304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,385/MT(plus taxes) which is US$28/MT lower than that of last week, and the decreasing percentage is 1.09%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,430/MT(plus taxes) which decreases by US$28/MT, and the decreasing percentage is 1.07%.

304/2B: The average price of 2.0*1240*C (slit edge) of Hongwang in the Wuxi market is US$2,205/MT(plus taxes) which is US$37/MT higher than that of last week, and the decreasing percentage is 1.57%. Besides, the average price of 2.0*1240*C(slit edge) in the Foshan market is US$2,210/MT(plus taxes) which droped by US$33/MT, and the decreasing percentage is 1.37%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,200/MT(plus taxes) which decreased by US$40/MT compared with last week and the decreasing percentage is 1.70%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,235/MT(plus taxes) which fell by US$28/MT compared to last week, and the decreasing percentage is 1.17%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,365/MT(plus taxes) which decreased by US$2/MT compared with last week and the declining percentage is 0.04%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,360/MT(plus taxes) which remains as last week.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$3,170/MT(plus taxes) which is US$2/MT lower than last week and the decreasing percentage is 0.72%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$3,195/MT(plus taxes) which dropped by US$9/MT compared to last week and the decreasing percentage is 0.27%.

201/2B: This week, the average price of 1.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$1,320/MT(plus taxes) which is US$29/MT lower than last week and the declining percentage is 2.14%. Besides, the tax-inclusive average price of the Foshan market is US$1,245/MT(mill edge) which is US$23/MT less than last week and the decreasing percentage is 2.06%.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,260/MT(plus taxes) which is US$28/MT lower than last week and the decreasing percentage is 2.48%. Besides, the tax-inclusive average price of the Foshan market is US$1,245/MT(mill edge) which decreases by US$23/MT and the decreasing percentage is 1.81%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,470/MT(plus tax), which is US$23/MT less than last week and the decreasing percentage is 2.01%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,470/MT(plus taxes) which decreased by US$31/MT and the declining percentage is 2.01%.

Statistics|| Core data of Q1 in China’s stainless steel industry

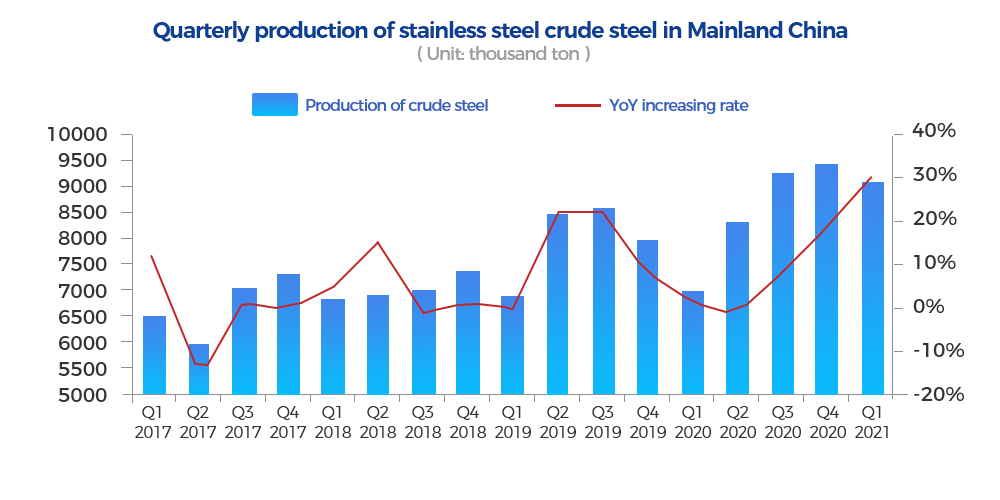

1. The production of crude steel

According to our survey, during the first quarter of 2021, stainless steel enterprises above designated size (industrial enterprises with annual main business income of RMB 20 million/ US$310 million and above) produced 9.078 million tons of crude steel, YoY increased by 2.11 million tons, about 30.3% higher than the same period of last year.

Specifically, the crude steel production of 200 series is 3.034 million tons (33.4% of the total production), increased by 892 thousand tons, and 41.6% higher compared to the same period of 2020; for 300 series, the production of crude steel is 4.098 million tons (45.1% of the total production), 618 million tons higher than that in Q1 of 2020, increased by 17.8%; as for 400 series, the production of crude steel is 1.947 million tons (21.4% of the total production), which increased by 0.6 million tons and 44.6% compared to the Q1 of 2020.

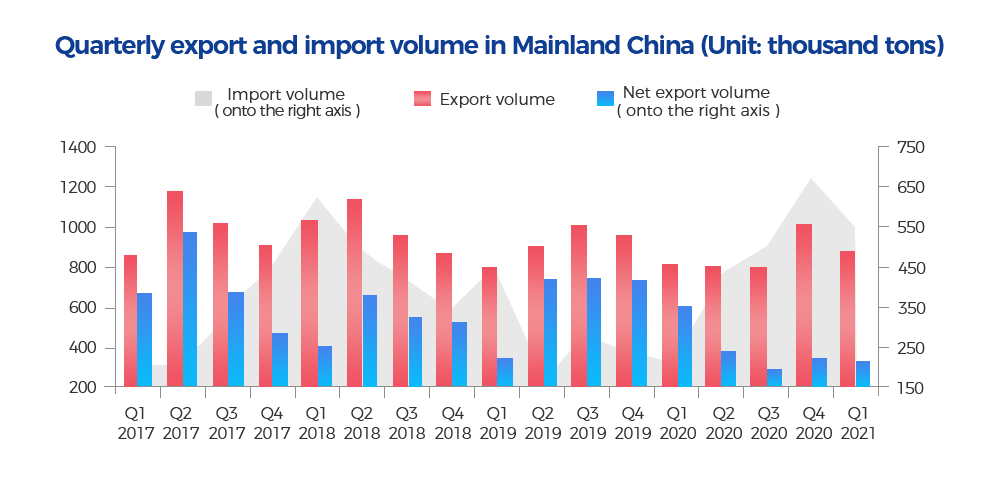

2. Statistics on the export and import volume

On the basis of custom data, in the Q1 of 2021, China’s total import volume amounted to 542.8 thousand tons, YoY 332.3 thousand tons higher and increased by 157.9%; about the export volume, the number was 870.7 thousand tons, which increased by 60.8 thousand tons and was 7.5% higher compared to the same period of 2020.

During the Q1 in 2021, the net export volume (export volume- import volume) from China was 327.9 thousand tons, reduced by 271.5 thousand tons which was 45.3% lower.

3. Apparent consumption

According to our data, in the first quarter of 2021, the apparent consumption regarding stainless steel in China is 7.9334 million tons, which rose by 2.2267 million tons, 39% higher than that of Q1 of 2020.

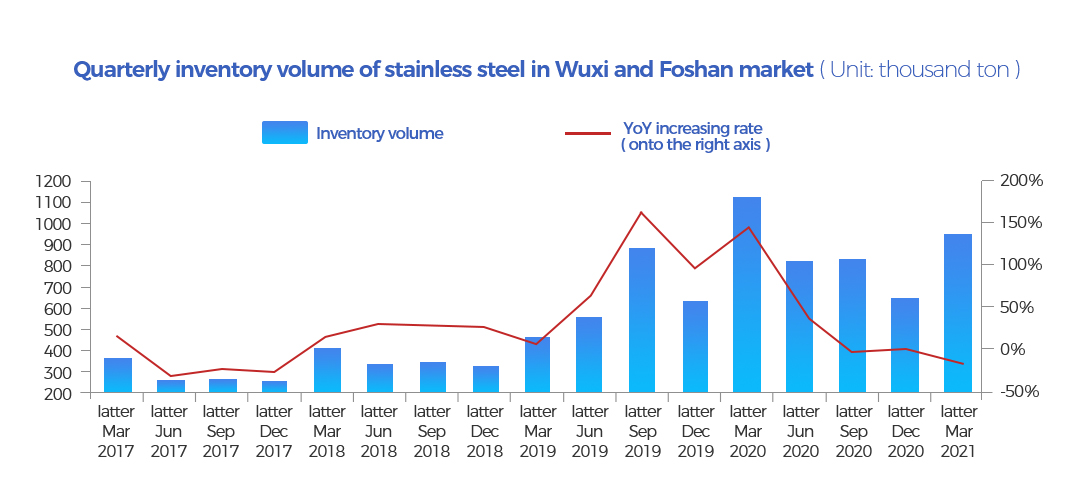

4. Social inventory

Until the latter March of 2021, the total social inventory of Wuxi and Foshan was about 946.2 thousand tons which was reduced by 176.9 thousand tons and 15.7% compared to the same period of last year.

Breaking News|| The purchasing price of high chrome in May dropped by US$155/MT.

A stainless steel mill in Northern China firstly finalized the purchasing price of high carbon ferronickel of May, which is US$1,132/50 base ton (tax inclusive, to the factory); for constant purchases, the delivery date is before June 15, 2021. The price sharply decreased by US$163/50 base ton compared to the purchasing price of April.

The sharp drop surprised the industry. But to a certain extent, it is not reasonless. The production of high chrome has kept increasing in April, influencing the price to decline. Although the EXW price quoted by the factories still maintained around US$1,209/50base ton~US$1,240/50 base ton, compared to the price in April, it still has a decrease of US$85.

Referring to the decrease of US$163/50 base ton in the purchasing price of high chrome, the production cost of stainless steel 430 will reduce US$56/50 base ton.

The price of 430/2B has been falling recently and on Thursday, the guidance price of TISCO was cut down by US$47/50 base ton and to US$1,505/50 base ton. As for the market trading price, it has fallen to about US$1,460/MT.

After this decrease in the raw material, a factor supporting the stainless steel price will be weakened. Moreover, the spot inventory of 400 series has kept rising. The stress over sales is high. It is predicted that the cold-rolling 430 will remain low next week.

----------------------------------------------------------------------Stainless Steel Market Summary in China----------------------------------------------------------------------