304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,130/MT(plus taxes) which is US$29/Mt lower than that of last week, and the decreasing percentage is 1.31%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,170/MT(plus taxes) which decreases by US$29/MT, and the decreasing percentage is 1.28%.

304/2B: The average price of 2.0*1240*C (mill edge) of Hongwang in the Wuxi market is US$1,930/MT(plus taxes) which is US$46/MT lower than last week and the declining percentage is 2.29%. Besides, the average price of 2.0*1240*C (mill edge) of Hongwang in the Foshan market is US$1,945/MT(plus taxes) which decreases by US$28/MT compared with last week and the decreasing percentage is 1.36%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,910/MT(plus taxes) which decreased by US$17/MT compared with last week and the declining percentage is 0.85%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,930/MT(plus taxes) which is US$125/MT lower than last week and the decreasing percentage is 6.18%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,875/MT(plus taxes) which dropped by US$31/MT compared with last week and the decreasing percentage is 1%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,940/MT(plus taxes) which decreases by US$19/MT compared with that of last week, and the decreasing percentage is 0.59%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,675/MT(plus taxes) which is US$9/MT less than last week and the decreasing percentage is 0.33%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,720/MT(plus taxes) which is US$19/MT less than last week and the declining percentage is 0.64%.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,170/MT(plus taxes) which is US$2/MT more than last week and the rising percentage is 0.13%. Besides, the tax-inclusive average price of the Foshan market is US$1,175/MT(mill edge) which decreases by US$3/MT compared to last week and the decreasing percentage is 0.26%.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,130/MT(plus taxes) which is US$6/MT higher than last week and the rising percentage is 0.54%. Besides, the tax-inclusive average price of the Foshan market is US$1,125/MT(mill edge) which decreases by US$3/MT compared with last week and the decreasing percentage is 0.27%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,410/MT(plus tax), which is US$83/MT higher than last week and the rising percentage is 5.78%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,375/MT(plus taxes) which increased by US$76/MT and the rising percentage is 5.39%.

Product|| 430 makes its year of 2020 surpass 201

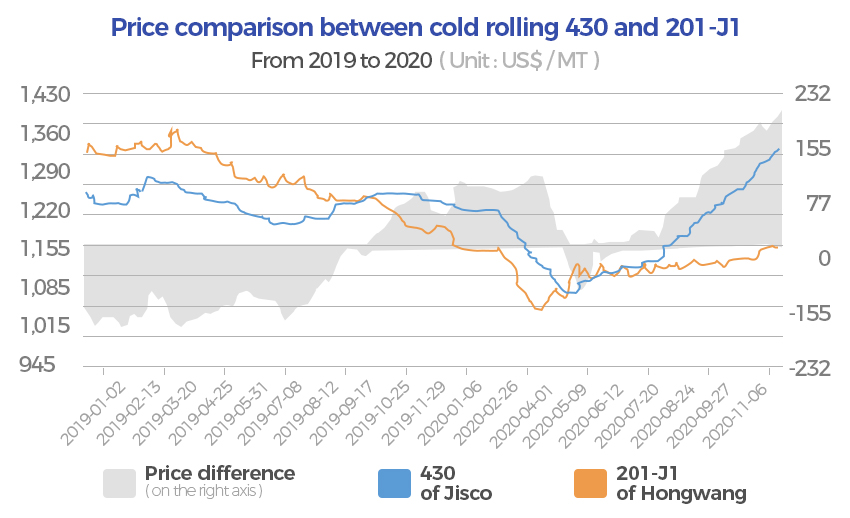

2020 is such a low year for 201. Even 430 which is used to be inferior to 201, has surpassed 201 and kept increasing in price.

From the demonstration above, from January to October of 2019, the base price of Hongwang cold rolling 201J1 was higher than that of Jisco cold rolling 430. But since October 16th, 2019, the price difference turned positive—the base price of cold rolling 430 had been higher than that of 201J1 and this situation lasted until May 6th, 2020.

From May 7th to July 2nd, this period is regarded as the fluctuation time, although the fluctuation was small. But after July 3rd, the price of cold-rolling 430 again surpassed that of the cold rolling 201J1 and since then, 430 has stayed in increasing mode.

For now, the base price of Jisco’s cold rolling 430 is US$1,325/MT in slit edge(US$1,310/MT in mill edge), and the base price of spot product of Hongwang’s cold rolling 201J1 is US$1,145/MT. The price difference reaches US$180/MT.

What makes this embarrassing situation and a huge difference? As the experts analyzed, we summarized three reasons as follow:

1. A new topic to hit 430 up in 2020.

The topic of 430 is not about raw material but the stop of mid-frequency furnace in Yangjiang, which intensifies the hidden capacity and changes it into dominant capacity.

When the mid-frequency furnace left the market, the large manufacturers will make up the deficit. The deficit is mainly originated from the production of 420. Due to the special process, the alloy cost of 420 production is low and the same as 410S which has a high carbon content, but 420 is required more strictly, which affects the production efficiency.

Therefore, the steel mills that have the capacity have to decide whether they arrange to produce 420 or 430. Before September, many buyers were stocking up the products, so after September, the orders rushed in and many mills accepted the orders which have to arrange to the future schedule.

Many people thought that the December order was completed in September and that the market price was about to fall, but they never thought that the price increase of 430 would continue.

2. 430 shares a different target market to 201.

First of all, 70%-80% of users to 430 are the end-users, which means that there is less speculation. While in the 201 markets, the speculation is overwhelmed.

Second, speaking about 430, the first impression is that it is used in kitchenware and small electronic devices. In November, stated by CCTV Financial News, domestic export enterprises of small household appliances started the "explosive orders" mode. In the first half of 2020, China's exports of electric frying pans, bread machines, and juicers increased by 62.9%, 34.7%, and 12.1% respectively. An enterprise in Guangdong province that produces humidifiers, vacuum cleaners, and other products has an export growth of more than 600%.

But for 201 which is used in decorative products, such as decorative tubes and plates, people seemed to hold negative opinions in the seminar.

3. 430 supply was reduced when Tisco had 3-month maintenance.

During the pandemic, people are panic. the prices of all the grades are cut to release the panic. When the industry restarted, Tisco began its maintenance which affected 430 production. It was a beneficial factor for the 430 market.

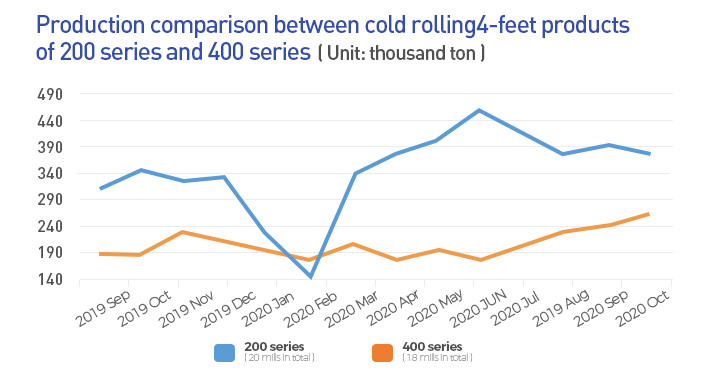

But to 201 market, no matter how many tons of production it cut, there still has no sign to recover from the downward price trend. The cold-rolling flat product of 200 series, typically 201, has kept cutting the production down in the past consecutive five months. The reality seems to be harsh to 201. It doesn't work.

It is news claims that after one mill began to produce 430 in November, in the consequential month, there will be two more large steel mills beginning to produce cold rolling 430 which can reach more than 10 thousand tons of production in total.

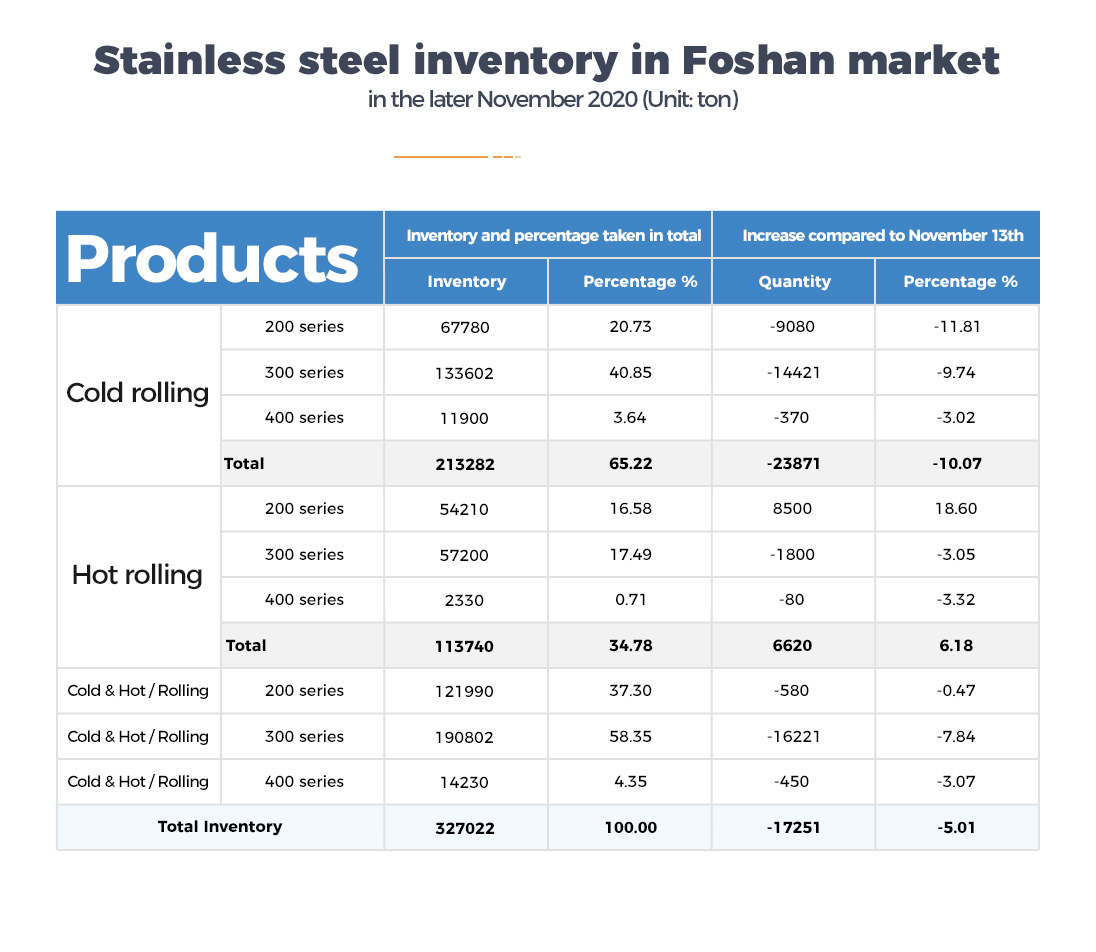

Inventory in Foshan|| keep decreasing in the later November, while hot rolling 200 series inventory is increasing.

The data we adopt is categorized into cold rolling (data due to November 26th) and hot rolling (data due to November 27th).

And we make the comparison between it and that of the last term which is the data about the first half of November (we released on November 13th).

For the statistics of this term, the total inventory is 327,022 tons which reduce by 17,251 tons and the decreasing percentage is 5.01% compared to the last data we released on November 13th. As for the different series, the inventory of the 200 series was reduced to 121,990 tons, a decrease of 580 tons from the previous time, a decrease of 0.47%; the inventory of the 300 series was cut to 190,802 tons, 16,221 tons less than that of the previous time, a decrease of 7.84%; the inventory of the 400 series was decreased to 14,230 tons which were 450 tons lower compared with the previous time, a decrease of 3.07%.

Reasons to decrease:

Except that the hot rolling 200 series was increased in inventory, the other series were all declined. The reasons for the decreased inventory as the three points as follow:

1. Large reduced inventory in the cold rolling products.

On one hand, after the market price decreased and is maintained at a certain price, the downstream and export market gradually increase in demand and the purchasing term appears.

2. Hot rolling 304 prices are topsy-turvy with cold rolling 304 price.

After the price contradiction, the tube making factories are in favor of the cold rolling products which are lower in price. Some tube-making factories turned their purchase to cold rolling products, which consumes the cold-rolling products more quickly.

3. Compared to stripe resources, wide plate resources have better cost performance

Because of the high cost of stainless steel, the price difference of the same grade from different origin reduces. Some re-rolled factories and tube factories tend to purchase the wide plate and Tsingshan's cold rolling products, which helps speed up the consuming process.

----------------------------------------------------------------------------------Stainless Steel Market Summary in China----------------------------------------------------------------------------------