304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,180/MT(plus taxes) which is US$34/MT higher than last week and the rising percentage is 1.50%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,220/MT(plus taxes) which is also US$34/MT higher than last week and the increasing percentage is 1.47%.

304/2B: The average price of 2.0*1240*C (mill edge) of Hongwang in the Wuxi market is US$2,115/MT(plus taxes) which is US$27/MT higher than last week and the rising percentage is 1.20%. Besides, the average price of 2.0*1240*C (mill edge) of Hongwang in the Foshan market is US$2,100/MT(plus taxes) which increases by US$27/MT compared with last week and the increasing percentage is 1.21%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,055/MT(plus taxes) which increased by US$33/MT compared with last week and the rising percentage is 1.52%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,055/MT(plus taxes) which is US$28/MT higher than last week and the increasing percentage is 1.31%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,910/MT(plus taxes) which is US$15/MT higher than last week and the increasing percentage is 0.48%. Moreover, the average price of 316L/2B 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,920/MT(plus taxes) which increases by US$15/MT and the rising percentage is 0.47%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,790/MT(plus taxes) which is US$58/MT more than last week and the increasing percentage is 1.97%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,780/MT(plus taxes) which is US$30/MT higher than last week and the increasing percentage is 1.00%.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,095/MT(plus taxes) which is US$6/MT higher than last week and the rising percentage is 0.54%. Besides, the tax-inclusive average price of the Foshan market is US$1,095/MT(mill edge) which decreases by US$12/MT compared to last week and the decreasing percentage is 1.09%.

J2, J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,045/MT(plus taxes) which remains as the price of last week. Besides, the tax-inclusive average price of the Foshan market is US$1,050/MT(mill edge) which increases by US$12/MT compared with last week and the rising percentage is 1.14%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,135/MT(plus tax), which is US$13/MT higher than last week and the rising percentage is 1.17%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,135/MT(plus taxes) which increased by US$15/MT and the rising percentage is 1.31%.

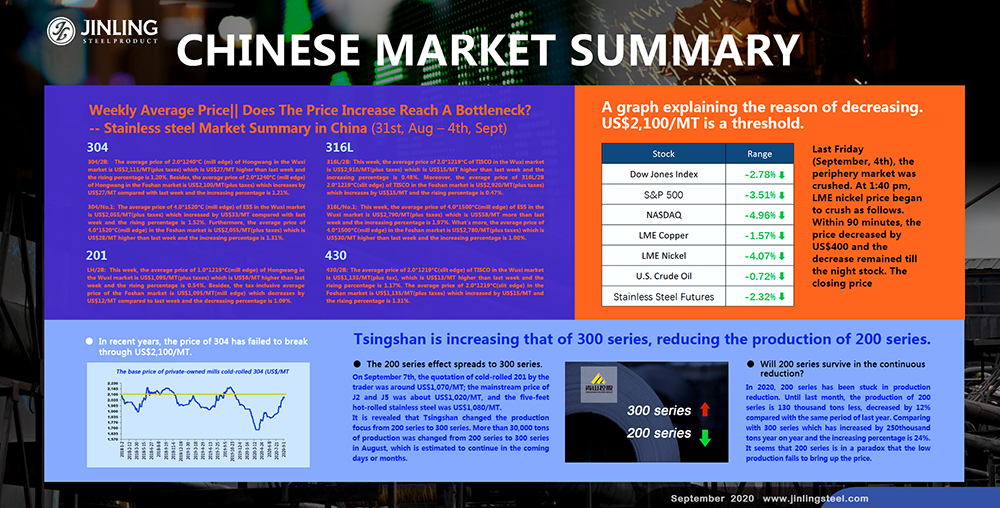

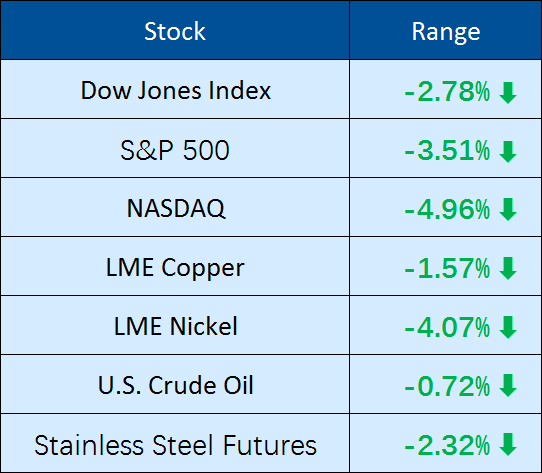

A graph explaining the reason of decreasing. US$2,100/MT is a threshold.

Last Friday(September, 4th), the periphery market was crushed. At 1:40 pm, LME nickel price began to crush as follows. Within 90 minutes, the price decreased by US$400 and the decrease remained till the night stock. The closing price dropped by US$640, decreasing to US$15,070/MT.

In recent years, the price of 304 has failed to break through US$2,100/MT.

In recent years, the base price of private-owned enterprises cold-rolled 304, mostly lingers below US$2,100/MT. For example, in lately three years, the price is under US$2,100/MT during 75.8% of the time.

Why the threshold is US$2,100/MT?

There is an opinion explaining that the way that downstream users choose stainless steel, depends on the cost performance, and among different grades of stainless steel can substitute each other. For example, when the stainless steel price reaches around US$1,570/MT, the downstream users would consider it cheap. Low prices can stimulate demand increase, so more people choose 304 around this price. However, when the price surpasses US$2,100/MT, the users would hesitate. Gradually, US$2,100/MT becomes a threshold to the market.

Three things you need to focus on after the price decreased.

1. In September, the price tends to be steady. In the industry, the fear of high prices appeared, which leads to a weak transaction in September compared with the good transaction situation in August.

2. Price adjustment is more obvious in the Foshan market. Due to profit-taking, the self-adjustment of the Foshan market has been more flexible and quicker than that of the Wuxi market in the recent two months. For now, the price difference between the two markets again reaches US$160/MT. The price of Delong in the Wuxi market is quoted US$2,060/MT while that of the Foshan market is at US$2,005/MT. Although the price is lowering, the inventory has been at low also, so it is positive support for the future price.

3. There is a saying about an advanced demand burst. Discussion about the demand in September is a hot topic lately, because of the prosperous scenes in both supply and demand of August.

Tsingshan is increasing that of 300 series, reducing the production of 200 series.

The 200 series effect spreads to 300 series. 200 series shall be the least profitable stainless steel grade of this year.

On September 7th, the quotation of cold-rolled 201 by the trader was around US$1,070/MT; the mainstream price of J2 and J5 was about US$1,020/MT, and the five-feet hot-rolled stainless steel was US$1,080/MT.

It is revealed that Tsingshan changed the production focus from 200 series to 300 series. More than 30,000 tons of production was changed from 200 series to 300 series in August, which is estimated to continue in the coming days or months.

Tsingshan is not the only example. A mill in northern China, the proportion of 200 series and 300 series is also adjusting—200 series is used to be the major product, but now over half of the products belong to the 300 series.

Will 200 series survive in the continuous reduction?

In 2020, 200 series has been stuck in production reduction. Until last month, the production of 200 series is 130 thousand tons less, decreased by 12% compared with the same period of last year. Comparing with 300 series which has increased by 250thousand tons year on year and the increasing percentage is 24%. It seems that 200 series is in a paradox that the low production fails to bring up the price.

Many people feel that the 200 series is difficult to sell even though the production is decreasing. While the 300 series has increased by US$444/MT from the lowest price of this year, the 200 series only rises by US$89/MT comparing to its lowest price in 2020.

The price of 200 series failed to rise, even shows a declining trend in September, although the prices were boosted in the previous month. The price of 201 has been at a steady level. Many operations acted to try to increase the price. Eventually, it doesn't do much good whether in price or transaction.

--------------------------------------------------------------------------------------Stainless Steel Market Summary in China--------------------------------------------------------------------------------------