According to the World Stainless Steel Association (ISSF), global stainless steel production increased by 4.6% to 58.444 million tons in 2023. However, unlike China, all other major regions experienced varying degrees of decline in production. China's stainless steel production, on the other hand, defied the global trend and grew by 10.4% to 37.48 million tons in 2023. In other words, global stainless steel production rose in 2023 due to China's significant growth. However, production in other major regions declined due to weak demand and economic challenges. Government stimulus and infrastructure investment likely fueled China's production increase. The global stainless steel market outlook for 2024 remains uncertain, with expectations of subdued demand and potentially high production costs. To know more specific analysis and news, please keep reading our Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,115 | 32 | 1.63% |

| Foshan | 2,160 | 32 | 1.60% | ||

| Hongwang | Wuxi | 2,025 | 42 | 2.28% | |

| Foshan | 2,025 | 31 | 1.64% | ||

| 304/NO.1 | ESS | Wuxi | 1,955 | 47 | 2.62% |

| Foshan | 1,950 | 30 | 1.64% | ||

| 316L/2B | TISCO | Wuxi | 3,500 | -7 | -0.21% |

| Foshan | 3,590 | -4 | -0.12% | ||

| 316L/NO.1 | ESS | Wuxi | 3,360 | 12 | 0.38% |

| Foshan | 3,390 | -7 | -0.22% | ||

| 201J1/2B | Hongwang | Wuxi | 1,370 | 17 | 1.38% |

| Foshan | 1,370 | 17 | 1.35% | ||

| J5/2B | Hongwang | Wuxi | 1,285 | 21 | 1.79% |

| Foshan | 1,285 | 17 | 1.45% | ||

| 430/2B | TISCO | Wuxi | 1,235 | -7 | -0.62% |

| Foshan | 1,240 | 0 | 0.00% |

TREND|| Lack of downstream digestion capacity hinders stainless steel rally.

Stainless steel futures prices showed a relatively strong performance last week. Futures opened higher on Monday and remained strong for the next two days. Prices returned to the previous volatile range, nearing the previous high by Thursday before beginning to decline. Trading activity remained relatively active throughout the week, but open interest decreased daily, indicating a growing wait-and-see sentiment in the market. Market participants became more cautious as prices approached their highs. The main contract for stainless steel futures closed at US$2040/MT last week, up 2.45% from the previous week, with the highest price during the week reaching US$2060/MT.

In the spot market, stainless steel spot prices rose last week. Prices for the 300 series and 200 series increased, while the 400 series remained stable. Spot prices rebounded from the bottom on the market, following an uptrend, with an increase in market arrivals and a re-accumulation of inventory. As of the end of last week, the main contract price for stainless steel increased by US$42/MT to US$2040/MT compared to the previous week, representing a 2.45% increase. At the beginning of the week, the atmosphere in the spot market was relatively active, but it was mainly limited to the trading sector. There was not a significant boost in downstream consumer demand, and overall purchasing conditions were mediocre. Prices in the raw materials market also rose due to the boost from stainless steel.

300 Series: Increased arrival of steel mill resources leads to continued accumulation of inventory.

Last week, prices in the 304 market rose rapidly. By Friday, the mainstream base price for cold-rolled four-foot stainless steel 304 in Wuxi was reported at US$1985/MT, up US$35/MT from the previous Sunday; the price for private hot-rolled coils was reported at US$1955/MT, up US$42/MT from the previous Sunday. Prices fluctuated upwards last week, with Tsingshan continuously raising prices for two consecutive days at the beginning of the week to boost market confidence. Steel mills held a relatively strong stance on price increases, and traders were optimistic about the future, with many offerings’ higher prices for follow-up trading. However, as spot prices continued to rise, the market's acceptance of high-priced resources gradually declined.

200 Series: Strong rebound of US$28.

Last week, prices in the 201 spot market in Wuxi rose. As of last Friday, the mainstream base price for cold-rolled 201J1 in Wuxi rose by US$21/MT from the previous week to US$1345/MT; the base price for cold-rolled J2/J5 rose by US$21/MT to US$1260/MT; the mainstream price for five-foot hot-rolled coils rose by US$14/MT from the previous week to US$1325/MT. Prices in the 201 market rose last week. With recent small rebounds in futures trading, there was a strong atmosphere of price increases in the spot market, and the 201 series also followed suit, gradually initiating a price hike rhythm, with transactions improving in response to the price rebound.

400 Series: Inventory accumulation puts pressure on prices.

Last week, the guiding price for cold-rolled stainless steel 430 coils by TISCO was US$1460/MT, and for JISCO, it was US$1580/MT, both unchanged from the previous week. Last week, the mainstream offer price for state-owned mills’ cold-rolled stainless steel 430 in Wuxi was US$1240/MT, down US$7/MT from the previous week, and the offer price for hot-rolled 430 was US$1130/MT, unchanged from the previous week.

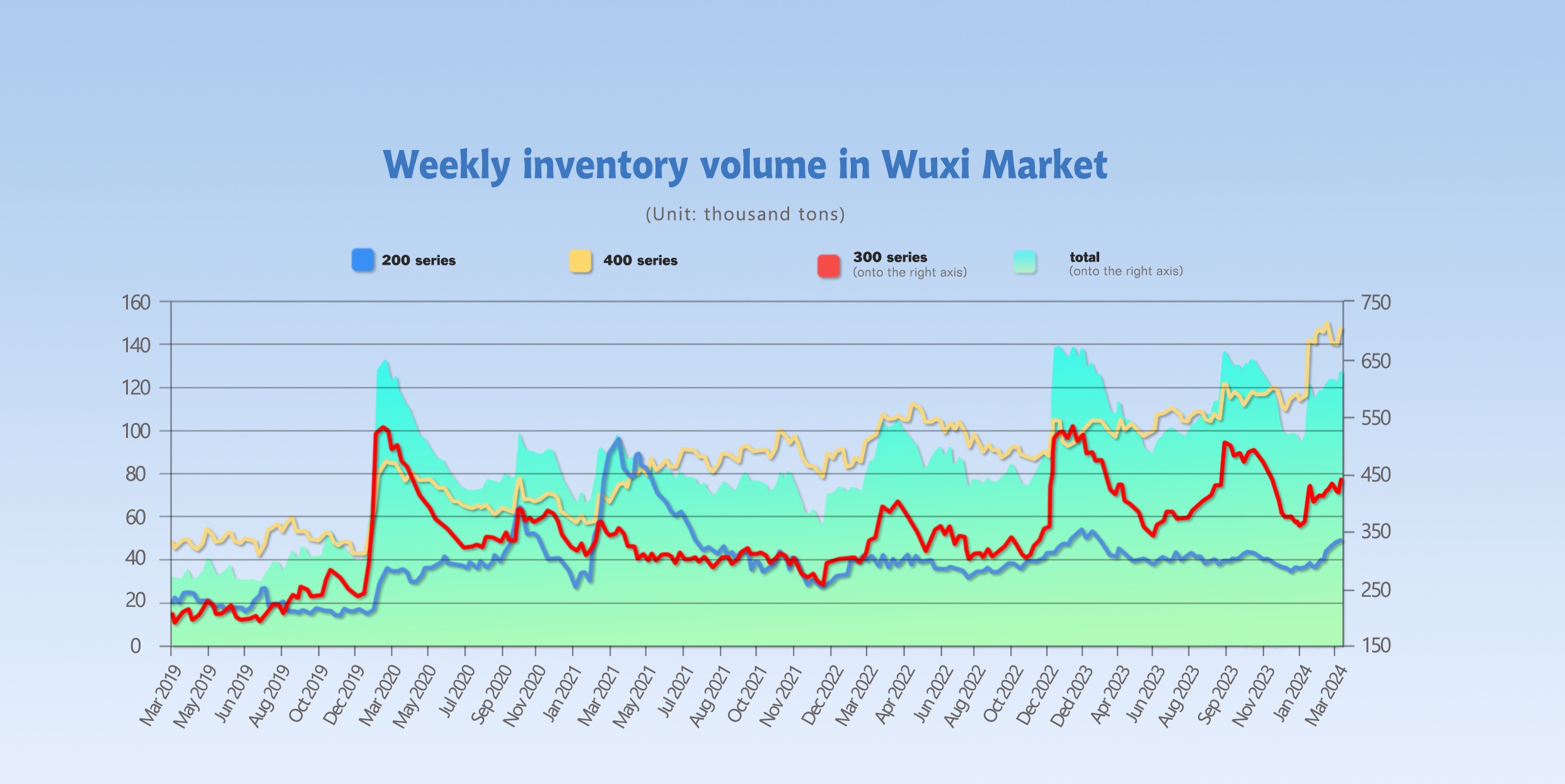

INVENTORY|| Inventory level hit new height.

The total inventory at the Wuxi sample warehouse increased by 32,449 tons to 635,972 tons (as of 11th April).

the breakdown is as followed:

200 series: 998 tons up to 48,657 tons,

300 Series: 23,446 tons up to 440,200 tons,

400 series: 8,005 tons up to 147,115 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| April 4th | 47,659 | 416,754 | 139,110 | 603,523 |

| April 11th | 48,657 | 440,200 | 147,115 | 635,972 |

| Difference | 998 | 23,446 | 8,005 | 32,449 |

300 Series: Increase in Arrival Resources.

During last week, there was a slight rebound in prices, and the enthusiasm of terminal enterprises for purchases improved. However, it still fell short of expectations, weakening after concentrated buying at the beginning of the week as acceptance of price hikes declined. Downstream enterprises have not yet taken delivery after purchasing, coupled with significant replenishment of inventory by traders, resulting in an increase rather than a decrease in inventory. Approaching delivery, with a noticeable increase in registered warehouse resources, social inventory increased compared to the previous period. Based on current raw material prices, steel mills are still operating at a loss, with a decrease in production scheduled for April. With market demand gradually recovering, it is expected that inventory may decrease next week.

200 Series: Slight Increase of 10,000 tons in 201 Inventory.

Last week, futures rebounded slightly, and transactions improved with the rebound in prices. Market arrivals were normal, so although there was an increase in inventory last week, the increase was not significant. According to research statistics, the planned crude stainless steel production in China in April was 3.2429 million tons, a decrease of 164,700 tons compared to the previous month. The decrease in planned production by steel mills, coupled with an increase in purchasing intentions by downstream enterprises, may help reduce inventory. It is expected that the short-term spot price of 201 will fluctuate slightly higher.

400 Series: Demand Falls Short of Expectations, Inventory Accumulates.

Demand from downstream industries fell short of expectations, leading to a delay in inventory digestion last week. The market price of cold-rolled 430 was weak last week, with significant inventory pressure on traders, leading to proactive price reductions to clear inventory and recover funds. With upstream raw material costs remaining high, steel mills continue to operate at a loss, and future production may decrease.

However, downstream demand remains primarily based on demand, and the inventory of the 400 series may continue to accumulate. It is expected that prices will remain weak in the short term.

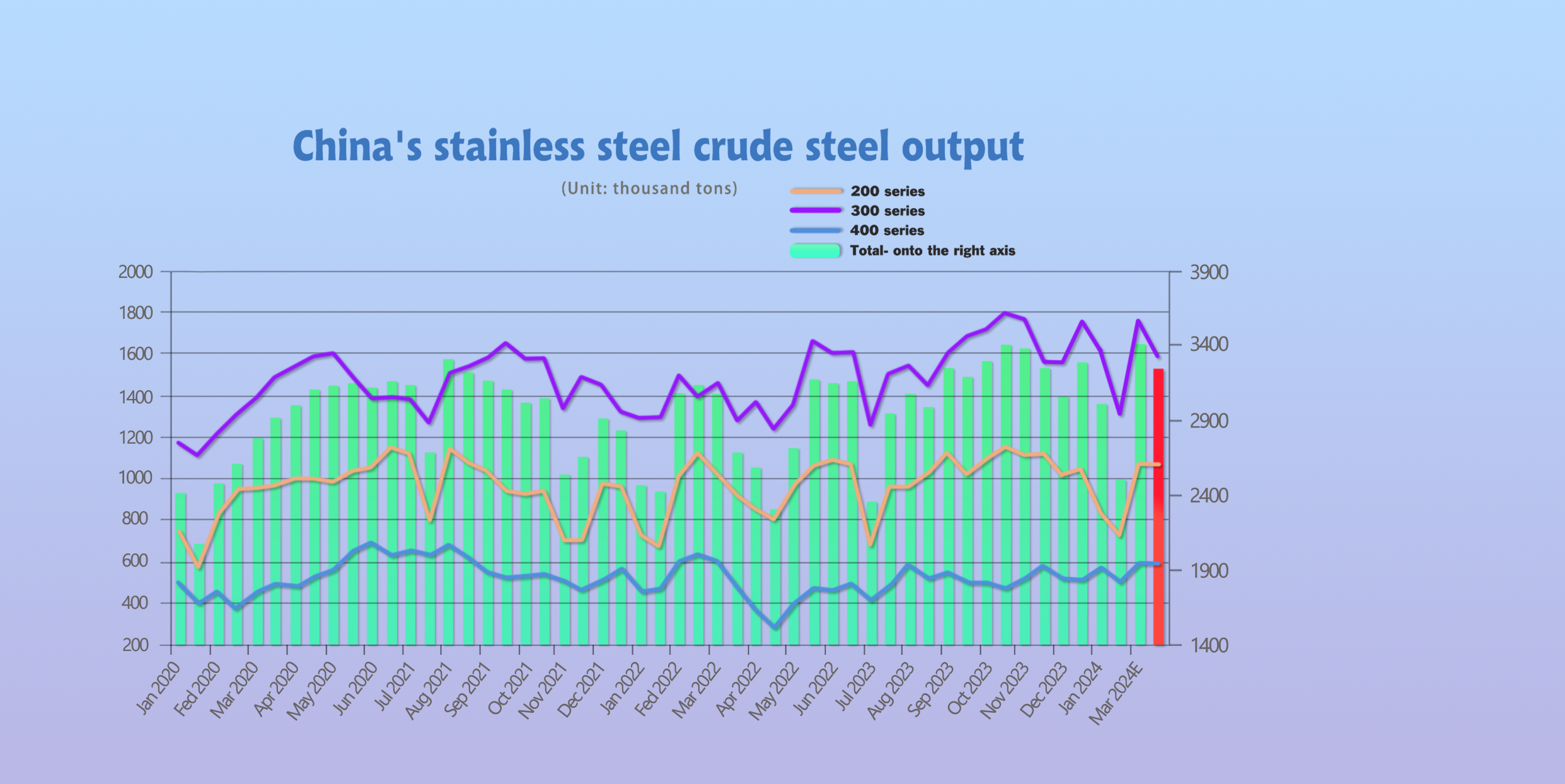

Scheduled production of crude stainless steel reduces in April.

Stainless Steel Production Soars in March, But Prices Fall.

China's stainless steel production surged in March 2024, with total output from major producers reaching 3.4 million tons. This is a significant jump of 35% compared to February and 11% higher than March 2023.

The increase was driven by a rise in production across all series:

200 series: The production was 1.0656 million tons, up 48% from February and 12% year-over-year.

300 series: The production was 1.7536 million tons, up 34% from February and 14% year-over-year.

400 series: The production was 588,400 tons, up 20% from February but only 2% higher than March 2023.

Despite the production increase, steel mills faced a challenging market in March.

Increased supply led to rising inventories for four consecutive weeks. This, combined with volatile futures and falling spot prices, resulted in continued losses for steel mills.

As a consequence, steel mills in Eastern China adjusted their strategies in April. Some limited order intake, while others offered discounts, reflecting a cautious approach due to the uncertain market conditions. Overall production in April dipped slightly, with the 300 series experiencing the most significant decline (down 10% compared to March).

RAW MATERIALS|| Purchasing price of ferronickel slightly increased following stainless steel renounce.

The EXW price of high-carbon ferronickel remain stable last week and quoted as US$235/Nickel point.

ShFE Nickel saw a significant surge on last Thursday, peaked at US$20035/MT and closed at US$19700/MT, concluding a 4.62% increase from last Wednesday.

A deal involves over thousand tons of high-Carbon Ferronickel recently struck by one of the major steel mills in Eastern China in the price of US$235/Nickel point.

The EXW price of high-carbon Ferrochrome closed at US$1355/50 reference tons with a US$7 drop.

Recently, the price of coking coal has declined, while the spot price of chromite ore has remained stable. The comprehensive production cost of high-chromium alloys has slightly decreased, leading to an improvement in the loss situation of steel mills. The recent increase in the operation of high-chromium furnaces, coupled with the recovery in imports, has gradually increased the supply pressure in the domestic high-chromium market. However, due to a slight decrease in production capacity by downstream stainless-steel producers in April, there is a slight reduction in demand for high-chromium raw materials. With the expectation of increasing supply and decreasing demand, the support for high-chromium prices is weakening, and it is expected that high-chromium prices will remain weakly stable in the coming week.

Brazilian court suspends Vale's Onca Puma mine operating licence again.

A local court has again suspended the operating licence for Brazilian miner Vale’s Onca Puma nickel mine in the north of the country, according to a company securities filing.

Brazil’s Para state won an appeal overturning a previous court ruling that had reinstated the mine’s operating licence, Vale said in a filing late on Wednesday.

The firm said it will adopt the appropriate legal measures, seeking to reverse the latest decision.

Para’s environment department originally suspended the licence to operate Onca Puma, which has an estimated nominal capacity of 27,000 metric tons of nickel per year, in February.

SUMMARY|| Future prices expected to fluctuate weakly.

Last week, stainless steel futures prices showed a tendency to strengthen, leading to the recovery of steel mill production profits. Overall distribution was limited during the week, with initial transactions being brisk. However, downstream consumer demand remained mediocre, with limited overall digestion capacity. Market inventory remained high, although there was a noticeable decrease in inventory on the agency side. Prices continued to strengthen during the week, currently hovering near previous highs, facing certain resistance. The market has gradually become cautious, with a growing sense of wait-and-see.

300 Series: Production increased significantly in March, leading to an increase in market delivery resources and inventory pressure. As futures and spot prices rebounded, the acceptance of high-priced resources in the market gradually decreased, leading to weaker transactions. Short-term expectations are for 304 cold-rolled spot prices to fluctuate mainly, with attention to market transaction follow-up after price rebound.

200 Series: Overall, steel mill production plans decreased in April, while downstream purchasing intentions increased. However, overall transaction volume has not increased significantly, maintaining a stable trend.

400 Series: Last week, 430 cold-rolled market prices were weak, with significant inventory pressure on traders prompting proactive destocking to recover funds. High raw material costs have led to continued losses for steel mills, with possible future production decreases. However, downstream demand remains weak, with purchases mainly based on immediate needs, resulting in a supply-demand stalemate.

MACRO|| Global Stainless Steel Production Rises 4.6% in 2023, Led by China.

Global stainless steel production increased by 4.6% in 2023 to 58.444 million tons, according to the World Stainless Steel Association (ISSF). However, production in all major regions declined except China.

Europe: Stainless steel production fell by 6.2% to 5.902 million tons in 2022.

United States: Production declined by 9.6% to 1.824 million tons.

Asia (excluding China and South Korea): decreased by 7.2% to 6.88 million tons.

Other regions (Brazil, Russia, South Africa, South Korea, and Indonesia) fell by 5.2% to 7.163 million tons.

In contrast to the global trend, China's stainless steel production increased by 10.4% to 37.48 million tons in 2023, according to Chinese statistics.

Production of stainless steel wide-strip cold-rolled steel in China increased by 6.8% to 15.24 million tons in 2023. Of this, 200 series production was 4.44 million tons, 300 series production was 7.67 million tons, and 400 series production was 3.13 million tons. The proportion of cold-rolled steel in total wide-strip crude steel production was 55.1%, down 3 percentage points from the previous year.

Sea Freight|| Price differentiation among different shipping routes continued.

China’s Containerized Freight market continued to be interrupted by the regional fluctuation. On 12th April, the Shanghai Containerized Freight Index rose by 0.7% to 1757.04.

Europe/Mediterranean:

On 12th April, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1971/TEU, which slide by 1.3%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3010/TEU, which dropped 0.1%

North America:

On 12th April, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$3205/FEU and US$4179/FEU, reporting a 3.1% and 4.1% decrease accordingly.

The Persian Gulf and the Red Sea:

On 12th April, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 8.3% from last week's posted US$2051/TEU.

Australia/New Zealand:

On 12th April, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$824/TEU, a 17.5% jump from the previous week.

South America:

On 12th April, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$3627/TEU, an 17.7% growth from the previous week.