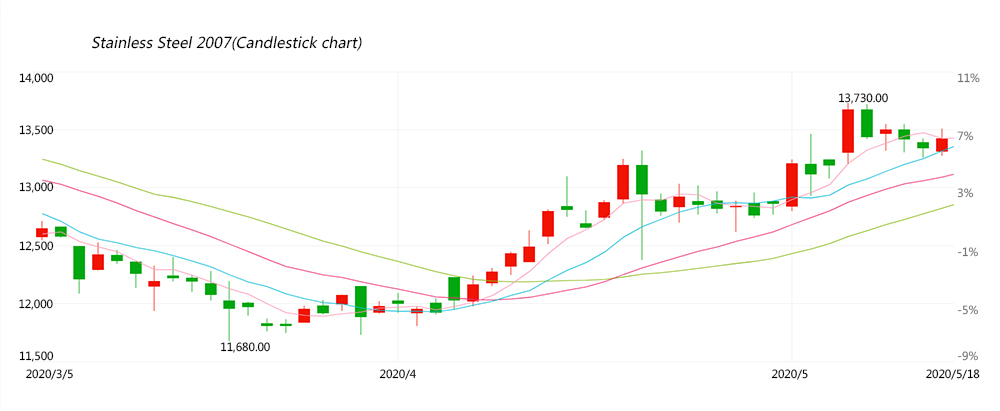

Analyzing from the stainless steel trending which is at the same trend as the ferronickel and alienated the nickel trend. By 18th May at night, the stainless steel futures 2007 has risen $66/MT in May and the rising percentage is 3.6% while the LME nickel decreased by $310/MT whose declining percentage is 2.6%. It comes out with a question of why stainless steel keeps increasing in price.

The inventory is reducing, leading to more speculation in the market.

Since late April, the end demand has kept increasing. The resource has been consuming. The inventory in Wuxi and Foshan both remain reducing. In early May, the declining percentage of inventory in Wuxi and Foshan is 3.10% and 7.81% respectively. With this advantage, the mills and traders increase the price and drive the stainless steel market to a higher price.

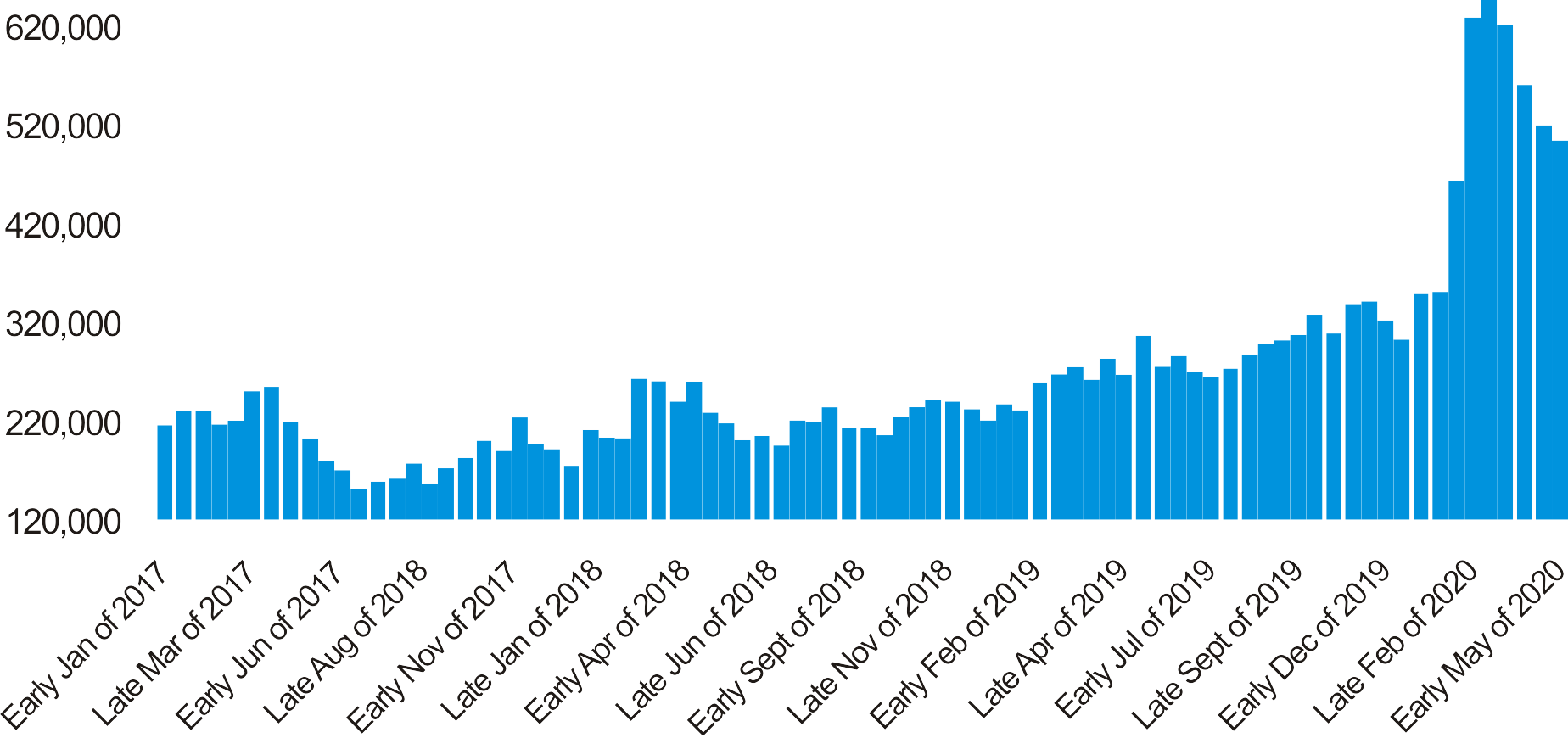

Inventory|| Inventory in early May decreased by 16 thousand tons but the pace slows down.

In early May, the stainless steel sample inventory of Wuxi is 499.4 thousand tons which decreases by 16 thousand tons compared to the last late April and the declining percentage is 3.10%.

The inventory of stainless steel in Wuxi (Unit: ton)

From the perspective of the inventory change, the hot-rolled resource decreases much. In late April, some private-owned mills have begun to process the hot-rolled materials into cold-rolled materials until early May. This action accelerates the consumption of hot-rolled materials. Moreover, the low price is the other factor that speeds up the consumption of hot-rolled materials. Besides, the traders and mills are taking this chance to sell out to avoid risks. The stock is consumed further.

However, the inventory has been reducing, compared to the declining percentage of 7.40% in late April, the downturn is less. Although the stainless steel price rises largely, for now, the transaction fails to keep up with the increase. With the price drop in these two days, buyers are firmer in waiting for a lower price. Thus, the demand is again sinking. When the mills finish production, the inventory will be increasing again.

--------------------------------------------------------------------Stainless Steel Market Summary in China-------------------------------------------------------------------------------------