304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,440/MT(plus taxes) which is US$59/MT lower than that of last week, and the decreasing percentage is 2.28%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,480/MT(plus taxes) which decreases by US$59/MT, and the decreasing percentage is 2.24 %.

304/2B: The average price of 2.0*1240*C (slit edge) of Hongwang in the Wuxi market is US$2,265/MT(plus taxes) which is US$22/MT less than that of last week, and the decreasing percentage is 0.91%. Besides, the average price of 2.0*1240*C(slit edge) in the Foshan market is US$2,265/MT(plus taxes) which decreases by US$50/MT, and the decreasing percentage is 2.11%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,280/MT(plus taxes) which decreased by US$40/MT compared with last week and the declining percentage is 1.68%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,305/MT(plus taxes) which cut down US$53/MT compared to last week, and the decreasing percentage is 2.16%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,365/MT(plus taxes) which decreased by US$34/MT compared with last week and the decreasing percentage is 0.94%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,350/MT(plus taxes) which decreases by US$28/MT compared with that of last week, and the decreasing percentage is 0.78%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$3,210/MT(plus taxes) which is US$44/MT lower than last week and the decreasing percentage is 1.26%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$3,220/MT(plus taxes) which decreased by US$44/MT compared to last week and the decreasing percentage is 2.87%.

201/2B: This week, the average price of 1.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$1,350/MT(plus taxes) which is US$20/MT less than last week and the declining percentage is 1.47%. Besides, the tax-inclusive average price of the Foshan market is US$1,340/MT(mill edge) which is US$47/MT lower than last week and the decreasing percentage is 3.41%.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,280/MT(plus taxes) which is US$33/MT lower than last week and the decreasing percentage is 2.51%. Besides, the tax-inclusive average price of the Foshan market is US$1,280/MT(mill edge) which decreases by US$65/MT and the decreasing percentage is 5.02%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,590/MT(plus tax), which is US$2/MT higher than last week and the rising percentage is 0.09%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,590/MT(plus taxes) which increased by US$6/MT and the rising percentage is 0.38%.

Who are the winners and losers in this round of decreasing price battlefield?

Reviews:

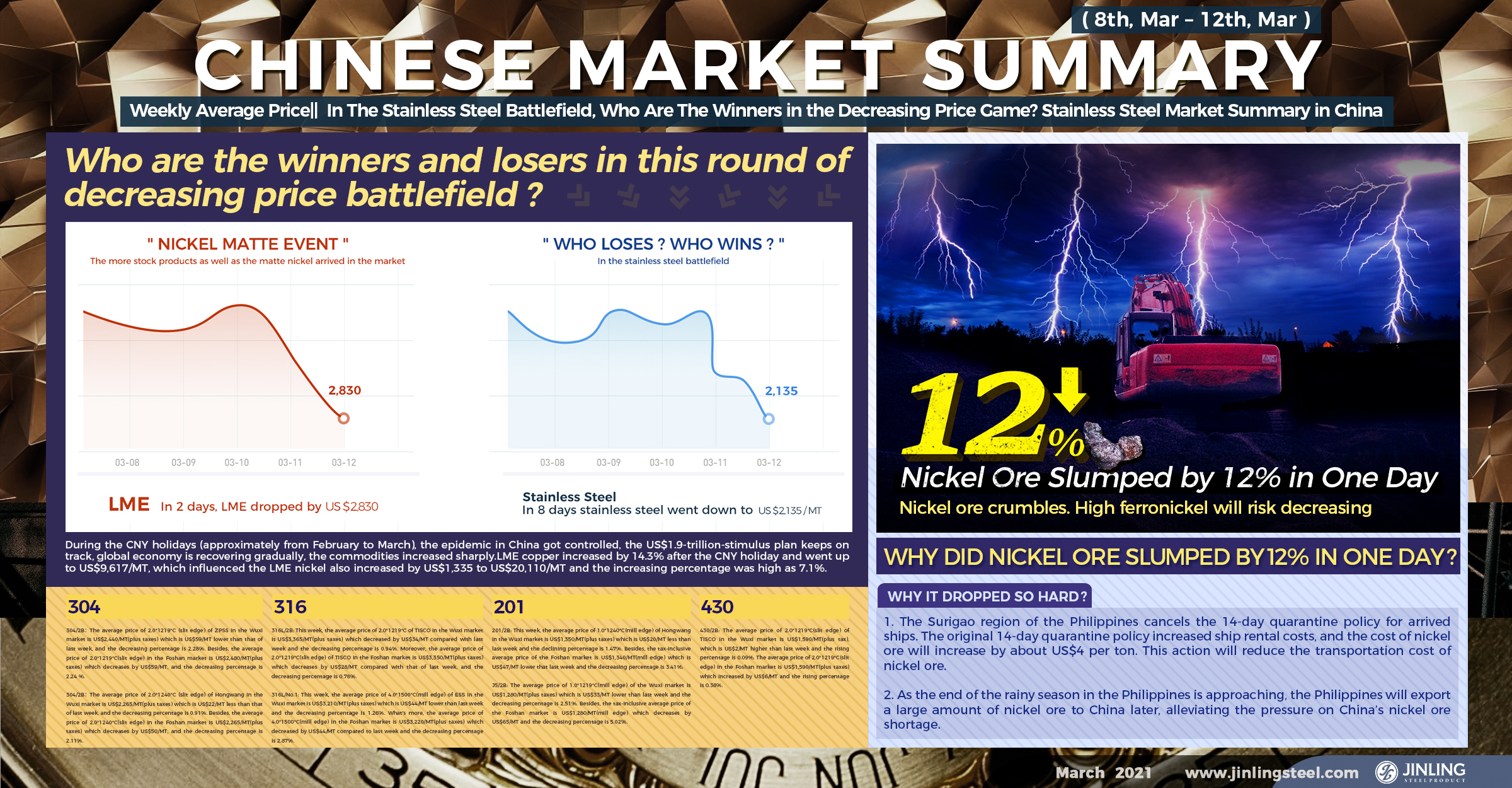

During the CNY holidays (approximately from February to March), the epidemic in China got controlled, the US$1.9-trillion-stimulus plan keeps on track, the global economy is recovering gradually, the commodities increased sharply. LME copper increased by 14.3% after the CNY holiday and went up to US$9,617/MT, which influenced the LME nickel also increased by US$1,335 to US$20,110/MT and the increasing percentage was high as 7.1%.

Under the increasing atmosphere, within 5 days after the stainless steel market began to work, the price already rose by US$187/MT. In the Wuxi market, the mill-edge CR 304 of private-owned mills was US$2,330/MT (US$2,400/MT in 2.0 slit). However, with the more stock products as well as the matte nickel arrived in the market, the LME nickel fell by US$2,830 in two days; stainless steel also dropped to the lowest price in this round of decreasing price, US$2,135/MT (US$2,200 in 2.0 slit edge) in eight days.

In the fluctuated market, who are the winners and losers?

Winner A: Steel Mills

The raw materials cost was rather high, but after the holiday, the stainless steel price went up. Therefore, the profit margin left large to steel mills. With the increase, steel mills limited the orders, and people kept buying because they believed that the price was still on a rise. Moreover, steel mills postponed the delivery of the former orders that were of lower price to enlarge the profit to the maximum. While in the decrease, some private-own mills only deliver high-priced products or mixing the delivery of high and low-price products instead of delivering according to chronological order.

Winner B: Raw materials producers

For sure, one of the winners must be the raw material producers like the manufacturers of ferronickel and ferrochrome. In February, the price of nickel ore did not show any increasing sign. Before the holiday, the CIF price of the nickel ore (of 1.5 contractions) was quoted at only US$64/MT which was US$14/MT lower than the price now. In March, the raw material of producing ferronickel used the former low-price material. After the holiday, in March, the transaction price of ferronickel is around US$187/nickel which is US$6/nickel higher than the pre-holiday price. From this point of view, the ferronickel producers do have a good profit margin.

As for the ferrochrome manufacturers, thanks to the power control policy in Inner Mongolia, the production of ferrochrome was limiter, and thus the price remains high. In March, the bidding price by the large-size steel mills is given at around US$1,384/50 base ton which increased by US$109/50 base ton compared to the price in February. Recently, the transaction price of the small orders remains at around US$1,376/50 base ton. The large decrease in the stainless steel price has yet not influenced the ferrochrome market, and thereby, the manufacturers still have substantial gains.

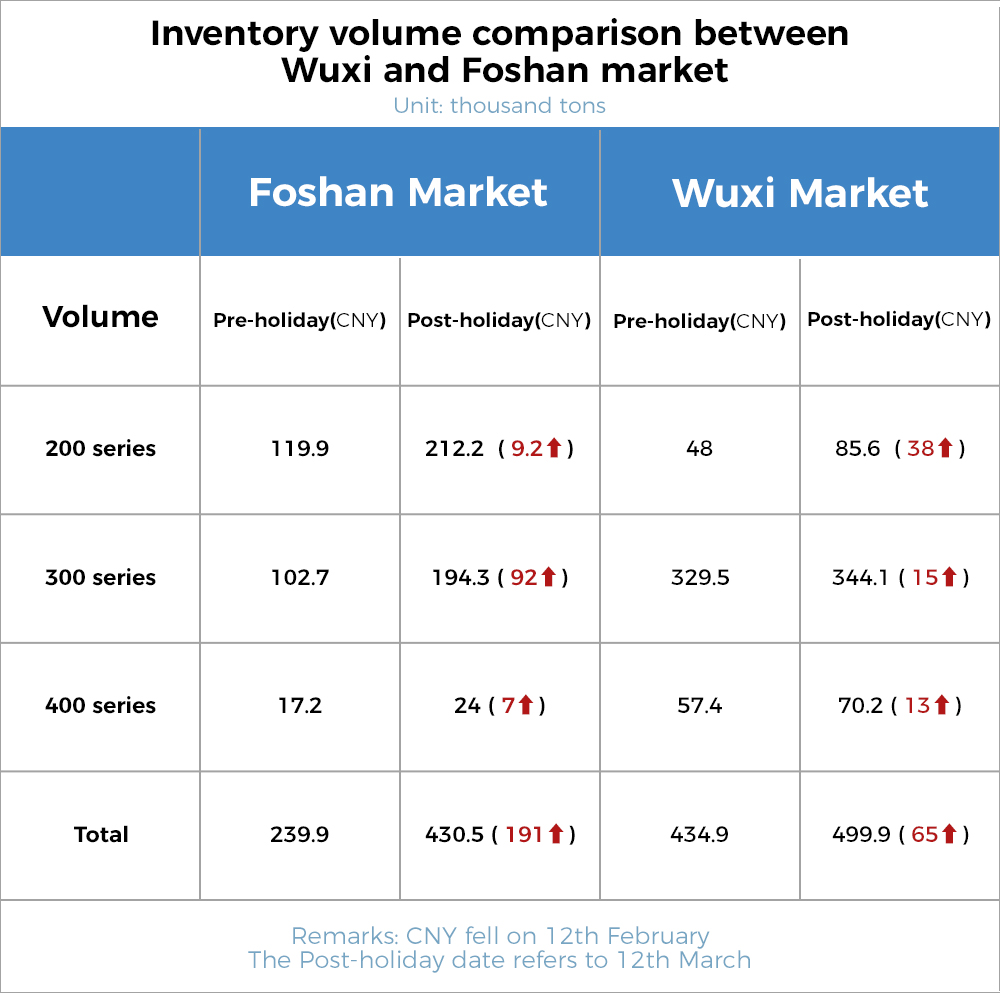

Winner C: Traders in the Wuxi Market

The win of Wuxi’s traders is a comparative result to Foshan’s traders. Wuxi market was earlier to work (on 17th or 18th March). The stock products from steel mills have already been taken by the Wuxi’s traders who sold them out with the increasing price trend, which locked the profit that was brought by the increasing price. Besides, compared to the Foshan’s traders, Wuxi’s traders are more conservative in purchasing plan, so in most cases, they purchase according to their demands.

Winner D: Steel traders who settle in average price

In recent years, with the development of the steel mills which own laterite nickel ore, the steel mills have larger rights to decide the prices. For whatever reasons, they just can justify themselves to increase or reduce the price. For many traders, they have nothing to do with the mills’ decisions—when the price is increasing, the stainless steel mills are unwilling to hand out the products until the price trend is downward. As if the traders do business can only rely on luck. Therefore, steel traders who settle the contracts at the average price are more likely to make a balance.

Losers

Loser A: Most of the traders in Foshan

Buying in the bottom price, US$1,900/MT, many Foshan’s traders got a taste from it. However, the fluctuations also gained them greater bitterness. Because of the late start in Foshan after CNY, stockpiled inventory, high guidance prices, people were positive and confident towards the increasing market price. In a day, orders from Foshan was contributed more than 30 thousand tons of orders to a steel mill. The price reduced later and it seems that Foshan’s traders were being taken advantage of.

Price reduced, inventory accumulated. Compared to Wuxi’s traders, Foshan’s traders look losing a lot. Some people think the Foshan traders have more long positions in hand. But to gain a low-cost resource, they have to buy three high-cost resources. Does it worth it?

Loser B: Agents and traders who locked the price

In these years, the traditional large steel mills’ influence on the southern Chinese market gradually declines. It is because the distance and high price. Tsingshan and Delong have greater influence on the southern Chinese market and they are used to adopt the “lock price” strategy, which allows the steel mills to have greater control in the business.

Summary:

In nature, only the strong lives. Taking price difference as a major profit gain will be eliminated sooner or later. Some enterprises were once famous but soon faded. While some other enterprises, don’t stop at trading business. They also explore other areas such as manufacturing, to extend their market down to more buyers, to take over more end market in advance.

Panic|| Why did nickel ore slumped by 12% in one day?

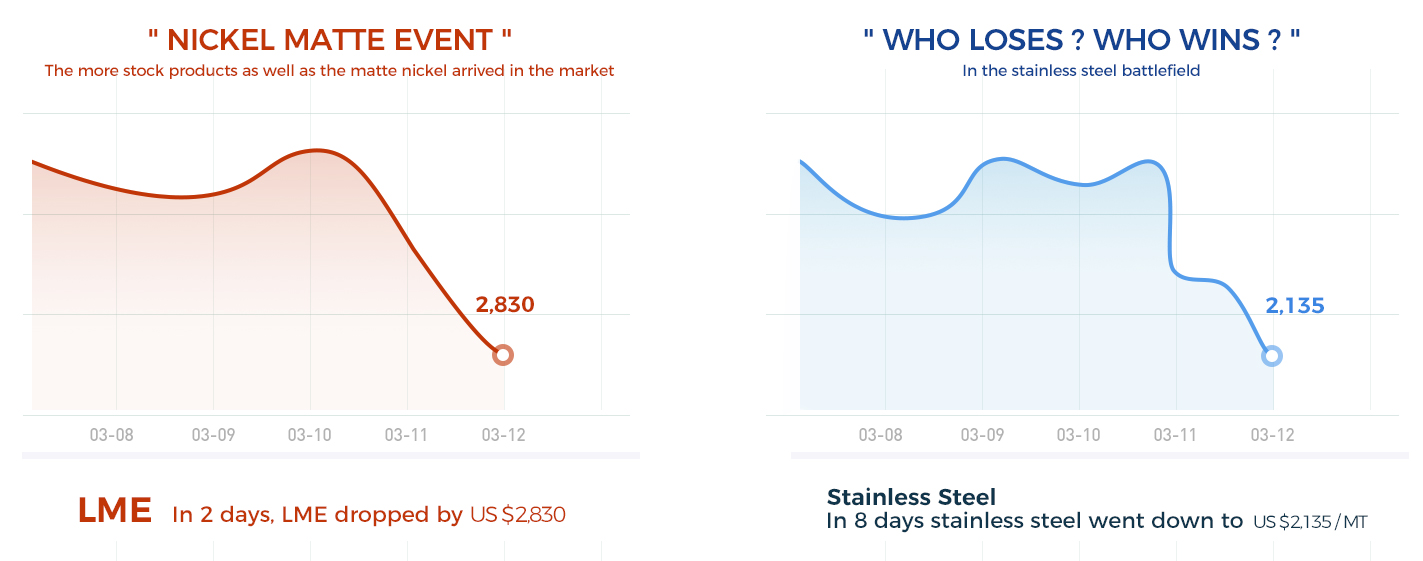

Nickel market is weakening, meanwhile, the price of the nickel ore begins to fluctuate. The CIF quotation of the Philippines nickel ore (of 1.5% contradiction) cut down by US$10/MT (that is 12%) and reaches US$72.5/MT. Within one transaction day, it lost 75% of the increase after the holiday.

Why it dropped so hard?

We learned from the market that following are the major factors:

1. The Surigao region of the Philippines cancels the 14-day quarantine policy for arrived ships. The original 14-day quarantine policy increased ship rental costs, and the cost of nickel ore will increase by about US$4 per ton. This action will reduce the transportation cost of nickel ore.

2. As the end of the rainy season in the Philippines is approaching, the Philippines will export a large amount of nickel ore to China later, alleviating the pressure on China’s nickel ore shortage.

At present, factories mostly have nickel ore inventory that can support 2-month production, that is, before the end of the rainy season in April, there will be no shortage of minerals in China. The abundant supply backup brings less confidence to the future market for the ore suppliers.

Nickel ore crumbles. High ferronickel will risk decreasing.

Now, Chinese transactions of ferronickel have a low quantity, and Chinese factories rarely offer external quotations. The high ferronickel is quoted at around US$187/nickel. However, the recent Indonesian ferronickel transaction mostly quoted at US$170/nickel. Besides, two steel mills in China also made a deal with the Indonesian high ferronickel in US$170/MT as well.

From the perspective of cost, according to the nickel ore trend, in the near future, the production cost can be reduced by US$11/MT, so the price of ferronickel will have a larger space to decrease. Moreover, when stainless steel has been in a downward trend, the raw material remains high. It causes an imbalance to steel mills between production cost and price. Thus, the ferronickel price will be forced to decrease when the nickel or nickel ore reduces in price.

To summarize, due to the impact of the sharp drop in nickel ore, China’s high ferronickel market will break the deadlock in the short term, and the price is expected to drop significantly in the later period.

---------------------------------------------------------------------------------Stainless Steel Market Summary in China---------------------------------------------------------------------------------