Stainless steel 304 rose in price after Tsingshan called the price limit back on his agents. Moreover, the prices rose too fast and sellers even couldn't give a quotation. In March, according to official data, China's export volume increased by 14.8% compared to the same period of last year, which has twisted the downward trend in January and February. The increasing sea freight seems to be strong evidence of the recovering demand. Sea freight to North America increased the greatest, by 12.5%. For more about the market, please keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,395 | -85 | -3.61% |

| Foshan | 2,440 | -85 | -3.55% | ||

| Hongwang | Wuxi | 2,315 | -89 | -3.91% | |

| Foshan | 2,295 | -94 | -4.14% | ||

| 304/NO.1 | ESS | Wuxi | 2,220 | -100 | -4.57% |

| Foshan | 2,280 | -91 | -4.06% | ||

| 316L/2B | TISCO | Wuxi | 4,030 | -260 | -6.27% |

| Foshan | 4,110 | -265 | -6.27% | ||

| 316L/NO.1 | ESS | Wuxi | 3,820 | -258 | -6.55% |

| Foshan | 3,905 | -247 | -6.16% | ||

| 201J1/2B | Hongwang | Wuxi | 1,515 | -22 | -1.55% |

| Foshan | 1,500 | -26 | -1.83% | ||

| J5/2B | Hongwang | Wuxi | 1,430 | -26 | -1.98% |

| Foshan | 1,430 | -22 | -1.63% | ||

| 430/2B | TISCO | Wuxi | 1,270 | -7 | -0.63% |

| Foshan | 1,265 | -7 | -0.64% |

TREND|| Will April be the turning point during the continuously weak tendency?

The stainless steel prices remain weak except for the price of stainless steel 430 which was stable last week. Until April 7th, the most-traded contract of stainless steel futures increased by US$4/MT to US$2,295/MT.

Stainless steel 300 series: Tsingshan brings back the price limit

As the raw material cost shifts down quickly, the stainless steel spot price fluctuated to drop last week, until April 7th, the base price of cold-rolled 4-foot stainless steel 304 decreased to US$2,260/MT while the hot-rolled to US$2,215/MT, and both was US$59/MT less compared to a week ago. However, on April 7th, Tsingshan brought back the price limit on the agent prices, boosting the market confidence and purchases. The price of futures and spots both bounced back.

Stainless steel 200 series: Market remains gloomy, 201 fell.

Last week, the spot price of stainless steel 201 declined day by day last week. Until April 7th, the base price of cold-rolled stainless steel 201 and SS201 J2 in Wuxi fell by US$29/MT on a one-week basis, to US$1,480/MT and US$1,390/MT respectively. As for the hot-rolled 5-foot stainless steel, it was US$22/MT lower compared to a week ago, down to US$1,420/MT.

Influenced by the bland market, since March, steel giants have begun their maintenance to reduce production. Tsingshan and Baosteel both cut down 20% of the volume in April. For now, although some specifications of stainless steel 201 are in short, it is not enough to affect the market trend due to the pathetic demand. Low production, lower prices but these all fail to boost the market, and thereby traders are pessimistic about the future.

Stainless steel 400 series: Cost goes low, prices drop.

The guidance price of TISCO stainless steel 430/2B declined to US$1,415/MT which was US$7/MT lower than March 31st. While JISCO even dropped much by US$22/MT to US$1,495/MT.

Summary:

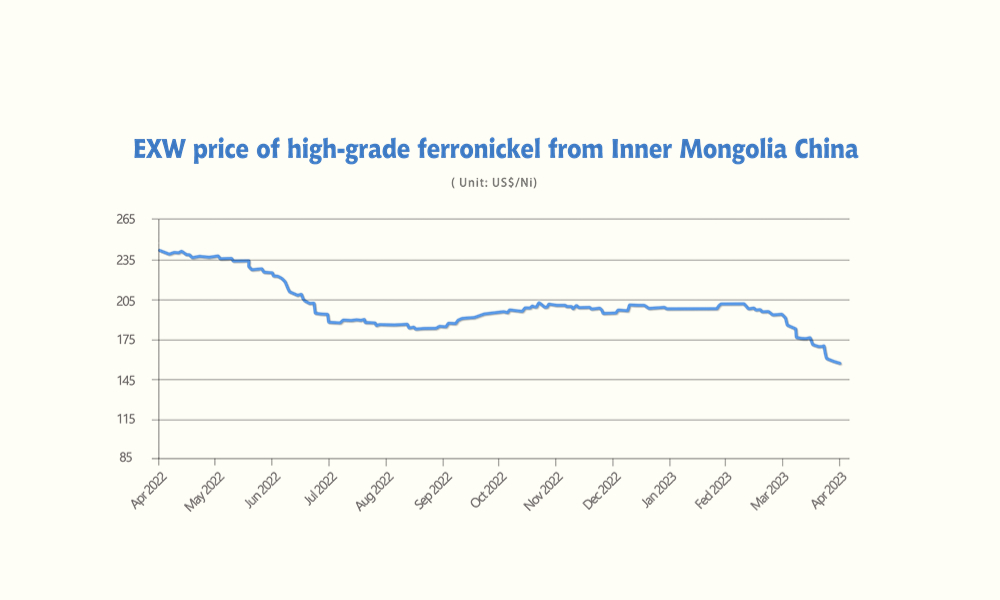

300 series stainless steel: To relieve the stress of large inventory, many steel mills are reducing production, and traders are also lower the prices to sell. The prices were stable, and more downstream buyers start to purchase. But as the price of ferronickel keeps decreasing, the stainless steel prices also do down. In a short term, the prices will remain a downward trend.

200 series stainless steel: The transaction remains weak. The spot prices of stainless steel 201 were back down to about three weeks ago before the three steel giants united to prop up the prices. Traders hold a negative view of the future. But the stainless steel output will be reduced in April as steel mills have taken a cut-down in March. It is predicted that the stainless steel 201 will drop in April.

400 series stainless steel: Last week, the price of high chrome decreased. Demand for stainless steel maintains feeble and the prices continue to drop. There leaves less support for the cold-rolled stainless steel 430 price. It is predicted that the price will remain slightly weak.

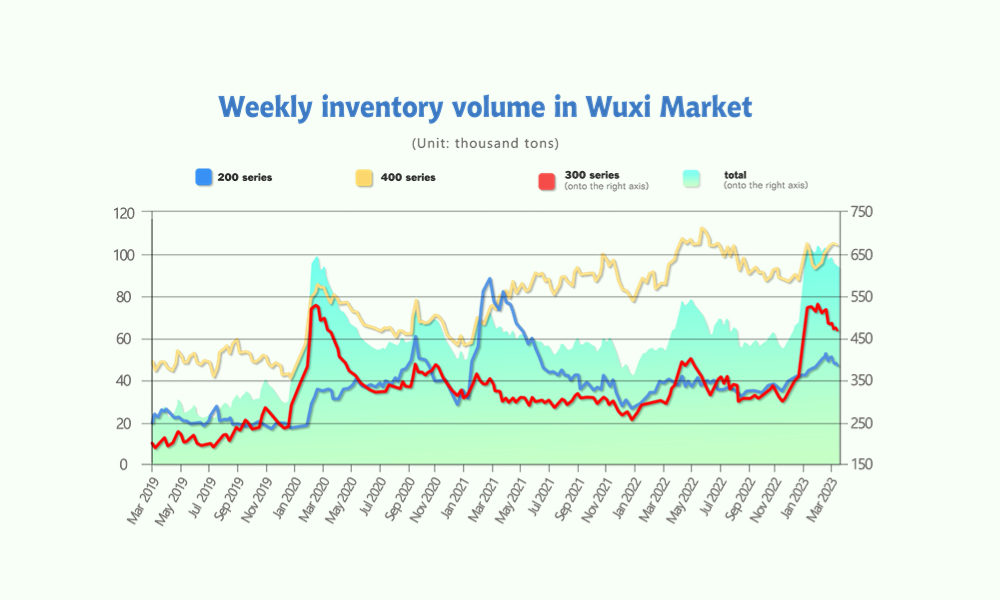

Inventory|| Inventory has reduced for two weeks

The inventory level at the Wuxi sample warehouse fell by 3,456 tons to 619,905 tons (as of 7th March).

the breakdown is as followed:

200 series: 1,450 tons down to 46,650 tons

300 Series: 1,368 tons down to 469,652 tons

400 series: 638 tons down to 103,603 ton.

Stainless steel series 200: Dull as before

There was no sign of rebound of the transaction of stainless steel 201 and reduced arrival from steel mills and slightly reduced inventory last week, the spot trading of Series 201 in the Wuxi market performed weakly, with spot prices falling for three consecutive working days except for the Qingming Festival holiday on Wednesday. The trading performance was mostly dull, with most orders for coiled materials and relatively difficult flat plate shipments. In order to promote transactions, some merchants lowered their prices, but the effect was not satisfactory, and traders held a pessimistic attitude towards the future market. At present, the reduction in production by steel mills in March has not yet been reflected in the market, while discounts for April agreement quantities have been implemented. The arrival of steel mills this week was sparse, and the arrival of steel mills in South China and East China was significantly narrower than usual, and other steel mills delivered a small amount of resources to Wuxi. The spot inventory showed a slight decrease.

Stainless steel series 300: Only Slightly Reduced Inventory

Last week, the inventory of Series 300 in the Wuxi market decreased by 0.14 million tons to 4.697 million tons, with a slight reduction in cold and hot rolled resources. Recently, steel mills and traders have actively lowered prices to reduce inventory, and low-priced transactions have gradually improved. As steel mill resources arrived one after another, Delong cold-rolled and hot-rolled resources were fully allocated in the Wuxi area this week, and Tsingshan cold-rolled and hot-rolled resources continued to arrive in Wuxi, resulting in only a slight reduction in inventory in the Wuxi market in the coming time.

Stainless steel series 400: Cost and demand support both weak, Prices slightly Down!

Last week, the inventory of Series 400 stainless steel spot remained relatively high this week, with no obvious improvement in market demand. In addition, the price support was continuously weak due to the large drop of 88/MTU in the price of high-carbon ferrochrome raw material steel in April. Considering that steel companies generally have not yet reversed their losses and have low production enthusiasm, the weak price of Series 400 stainless steel will slightly improve in the short term, which is conducive to the reduction of spot inventory.

RAW MATERIAL|| The price of raw materials hit a new low

Nickel: EXW price of high-nickel iron reaches the lowest point in two years due to oversupply

Last week, the EXW price of high-nickel iron kept decreasing and dropped to a two-year low. Until April 8th, it was quoted between US$158 ~ US$160/Ni which was down by around US$4/Ni from a week ago.

During last week, the ShFE nickel was fluctuating. Until April 8th, the most-traded contract of ShFE nickel closed at about US$26,368/MT which increased by US$75/MT (2.95%) from a week before. Early in the week, the purchasing price of Indonesian high-nickel iron given by Chinese steel mills was again reduced by US$4/Ni, which forced Chinese prices to drop as well. As the stainless steel prices keep decreasing, steel mills are losing profit, making them take strict material costs. Moreover, with the news of the output reduction of steel mills, the Ferronickel price also goes even lower.

The nickel ore price drops after the rainy season ended in The Philippines, which brings up the Chinese imports seasonally. The production cost of stainless steel declines further. As a whole, because the steel mills reduce production and the nickel ore price decreases, meanwhile the Indonesian ferronickel is competitive in price, while the Chinese ferronickel price will remain low in the short term.

Chrome: The purchasing price is too high for the current selling price

Except for the stainless steel mills reducing production, high-carbon ferrochrome is also on the way to decreasing the output. Recently, the futures price of chrome ore are weakening. The transaction price of South African fine ore (40%~42%) futures dropped significantly to about US$280/MT, down US$20/MT, and the delivery date was in late May.

However, the spot price of chrome ore does not drop as much as fine ore. Last week, Tsingshan Group took the lead in promulgating the purchase price of high-carbon ferrochrome in April 2023 as US$129/50 basis ton (cash including tax to ex-factory price), and the receiving price at Tianjin Port was reduced by US$22/50 basis ton, a month-on-month decrease of US$88/ 50 basis tons, the delivery deadline is before May 10, 2023. Affected by the steel recruitment policy, the mainstream quotation of high-carbon ferrochromium fell by US$29/50 basis ton this week to US$1265 ~ US$1294/50 basis ton.

MACRO|| Is it possible to trade in Chinese Yuan?

WATCH THE VIDEO NOW: Will you trade without using US dollar?

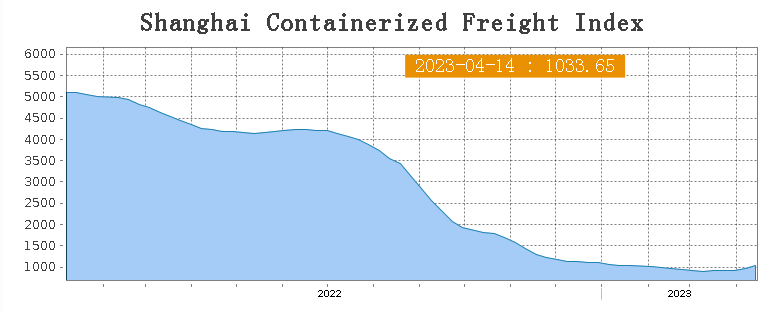

Sea Freight|| The shipping market tends to rise

Freight rates overall on multiple sea routes trended differently last week as the market is rising, On 7th April, the. Shanghai Containerized Freight Index rose by 3.6% to 956.93.

Europe/ Mediterranean: Economic Sentiment Indicator turns better, the market confidence is recovering. As the demand recovers, the sea freight increases slightly.

Last week, transportation demand remained flat. Until 7th April, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1621/TEU, which increased by 1.6 %. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1621/TEU, which rose by 1.2%.

North America: The interest rate had been raised aging by the Fed last few weeks, escalating worry of economic recession.

Until 7th April, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,292/FEU and US$2,147/FEU, 12.5% and 6.8% rise accordingly.

The Persian Gulf and the Red Sea: Until 7th April, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 5% rose from last week's posted US$1092/TEU.

Australia/ New Zealand: Until 7th April, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$267/TEU, which dropped by 16.0% from the previous week.

South America: The freight market had a significant rebound. on 7th April, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1817/TEU, a 5.6% rose from the previous week.