TREND|| Market prices are expected to fall. Is the drop only a beginning?

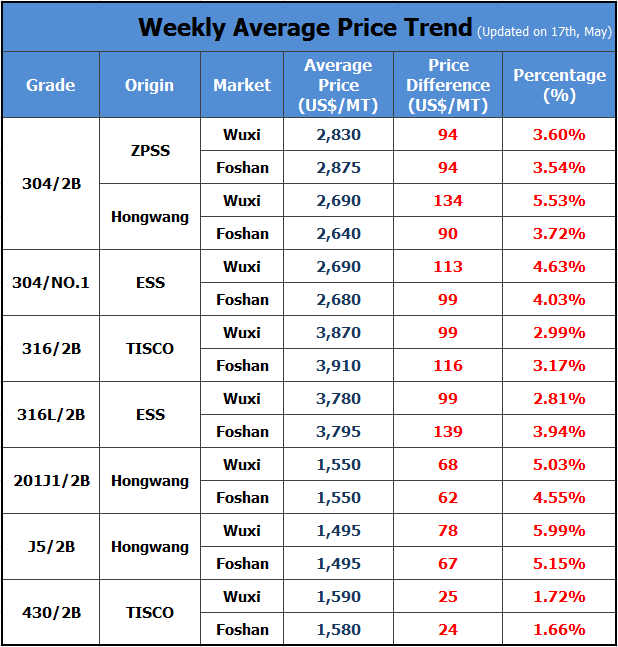

Last week seems to be a “transit point” of the stainless steel price. From last Monday to Wednesday, the overall price trend maintained at increasing, and in the following two days, the price started to reduce and remained on Saturday. As for the future trend, people have different opinions.

Opinion1: Don’t be panic. Stainless steel has support in the price during a short period.

Opinion2: It is only a start! There are more to come.

304: The price difference between futures and spot is the largest ever. It is of a large percentage that the spot price will be revised down.

Macroeconomics: The State Council once again mentioned bulk commodities. The State Council's executive meeting was held, requiring tracking and analyzing situations home and abroad as well as the market changes, in order to adjust with the changing market, and respond to the rapid rise in bulk commodity and its side effects.

Jinling Steel: The price of steel is not blindly controlled by the government. The government aims to suppress the exaggerated rise of steel prices. The government will emphasize the effect of the monetary policy and other measures, to ensure the economy developing stably and steadily.

Futures stock market: the discount of the futures stock price is large. For now, the futures stock price is around US$2,490/MT. Compared to the spot price, the futures stock price is US$233/MT higher which hits the record high again. However, the stainless steel futures will have a quicker response to the market dynamics than the spot, so this week, the spot price may be reduced and the price difference will be probably narrowed down.

From the perspective of the spot market, the fast increase in price might cause the risk of massive sell-off. The profit gain of 300 series is higher than other grades. The current price of ferronickel and ferrochrome which respectively is US$176/MT and US$1,116/MT, while the production cost (by private-owned steel mill) of hot-rolled 304 is about US$2,171/MT. Comparing the selling price of US$2,675/MT now, the profit is large enough for the mills to increase the productivity of 300 series.

201: Influenced by the lower production, the support of price is strong.

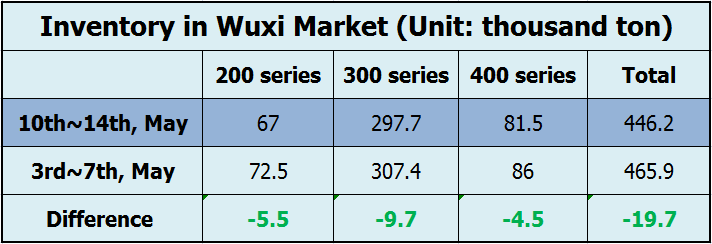

According to the production statistics of the cold-rolled stainless steel, the output of 200 series decreased by 56 thousand tons by 34 steel mills. Last week, the inventory of 201(Wuxi market) and 200 series (Foshan market) both fell, respectively fell by 5,500 and 8,000 tons.

Besides, we knew that in all steel mills that produce 200 series, 6 of them now and will produce 304 or plain carbon steel, which indicates that the volume to market in May and June will cut down a large amount. Last week, the arrival of 200 series has already decreased.

430: After an abrupt increase of US$31/MT, the fever declines.

On the side of raw material, in April, the total production of high chrome was about 518.3 thousand tons. In May, the electric power used by the energy-oriented enterprises in Inner Mongolia continues to increase, and thereby the output of high chrome will also in a rising status but it will gradually slow down. At present, the high chromium market has sufficient supply. The overall output of 400 series stainless steel decreased by 71,400 tons in April, down to 520,800 tons. Last week, the price of 430/2B increased byUS$31/MT. At the beginning of the week, people were fevered in buying. However, as the price of iron ore fell sharply, the upward momentum of 430/2B was significantly weakened, and the price was maintained. The current price is US$1,600/MT. Last week, stainless steel inventories of 400 series fell by about 4,500 tons and reached 81,500 tons.

Summary:

According to the latest inventory report, the inventory of 304 is now in a record low status. Therefore, the price is difficult to decrease lately.

Recently, influenced by the former decreasing trend, 200 series also reduced the price within a rational range. But from a longer view, steel mills will reduce production, which will support the price to increase.

In recent days, the price of iron ore fell greatly, plus that the production of high chrome is expected to rise, the mills are active in sending out the products as well, which is thought as surrendering part of the profits. The cost of the 400 series will be reduced, and thereby the transaction price of 430/2B will maintain low.

All stocks hit the limit down. Almost 20,000 tons of stainless steel was consumed.

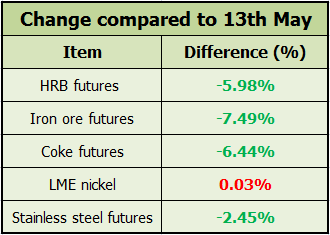

On 14th May, the decrease news flew all over the market. In consecutive two days, the bulk commodity decreased significantly. During the former trend, the Ferrous stocks which increased largely were cut down the most. The futures of RHB, iron ore, and coke all hit the limit down. Until the closing bell, the futures of RHB decreased by 5.98%; coke futures dropped by 6.44%, and iron futures cut down by 7.49%.

LME nickel once fell by US$270 in intraday trading and the largest drop of more than US$900 in the past three trading days. Stainless steel futures 2107 contract continued to drop sharply. On 14th, the largest intraday drop was as high as US$100/MT, and the closing fell by US$59/MT to US$2,475/MT. However, compared with the high of US$2,595/MT on 12th, the closing price on 14th fell byUS$121/MT.

Did the futures’ drops affect the spot market?

304 spot again reduced by US$16/MT ~ US$31/MT, but many factors are boosting the high price of 304.

On 14th May, in the Wuxi market, about the 304 spot product, the high price began to fall as the market trend, decreasing by US$13/MT ~US$31/MT. Delong’s cold-rolled 304 and the four-foot mill-edge product of Chengde Group were cut down to US$2,645/MT (US$2,725/MT in 2.0 slit); Yongjin remained the price at US$2,725/MT (US$2,800/MT in 2.0 slit). As for the hot-rolled products, ESS and other private-owned mills decreased the price to US$1,645/MT, dropping by US$31/MT.

On the day, some agents and traders thought the future prices would keep decreasing and they began short selling.

Although the price was decreasing, from our perspective, many factors can boost the price.

Products have been consuming. The pressure from inventory is little.

201: Recent transactions are optimistic, and inventory continues to decline! Although new resources arrived this week, such as Baosteel Desheng and Lisco both have new resources to supplement the market, affected by the atmosphere of rising prices, market transactions are also heated. A warehouse staff said, “Recently, the daily arrival volume is about 500 tons, but the shipment volume reaches about 700 tons, and the inventory is being consumed.”

300 series: The inventory has dropped by 9,700 tons. In the process of dragging prices up, the downstream demand burst out. Merchants took this opportunity to actively sell the goods, and their resources have been fully consumed. Moreover, the recent arrivals are limited. The supply from Tsinghsan and Baosteel continues to remain low. The pre-resources of mainstream steel mills have been decreasing lately. On the one hand, the agent picked up the goods during the early price increase process. On the other hand, part of the resources went to the end-users to digest. However, the price dropped significantly in the latter two days, influencing the market transaction to turn weak.

400 series: The inventory has fallen from a high level. The 430 markets stopped falling and rebounded recently. The mainstream prices in the Wuxi market, TISCO, and Jisco have maintained around US$1,600/MT. People tend to buy in when the prices are increasing, recent transactions are comparatively more active than the precious time. In terms of prices quoted by the steel mill, Tisco rose slightly by US$8/MT to US$1,605/MT, and Jisco remained US$1,625/MT as the last opening price.

Overall, under the impact of recent macroeconomic factors and other factors, futures of ferrous series were the most affected, which in turn affected the performance of the stainless steel market. The price has ushered in a significant drop, and the purchase has significantly weakened. However, there is still a bullish voice for the market outlook. The supply in the market continues to be consumed, and inventories continue to remain low. Even if prices fall, wholesale dumping won’t appear easily.

Mills|| A stainless steel mill in northwest China will enter the maintenance period. 400 series might be cut down to almost 50,000 tons.

The mill plans to begin the maintenance in latter May. First is machines of steelmaking and hot rolling; then is the cold rolling machines, lasting for around 20~25 days. It is estimated that 15,000 tons of 300 series production, 45,000 tons of 400 series production will be affected. Of which, 400 series will get influenced the most.

Based on the 430 market situation last week, in 15th May, rumor has it that 400 series steel mills will all support the price to rise. The news of price increasing boosted the cold-rolled 430in the Wuxi market to US$1,600/MT and US$1,615/MT, which increase by US$31/MT. People tend to buy in when the price is increasing, so the 430 market once went heat. But after the general trend of stainless steel price fell and the iron ore price dropped from high, in the 430 market, the trend remained stable. Until then, the price of cold-rolled 430 was around US$1,615/MT.

Stainless Steel Market Summary in China

Stainless Steel Market Summary in China