Last week, stainless steel prices went weak. Non-ferrous metals declined in price in the global market, and meanwhile, China's bullish news has settled down, leading to the drop of Stainless steel futures, decreasing by US$43/MT and spots followed to decline. Demand actually has remained sluggish. As the production of stainless steel is large, the inventory keeps rising. It is worrying. Moreover, it is reported that Indonesian nickel ore used in stainless steel production will be exhausted in 2029. No wonder, TSINGSHAN plans to list another 50,000 tons of nickel on the LME this year. This move shows that the group expects demand to rise and nickel prices to rise this year. If you want to know more about the market dynamics, please keep rolling up to the Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,155 | -26 | -1.27% |

| Foshan | 2,195 | -26 | -1.24% | ||

| Hongwang | Wuxi | 2,060 | -20 | -1.03% | |

| Foshan | 2,065 | -16 | -0.83% | ||

| 304/NO.1 | ESS | Wuxi | 1,990 | -14 | -0.76% |

| Foshan | 1,990 | -14 | -0.74% | ||

| 316L/2B | TISCO | Wuxi | 3,685 | 3 | 0.08% |

| Foshan | 3,750 | 2 | 0.06% | ||

| 316L/NO.1 | ESS | Wuxi | 3,540 | 9 | 0.28% |

| Foshan | 3,540 | -7 | -0.19% | ||

| 201J1/2B | Hongwang | Wuxi | 1,400 | -10 | -0.81% |

| Foshan | 1,395 | -10 | -0.76% | ||

| J5/2B | Hongwang | Wuxi | 1,300 | -10 | -0.87% |

| Foshan | 1,300 | -10 | -0.82% | ||

| 430/2B | TISCO | Wuxi | 1,235 | 1 | 0.07% |

| Foshan | 1,240 | 1 | 0.12% |

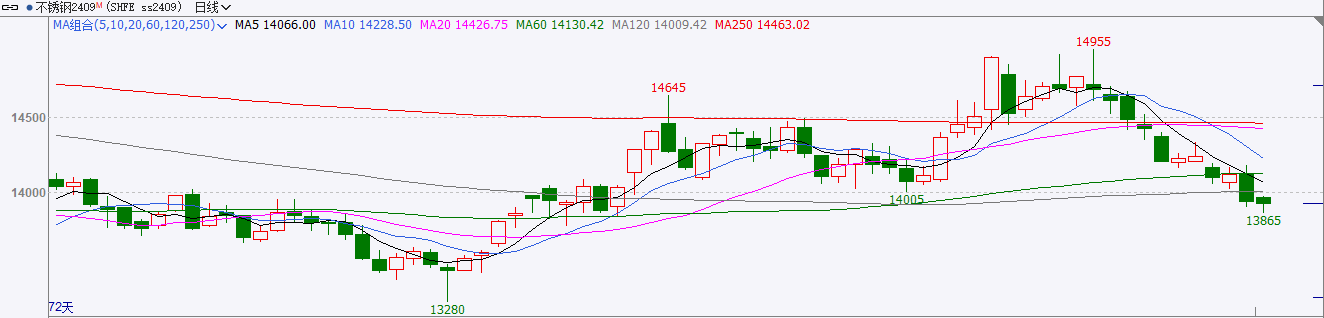

TREND|| US$2070 Mark Broken, Fundamentals Remain Weak.

Stainless steel spot prices for the three series in the Wuxi market remained stable with a downward trend last week. 300 series prices followed the futures market and declined, while 200 and 400 series prices remained stable. Futures prices fell last week, overseas non-ferrous metals rose and then fell back, domestic macro-positive factors gradually digested, spot trading was weak, and inventory continued to accumulate. As of Friday of last week, the main stainless steel futures contract price has fallen by US$43.17/MT to US$2060 compared with last Friday, a decrease of 2.18%.

300 Series: Prices Break Below US$2070/MT Mark, Post-Festival Market Performance Remains Sluggish.

The market performance of 304 was light after the festival. The price of 304 market was adjusted downward last week. As of Friday, the mainstream base price of 304 civil cold-rolled four feet in Wuxi area was reported to be US$2005/MT, down US$21/MT from previous Friday; the price of civil hot-rolled steel was reported to be US$1980, down US$28/MT from last Friday. Stainless steel prices fell weakly last week. TSINGSHAN issued a lower price on Wednesday, and the quotations of most traders followed the decline. There were abundant spot resources in the market, downstream procurement was slow, merchants made concessions to ship goods, and low-priced resources frequently appeared in the market. The current futures market has broken below the US$2070/MT, and the pressure of inventory and warrants has continued to accumulate to a new high for the year. The market is full of wait-and-see sentiment, and the trading performance within the week is not good.

200 Series: Supply Exceeds Demand, 201 Weakens and Slides.

The price of 201 fell mainly last week. The price of 201J2/2B 1.0 Hongwang four-foot coil was reported to be around US$1305/MT; the price of 201J1/2B 1.0 Hongwang four-foot coil was reported to be around US$1405/MT; the price of 201J1 five-foot hot-rolled steel was reported to be around US$1335/MT. Recently, non-ferrous metals have been weakly fluctuating, and the trading of stainless steel spot prices has been light. There is news that steel mills are "waiting for approval at the same price", and agents are making concessions to promote transactions.

400 Series: Prices Remain Stable.

As of Friday, the JISCO 430 cold-rolled guide price last week was US$1475/MT, and the JISCO 430 cold-rolled guide price was US$1605/MT, both of which remained the same as last week. In terms of spot in the Wuxi market last week, the price of state-owned 430 cold-rolled steel was quoted at US$1235/MT to US$1240/MT, and the price of state-owned 430 hot-rolled steel remained stable at around US$1130/MT, both of which remained the same as the quotation of last week. With the continuous strengthening of the raw material side, the cost support for 430 has risen. According to the current raw material price, the losses of steel mills have intensified, and they have a strong will to raise prices.

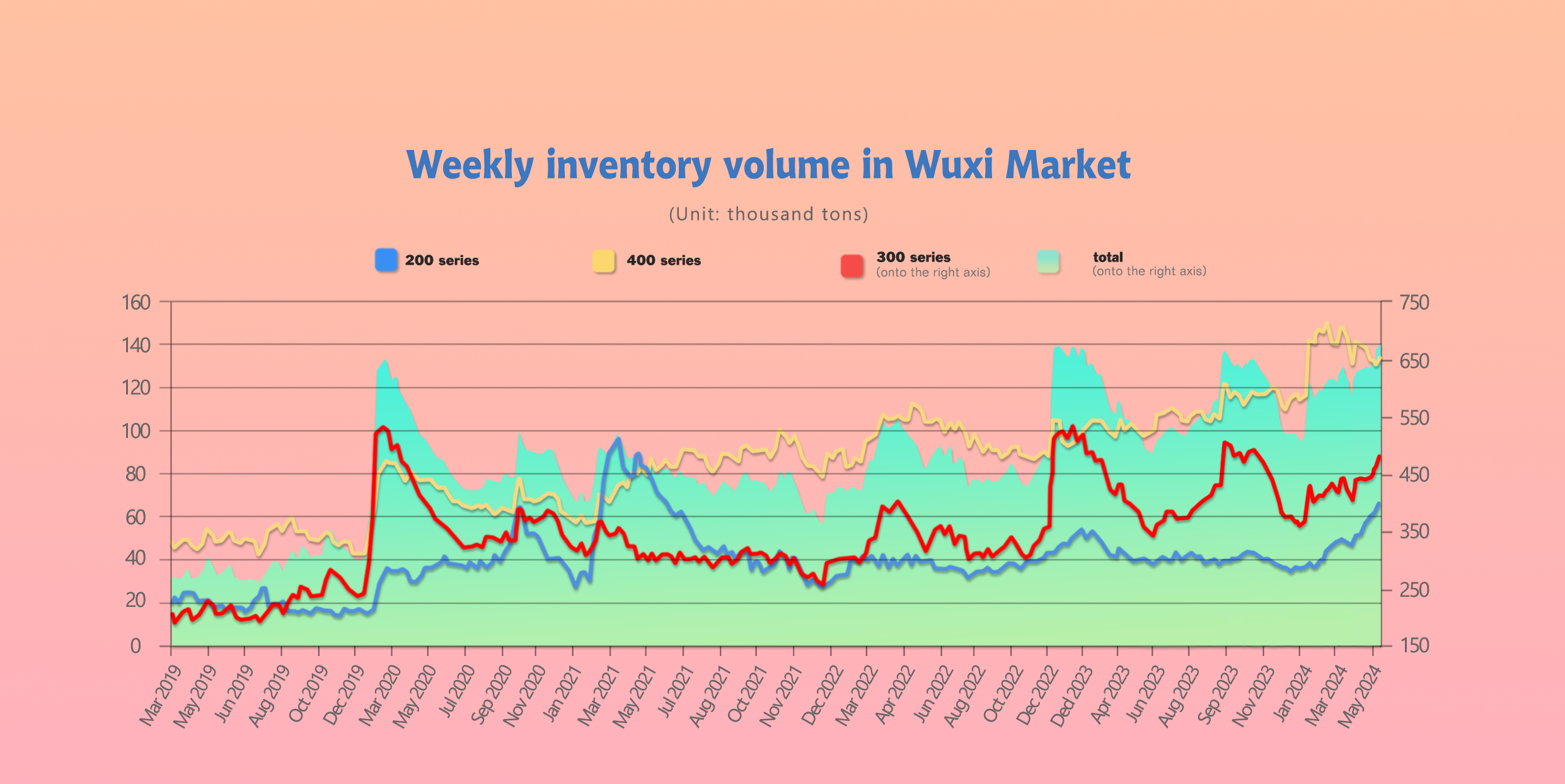

INVENTORY|| Inventory Piled Up, Up 28,900 Tons Last Week.

The total inventory at the Wuxi sample warehouse lifted by 28,931 tons to 676,938 tons (as of 13th June).

the breakdown is as followed:

200 series: 4,694 tons up to 66,131 tons,

300 Series: 22,228 tons up to 4477,744 tons,

400 series: 2,009 tons up to 133,063 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Jun 6th | 61,437 | 455,516 | 131,054 | 648,007 |

| Jun 13th | 66,131 | 477,744 | 133,063 | 676,938 |

| Difference | 4,694 | 22,228 | 2,009 | 28,931 |

300 Series: Production Reaches New High, Supply and Demand Remain Weak.

Market arrivals increased last week, and with the decline in prices, terminal confidence was insufficient, and previous orders were delayed in delivery, resulting in a significant increase in social inventory. The year-on-year level of warrants remains high, and the resources of registered warrants continue to increase, and there is still spot supply pressure. According to the current raw material price, steel mills are still in a state of small losses. The production schedule of steel mills in June remains high, and the off-season demand is relatively weak. It is expected that the inventory will continue to increase slightly next week. Continue to pay attention to the subsequent production of steel mills and market trading conditions.

200 Series: Inventory Increases by 47,000 Tons.

During last week’s inventory cycle, affected by the weak fluctuations in international bulk commodity prices, the price of 201 stainless steel fell slightly, and market trading was light. On the supply side, the production of the 200 series in June was close to 108,000 tons, and steel mills such as TSINGSHAN Hongwang continued to arrive, and supply pressure remained. On the demand side, downstream enterprises did not receive good orders, mainly for rigid demand procurement, resulting in the inability of inventory digestion to keep up with the increase in supply. The pattern of oversupply has not changed, and inventory has continued to accumulate.

400 Series: Inventory Changes from Decrease to Increase.

Last week, steel mills arrived normally, and the trading atmosphere downstream was relatively deserted. The overall shipment volume has decreased compared with last week, and the spot market inventory digestion is slow. Although the production schedule of steel mills in June has fallen slightly, the overall output is still high, and the market supply pressure has not been reduced. The off-season demand is relatively weak, and the supply is strong, and the demand is weak. It is expected that the inventory will continue to increase slightly next week. Continue to pay attention to inventory changes and market trading conditions.

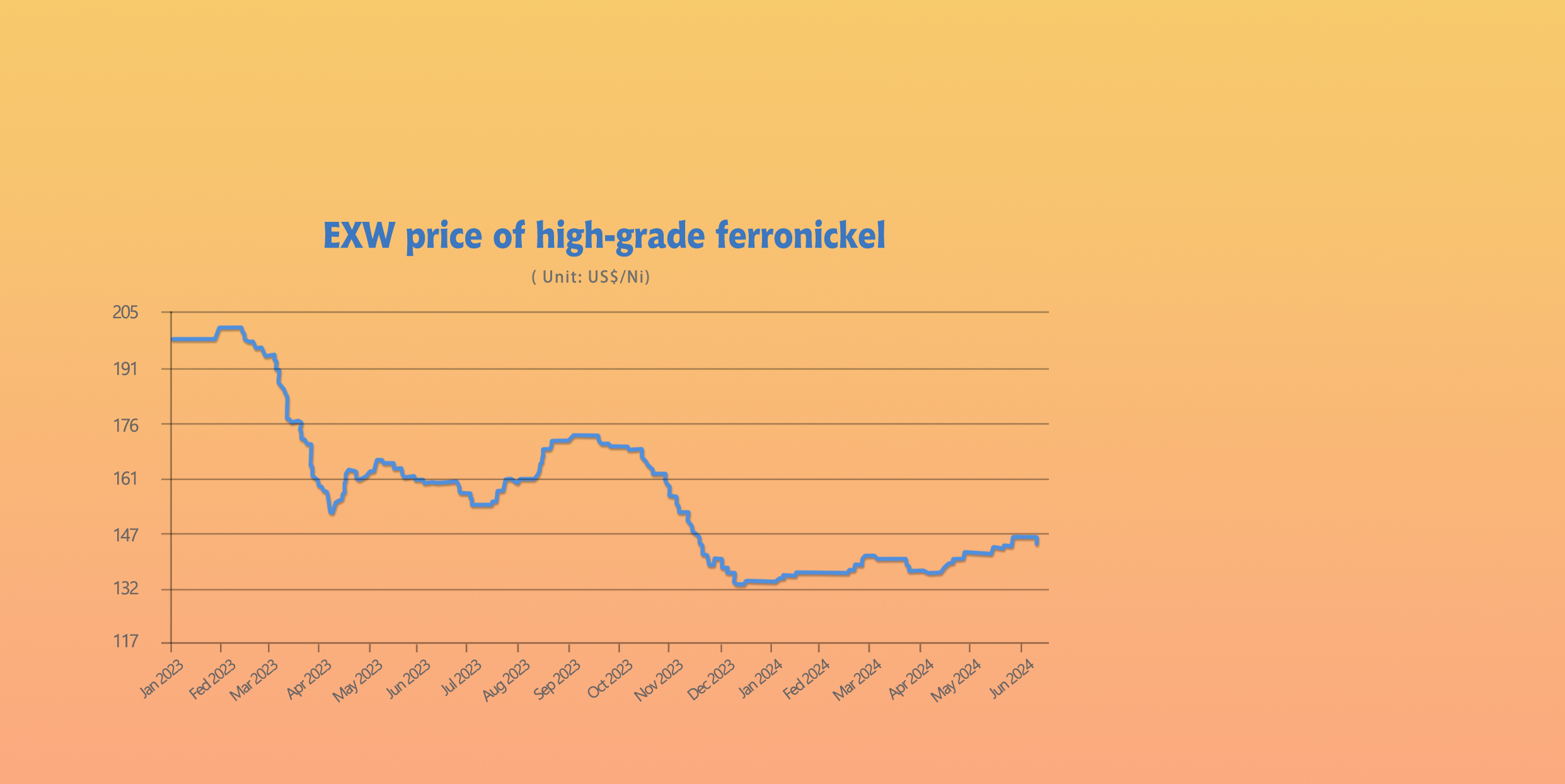

RAW MATERIAL|| Opinions Believe Nickel Demand Will Increase This Year, Comprehensive Index Continues to Rise.

Last week, the mainstream ex-factory price of high-nickel iron fell by $1.4 to $136.5/nickel point, and the price of ferrochrome rose by $14 to 1235 USD/50 reference ton. The mainstream ex-factory price of high-chromium raw materials is 1235-1267 USD/50 base ton, an increase of 14 USD from last week.

Nickel: The problem of Indonesia's nickel ore supply has been solved, but the reserves of high-grade nickel ore will be exhausted in 2029.

In early June, the Indonesian government has approved the miners' work plans to produce an average of 240 million tons of ore annually for three years, which basically meets the current production of nickel products, and the problem of local nickel ore shortage will be alleviated. The nickel ore premium problem will also be solved, and the cost support will be weakened. The ex-factory price of high-nickel iron last week was weak, and the price was 138 USD/nickel point as of Thursday, down US$1.4/nickel from last Thursday.

Shanghai nickel fell weakly, and as of Thursday's close, the main Shanghai nickel contract was closed at 19,545 USD/ton, down 613 USD/ton from last Thursday, a decrease of 3.08%.

On the other hand, according to Gerber's website on June 12, 2024, it is currently estimated that Indonesia's high-grade nickel ore (nickel content 1.7%) will be exhausted in 2029. The rapid depletion of Indonesia's mineral reserves has prompted the Indonesian government to find ways to reserve the remaining mineral reserves for the production of higher value-added products. The licenses of nickel pig iron smelters have also been revoked. Ore used for stainless steel production has to be imported from the Philippines. Now, the Indonesian government is apparently considering revoking the licenses of at least some nickel pig iron smelters to protect the rapidly shrinking reserves.

Therefore, it is not surprising that TSINGSHAN plans to list another 50,000 tons of nickel on the LME this year. This move shows that the group expects demand to rise and nickel prices to rise this year.

SUMMARY|| High Inventory and Weak Support Double Down on the Stainless Steel Market.

Spot prices weakened again this cycle. On the macro side, the Federal Reserve's June meeting ended, revising up inflation forecasts and maintaining a neutral overall view. The Indonesian government has approved a work plan for nearly three years, and the phenomenon of nickel ore shortage has been alleviated. It is expected that the price of hot-rolled stainless steel will remain stable and weak in the short term, the price of 304 hot-rolled stainless steel will be around US$1930/MT-US$2000/MT, and the price of 316L hot-rolled steel will fluctuate around US$3500/MT-US$3555/MT.

300 Series: The current futures price has broken below the US$2070 mark, market demand remains weak, spot prices have fallen, steel mills have opened lower, and the cost inversion phenomenon has intensified. The output of steel mills in May and June is still at a high level, the supply exceeds demand, and the pattern of oversupply has not changed. It is expected that the spot price of 304 cold-rolled steel will fluctuate weakly in the short term, and the subsequent production and inventory changes of steel mills will be closely watched.

200 Series: Steel mills continued to maintain high output in June, downstream demand was sluggish, inventory continued to accumulate, and the price of 201 is expected to continue to fall weakly in the short term.

400 Series: The production of steel mills in June has fallen slightly, but the overall output is still high; the market supply pressure will not be reduced in the later period, the off-season demand is relatively weak, the supply is strong and the demand is weak, and it is expected that the inventory will continue to increase slightly next week. The price of 430 will be weak and stable in the short term, and the subsequent inventory changes and steel mill production will be closely watched.

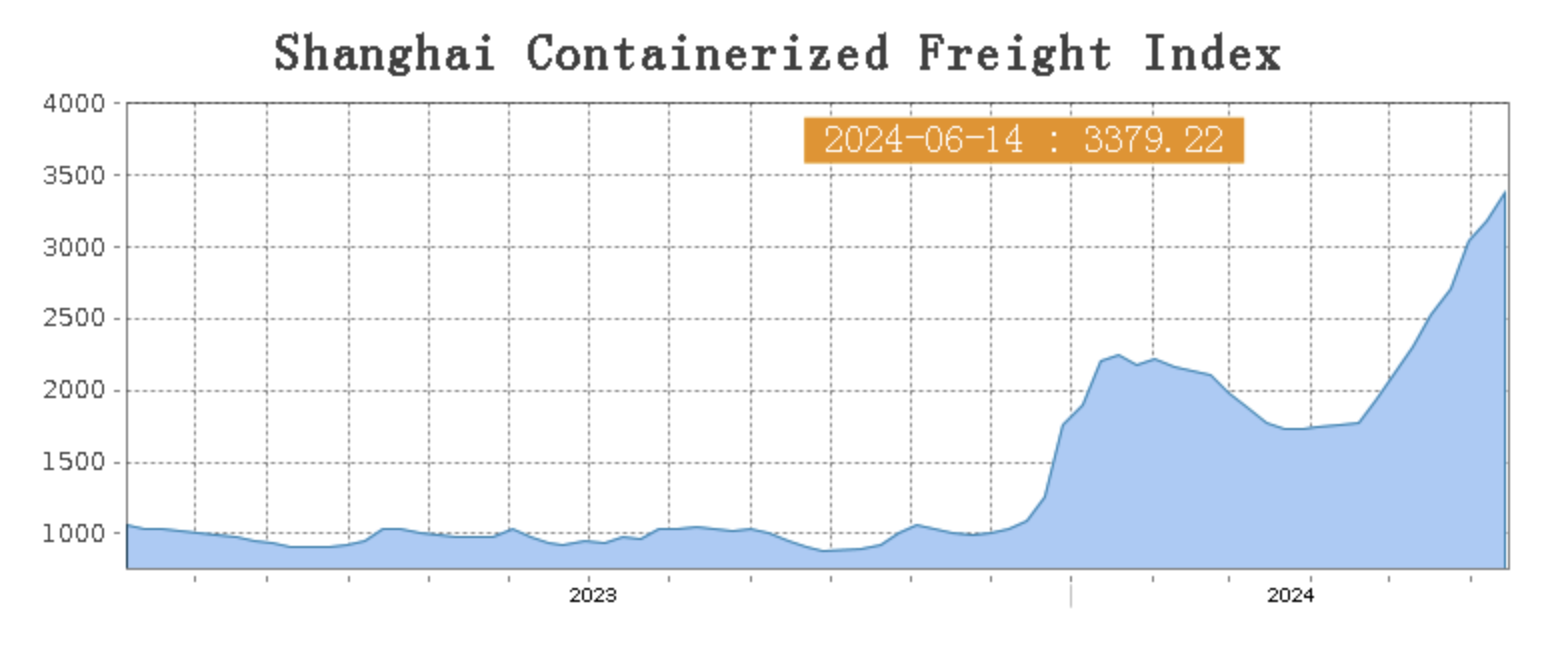

Sea Freight|| Composite Index Continues to Rise.

The market for Chinese export container transportation continued to show a steady upward trend. Transport demand remained high, with most ocean routes seeing an increase in market freight rates, driving the comprehensive index to continue rising. On 14th June, the Shanghai Containerized Freight Index rose by 6.1% to 3379.22.

Europe/ Mediterranean:

Due to inflation continuing to be higher than the Federal Reserve's 2% target, the Federal Reserve maintained interest rates unchanged this week. This week, overall transportation demand remained stable, the supply-demand balance was still relatively tight, and spot booking market prices continued to rise.

On 14th June, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$4179/TEU, which rose by 5.8%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$4848/TEU, which jumped by 1.3%.

North America:

Recently, the European Union announced that it will impose tariffs on electric vehicles exported from China, which may cause disruptions in China-Europe trade. How this will affect transportation demand on the Asia-Europe routes in the future needs further attention. This week, transportation demand remained high, and market freight rates continued to rise.

On 14th June, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$6906/FEU and US$7993/FEU, reporting a 11.2% and 7.3% lift accordingly.

The Persian Gulf and the Red Sea:

On 14th June, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 3.3% from last week's posted US$2950/TEU.

Australia/ New Zealand:

On 14th June, the freight rate (shipping and shipping surc-harges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1382/TEU, a 4.0% fall from the previous week.

South America:

On 14th June, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$8263/TEU, an 4.1% growth from the previous week.