304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,410/MT(plus taxes) which is US$11/MT lower than that of last week, and the decreasing percentage is 0.42%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,455/MT(plus taxes) which decreases by US$11/MT, and the decreasing percentage is 0.41 %.

304/2B: The average price of 2.0*1240*C (slit edge) of Hongwang in the Wuxi market is US$2,235/MT(plus taxes) which is US$20/MT less than that of last week, and the decreasing percentage is 0.84%. Besides, the average price of 2.0*1240*C(slit edge) in the Foshan market is US$2,240/MT(plus taxes) which decreases by US$5/MT, and the decreasing percentage is 0.23 %.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,235/MT(plus taxes) which decreased by US$14/MT compared with last week and the declining percentage is 0.59%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,260/MT(plus taxes) which decreased by US$11/MT compared to last week, and the decreasing percentage is 0.45%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,370/MT(plus taxes) which remains the same price as last week. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,380/MT(plus taxes) which increases by US$23/MT compared with that of last week, and the increasing percentage is 0.64%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$3,190/MT(plus taxes) which is US$5/MT higher than last week and the increasing percentage is 0.41%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$3,200/MT(plus taxes) which increased by US$8/MT compared to last week and the increasing percentage is 0.22%.

201/2B: This week, the average price of 1.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$1,345/MT(plus taxes) which is US$11/MT lower than last week and the declining percentage is 0.89%. Besides, the tax-inclusive average price of the Foshan market is US$1,330/MT(mill edge) which is US$16/MT lower than last week and the decreasing percentage is 1.13%.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,290/MT(plus taxes) which is US$12/MT lower than last week and the decreasing percentage is 0.94%. Besides, the tax-inclusive average price of the Foshan market is US$1,265/MT(mill edge) which decreases by US$15/MT and the decreasing percentage is 1.13%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,500/MT(plus tax), which is US$24/MT lower than last week and the decreasing percentage is 1.53%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,500/MT(plus taxes) which decreased by US$28/MT and the declining percentage is 1.75%.

Will a drop of US$155/MT recur in 304?

The market was stable for long. Unsurprisingly, last week, Tsingshan cut down US$62/MT on all 304 wide sheet products. Besides, 201 was sold US$31/MT below the guidance price.

To this decrease, although it was within expectation, people suspected that this sharp drop is a scheme.

In fact, in the recent six months, steel mills have reduced the price for several times. In March, the decrease was related to the “nickel matte”, what about the latest drop?

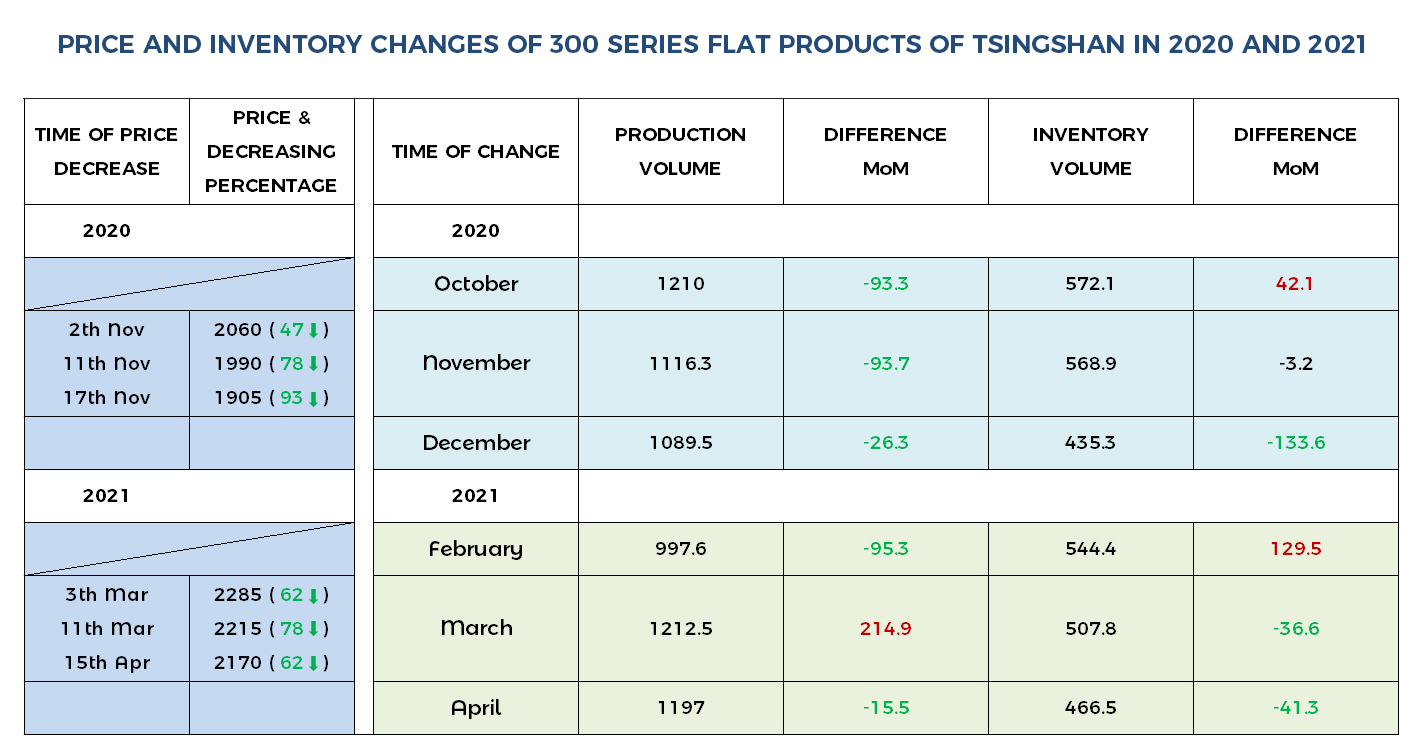

Similar to the decrease in November of 2020, little concerned with inventory or production, it is simply an operation by the mills. In the consecutive three openings in 2020, within 15 days, the decrease reached US$217/MT and the market price fell by US$233/MT.

This time, Tsingshan firstly cut down the price. The one in the know that say because the production volume from April to September will increase and meanwhile Baosteel Desheng and Delong will also increase investment in the second and third quarter, by decreasing the price, Tsingshan aims to win more futures orders. Therefore, occupying market margins becomes essential.

However, the most suffering is not the steel mills and the agents, but the traders who hold many spot products.

When the decrease so far is not inevitable, and it comes to the moment people can buy in at the lowest price, but do you dare to?

Products|| Summary of grade 200, 300 and 400

201: Stress of large inventory remains.

From the perspective of the raw material market, the price of the main raw materials of the 200 series is still weak. As the rainy season in the Philippines is over, in the future, the supply of low-grade nickel ore will gradually recover, so the low-nickel iron price will weaken. In terms of electrolytic manganese, the bidding situation of steel mills is rather negative. The price of electrolytic manganese has dropped significantly. Last week, the price of electrolytic manganese from the main production area has dropped by US$62/MT, reaching at around US$2,527/MT.

As for the inventory, last week, it increased by 7.5 thousand tons to 81.2 thousand tons. It was consumed, but the previous production keeps pouring into the market. On the whole, the inventory volume increases, and the high inventory stress remains.

About the transaction, agents had difficulty in selling and traders had less willingness to buy. No wonder Tsingshan allowed to sell at US$31/MT lower than the guidance price. Besides, the manufacturing mills said that the orders of 200 series reduced.

304: Cost keeps decreasing, as so does the future estimated price.

Last week, nickel and stainless steel futures were largely decreased, as well as the stock price of the main mills. The futures of May of Tsingshan decreased by US$62/MT, which affected the spot market to drop. Many products were sold in a low price. The base price of 304 by private-owned mills fell by US$39/MT to US$2,170/MT.

The raw material was also in a downward trend. Last week, the quoting price of high ferronickel maintained at US$171/nickel as last week. But the price of nickel ore kept decreasing slightly—— the CIF price of 1.5 contradiction nickel ore decreased by US$2/MT to around US$65/MT. Compared with the current price of nickel ore, the price of ferronickel fails to create enough margin for the ferronickel factories. Considering the low price of the Indonesian ferronickel, Chinese ferronickel factories have to decrease the cost in nickel ore, which makes the cost of ferronickel decrease. Calculating the price of current prices of ferronickel and ferrochrome, the cost of Chinese private-owned mills’304 (2.0 slit) is around US$2,165/MT. Steel mills still have profit margin.

However, in the spot market, there are positive factors to support the price to increase. First is the inventory. Last week, in the Wuxi market, the inventory of 300 series decreased by 22 thousand tons; demand is still large. But the most important factors are the stock price and guidance price of steel mills.

400: The decreasing trend does not fade.

Recently, the high carbon ferrochrome keeps decreasing. From April to now, there has a US$62/50 base ton of decrease. For now, the quotation of high chrome is about US$1,240/50 base ton ~US$1,271/50 base ton. Some products are quoted at US$1,225/50 base ton.

Influenced by the policy in Guangxi province, the raw material production is reduced, but in Inner Mongolia, the high chrome production is estimated to increase. It is predicted that in April, the total production of high chrome in China is more than 500 thousand tons which is 40~50 thousand tons higher than last month. The supply is sufficient. In the future, the ferronickel market is still low in price.

From the perspective of inventory, last week, in the Wuxi market, the inventory of 400 series increased by 500 tons to 80.4 thousand tons. According to the traders, it is difficult to sell 400 series. Due to decreasing price, traders are reserved to buy. Although the inventory decreased, the transaction price still reduced to US$1,490/MT. People are not positive toward the future market.

On the basis of our statistics, the production of 400 series reduced by 14 thousand tons in April, and the supply will keep decreasing. However, the high inventory will remain in a short term. The market is still hazy.

Summary:

201: Week demand, high inventory stress. Next week, it is possible that 201 will reduce the price. Cold rolling J2 in the Wuxi market is US$1,210/MT~US$1,240/MT.

304: In the next half of year, Chinese stainless steel will increase the production and thereby the stress of supply will rise. Besides, with the influence of the end of rainy season in The Philippines and the low-cost Indonesian ferronickel, as well as the tight fiscal forecast, the price of 304 will probably keep decreasing.

430: Thanks to the large inventory, next week, traders will still reduce the price to sell. 430/2B will maintain the falling trend, and the price will be US$1,475/MT ~US$1,490/MT, which will be US$16/MT lower than last week.

Breaking News|| The Philippines abolishes the 9-year ore ban. What happens to the ferronickel market?

The Philippines abolishes the 9-year ore ban.

It is reported that the Presidential Office of the Philippines issued an executive order on the 15th: the ban on the new mineral agreement implemented in 2012 is abolished, but the regulations on mine safety and environmental policies must be carried on. This decision aims to increase national income, which is used to fund infrastructure projects and other programs.

Although the mining rate of all mineral reserves is less than 5%, Southeast Asian countries are still the largest nickel ore supplier to the largest consumer, China. However, according to the tax reform that took effect in 2018, the consumption tax on mineral products and quarry resources has doubled to 4%.

In the past, the mining industry has become a controversial topic in the Philippines due to poor environmental management. President Duterte warned miners to comply with stricter environmental regulations or shut down mining shortly after taking office in 2016. Although senior officials suggested milder policies, he insisted on the ban on new open-pit mines.

What will happen to the future ferronickel market?

In this regard, some believe that the government encourages increased nickel mining and investment in local factories. This action is to replicate Indonesia to establish a ferronickel industrial park. After all, Indonesia has successfully completed the production of ferronickel production lines. If the policy is implemented as scheduled, China’s imports of nickel ore and ferronickel will both usher in growth in the later period, which will have a greater negative effect on the ferronickel market.

However, there are also opinions that it will be more difficult to implement this policy, because the grade of nickel ore in the Philippines has no advantage compared to Indonesia. Moreover, Indonesia is experienced in investment and construction of ferronickel plants. More companies may still prefer to set factories in Indonesia.

-----------------------------------------------------------------------Stainless Steel Market Summary in China-----------------------------------------------------------------------