304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,275/MT(plus taxes) which is US$63/MT higher than that of last week, and the increasing percentage is 2.60%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,315/MT(plus taxes) which increases by US$63/MT, and the increasing percentage is 2.55 %.

304/2B: The average price of 2.0*1240*C (mill edge) of Hongwang in the Wuxi market is US$2,145/MT(plus taxes) which is US$56/MT higher than that of last week, and the increasing percentage is 2.49%. Besides, the average price of 2.0*1240*C(mill edge) in the Foshan market is US$2,155/MT(plus taxes) which increases by US$92/MT, and the increasing percentage is 4.05 %.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,120/MT(plus taxes) which increased by US$86/MT compared with last week and the rising percentage is 3.85%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,140/MT(plus taxes) which increased by US$89/MT compared to last week, and the increasing percentage is 3.95%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,095/MT(plus taxes) which increased by US$75/MT compared with last week and the increasing percentage is 2.26%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,135/MT(plus taxes) which increases by US$72/MT compared with that of last week, and the increasing percentage is 2.14%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,915/MT(plus taxes) which is US$110/MT higher than last week and the increasing percentage is 3.51%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,955/MT(plus taxes) which increased by US$91/MT compared to last week and the increasing percentage is 2.87%.

201/2B: This week, the average price of 1.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$1,320/MT(plus taxes) which is US$78/MT more than last week and the rising percentage is 5.83%. Besides, the tax-inclusive average price of the Foshan market is US$1,360/MT(mill edge) which is US$111/MT higher than last week and the rising percentage is 8%.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,280/MT(plus taxes) which is US$72/MT higher than last week and the rising percentage is 5.55%. Besides, the tax-inclusive average price of the Foshan market is US$1,330/MT(mill edge) which increases by US$106/MT and the increasing percentage is 7.85%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,500/MT(plus tax), which is US$59/MT higher than last week and the rising percentage is 3.85%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,470/MT(plus taxes) which increased by US$74/MT and the rising percentage is 4.87%.

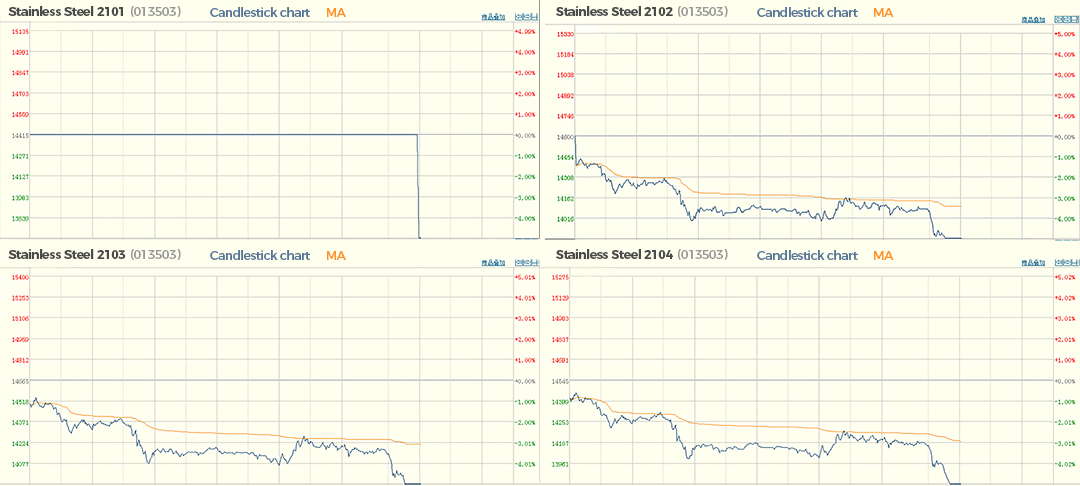

Market|| Capital escaped! Stainless steel futures crashed down $110/MT.

On January 11th, at around 11:15 pm(Beijing time), the stainless steel futures stock market got stuck in the decreasing tendency. The futures of stainless steel contract 2102 and 2103 all hit the limit down, accordingly decreased by $114/MT and $115/MT. Until noon, Contract 2101 and 2104 also crumbled and closed at the limit down.

4 futures hit the limitdown within one day (on January 11th)

What is the reason leading to the limit down of stainless steel futures?

As the industry disclosed that the large-scale limit down in the market comes from the escaping capital. A week before, too many long positions focused on the market and got profit, and thereby on Monday, the capital withdrew in case there would be a risk of declining. Until the close of 11th noon, compared to the closing price of last Thursday(7th January), the stainless steel positions cut down by almost 10,000 plots, that is 50 thousand tons! The decrease is caused by the withdraw of capital.

Then why did the capital escaped?

Street said that Tsingshan has delivered most of its resources to the appointed In Warehouse and yet did not register the delivery note. Thus it goes without reason to say the settlement of contract 2101 would fail to be delivered. Recently, the risk of squeezed does not exist. With this “squeezed” speculation stopped, the long positions found that there was not more profit to gain and so they withdraw from the market.

There is an opinion that holds differently.“Lately, the US FederalDecember Meeting Minutes disclosed that policymakers were optimistic about the economic growth and the midterm prospects for inflation. Although now the policy remains, people have started to think when and why they will begin to reduce the volume of purchasing assets gradually. The market has certain expectations of tightening on the funding level, so bulk commodities have generally seen a sharp correction in the short term, and there has also been a relatively large negative sentiment on the stainless steel futures.

Will the 304 stock market also decline?

Until January, 11th afternoon, in the Wuxi market, 304 did not seem to decline. A trader told that recently some steel mills indeed have arrival products but the quantity is small and the products are mostly for delivery, so actually, the available specifications of stock are still not abundant.

In the afternoon(January 11th), in the case of the cold rolling products, the base price of the 4-feet mill-edge product is quoted at around US$2,135/MT-US$2,150/MT(US$2,205/MT-US$2,220/MT in 2.0 slit) by Delong and Chengde, and some inferior specifications are US$2,120/MT. The base price of Yongjin’s 4-feet mill-edge remains at US$2,200/MT (US$2,290/MT in 2.0 slit), and some popular specifications are quoted at US$2,250/MT. As for the hot rolling products, the price remained around US$2150/MT and US$2,165/MT.

Due to the continuous stock-out, the stainless steel stock price has been in a robust status. The downstream purchasers mostly hold a cautious attitude toward the price trend, plus that the futures stock price has gone all the way down. Therefore, the market is stuck in an embarrassing situation: the prices remained unasked.

Market|| People regard 201 will decrease but the price stands still.

The voice about the decreasing price trend has been overwhelming, but until now there is still no actual decline in the market. Does the price standstill?

Earlier in the day, the 4-feet mill-edge cold rolling 201 of the mainstream steel mills quote the base price at US$1,305/MT; as for J2 and J5, they are quoted at US$1,265/MT, and 5-feet hot-rolling is also quoted at US$1,265/MT.

Why can the price remain high?

It is because 201 is in shortage. Since October of 2020, 201 has been out of stock, and the inventory has not been saturated, and worst, the thin and thick products once closed to stop supply. Although Hongwang and Chengde have products successively arrived in recent days, the quantity is not large enough to accumulate, so they do not stock up the products but tend to send them out.

5-feet hot rolling products are quoted excessively?

According to feedback from market personnel, the current price of the five-feet hot-rolling product is not consistent. The mainstream price is US$1,265/MT, but the selling price is said to be US$1,235/MT in the market. However, these are the selling prices of small households in the market, and only the specifications with large inventory are sold at US$1,235/MT.

Summary:

The price has not been lowered for the time because it is supported by the inventory shortage, but the transaction does not seem to keep up. According to feedback from the market, the transaction on Monday (January, 11th) was not as impressive as other usual Mondays. It was slightly dismal. Market traders are still waiting and watching, and the bearish attitude towards the future market has not dissipated.

-----------------------------------------------------------------------------------------Stainless Steel Market Summary in China-----------------------------------------------------------------------------------------