304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,450/MT(plus taxes) which is US$3/MT higher than that of last week, and the increasing percentage is 0.12%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,490/MT(plus taxes) which increases by US$3/MT, and the increasing percentage is 0.12%.

304/2B: The average price of 2.0*1240*C (slit edge) of Hongwang in the Wuxi market is US$2,280/MT(plus taxes) which is US$6/MT higher than that of last week, and the increasing percentage is 0.26%. Besides, the average price of 2.0*1240*C(slit edge) in the Foshan market is US$2,255/MT(plus taxes) which increases by US$2/MT, and the increasing percentage is 0.07%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,280/MT(plus taxes) which increased by US$3/MT compared with last week and the rising percentage is 1.13%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,290/MT(plus taxes) which decreased by US$22/MT compared to last week, and the decreasing percentage is 0.09%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,405/MT(plus taxes) which remains as last week. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,390/MT(plus taxes) which increases by US$3/MT compared with that of last week, and the increasing percentage is 0.09%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$3,220/MT(plus taxes) which is US$13/MT higher than last week and the increasing percentage is 0.36%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$3,250/MT(plus taxes) which increased by US$3/MT compared to last week and the increasing percentage is 0.09%.

201/2B: This week, the average price of 1.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$1,370/MT(plus taxes) which is US$5/MT more than last week and the rising percentage is 0.34%. Besides, the tax-inclusive average price of the Foshan market is US$1,365/MT(mill edge) which is US$5/MT lower that last week and the decreasing percentage is 0.34%.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,315/MT(plus taxes) which is US$5/MT higher than last week and the rising percentage is 0.35%. Besides, the tax-inclusive average price of the Foshan market is US$1,305/MT(mill edge) which decreases by US9/MT and the decreasing percentage is 0.70%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,550/MT(plus tax), which is US$27/MT less than last week and the declining percentage is 1.63%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,555/MT(plus taxes) which decreased by US$24/MT and the decreasing percentage is 1.44%.

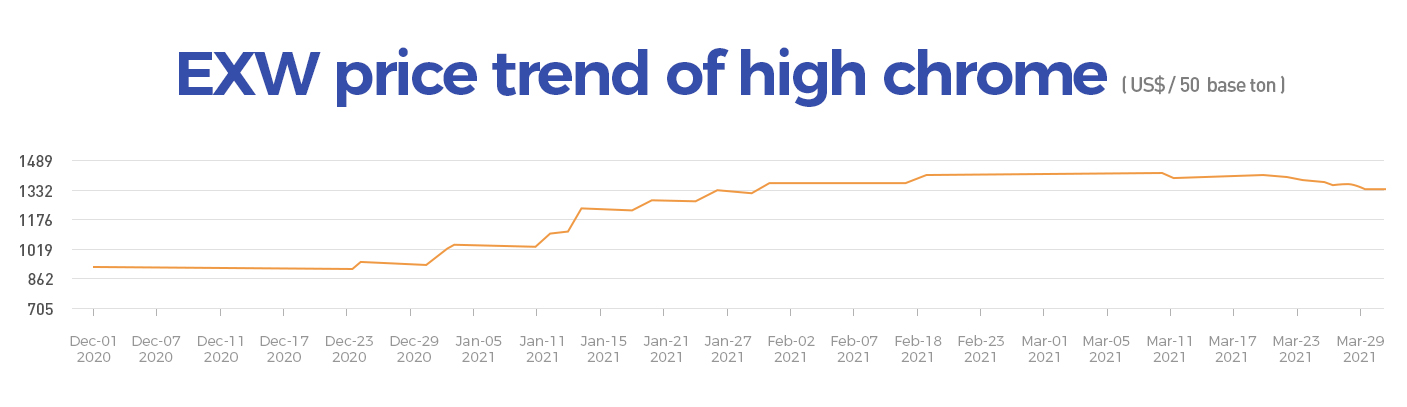

RAW MATERIAL || The price of high chrome increased by 58%.

It is going to call for bids of high carbon ferrochrome in April, which will highly affect the price of stainless steel. We still remember the frantic increase of high chrome price before CNY.

1. The price of high chrome increased sharply by 57.89%, boosting stainless steel.

In the later of December 2020, the EXW price of high chrome was around US$893/50 base ton which was rather low. In the later two months, it kept increasing. Until later February, it has increased to US$1,411/50 base ton, 57.89% higher compared to the previous price which is frantic.

This unusual increase lights up the stainless steel market.

- 201

- 304

- 430

2. “Dual Controls” is the hidden hand.

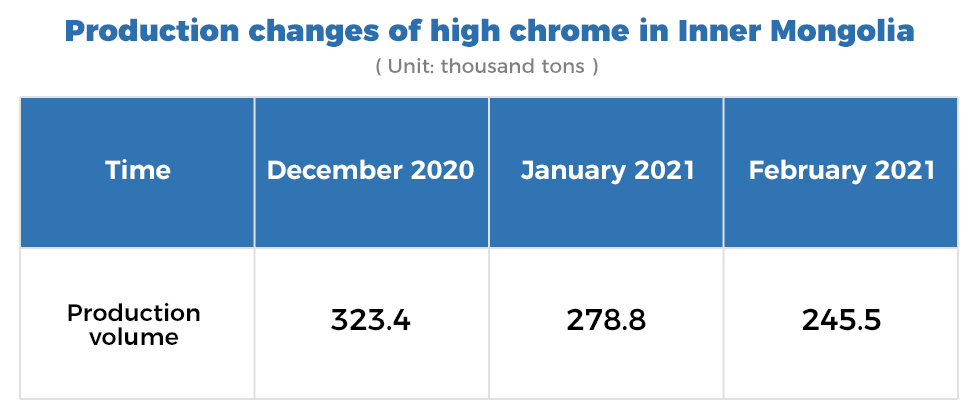

What leads to this situation is the “Dual Controls”(electric power and coal rationing) policy implemented in Inner Mongolia.

In mid-January of 2021, to complete the goal of “dual controls”, the government of Inner Mongolia shut down the operation of the furnace below 2500KVA, resulting in the recession of production in consecutive two months, and the decreasing percentage is as high as 24.09%.

Traditionally, months before the CNY, such as January and February is a high time for the stainless steel makers to stock up. The sudden decrease of high chrome production even sharpened the contradiction between supply and demand. Therefore, the price ramped up.

3. The policy is looser. The price of high chrome is back down.

Affecting the price trend of high chrome, the policy again changes, and thereby it comes to the changing point of the high chrome.

In April, the quota of the energy-intensive enterprises in Wulanchabu City is increased by 750 million kWh to 3.45 billion kWh compared to the quota of March which was 2.7 billion kWh. With the rationing limit getting loose, there will be more high chrome manufacturers back to produce in Inner Mongolia.

Some believe that the production capacity will expand by at least 40,000 tons in April according to the current larger quotas of the high chrome factories in Wumeng, Inner Mongolia.

Except for the production in Inner Mongolia, other producers in China also enlarge the production. It is estimated that in April, the production of high chrome will increase by around 120,000 tons YoY and 90,000 tons higher than last month.

Because of this expectation, recently, the price of high chrome has reduced and it is around US$1,301/50 base ton –US$1,332/50 base ton. Compared to the previous high price, it has cut down about US$78/50 base ton.

Due to the instantly sharp increase in February, which brings a considerable profit to the manufacturers, as long as the supply is increased, the industry will face an increasing risk of downward price.

4. Risky! More factors affect the price to go down.

Except for high chrome, the price of high ferronickel is also reduced. The bidding price of the main-stream steel mills decreased by US$16/nickel. Based on the raw material costs, there is less to keep the price high.

400 series benefited the most during the increase of high chrome price. High profit is accompanied by high risk. When the high chrome is reduced in price, 400 series also faces the risk of decreasing price.

Lately, the guidance price of Tisco's 430 is adjusted to US$1,560/MT. If the raw material market remains the trend, it will be probably that 430 will keep decreasing in price.

Automakers are facing with production slash, which will cut down 5-10%.

Since March, there are at least 10 auto manufacturers around the world calling a pause in production due to the shortage of chips, including Volkswagen, Ford, GM, Volvo, Toyota, Honda, Nissan, Mitsubishi, Hyundai, NIO.

It is difficult to define how large the influence of the chip deficit is on Chinese automakers but in quarter one, the deficit caused the largest influence on production which was cut down 5%-10% in China. Most believe the deficit will be released after March.

It is estimated that the production lost 300,000 cars and it is yet to know whether it can fill the gap up after March.

Every industry, no matter closed or remote affects each other. For automobiles, stainless steel is mainly used in exhaust systems, fuel tanks, parts and frames, and automobile interior and exterior decoration. Commonly used stainless steels for exhaust systems are 400 series, including SUS409L, SUS436L, SUS439L, SUS429, SUS441, SUS304, etc.

The decreasing production in the automobile affects the demand for stainless for sure. Typically for 400 series, at the beginning of 2021, many had good expectations towards the producing capability, but now this is even worsening the market.

TRENDS|| Increasing 304; gloomy 201; decreasing 430

On 6th April 2021, in the Foshan market, the price of 304 rose along with the increasing nickel price. Both cod and hot-rolled products increased by US$8/MT-US$16/MT, and some typical cold-rolled products even had a larger increase.

Compared to the rising price of 304, 201 tended to be bland. Though most of the prices remained, there were still discounts made in some transactions. The spot products of 201 fluctuated. The price showed a downward tendency because of the gloomy demand of 201.

As for 430, some remained while some were reduced by US$8/MT-US$16/MT. The guidance price from steel mills remained, and buyers did not show great interest. Therefore, although discounts were given, the price still tends to decrease.

----------------------------------------------------------------------------------Stainless Steel Market Summary in China--------------------------------------------------------------------------------------