304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,515/MT(plus taxes) which is US$11/MT lower than that of last week, and the decreasing percentage is 2.60%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,555/MT(plus taxes) which decreases by US$11/MT, and the decreasing percentage is 0.40%.

304/2B: The average price of 2.0*1240*C (slit edge) of Hongwang in the Wuxi market is US$2,300/MT(plus taxes) which is US$66/MT less than that of last week, and the decreasing percentage is 2.70%. Besides, the average price of 2.0*1240*C(slit edge) in the Foshan market is US$2,290/MT(plus taxes) which cut down by US$103/MT, and the decreasing percentage is 4.27 %.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,335/MT(plus taxes) which decreased by US$91/MT compared with last week and the declining percentage is 3.68%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,375/MT(plus taxes) which decreased by US$47/MT compared to last week, and the decreasing percentage is 1.87%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,420/MT(plus taxes) which increased by US$22/MT compared with last week and the increasing percentage is 0.06%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,400/MT(plus taxes) which increases by US$13/MT compared with that of last week, and the increasing percentage is 0.34%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$3,275/MT(plus taxes) which is US$6/MT lower than last week and the decreasing percentage is 0.18%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$3,285/MT(plus taxes) which decreased by US$3/MT compared to last week and the declining percentage is 0.09%.

201/2B: This week, the average price of 1.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$1,375/MT(plus taxes) which is US$16/MT less than last week and the declining percentage is 1.11%. Besides, the tax-inclusive average price of the Foshan market is US$1,395/MT(mill edge) which is US$19/MT less that last week and the decreasing percentage is 1.32%.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,320/MT(plus taxes) which is US$19/MT less than last week and the declining percentage is 1.40%. Besides, the tax-inclusive average price of the Foshan market is US$1,350/MT(mill edge) which decreases by US$22/MT and the declining percentage is 1.59%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,605/MT(plus tax), which is US$16/MT higher than last week and the rising percentage is 0.94%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,600/MT(plus taxes) which increased by US$34/MT and the rising percentage is 2.08%.

FOCUS|| Nickel Slumped by about US$3,000. Will it be a new opportunity?

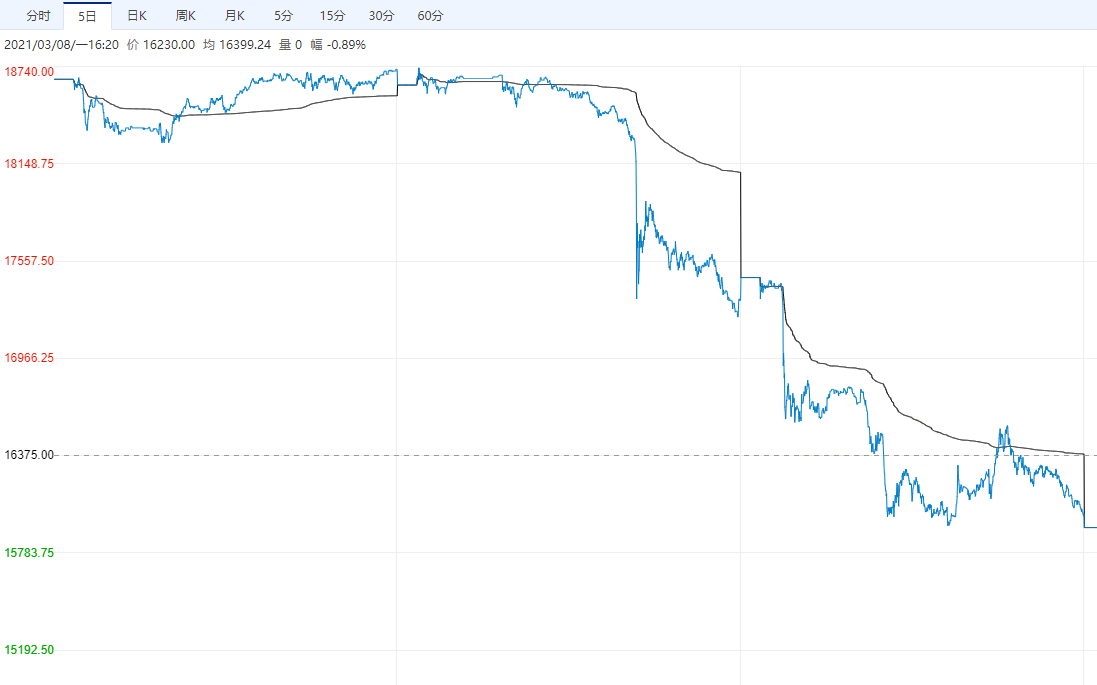

Last week, the nickel market tumbled. LME nickel cut down US$3,000 within two days. Compared to the highest price after the CNY holiday, which is US$20,100/MT, it dropped down by more than 4,000 dollars and the decreasing percentage is as high as 20%.

Regarding this slump, most believed that it is because Tsingshan changes the production line from ferronickel to nickel matte. On 1st March, Tsingshan signed a supply contract with Huayou Cobalt and CNGR, stating that Tsingshan will supply 60,000 tons of nickel matte to Huayou Cobalt and 40,000 tons of nickel matte to CNGR from October of 2021 and during one year. In total, Tsingshan will supply 100,000 tons of nickel matte which is equivalent to 75,000 thousand MMT (the nickel matte is about 75% of nickel content).

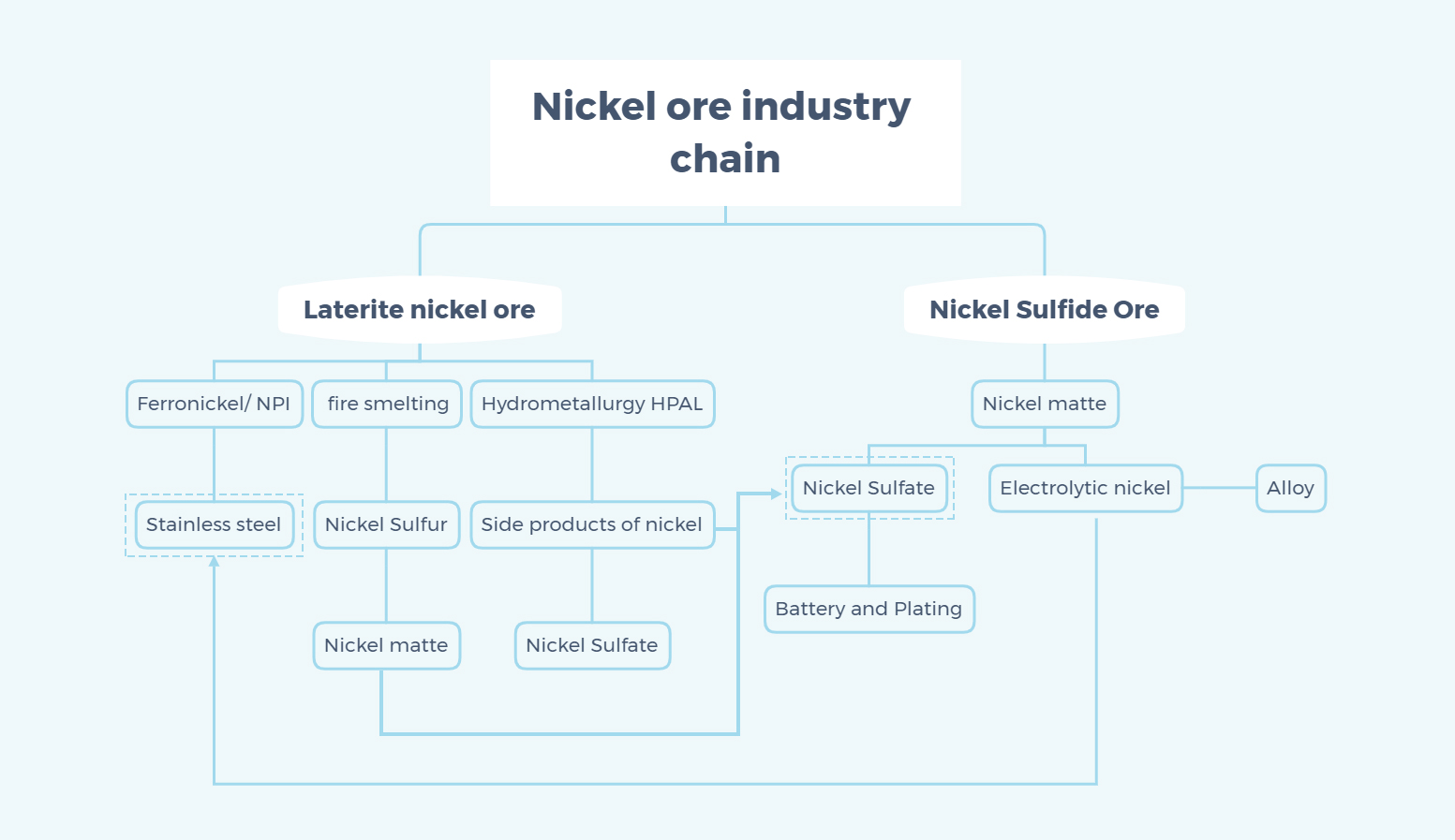

From the perspective of the nickel industry chain, the pillar industries are stainless steel and the new energy battery. At present, in China, the production of stainless steel mostly adopts ferronickel, and the proportion of pure nickel is gradually decreasing.

As for the new energy industry, for now, the power batteries that are mostly selected by new energy car companies are lithium iron phosphate batteries and ternary batteries. The former has low cost and high safety, while it is of low energy density and high loss of low-temperature batteries. The ternary battery has higher energy density and better low-temperature performance. The ternary battery uses lithium nickel cobalt manganate and nickel cobalt aluminum as cathode materials. Because of the high nickel ternary materials in terms of energy density, the high nickel of ternary materials has gradually taken the place.

In the past, because the mid-quality product of nickel and other raw materials were in shortage, the production of nickel sulfate mainly uses electrolytic nickel (pure nickel), and so the supply of nickel sulfate was restricted. But now, as the technology of pyrometallurgical high matte nickel improves, the stress of the insufficient nickel sulfate supply will be relieved.

Some experts said, the production chain “Laterite nickel ore-Nickel matte-Nickel Sulfate” of Tsingshan will transfer the surplus of ferronickel to the new energy industry. In the future, according to the demand, profit, and other factors, the method of fire smelting can be changed between ferronickel and nickel matte, which will connect the two industries on the raw material side. Therefore, it will bring back the price difference between ferronickel and pure nickel.

Influence on the future market:

After the slump of nickel stock in 2 days, the price difference between pure nickel and ferronickel narrows and the prices are almost even. In a short period, the nickel price may be back to the normal trend. Influenced by the slump of nickel, the stainless steel futures also hit the limit. However, having gone through the continuous drop of LME nickel the next day, the stainless steel futures remained, conveying a stable sign.

Due to the limited inventory of nickel ore in China during the rainy season in the Philippines, the quotation of the ore keeps increasing. The CIF price of nickel ore(of 1.5% contraction) remains at around US$83/MT, while the Chinese ferronickel producers mostly quote at US$188/MT and some are US$185/MT. Under this quotation of nickel ore, the Chinese ferronickel manufacturers are all facing profit loss. Even though when the nickel price drops, the ferronickel and nickel ore won't be sold at a lower price.

Based on the present prices of ferronickel (US$188/nickel) and ferrochrome (US$1,395/nickel), the cost of the hot-rolling 304 should be US$2,280/MT and the cost of the cold-rolling 304 is as high as US$2,365/MT which is US$141/MT higher than the present stock price. Compared to the price of the futures product, the price difference reaches US$282/MT.

There is another opinion that although the production of stainless steel has been a loss, the Indonesian ferronickel still has an advantage and profit margin because of its low cost. Thus this will help it to take over a larger market.

Production volume cut down over 460 thousand tons in February.

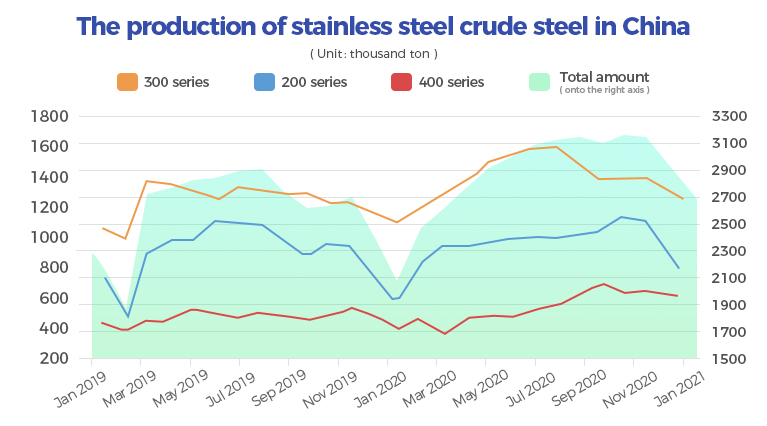

In February, the production volume of Chinese stainless steel producers above designated size (Referring to all industrial enterprises with annual main business income of US$3 million and above) is approximately 2,686 thousand tons. Compared to January, it decreases by 462 thousand tons and the decreasing percentage is 14.7%. Compared to the same period of last year, the production rises by 605 thousand tons and the rising percentage is 29%.

In February, the decrease mostly falls in the 200 series. The total production volume of 200 series is 789 thousand tons which are 327 thousand tons less than that in January; Compared to February of 2020, it increases by 212 thousand tons and the increasing percentage is 36.7%.

As for 300 series, the production volume is 1.263 million tons in total, which is 121 thousand tons less than that of last month and the decreasing percentage is 8.8%; it increases by 158.5 thousand tons compared to the same period of last year and the increasing percentage is 14.4%.

In the case of the production of 400 series, it reduces by 14 thousand tons compared to last month and the reducing percentage is 2.1%; it increases by 234 thousand tons and the increasing percentage is 58.6%.

---------------------------------------------------------------------------------Stainless Steel Market Summary in China---------------------------------------------------------------------------------