304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,085/MT(plus taxes) which is US$55/MT higher than last week and the rising percentage is 2.59%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,120/MT(plus taxes) which is also US$55/MT higher than last week and the increasing percentage is 2.53%.

304/2B: The average price of 2.0*1240*C (mill edge) of Hongwang in the Wuxi market is US$2,040/MT(plus taxes) which is US$19/MT higher than last week and the rising percentage is 2.93%. Besides, the average price of 2.0*1240*C (mill edge) of Hongwang in the Foshan market is US$2,020/MT(plus taxes) which increases by US$16/MT compared with last week and the increasing percentage is 4.36%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,955/MT(plus taxes) which increased by US$63/MT compared with last week and the rising percentage is 3.15%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,955/MT(plus taxes) which is US$55/MT higher than last week and the increasing percentage is 2.77%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,790/MT(plus taxes) which is US$76/MT higher than last week. Moreover, the average price of 316L/2B 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,825/MT(plus taxes) which increases by US$50/MT and the rising percentage is 1.67%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,620/MT(plus taxes) which is US$81/MT less than last week and the decreasing percentage is 2.84%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,655/MT(plus taxes) which is US$82/MT higher than last week and the increasing percentage is 2.96%.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,075/MT(plus taxes) which is US$6/MT higher than last week and the rising percentage is 0.54%. Besides, the tax-inclusive average price of the Foshan market is US$1,075/MT(mill edge) which increases by US$3/MT compared to last week and the increasing percentage is 0.27%.

J2, J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,025/MT(plus taxes) which is US$4/MT more than last week and the increasing percentage is 0.43%. Besides, the tax-inclusive average price of the Foshan market is US$1,025/MT(mill edge) which decreases by US$3/MT compared with last week and the declining percentage is 0.29%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,105/MT(plus tax), which is US$15/MT higher than last week and the rising percentage is 1.33%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,100/MT(plus taxes) which increased by US$9/MT and the rising percentage is 0.80%.

FOUR Key Words to Understand the Market of Last Week

1.Combine

A new-born giant is on the way. Baowu and Tisco combined, which can bring production over 10,000 thousand tons respectively.

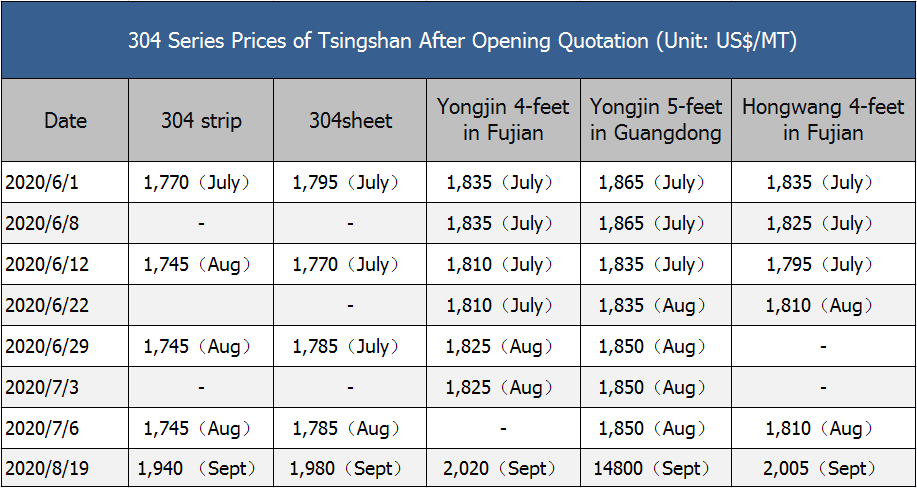

2. Opening quotation

Since Tsingshan has closed to give offer to the market for more than 50days, eventually it opened quotation and the prices did not fail people’s expectations, which has an increase 220USD/MT. As to Yongjin, cold-rolled stainless steel base price is US$2,020/MT.

3. Increasing price

Why does the price rise?

For now, the biggest driven force is ferronickel which increased from US$146/nickel to US$161/nickel and the cost has increased by US$146/nickel.

4. Lacking Nickel

The rising price of nickel is also out of the increase of ferronickel price. Mills are crazed about purchasing nickel. Due to the Chinese nickel ore suppliers reveal that the production of ferronickel is decreasing while the production of stainless steel is increasing, ferronickel supply is in short.

Tsingshan Indonesian workers struck, worsening nickel supply shortage.

Nickel market has been in volatility in August. In the first half of August, Philippine nickel ore ship crew were found out to be infected with COVID-19 in Chinese ports. Moreover, a strike broke out in the Indonesian Tsingshan industrial park recently.

The strike led to financial loss, but production recovers.

In response to the follow-up to the strike, on August 24, Jakarta Reuters news revealed that a spokesman of IMIP(PT Indonesia Morowali Industrial Park) said on Monday, “Although the workers changed the strike position outside the factory because of the epidemic on Saturday, the operation of Indonesia's largest nickel smelting facility has not been interrupted by this.”

Dedy Kurniawan said to Reuters news, “The operation of the factory has continued. Since the strike, the situation has back to normal. The productivity of IMIP is larger than 30 nickel production lines.”

Worsening epidemic situation in Indonesia, panic upgrade.

According to the news, the strike has been eased. However, the Indonesian epidemic has been in a severe state quo. On August 14th, new infections cases were up to 1,877 and the total infections increased to 155 thousand.

The infections also consecutively affected Chinese workers recently, which has made the industry very worried. Plus, the Indonesian medical condition is unlike Chinese, the panic among people is upgrading.

Chinese mills rush to purchase. Nickel ore and ferronickel prices increase.

Incidents that happened in Indonesia may reduce the Indonesian ferronickel supply to China, and the import from Philippine nickel ore is also influenced by the epidemic and the weather, so the delivery has to be postponed. The rain season in Philippine is coming after two months. In case of shortage, Chinese manufacturers prepare for the stock in advance. That is why mills rush to purchase in the nickel ore and ferronickel market, resulting in nickel ore and ferronickel supply tightened up, increasing the prices.

For now, the transaction price of high ferronickel in Chinese market hits US$165/nickel(price to the factory, tax-inclusive), which increased by US$19/nickel compared with that in the first half of August; the mainstream nickel ore(concentration of 1.5%) price also rose to US$58/MT, which is US$10/MT higher than that in the first half of August.

A large quantity of nickel ore is reserved. The increase in price is for sure.

The Philippine nickel ore supply volume in the third season has been in a peak. It is predicted that the export volume of Philippine nickel ore during the three months from July to September will exceed the total import volume of nickel ore from China in the first half of the year. Due to a large number of backorders and the scarce supply in the market, most nickel miners have recently indicated that they are out of stock and will not offer quotations.

The nickel ore inventory in China has been a small quantity, and the supply shortage seems that it won’t be eased within this year. People believe in the increasing trend of price and start to reduce sales. Last week, steel mills started to bid and purchased, a large amount of ferronickel was locked and reserved. It is said that the production of the order of Shandong Xinhai is arranged until October. Nickel shortage and expensive price will be the trend in the high ferronickel market in the short term.

----------------------------------------------------------------------------Stainless Steel Market Summary in China-------------------------------------------------------------------------