304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,155/MT(plus taxes) which is US$62/Mt lower than that of last week, and the decreasing percentage is 2.71%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,200/MT(plus taxes) which decreases by US$62/MT, and the decreasing percentage is 2.66%.

304/2B: The average price of 2.0*1240*C (mill edge) of Hongwang in the Wuxi market is US$1,970/MT(plus taxes) which is US$121/MT lower than last week and the declining percentage is 5.82%. Besides, the average price of 2.0*1240*C (mill edge) of Hongwang in the Foshan market is US$1,970/MT(plus taxes) which decreases by US$117/MT compared with last week and the decreasing percentage is5.67%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,925/MT(plus taxes) which decreased by US$100/MT compared with last week and the declining percentage is 4.98%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,040/MT(plus taxes) which is US87/MT lower than last week and the decreasing percentage is 4.19%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,905/MT(plus taxes) which dropped by US$53/MT compared with last week and the decreasing percentage is 1.69%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,960/MT(plus taxes) which decreases by US$53/MT compared with that of last week, and the decreasing percentage is 1.66%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,680/MT(plus taxes) which is US$71/MT less than last week and the decreasing percentage is 2.48%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,735/MT(plus taxes) which is US$71/MT less than last week and the declining percentage is 2.43%.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,165/MT(plus taxes) which is US$5/MT more than last week and the rising percentage is 0.39%. Besides, the tax-inclusive average price of the Foshan market is US$1,175/MT(mill edge) which increases by US$9/MT compared to last week and the increasing percentage is 0.78%.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,125/MT(plus taxes) which is US$19/MT higher than last week and the rising percentage is 1.64%. Besides, the tax-inclusive average price of the Foshan market is US$1,130/MT(mill edge) which increases by US$9/MT compared with last week and the increasing percentage is 0.82%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,335/MT(plus tax), which is US$9/MT higher than last week and the rising percentage is 2.16%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,305/MT(plus taxes) which increased by US$11/MT and the rising percentage is 0.81%.

Market|| 304 order acceptance is limited. Futures for February will soon open to sell.

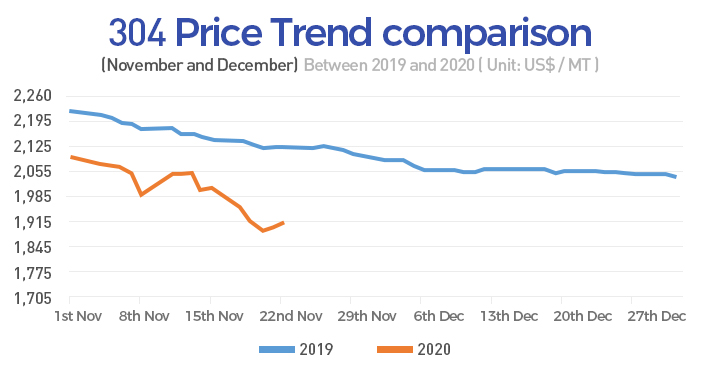

In the later part of November 2019, steel mills opened the futures for January and February to the market, while until now, there are only futures for December 2020 and January 2021.

Many traders think that it is because people tend to order based on their actual demand. For cold rolling 304 in the market, it has insufficient spot products for agents as well as traders, so only low price is available in the market trade—low price in and low price out.

Another opinion explains that the futures orders for December are not as many as that in 2019. The forecast is not optimistic as last year, so the futures market has to open gradually and it is more dependent on the actual situation. But soon we find out that the futures for February are one step closer to us because the cold rolling 304 of Hongwang has already limited the acceptance of the December futures order.

What is the future trend of 304 price?

Earlier on 24th November, the cold rolling futures for December and January was opened at US$1,890/MT. The spot product of 304 did not show a declining trend for now. In the Wuxi market, the cold rolling 304(4-feet & mill-edge) base price of Delong and Chengde is between US$1,915/MT and US$1,920/MT; as for Yongjin, it increases to US$1,970/MT. And the hot rolling 5-feet 304 price of the private-owned mills maintains at US$1,915/MT.

304 seems to linger around at the fork road. Whether it is to increase, decrease, or maintain?

After a big drop in the cold rolling 304 price in 2019, the futures of December stopped falling. However, this year, the declining trend was severer. During the fall, the price surprisingly shows a bounce-back, which boosts the order quantity. So far, according to the market, the cold rolling 304 futures which are quoted at US$1,890/MT has been popular while spot products above US$1,915/MT are comparatively less favorable.

Raw Material|| Ferronickel has to reduce production.

While the 304 is increasing, it shows an opposite trend in the raw material market.

In this week, a ferronickel plant has reduced production to 90,000 tons.

According to the regular production, this plant produces 150 thousand tons every month. A 60-thousand-ton decline? It is almost half of the regular production! The decline in production is not a sudden decision. It is noticed that this plant has decreased to around 100 thousand tons last month.

For the reduced production in the ferronickel plant, some people believe that it is because most of the plants are facing a deficit. Lately, the ferronickel price has been falling. Since November, it has been reduced by US$20/nickel and the recent quotation in China is US$165/nickel. In this way, the manufacturer controls the production can reduce the risk brought by the lower price, on one hand. On the other hand, when the nickel ore supply is shrinking, the low production can prolong the usage of the contemporary inventory.

Another news even worsens the situation. The transaction price of ferronickel breaks the new lowest point. Some traders made a 30-thousand-ton deal of Indonesian ferronickel in US$159/nickel, which further suppresses the Chinese ferronickel market.

Although many ferronickel plants do not recognize this low price, with rounds of decreases, the domestic plants can do nothing but to cut down the production largely, which is the only and most effective solution for them.

Summary: Stainless steel price drops plus ferronickel production reduces. The “show” of early November is not satisfying. For now, 304 tries to flips the situation over. Will it bring a different ending for us in November? Let’s see.

430 Market|| Has kept increasing for consecutive 6 months.

430 stands out in the falling trend lately.

According to the record of the recent two days (until 24th November), the reference price of Tisco has increased by US$15/MT. On 24th November, the cold rolling 430 was quoted at US$1,320/MT by Tisco. On 23rd November, Jisco quoted US$1,305/MT. Is this a sign of increasing?

As for the spot price, the cold rolling 430 price tends to be reserved—partly increased by US$8/MT-US$15/MT. In Wuxi market, there was quotation around US$1,320/MT and also US$1,345/MT by other mills. The reason why prices are different is lacking stock. Some specifications have risen to US$1,375/MT recently. Normally,people tend to buy in an increasing trend instead of a decreasing trend, but in a such high price, people would hold their purchasing plan.

Until now, 430 has kept increasing for consecutive six months. It is not far from US$1,360/MT. Compared to the price of 200 series which is more than US$1,085/MT, 430 price is US$275/MT higher, which keeps people staying away from 430.

------------------------------------------------------------------------Stainless Steel Market Summary in China----------------------------------------------------------------------