Stainless steel 316L rose in price on a one-week basis. But the reality was that after Labor Day, the stainless steel market cooled down gradually. The stainless steel production in April dropped more than expected, while it is predicted that the scheduled production in May will increase because the profit margin is recovering during the last round of price increases. However, China's manufacturing PMI in April unexpectedly fell down below 50%, back to the contraction zone, indicating that the economic development might lose momentum as the accumulative demand and orders from the last year have been consumed and meanwhile, the inner and new demand fails to keep up. If you want to know more about the Stainless Steel Market Summary in China, please keep reading down below.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,455 | -53 | -2.21% |

| Foshan | 2,495 | -53 | -2.17% | ||

| Hongwang | Wuxi | 2,380 | -48 | -2.10% | |

| Foshan | 2,360 | -48 | -2.11% | ||

| 304/NO.1 | ESS | Wuxi | 2,285 | -38 | -1.73% |

| Foshan | 2,305 | -47 | -2.10% | ||

| 316L/2B | TISCO | Wuxi | 4,115 | 143 | 3.74% |

| Foshan | 4,180 | 111 | 2.83% | ||

| 316L/NO.1 | ESS | Wuxi | 4,050 | 228 | 6.20% |

| Foshan | 4,070 | 190 | 5.08% | ||

| 201J1/2B | Hongwang | Wuxi | 1,525 | -4 | -0.31% |

| Foshan | 1,500 | -10 | -0.74% | ||

| J5/2B | Hongwang | Wuxi | 1,440 | -4 | -0.33% |

| Foshan | 1,425 | -10 | -0.78% | ||

| 430/2B | TISCO | Wuxi | 1,240 | -7 | -0.65% |

| Foshan | 1,235 | -1 | -0.13% |

Trend|| Transaction cooled down in prepare for the hot summer.

On 4th May, the stainless-steel future price had an astonishing start on the first trading day after the Chinese Labor Day holiday, growing by 2.5% to US$2410/MT. Meanwhile, the mainstream contract price rose by US$37 (or 1.74%) to US$2390/MT along with the ShFE nickel, but the latter fell slightly in the afternoon and eventually closed at US$27710/MT with a US$759/MT(or 2.85%) growth.

The price of commodity rebounded slightly on 5th May, the ShFE future price of nickel and stainless steel ran weakly during the day and fell by 2.07% and 0.1% at the end of last week.

As for the spot price, the cold-rolled 4-foot mill-edge stainless steel 304 remained unchanged at US$2365/MT, and the hot-rolled 304 rose US$29/MT to US$2340/MT.

Statistic: The comparison of the average price of stainless steel series (5-days) before/after the Chinese Labor Day Holiday in recent years is as followed:

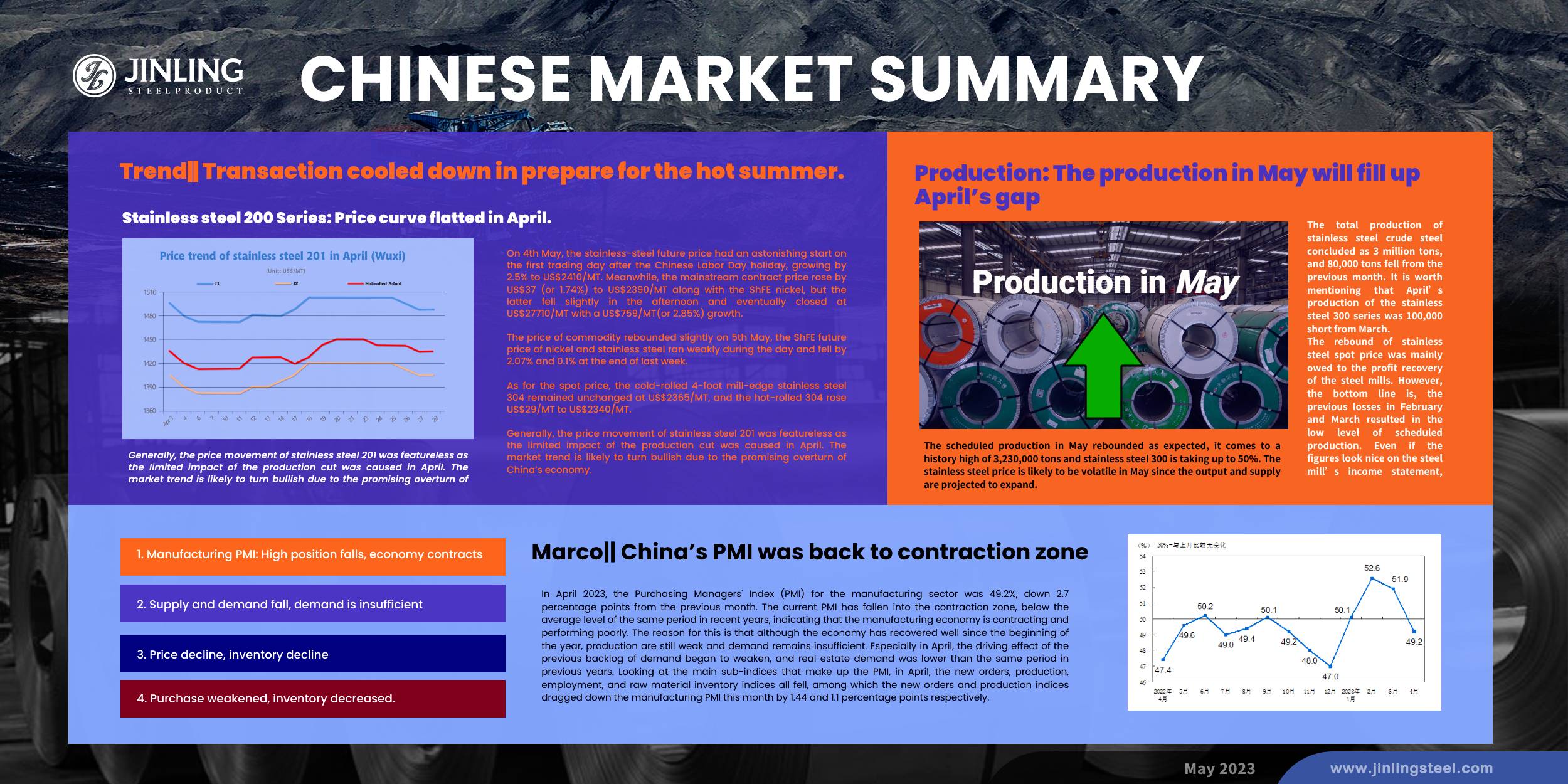

Stainless steel 200 Series: Price curve flatted in April.

The spot price of stainless steel 201 succeeds the upward momentum after the holiday. The mainstream price of cold-rolled 201 went up by US$7/MT to US$1495/MT, and cold-rolled stainless steel 201J2 and hot-rolled 5-foot stainless steel dropped US$15/MT to US$1420/MT and US$1450/MT respectively.

Generally, the price movement of stainless steel 201 was featureless as the limited impact of the production cut was caused in April. The market trend is likely to turn bullish due to the promising overturn of China’s economy.

Stainless steel 300 series:

The market price recorded a robust growth after the holiday, closing at US$2365/MT with a US$15/MT growth, and the hot-rolled price rose US$37/MT to US$2340/MT.Stainless steel 400 series:

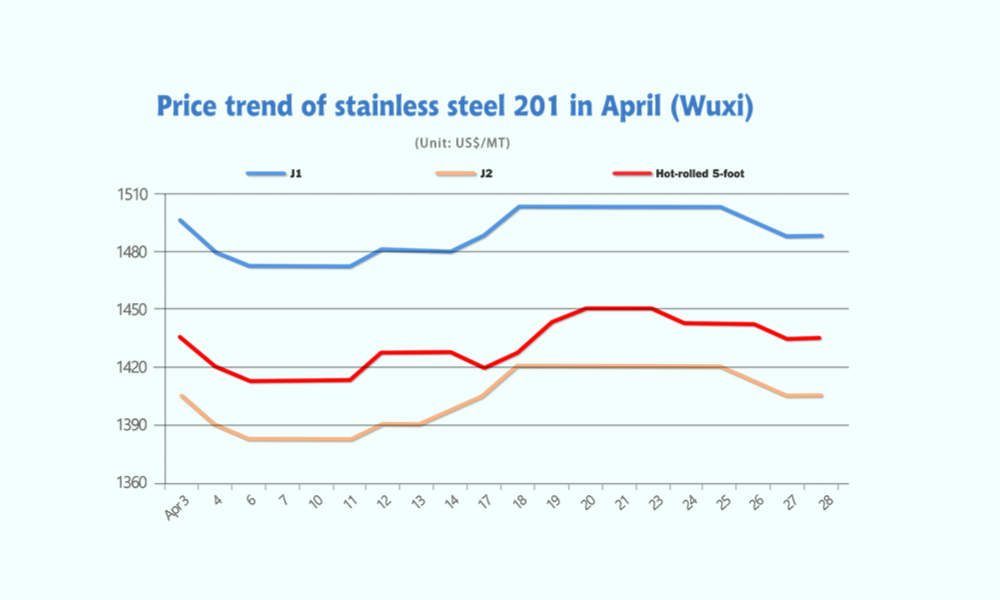

Until Friday, cold-rolled stainless steel 430 remain unchanged at between US$1385/MT to US$1390/MT.INVENTORY|| Inventory increased for the May’s arrival.

The inventory level at the Wuxi sample warehouse rose by 25,413 tons to 575,039 tons (as of 5th May).

the breakdown is as followed:

200 series: 2,860 tons up to 43,530 tons

300 Series: 15,077 tons up to 427,183 tons

400 series: 7,476 tons up to 104,326 tons

Stainless steel 200 series: Inventory stacked up during the holiday.

The stainless-steel inventory consumption was overturned by the Chinese Labor Day holiday for the time being, approximately 18% of total inventory was digested since early March and it was upset by 5% last week. The market was crowded by the downstream users until last Friday and it is expected to be diminished in the coming period as the supply from the mill will be back to normal.

Stainless steel 300 series: The supply was taking no day off.

Similar to the 200 series, the goods arrival did not interrupt by the holiday, resulted in the inventory increases. However, according to the market, the inventory was actively consumed as the market reopened, and it is expected to continue the momentum in the coming week.

Stainless steel 400 series: Price were stabilized

The stainless steel 400 series also received active transactions last week, but the inventory is expected to be consumed rapidly after the holiday.

Production: The production in May will fill up April’s gap

The total production of stainless steel crude steel concluded as 3 million tons, and 80,000 tons fell from March. It is worth mentioning that April’s production of the stainless steel 300 series was 100,000 short from March.

The rebound of stainless steel spot price was mainly owed to the profit recovery of the steel mills. However, the bottom line is, the previous losses in February and March resulted in the low level of scheduled production. Even if the figures look nice on the steel mill’s income statement, the production level still needs a certain amount of time to turnover.

The scheduled production in May rebounded as expected, it comes to a history high of 3,230,000 tons and stainless steel 300 is taking up to 50%. The stainless steel price is likely to be volatile in May since the output and supply are projected to expand.

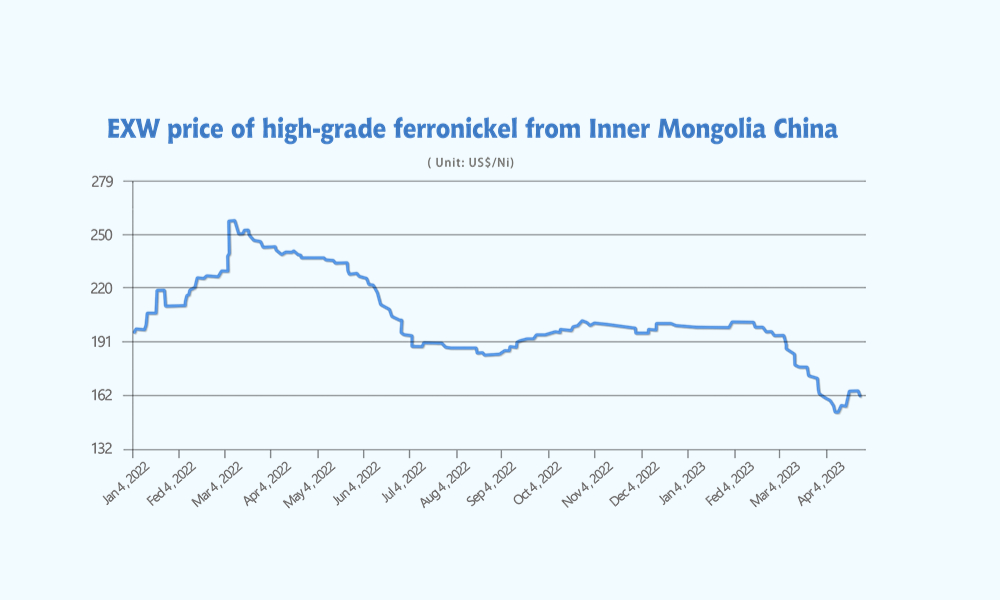

RAW MATERIALS|| Ferronickel might be weaken in the short term

The price of nickel ore was stabilized last week, the profit margin is now overturned, showing a significant improvement compared to the previous period's losses.

Previously, stainless steel prices rose, and steel mills purchased a large amount of nickel-iron. The domestic iron plants' stockpiled inventory has been basically cleared, and nickel ore prices are currently tending to be stable. In addition, Indonesia's nickel-iron production line continues to operate, continuously transporting low-cost nickel-iron to China. The oversupply of nickel-iron will be intensified in May, and it is expected that nickel-iron prices will run steadily and weakly in the short term.

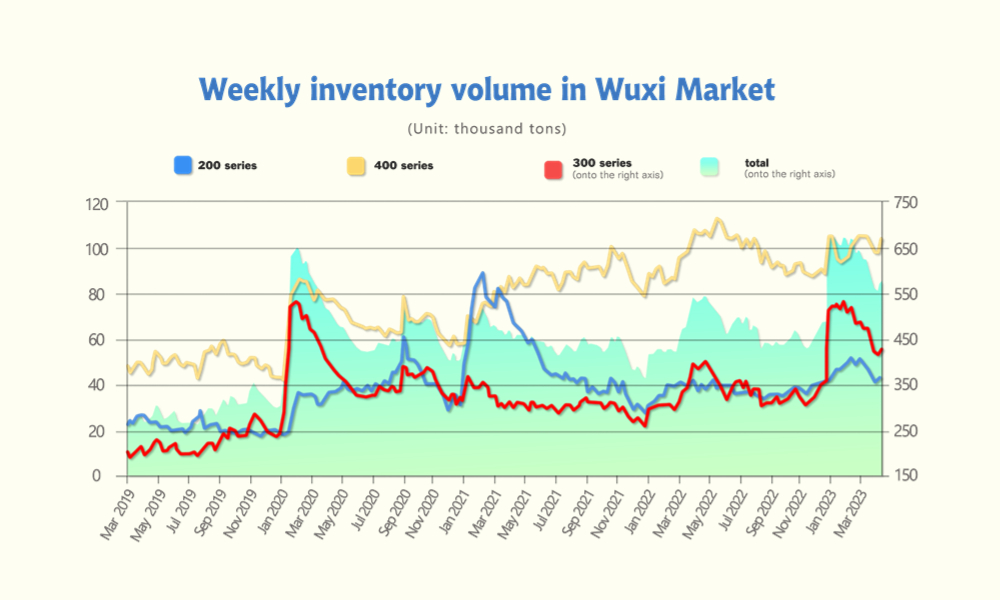

Marco|| China’s PMI was back to contraction zone

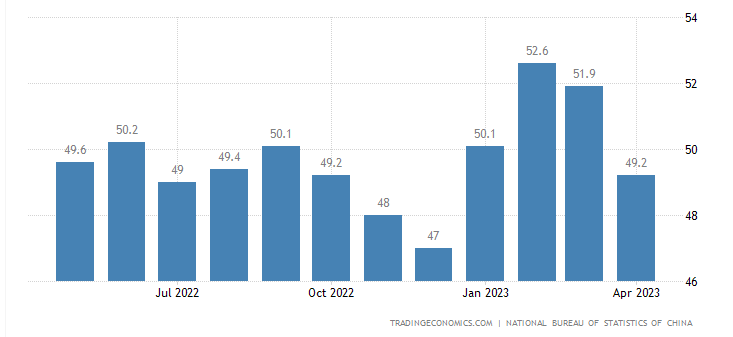

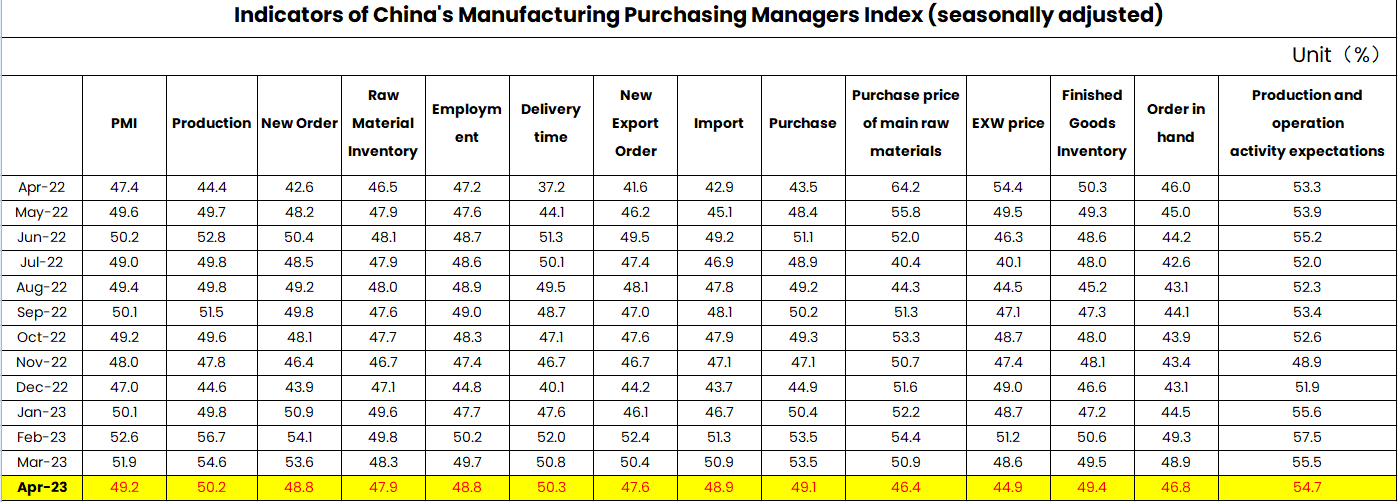

1. Manufacturing PMI: High position falls, economy contracts

In April 2023, the Purchasing Managers' Index (PMI) for the manufacturing sector was 49.2%, down 2.7% points from the previous month. The current PMI has fallen into the contraction zone, below the average level of the same period in recent years, indicating that the manufacturing economy is contracting and performing poorly. The reason for this is that although the economy has recovered well since the beginning of the year, production are still weak and demand remains insufficient. Especially in April, the driving effect of the previous backlog of demand began to weaken, and real estate demand was lower than the same period in previous years. Looking at the main sub-indices that make up the PMI, in April, the new orders, production, employment, and raw material inventory indices all fell, among which the new orders and production indices dragged down the manufacturing PMI this month by 1.44 and 1.1 percentage points respectively.

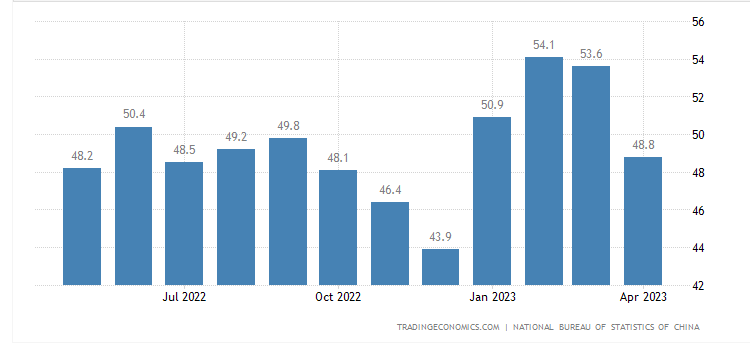

2. Supply and demand fall, demand is insufficient

Supply and demand have fallen, and the decline is stronger than seasonal. The production index and the new orders index in April were 50.2% and 48.8% respectively, down 4.4 and 4.8 percentage points from the previous month. The decline in the supply and demand index is stronger than the seasonal data, and the performance is lower than the average level in the same period in recent years. Hence, the slowdown in real estate industries may be the main drag on the demand side. Exports may still face downward pressure. The new export order index in April was 47.6%, down 2.8 percentage points from the previous month's 50.4%. Developed economies such as Europe and the United States are currently facing inflationary pressures, and monetary policies are tightening, resulting in a cooling demand trend. Europe and the United States account for around 50% of global terminal consumer demand, which is bound to exert a drag on global demand. It is expected that China's exports will still face downward pressure in the future.

3. Price decline, inventory decline

The price index has fallen. In April, the purchasing price index for major raw materials and the ex-factory price index were 46.4% and 44.9%, down 4.5 and 3.7 percentage points from the previous month, respectively. Among them, the two price indices of black metal smelting and rolling processing industries both fell below 30.0%.

4. Purchase weakened, inventory decreased.

Even though prices fell, in April, the purchasing enthusiasm of enterprises still weakened, and the purchasing volume index dropped from 53.5% last month to 49.1%. The main reason may be that insufficient demand has led to a low production willingness of enterprises. At the same time, the raw material and finished product inventory indices were 47.9% and 49.4%, respectively, a decrease of 0.4 and 0.1 percentage points from the previous month. The decline in the former may be affected by the decline in purchases, but the decline in the latter is relatively small and the level is relatively high, which may be related to insufficient demand and sluggish sales.

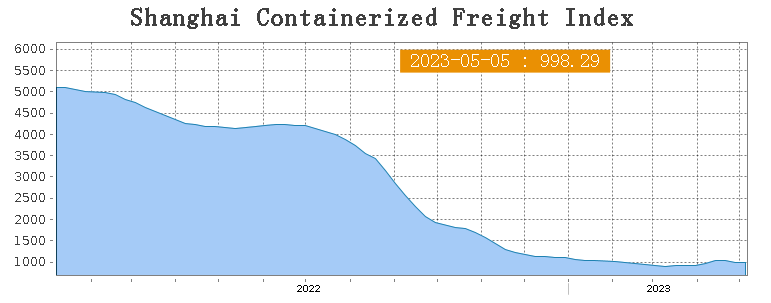

Sea Freight|| Freight rate stabilized in the first week of May.

Freight rates overall on multiple sea routes increased slightly last week, despite the demand dropped. On 5th May, the Shanghai Containerized Freight Index fell by 0.1% to 998.29.

Europe/ Mediterranean:

Continued tightening measures will increase the difficulty of future economic recovery in the European region. During the short Chinese Labor Day holiday period, transportation demand has slightly declined, and the supply and demand fundamentals are basically balanced, with market freight rates maintaining a slight fluctuation trend. Until 5th May, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$875/TEU, fell by 0.7%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1616/TEU, which rose by 0.4%.

North America:

To further curb high inflation levels, the Federal Reserve raised interest rates again last week . With the loss of accommodative policy support, the future of the US economy is not optimistic. The overall transportation market during the holiday period remained stable, with a balance between supply and demand, and the fluctuation of spot booking prices was relatively small. Until 5th May, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,453/FEU and US$2,396/FEU, 0% changed and 0.9% fell accordingly.

The Persian Gulf and the Red Sea:

Until 5th May, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 0.1% rose from last week's posted US$1298/TEU.

Australia/ New Zealand:

Until 5th May, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$218/TEU, which fell by 2.2% from the previous week.

South America:

The freight market had a slight rebound. on 5th May, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1929/TEU, an 0.8% rose from the previous week.