INVENTORY|| Will the price of SS304 keep increasing with more resources arrived?

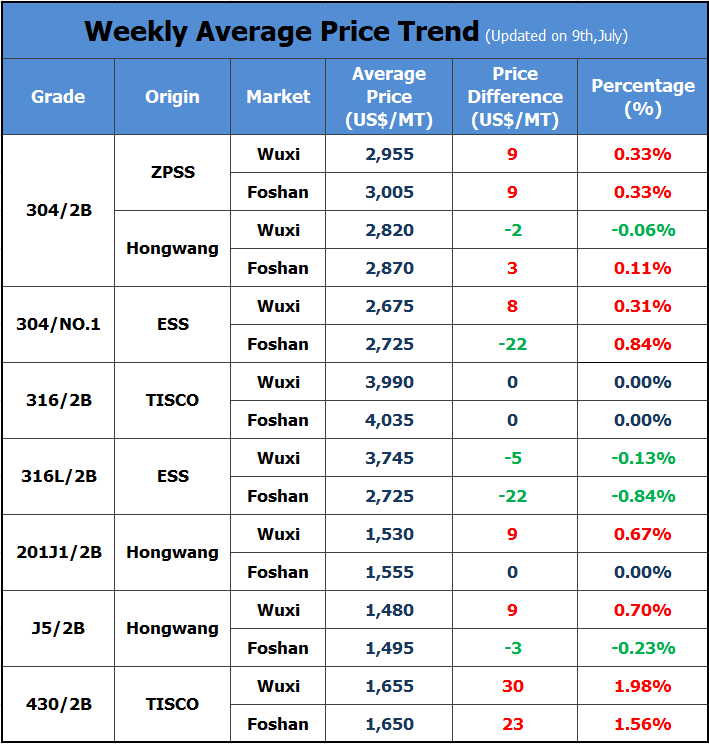

According to the database, last week, in the Wuxi market, the inventory volume decreased to 439.6 thousand tons which are 2,100 tons lower. In detail, the inventory of 200 series reduced by 4,900 tons, and left by 47,200 tons; as for 300 series, the inventory was 301,900 tons which increased by 2,400 tons; the inventory of 400 series was 90,500 tons which was 400 tons more than last week.

200 series: The inventory is reducing.

The 201 market in the last week performed tepidly. During the week, resources from Baosteel Desheng and SDSY entering the market, but it did not cause great influence due to its small quantity. Although the transaction was plain, the low supply still results in the declining inventory volume.

In June, the inventory volume of 200 series reduced by 90,900 tons compared to last month, down to 937,300 tons (8.84% lower MoM) and YoY decreased by 24,500 tons that is 2.54% lower. Because of the increasing costs of raw materials, the profit margin of 200 series has been reduced, which crashed down the productivity of steel mills. Besides, the production of plain carbon steel is also decreasing.

For now, many people said that they stock less now. Due to the low inventory volume, and the increasing price of SS304, it is believed that the price of 200 series will increase.

300 series: The inventory is increasing.

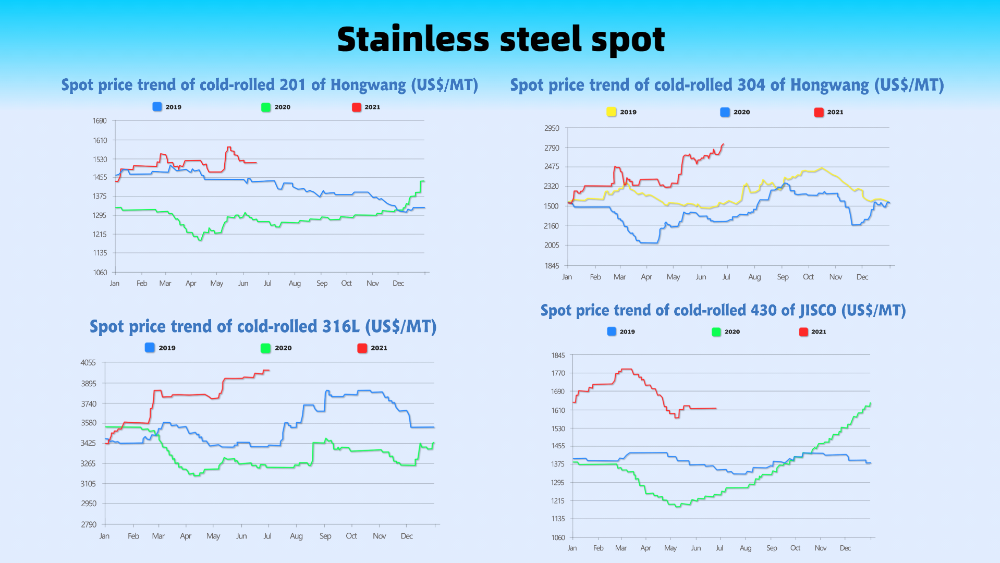

The stainless steel futures increased a lot last week. Contract 2108 reached its new high after it enters the market. Influenced by this, the spot price of SS304 also climbs. Recently, because Hongwang has been delivering products of the warehouse receipts, which occupies logistic flow, making other steel mills’ delivery postponed. What’s more, Tsingshan opened and accepted orders with small volumes and some flows to the downstream manufacturers, making it less for the traders.

From the perspective of supply, SS304 will maintain the increasing supply. According to the data, in June, the production volume of 200 series increased to 1,617,400 tons which is 64,500 tons more than last month. Driven by the high profitability and the phase 2 of production by an east Chinese mill in June, it is predicted that the production of 200 series will keep rising. If the demand fails to keep up with the trend, the stock will risk piling up.

400 series: Slack demand remains the inventory high.

Since July, the 430 market has ushered in an upward trend, increasing by US$31/MT. Although people tend to buy in when the price is increasing, traders tend to send out products. The transaction is rather gloomy. From the inventory of the 400 series of last week, it remains above 90,000 tons, staying at a high volume during the year. Because of the high inventory, it is hardly saying that the 400 series will turn optimistic in the later period.

Summary:

The resources of 200 series is reducing, it is possible that the future price trend will turn upward, As for 300 series, the spot resources are lacking, which makes a chance for the price to increase. But due to the rising production, be cautious that the pile-up of stock is caused by the weakening demand.

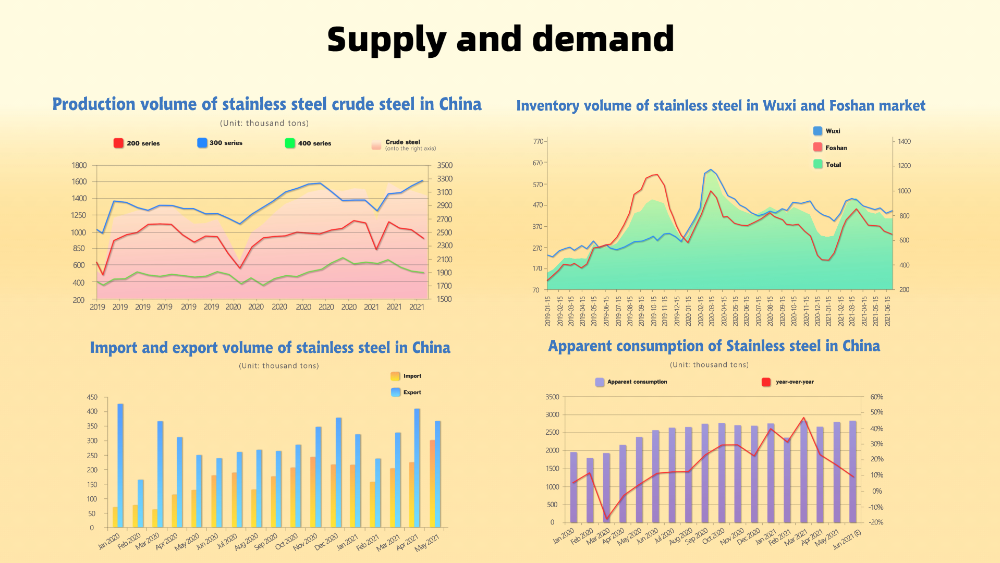

The stainless steel market was extremely hot last week. Contract 2108 has risen by more than US$156/MT, setting a record high, and the cold rolling product by private-owned mills in Wuxi market has risen by about US$47/MT. Will the stainless steel market continue to increase prices next week?

304: The price will keep going up.

Macroeconomics:

The Fed’s June meeting showed that most officials insisted that unless the economy makes substantial progress, the Fed will not make major policy changes. The U.S. economy has not yet reached this standard, reflecting that there are no plans to raise interest rates and reduce asset purchases in a short term.

Besides, in China, the central bank announced a RRR (ratio of reserve requirement) cut. The People's Bank of China decided to lower the deposit reserve ratio of financial institutions by 0.5 percentage points on July 15, 2021, and the RRR cut releases about 1 trillion yuan (about US$156 billion) in long-term funds. From the perspective of the overall macro policy, the expectation tends to be positive.

Production limit:

Recently there is news about the limit on crude steel production of 2021 which shall not higher than the production volume of 2020. Sources said that the limit is for controlling the carbon steel market.

However, the stainless steel market is still worried about the future supply, because the stainless steel production increase significantly compared to the same period of last year. People worry if the production limit also executes in the range of stainless steel, which will largely cut down the supply. This concern pushes the market going long.

Low inventory pressure:

According to the inventory data, in June, the production of 300 series crude steel increased by nearly 65,000 tons, but it did not cause pile up to the market. The reasons are, first, the stable demand keeps consuming the inventory; second, some steel mills enlarge the production of the less popular grades of 300 series, and actually, the supply of 304 did not increase a lot.

What is uncertain?

About the futures market, the price may decline. Last week, after the futures stock increased significantly, the price difference has narrowed down to around US$31/MT, reducing to a record low. Once the profitable stock withdraws at a high level, the spot market will be influenced greatly.

201: Inventory comes to a low level. The price may maintain high.

The price of 200 series main raw materials has continued to be strong recently. High-carbon ferrochromium has risen by US$47/MT, reaching US$1,313/50 base tons last week, and electrolytic manganese has risen by US$141/MT, hitting US$2,844/MT during the week. The cost is still a strong factor affecting the stainless steel price.

From the perspective of inventory, last week, 200 series decreased to 47,200 tons, 4,900 tons lower than a week before. Although there were some new resources entering, the supply volume was not too high and thereby the traders consumed the inventory. Thanks to the low inventory, the price might maintain high. SS201 might increase by US$8/MT.

However, the pressure of supply will gradually appear, because Baosteel Desheng will recover producing and other steel mills do not reduce the production as was expected. It is predicted that in July, the 200 series crude steel supply will increase by 100,000 tons. The price will fall.

The price of high chrome increases. SS430 might rise to US$1,563/MT.

The electrical power rationing is getting more severe in Inner Mongolia. Because the electrical power used by the high chrome production area in Inner Mongolia during May and June surpassed the limit by 95 million kWh, from July 6th to July 25th, except for the class A enterprises, other ferrochrome factories will reduce or stop producing, which will influence at least 20,000 tons of production. Besides, in July, the bidding price July rises significantly. The bidding purchase price of Tisingshan increases by US$148/50 base tons.

Due to the powering, last week, the price of high carbon ferrochrome continued to rise. During the week, it increased by US$47, reaching US$1,313/50 base tons. Now, the spot inventory volume is getting less and less, so the price will remain high in the short term.

Although the inventory of 400 series maintains high, due to the increasing raw material cost and high 300 series price, the market price will remain good. It is predicted that the cold-rolled 430 will increase by US$16/MT, quoting US$1,690/MT.

Summary:

The price of SS304 will still go up to about US$31/MT. The inventory volume of SS201 is low and the raw material cost is high, so the price is predicted to increase by about US$8/MT. As for SS430, influenced by the increasing price of high carbon ferrochrome and SS304, SS430 will also rise by US$16/MT.

Summary of the first half of the stainless steel market in 2021

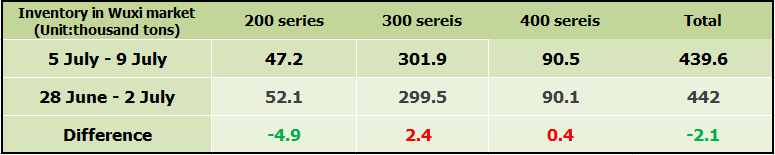

According to the data, in 2020, Chinese stainless steel enterprises above designated size (all industrial enterprises with annual main business income of RMB 20 million and above) produced 33,950,000 tons of crude steel.

Until now, China’s stainless steel capacity reaches up to 42,930,000 tons/year. From January to June of 2021, the crude steel production in China is 18,430,000 tons which is 3,140,000 tons more than the same period of last year, increasing by 21%.

Crude steel for 200 series is 6,060,000 tons, 33% of the total crude steel production, YoY increasing by 1,060,000 tons, 21% higher than last year.

Crude steel for 300 series is 8,750,000 tons, 47% of the total crude steel production, YoY increasing by 1,110,000 tons, 14% higher than last year.

Crude steel for 400 series is 6,060,000 tons, 20% of the total crude steel production, YoY increasing by 970,000 tons, 37% higher than last year.

The pandemic is getting to be stable globally, and the overseas stainless steel productivity recovers. With the imposition of tariffs on China’s stainless steel export hanging over the market, the export demand has gradually declined. However, China’s downstream manufacturers develop prosperously. Except for the automobile industry, stainless steel used in fridges, washing machines, elevators all increase.

In the second half of 2021, when the RRR is cut by the central bank, the market liquidity may change, which will boost the market hype. With the influence of the production limit and the power rationing policy, it is believed that the prices of stainless steel will further increase.

HOTSPOT|| A mill of NAS has to halt production. Credit Suisse AG: Steel stock will last the bullish trend.

Summary: In a letter to customers seen by Bloomberg on Friday (9th, July), North American Stainless Steel (NAS) stated that the company will not be able to maintain normal smelting operations at the Ghent plant.

Another sign of the chaos in the global supply chain is that a leading US stainless steel manufacturer was forced to declare force majeure at its Kentucky plant because it was unable to obtain enough industrial gas it needed.

One of the reasons for this situation is the shortage of truck transportation, which is a problem that can be seen in many industries.

01

NAS said that all supply contracts have been suspended and the Kent plant's delivery will be postponed indefinitely. The company is a subsidiary of Acerinox, a large global stainless steel manufacturer, and accounts for approximately 40% of the total stainless steel supply in the United States.

02

Recently, hot-rolled steel coil prices have continued to rise under supply pressure. Credit Suisse AG believes that it should continue to hold the bullish view on steel stocks.

Affected by the low US dollar and China’s production restrictions on polluting blast furnaces, US steel imports will remain sluggish, and tight supply has caused hot-rolled steel coil quotations to soar from US$500 per short ton a year ago to more than US$1,700.

03

However, because of the past surge in imports on steel stocks, many analysts have recently downgraded the ratings of such stocks to hold, but Woodworth of Credit Suisse AG believes that this upward trend will continue for several years and become a new normal in the market. With the widespread use of vaccines, raw materials and cyclical stocks that are closely related to the economic recovery have become hot spots of the stock market this year, and steel stock is one of them. Among them, US Steel (X-US) and Cleveland (CLF-US) ) have increased by 30% and 45% respectively.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China