304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,165/MT(plus taxes) which is US$15/MT lower than last week and the declining percentage is 0.65%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,205/MT(plus taxes) which went down by US$15/MT compared with last week and the decreasing percentage is 0.64%.

304/2B: The average price of 2.0*1240*C (mill edge) of Hongwang in the Wuxi market is US$2,075/MT(plus taxes) which is US$40/MT less than last week and the declining percentage is 1.84%. Besides, the average price of 2.0*1240*C (mill edge) of Hongwang in the Foshan market is US$2,050/MT(plus taxes) which decreases by US$33/MT compared with last week and the decreasing percentage is 1.51%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,015/MT(plus taxes) which decreased by US$17/MT compared with last week and the declining percentage is 0.84%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,030/MT(plus taxes) which is US$28/MT lower than last week and the decreasing percentage is 0.13%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,875/MT(plus taxes) which is US$37/MT lower than last week and the decreasing percentage is 0.12%. Moreover, the average price of 316L/2B 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,915/MT(plus taxes) which decreases by US$33/MT and the declining percentage is 0.10%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,720/MT(plus taxes) which is US$52/MT lower than last week and the decreasing percentage is 0.18%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,755/MT(plus taxes) which is US$48/MT lower than last week, and the decreasing percentage is 0.16%.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,095/MT(plus taxes) which is US$4/MT lower than last week and the declining percentage is 0.41%. Besides, the tax-inclusive average price of the Foshan market is US$1,095/MT(mill edge) which remains as last week.

J2, J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,040/MT(plus taxes) which is US$9/MT less than last week and the decreasing percentage is 0.86%. Besides, the tax-inclusive average price of the Foshan market is US$1,050/MT(mill edge) which remains as last week.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,175/MT(plus tax), which is US$12/MT higher than last week and the rising percentage is 0.10%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,155/MT(plus taxes) which remains as last week.

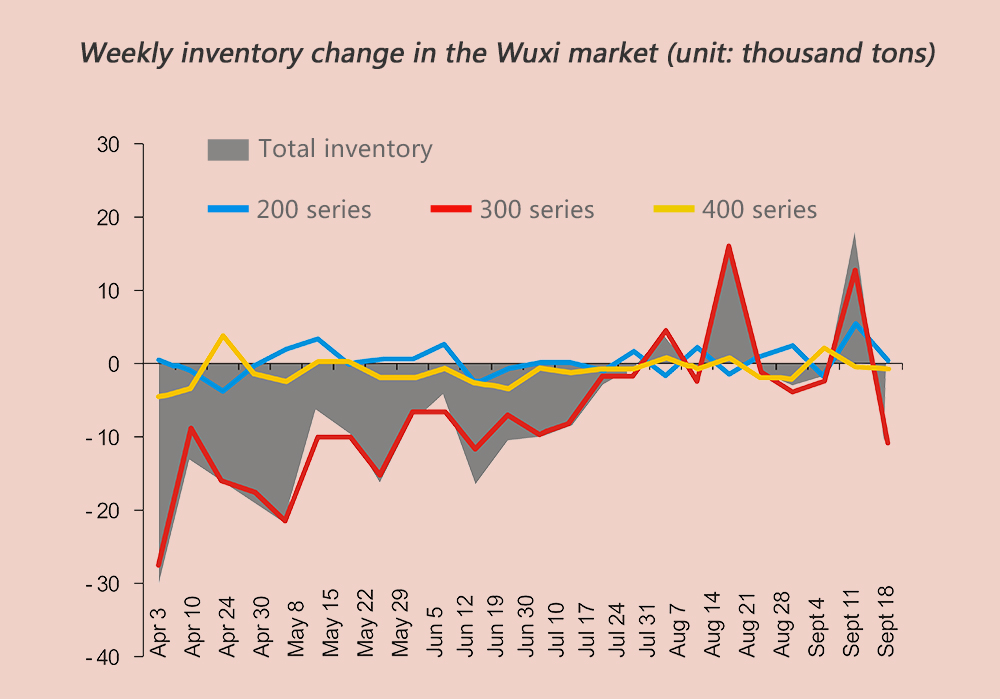

Inventory|| Demand not bad. Inventory in the Wuxi market was reduced by 11.1 thousand tons last week.

On September 18th, the stainless steel inventory was 439.8 thousand tons which reduced by 11.1 thousand tons compared with that on September 11th. About 300 series, it reduced to 332.8 thousand tons which were 10.8 thousand tons less in inventory; about 200 series, the inventory increased by 500 tons to 45.2 thousand tons; about 400 series, the inventory also decreased, which was 800 tons less to 61.8 thousand tons.

Although the stock good price has been in the downward trend lately, the market transaction was stable and the purchase did not stop. The lead inventory of steel mills and the resources of traders were partly consumed. Some buyers have purchased to stock up before the National holiday in October, which stimulated the market demand. The main-stream steel mills are accustomed to selling out the inventory product to reduce risk.

According to market feedback, the number of products arriving in the market has decreased, and there are no products in transit, which releases some inventory pressure.

So far, the production by steel mills has remained in high volume. Therefore, the pressure on the supply side is rather high. If the demand fails to keep up with the rise in supply, the market will risk the increasing inventory volume.

Nickel's price increased. Mills faced with nickel shortage: Steel mills and iron mills failed to reach the common ground on US$179/nickel.

Recently, it is widely reported in the market that a large-scale stainless steel plant in southern China and a Shandong ferronickel plant negotiated on the supply of ferronickel. However, due to the large divergence of target prices between the supply and demand sides, the negotiation breached.

According to the production schedule of ferronickel factories, the production was arranged for October. Then the supply time for this bidding and procurement should be between late October and November. The purchaser's initial purchase price is US$176/nickel (tax inclusive to the factory), but the supplier's intention price is US$179/nickel (tax inclusive to the factory).

The drama was that during the negation, the price of nickel ore has been rising over, bringing burdens to the price negotiation.

According to a factory, the price of nickel ore futures in the Philippines in November has skyrocketed in recent days. The nickel ore(concentration of 1.5%) price has reached US$70/MT. And a higher price of US$73/MT, then even US$76/MT shown. Meanwhile, the nickel ore(concentration of 1.8%) price has exceeded US$100 /MT.

Regardless of how LME Nickel fluctuates, it can't hold back the explosive rise of nickel ore prices. The most important factor is that nickel ore is in short indeed.

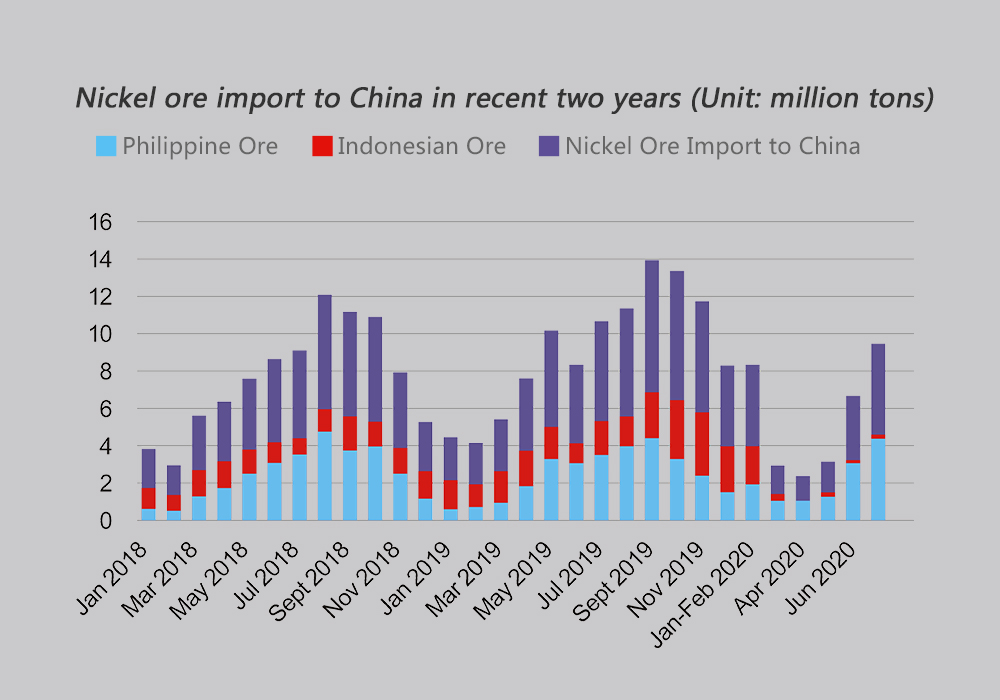

It is known to all that after Indonesia acted the ban on mines since January 2020, the Philippines has become China’s most important exporter of nickel ore. In November, the Philippines will enter the rainy season. According to previous years, the export volume of nickel ore will drop sharply. This year, plus the epidemic, the situation will be more troublesome. The difficulty in exporting nickel ore will increase compared with previous years.

Ore resource is not the first emergency for China’s manufacturers, but the high price of raw materials which they are unwilling to buy at this point.

It is critical to know how much Indonesia's new production can reach in November this year, and whether it can fill the domestic ferronickel shortage. The price concern of Chinese manufacturers is a side-effect of the fear of the large-amount Indonesian ferronickel flow-in.

According to the current tracked production of ferronickel projects in Indonesia, at the end of 2020, it is estimated that ten ferronickel production lines will be put into operation, eight from Tsingshan and Delong, one each for Huadi and Macrolink. Since the epidemic is getting worse, and there are still many uncertainties. Whether these production lines can be put into production on time during the year, we will see.

At present, ferronickel factories and steel mills are relatively stalemating, and their respective target prices are quite different. Considering the supply side of ferronickel is still tight, in the short term, the price of high ferronickel is more likely to rise rather than fall.

------------------------------------------------------------------------------------Stainless Steel Market Summary in China------------------------------------------------------------------------------------