304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$1,930/MT(plus taxes) which is US$14/MT higher than last week and the rising percentage is 0.72%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,965/MT(plus taxes) which is also US$14/MT higher than last week and the increasing percentage is 0.70%.

304/2B: The average price of 2.0*1219*C (slit edge) of Hongwang in the Wuxi market is US$1,850/MT(plus taxes) which is US$25/MT higher than last week and the rising percentage is 1.28%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,845/MT(plus taxes) which is US$7/MT higher than last week and the increasing percentage is 0.37%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,785/MT(plus taxes) which increased by US$25/MT compared with last week and the rising percentage is 1.33%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,800/MT(plus taxes) which is US$17/MT higher than last week and the increasing percentage is 0.93%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,670/MT(plus taxes) and the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,720/MT(plus taxes). Both remain the prices as last week.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,450/MT(plus taxes) which is US$16/MT less than last week and the decreasing percentage is 0.60%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,485/MT(plus taxes) which is US$14/MT higher than last week and the increasing percentage is 0.54%.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,045/MT(plus taxes) which is US$13/MT less than last week and the declining percentage is 1.23%. Besides, the tax-inclusive average price of the Foshan market is US$1,050/MT(mill edge) which decreases by US$6/MT compared to last week and the decreasing percentage is 0.55%.

J2, J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,000/MT(plus taxes) which is US$16/MT less than last week and the declining percentage is 0.85%. Besides, the tax-inclusive average price of the Foshan market is US$1,000/MT(mill edge) which decreases by US$14/MT compared with last week and the decreasing percentage is 1.34%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,055/MT(plus tax), which is US$19/MT higher than last week and the rising percentage is 1.81%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,045/MT(plus taxes) which increased by US$4/MT and the rising percentage is 0.42%.

Who is the next after LME soared by $400/MT? 304?

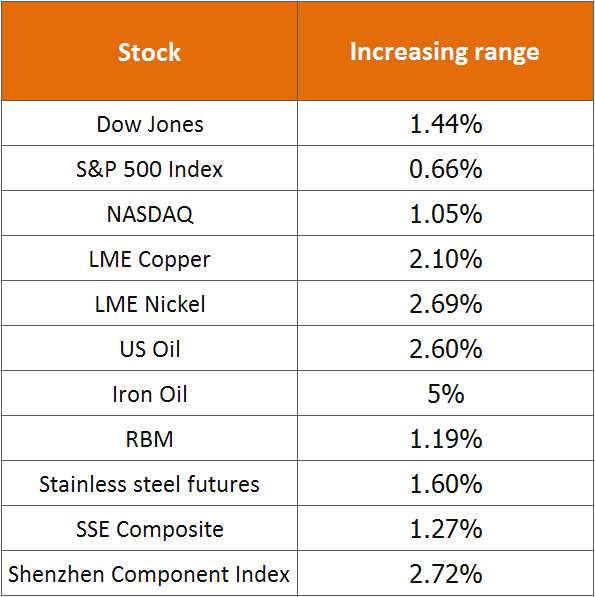

Last Friday, China released M2 data which shows better than expectation, plus the foreign market mostly has a slack financial policy, so the financial and commodity market is exciting. On Friday night, foreign finance and commodity ascended greatly in the stock. S&P 500 Index, Dow Jones Index, NASDAQ were all increased by 1%, and NASDAQ created its new highest; US oil futures increased by 2.60%; LME copper increased by 2.10%.

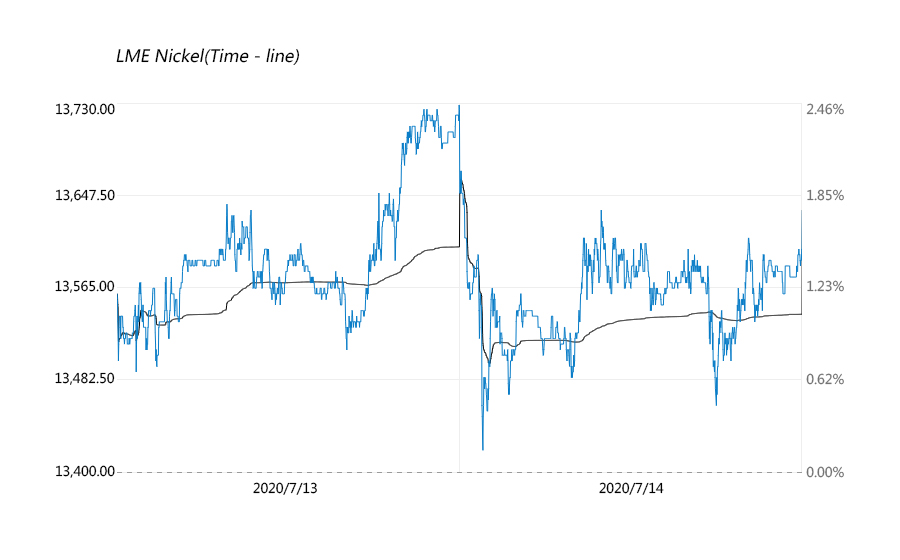

LME Nickel Price Boosted $500

At 8 pm, the LME nickel price began to rise and kept the trend, peaking at $13,580/MT, which increased by $500. The price closed at $13,560/MT which is $355 higher than the beginning price. Breaking the former highest point of $13,500/MT, it sets a new highest in this turn of bounce-back.

Domestic A stock and bulk commodity continue to rise in price

After a short reallocation on the last Friday, A stock regains its upward trend. Until the closure at the noon, the SSE Composite Index has increased by 1.27%, and the Shenzhen Component Index has increased by 2.72%.

The bulk commodity is also up. The black iron ore stock price rose by 5%, JM increased by 2.26%, and RBM price went up of 2%; Shanghai Nickel increased by 2%, stainless steel futures price increased by $29 and reached $1,875/MT and the highest point was once reached $1,880/MT which is a new highest point in recent time. The speculation mood is widely spreading in the market.

The stock and LME nickel boost, how about the stainless steel market?

Stockout? But the 304 price rises not as high as expected.

Compared with last Friday, in the 304 stainless steel stock market on Monday(13th July), the price only increased by $7/MT, which is the same price as last Saturday.

Summary:

Influenced by the slack financial policy around the world, the financial and commodity markets mostly show strong. Capitals are crazed about LME and stainless steel futures, the speculation seems will last for a while and the price will continue the upward trend. But for the stainless steel stock market, due to most of the resources are controlled by the mills, there are not many stocks in traders. The speculation is low in the stock market, so generally, the prices are adjusted along with the market.

-------------------------------------------------------------------------Stainless Steel Market Summary in China--------------------------------------------------------------------------------