304/2B: The average price of 2.0*1219*C (mill edge) of ZPSS in the Wuxi market is US$2,350/MT(plus taxes) which is US$34/MT higher than last week and the increasing percentage is 1.38%. Besides, the average price of 2.0*1219*C (mill edge) of ZPSS in the Foshan market is US$2,395/MT(plus taxes) which increases by US$34/MT compared with last week and the increasing percentage is 1.35%.

304/2B: The average price of 2.0*1240*C (slit edge) of Hongwang in the Wuxi market is US$2,220/MT(plus taxes) which is US$42/MT higher than that of last week, and the increasing percentage is 1.80%. Besides, the average price of 2.0*1240*C(slit edge) in the Foshan market is US$2,235/MT(plus taxes) which increases by US$94/MT, and the increasing percentage is 3.97%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,215/MT(plus taxes) which increased by US$80/MT compared with last week and the rising percentage is 3.41%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,235/MT(plus taxes) which increased by US$78/MT compared to last week, and the increasing percentage is 3.31%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,185/MT(plus taxes) which increased by US$41/MT compared with last week and the increasing percentage is 1.19%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,215/MT(plus taxes) which increases by US$41/MT compared with that of last week, and the increasing percentage is 1.78%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$3,050/MT(plus taxes) which is US$85/MT higher than last week and the increasing percentage is 2.58%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$3,065/MT(plus taxes) which increased by US$88/MT compared to last week and the increasing percentage is 2.66%.

201/2B: This week, the average price of 1.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$1,340/MT(plus taxes) which is US$3/MT more than last week and the rising percentage is 0.23%. Besides, the tax-inclusive average price of the Foshan market is US$1,345/MT(mill edge) which is US$14/MT higher that last week and the rising percentage is 1.03%.

J5/2B: The average price of 1.0*1240*C(mill edge) of the Wuxi market is US$1,295/MT(plus taxes) which is US$2/MT higher than last week and the rising percentage is 0.12%. Besides, the tax-inclusive average price of the Foshan market is US$1,305/MT(mill edge) which increases by US$9/MT and the increasing percentage is 0.71%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,525/MT(plus tax), which is US$6/MT higher than last week and the rising percentage is 0.40%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,510/MT(plus taxes) which increased by US$22/MT and the rising percentage is 1.14%.

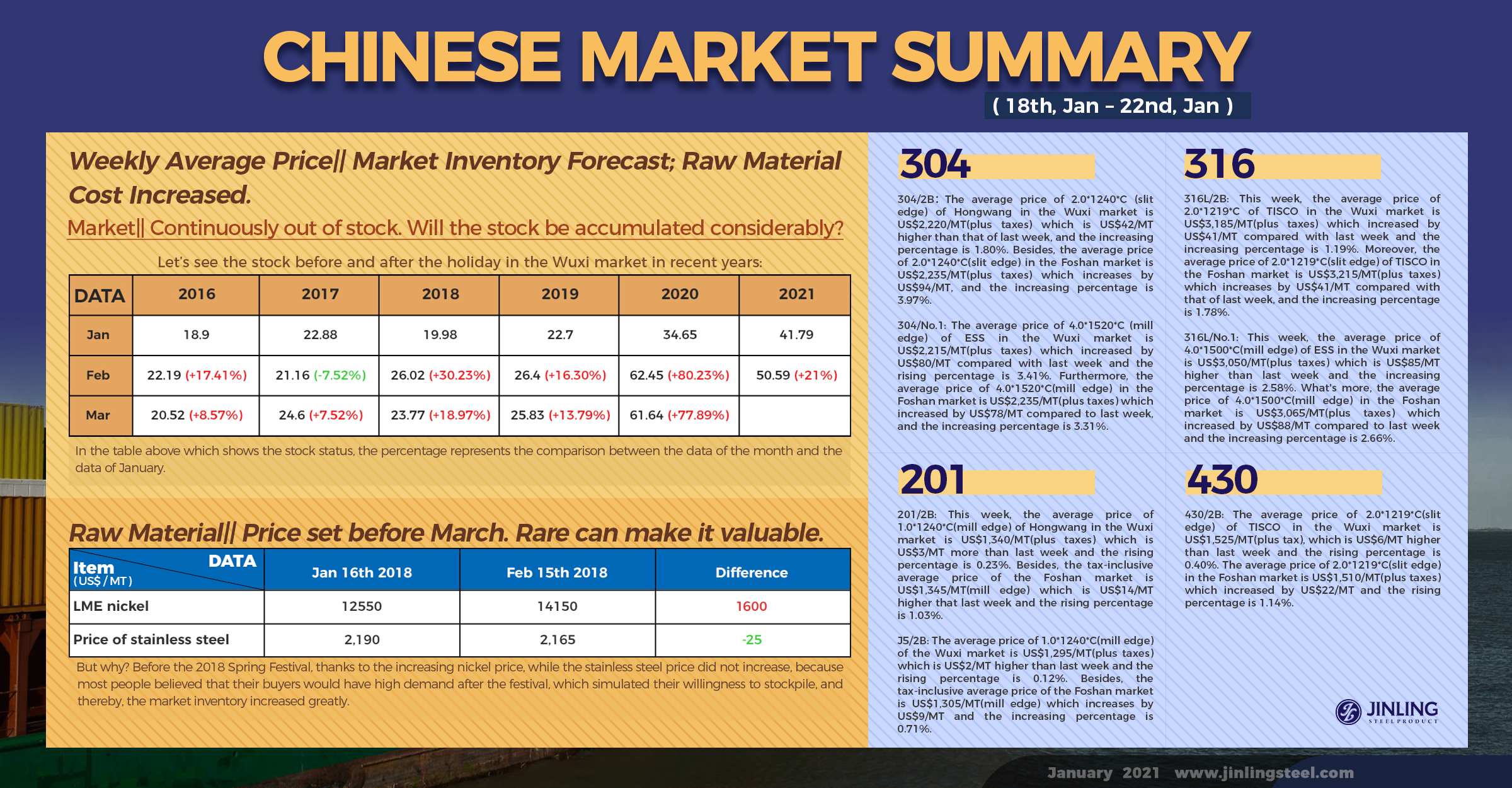

Market|| Continuously out of stock. Will the stock be accumulated considerably?

Stepping into 2021, stainless steel also steps into a hot market. The price has been increasing, but people still concern about the inventory when the Spring Festival (on February 12th) is approaching. During the holiday, the stock to be accumulated or not is a question to us all.

People have analyzed that if the stock is accumulated after the holiday, the out-of-stock pressure will be released substantially and thus the price will be adjusted to lower. However, if not, the market price is expected to be increasing for a long time.

Let’s see the stock before and after the holiday in the Wuxi market in recent years (unit: 10,000 tons):

(In the table above which shows the stock status, the percentage represents the comparison between the data of the month and the data of January.)

By comparing the recent inventory data, the stock after the holiday mostly increased. Especially, the increases were more obvious in 2018 and 2020.

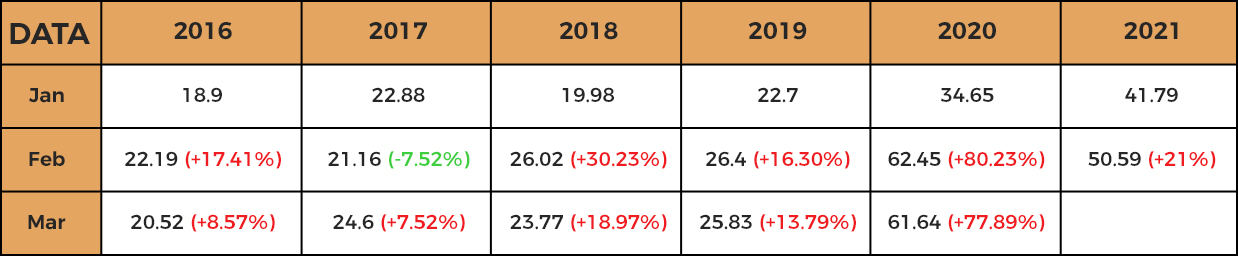

But why? Before the 2018 Spring Festival, thanks to the increasing nickel price, while the stainless steel price did not increase, because most people believed that their buyers would have high demand after the festival, which simulated their willingness to stockpile, and thereby, the market inventory increased greatly.

How was the market inventory in the past years? How will the inventory after the 2021 Spring Festival?

Some experts claimed that recently the pandemic has expanded again in China, which will lead to an early close in the downstream manufacturers. The downstream demand before the holiday may be difficult to follow up continuously. And the current demand of many downstream home appliance industries is weak. Due to the high export sea freight and the shortage of container, the exportation of goods is not smooth, which will also restrain future stainless steel demand.

During the holiday, steel mills mostly will remain to produce, so the products will still send out to the ports and market. With the pandemic spreads out, the demand may be postponed, and the futures will be invested in the market as well, so the inventory, probably, will be accumulated.

To summarize the stock changes in previous years, without considering the influence of the 2020 pandemic, the increases of 2016, 2018, and 2019 were all above 21%. If to calculate by an increase of 21% in inventory, after the holiday, the inventory in the Wuxi market will increase by about 88 thousand tons. If the pandemic is worsening which pushes off the workday, the increase of inventory will even be higher.

Compared to the increase of inventory after 2018 Spring Festival, the increase in 2020 was larger, when many warehouses were stocked fully.

Affected by the pandemic in 2020, most Chinese manufacturers postponed their workday, so the demand also got delayed. But during the holiday and post-holiday, the sea and land transportation both flew freely, sending the resources from ports to warehouses, so the inventory was pushed up.

Raw Material|| Price set before March. Rare can make it valuable.

With the Spring Festival approaching, the raw materials are boosting in price. Last week, Chinese mainstream steel mills announced the bidding purchase price of high chrome in February. The largest 4 stainless steel mills all increased the base price by US$344/50 reference ton.

Tisco announced the purchase price of the high carbon ferrochrome in February 2021 was US$1,252/50 reference ton (cash, tax-inclusive, to the factory), which is increased by US$344/50 reference ton compared to that of last month. The delivery date is before March 15th 2021.

Tsingshan announced the purchase price of the high carbon ferrochrome in February 2021 was US$1,283/50 reference ton (tax-inclusive, to the factory), which is increased by US$344/50 reference ton compared to that of January. Is delivery to Tianjin port, the price should be cut down US$23/50 reference ton. The delivery date is before March 15th 2021.

Baosteel Desheng announced the purchase price of the high carbon ferrochrome in February 2021 was US$1,283/50 reference ton (tax-inclusive, to the factory), which is increased by US$344/50 reference ton compared to that of January.

Jisco announced the purchase price of the high carbon ferrochrome in February 2021 was US$1,275/50 reference ton (tax-inclusive, to the factory), which is increased by US$344/50 reference ton compared to that of last month. The delivery date is in early March.

----------------------------------------------------------------------------------------Stainless Steel Market Summary in China----------------------------------------------------------------------------------------