304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,130/MT(plus taxes) which is US$12/Mt lower than that of last week, and the decreasing percentage is 0.55%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,175/MT(plus taxes) which decreases by US$12/MT, and the decreasing percentage is 0.54%.

304/2B: The average price of 2.0*1240*C (mill edge) of Hongwang in the Wuxi market is US$1,960/MT(plus taxes) which is US$23/MT higher than last week and the increasing percentage is 1.13%. Besides, the average price of 2.0*1240*C (mill edge) of Hongwang in the Foshan market is US$1,960/MT(plus taxes) which increases by US$3/MT compared with last week and the increasing percentage is 0.15%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,915/MT(plus taxes) which decreased by US$5/MT compared with last week and the declining percentage is 0.85%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,940/MT(plus taxes) which remains as last week.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,890/MT(plus taxes) which dropped by US$5/MT compared with last week and the decreasing percentage is 0.15%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,955/MT(plus taxes) which decreases by US$3/MT compared with that of last week, and the decreasing percentage is 0.098%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,690/MT(plus taxes) which is US$2/MT less than last week and the decreasing percentage is 0.05%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,735/MT(plus taxes) which remains as last week.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,180/MT(plus taxes) which is US$6/MT more than last week and the rising percentage is 0.52%. Besides, the tax-inclusive average price of the Foshan market is US$1,180/MT(mill edge) which remains as last week.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,140/MT(plus taxes) which is US$2/MT higher than last week and the rising percentage is 0.14%. Besides, the tax-inclusive average price of the Foshan market is US$1,130/MT(mill edge) which remains as last week.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,370/MT(plus tax), which is US$12/MT higher than last week and the rising percentage is 0.89%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,335/MT(plus taxes) which increased by US$12/MT and the rising percentage is 0.92%.

Market|| 201 increased by US$23/MT, and the reason is the inventory is in short.

Lately, 201 has been running out of stock, typically, the cold rolling sheet and thick products of 201. Because of lacking stock, and the turning-good transaction these days, the price of 201J1 has slightly increased by US$8/MT.

On December 9th, the cold rolling 201 (4-feet, mill-edge) of the mainstream mills was quoted at US$1,160/NT which was US$8/MT higher than before; the mainstream base price of J2 and J5 were around US$1,110/MT and the hot rolling and 5-feet product were around US$1,165/MT.

Baosteel Desheng increases the 201 price by US$23/MT.

It is said that Baosteel Desheng will increase the price of 1-meter 201J2. From a US$16/MT increase to a US$23/MT increase, the price will be US$7/MT higher.

Market interpretation version 1: the 1-meter 201J2 product is exclusive by Baosteel Desheng to a certain extent, because other giant steel mills do not produce it, thereby the increasing price won’t be an influence on its competitiveness.

Market interpretation version 2: the 1780mm production line of Baosteel Desheng will gradually meet its maximum, which will enlarge the production of the wide products and cut down the 1-meter product volume, so it is possible that Baosteel wants to increase the price or even wants to stop the production.

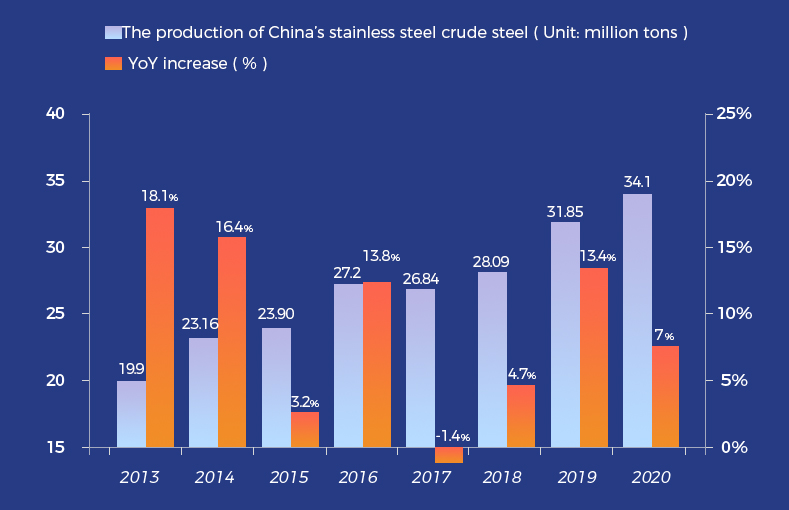

HIT|| Annual report: China’s stainless steel production increased by 7% and the apparent consumption increased by 12% in 2020.

The production of stainless steel crude steel increased by 7% in 2020.

In 2020, it is estimated that the production of stainless steel crude steel can reach 34.1 million tons which increases by 2.24 million tons and the increasing percentage is about 7%.

The reasons for increasing production:

1. After April, the demand for stainless steel in China was burst out. Steel mills expanded their productivity and thus the production rose largely. Moreover, some steel mills even reduced the production of straight carbon steel to make room for producing stainless steel.

2. After June, the steel mills invested in the stainless steel project, so the stainless steel production was released.

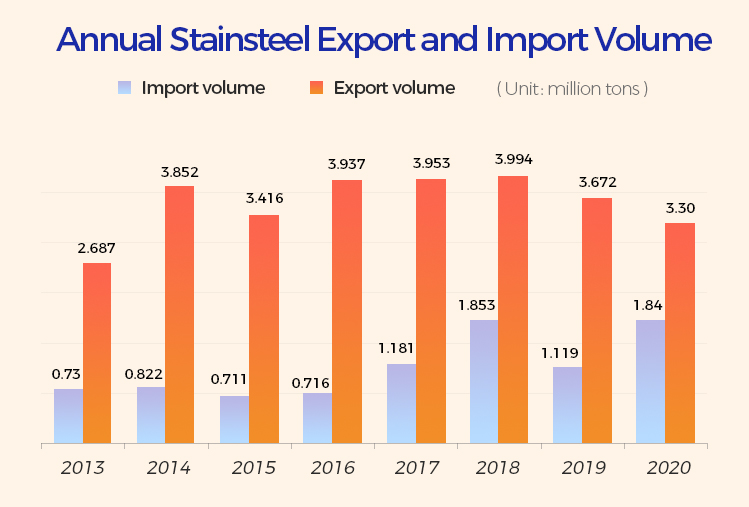

Import volume increases by 64% while the export volume decreases by 10% in 2020

In 2020, after the anti-dumping against the importing billet from Indonesia was abrogated, the import volume increased significantly, which is estimated to be 850 thousand tons more than last year.

In October, the cold rolling 304 imported from Indonesia reached 53 thousand tons which broke the historic high. Compared to September, it increased by 39 thousand tons, and the increasing percentage was 264.6%.

Some people in the industry have said that since that, the 304/2E importing from Tsingshan Indonesia to China was 60-80 thousand tons every month, which is estimated to increase by 280 thousand tons in 2020 compared to that in 2019.

In all, the import volume in 2020 rises by 720 thousand tons and the increasing percentage is 64.5%.

Due to the pandemic worldwide and the trade barrier, the export volume fell by 370 thousand tons and the decreasing percentage is 10%.

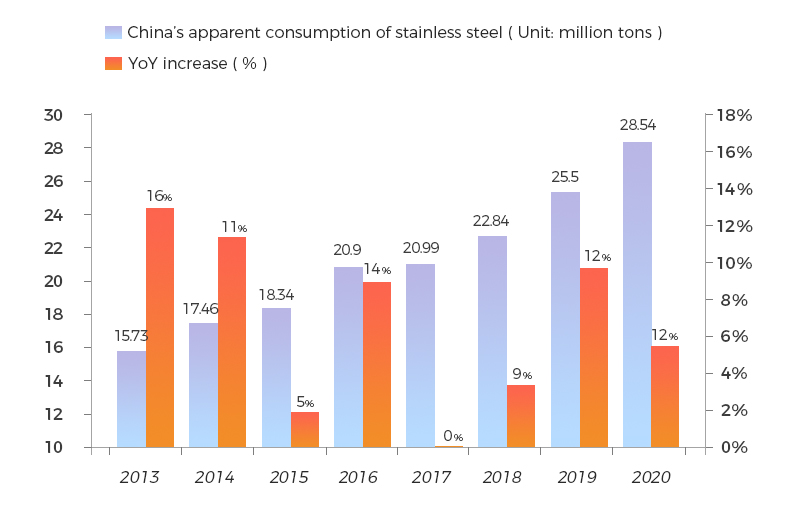

The apparent consumption in 2020 increases by 12%.

In 2020, the apparent domestic consumption of stainless steel is expected to reach 28.54 million tons, an increase of 3.04 million tons year-on-year, an increase of about 12%.

Three Reasons for the increase:

1. In 2020, the domestic stainless steel output increased, and the amount of steel in the market increased as well, which is expected to increase by 1.96 million tons;

2. China’s stainless steel imports increased;

3. China’s stainless steel exports have declined.

--------------------------------------------------------------------------------Stainless Steel Market Summary in China--------------------------------------------------------------------------------