304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,025/MT(plus taxes) which is US$15/MT higher than last week and the rising percentage is 0.68%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,065/MT(plus taxes) which is also US$15/MT higher than last week and the increasing percentage is 0.67%.

304/2B: The average price of 2.0*1240*C (mill edge) of Hongwang in the Wuxi market is US$1,980/MT(plus taxes) which is US$19/MT higher than last week and the rising percentage is 0.91%. Besides, the average price of 2.0*1240*C (mill edge) of Hongwang in the Foshan market is US$1,930/MT(plus taxes) which decreases by US$16/MT compared with last week and the decreasing percentage is 0.78%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,890/MT(plus taxes) which increased by US$10/MT compared with last week and the rising percentage is 0.52%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,900/MT(plus taxes) which is US$13/MT higher than last week and the increasing percentage is 0.66%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,715/MT(plus taxes) which remains as last week. Moreover, the average price of 316L/2B 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,770/MT(plus taxes) which increases by US$3/MT and the rising percentage is 0.10%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,545/MT(plus taxes) which is US$1/MT less than last week and the decreasing percentage is 0.05%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,575/MT(plus taxes) which is US$9/MT higher than last week and the increasing percentage is 0.32%.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,065/MT(plus taxes) which is US$4/MT higher than last week and the rising percentage is 0.41%. Besides, the tax-inclusive average price of the Foshan market is US$1,065/MT(mill edge) which decreases by US$1/MT compared to last week and the decreasing percentage is 0.14%.

J2, J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,020/MT(plus taxes) which is US$1/MT more than last week and the increasing percentage is 0.42%. Besides, the tax-inclusive average price of the Foshan market is US$1,020/MT(mill edge) which decreases by US$1/MT compared with last week and the declining percentage is 0.14%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,085/MT(plus tax), which is US$12/MT higher than last week and the rising percentage is 1.08%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,090/MT(plus taxes) which increased by US$13/MT and the rising percentage is 1.21%.

The price of 304 increases insanely. What are the reasons?

Spot 304 is accumulated to increase by US$29-US$44/MT in price.

The situation of the price difference in the same product is broken. The price of 304 in Foshan was lower than that in Wuxi. The difference between once reached more than US$58/MT. But the market has been expected to rise, last Saturday (Aug, 15th), the price in the Foshan market increased. On Aug, 18th, the price rises in both Wuxi and Foshan. Since then, the same resources of the two markets have been in a consistent price generally.

For now, cold-rolled 304 in Wuxi and Foshan whose Delong and Chengde average price of 1,240mm mill edge is US$1940/MT, which is US$2005/MT in slit edge (2.0*1219*C). The Yongjin average price of 1,240mm mill edge is quoted at US$1,975/MT and US$2,040/MT in slit edge (2.0*1219*C). As for the hot-rolled stainless steel market, the price of Wuxi and Foshan also tends to be similar. The price of a 1,520mm sheets increases to US$1,920/MT.

Except for the quotation by the mainstream mills, the agents also increase the price and begin to accept the order of September futures. In September futures, in Foshan, the dealer of Delong quoted US$1,975/MT, while Gaoming Chengde and Lisco quoted US$1,950/MT which is in limited order.

This time, the increasing price of stainless steel is owed to the mills’ operations, but what are the hidden reasons?

Raw materials cost increases.

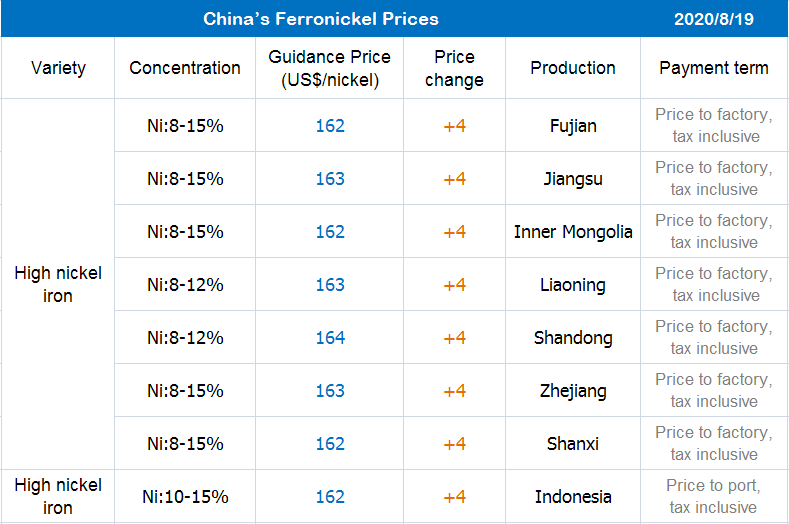

Last week, giant stainless steel mills began to purchase High nickel-iron, and Tsingshan made the biggest transaction in the market. Tsingshan bought in 90,000 tons in US$157/nickel(price to the factory, tax inclusive). The raw material resource is originated from a domestic supplier, and the order will be delivered before October. What’s more, there was a 1,000-ton transaction, supplied by Indonesian Nickel Iron and the price is US$154/nickel.

There was news in the market releasing that Tsingshan Group is still enquiring in the small order market at US$154/nickel(price to the factory, tax inclusive). Tsingshan has dealt several thousand tons of high nickel-iron at the same price last week. Besides, last week, a mill in Eastern China also bought high nickel-iron at the same price, US$154/nickel(price to the factory, tax inclusive). Recently, the price of high nickel-iron climbs up significantly, the purchasing price was US$150/nickel(price to the factory, tax inclusive) and rose to US$157/nickel at the weekend (Aug,15th-16th). With one week, the price increased by US$7/nickel.

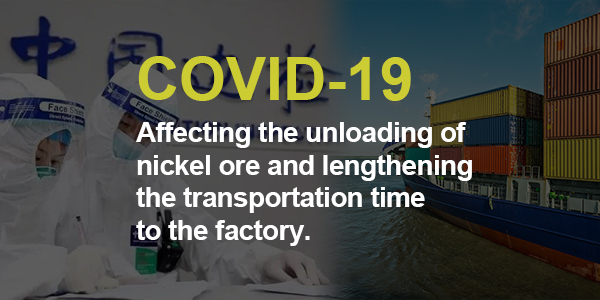

COVID-19 is still one of the reasons!

The biggest factor affecting the increasing high nickel-iron is the increasing price of the nickel ore. As Philippine crew members have been diagnosed with COVID-19 in Chinese ports, the quarantine and isolation measures taken in major domestic ports have been upgraded, affecting the unloading of nickel ore and lengthening the transportation time to the factory. The price of nickel ore(concentration of 1.5%) increased by US$53-US$54/MT.

Because of the incident, the EXW quotation of high nickel-iron is also on a rise. On August 18th, the EXW price (price to the factory, tax inclusive) of high nickel-iron increased by US$4/nickel and reached US$153/nickel - US$154/nickel which is US$9/nickel compared with the quotation at the beginning of August. According to industry sources, the third quarter was the peak of the export of Philippine nickel ore. In July, about 130-140 ships were scheduled to deliver, but about 20 ships were delayed to August. It is expected that the export volume in the three months from July to September will exceed the nickel ore total import volume in the first half of the year of China.

Recently, the domestic nickel ore market has shown an increasing trend. However, as the Philippines enters the rainy season in the fourth quarter, the domestic nickel ore reserve procurement demand is also increasing. The industry expects that China's nickel ore supply shortage will not be eased within this year, and the high cost of nickel-iron will continue.

Summary:

The production of 300 series stainless steel increases, boosting the price of nickel-iron. People are positive toward the price and expecting the increasing price once the mills begin to work which is delayed, however. This action further intensifies the rising trend of stainless steel prices.

------------------------------------------------------------------------------------Stainless Steel Market Summary in China--------------------------------------------------------------------------