"2024 is projected to be another tough year. Sluggish global growth is projected to slow further. Investment will remain weak. ", UNDESA reveals in the World Economic Situation and Prospects. Well, let's see. To sit down and worry about it is not our style. Handling wisely and flexibly is the only way. Last week, a petit rebound was seen in trade. However, on Thursday, the stainless steel futures had a sudden US65/MT drop, dragging down spot prices. With one month left before Chinese New Year, more buyers starting to stock up before the holiday, marking the ninth consecutive week of destocking. Again, this suaves the unmatch of supply and demand. The recent most eye-catching issue must be the Red Sea Conflict. Many sea shipping agents predict the supply chain will be more messed up as the original capacity has to spill out. Sea freight maintains the rising pace. Catch the time, and adjust the delivery time now rank top on our to-do list. If you want to know more about the dynamics, roll up and read the stainless steel market summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,145 | 1 | 0.07% |

| Foshan | 2,190 | 1 | 0.07% | ||

| Hongwang | Wuxi | 2,060 | -8 | -0.43% | |

| Foshan | 2,055 | -5 | -0.25% | ||

| 304/NO.1 | ESS | Wuxi | 1,980 | -9 | -0.49% |

| Foshan | 1,990 | -1 | -0.04% | ||

| 316L/2B | TISCO | Wuxi | 3,590 | 28 | 0.82% |

| Foshan | 3,700 | 44 | 1.26% | ||

| 316L/NO.1 | ESS | Wuxi | 3,570 | 47 | 1.39% |

| Foshan | 3,500 | 22 | 0.65% | ||

| 201J1/2B | Hongwang | Wuxi | 1,395 | 1 | 0.06% |

| Foshan | 1,395 | -2 | 0.17% | ||

| J5/2B | Hongwang | Wuxi | 1,310 | 2 | 0.21% |

| Foshan | 1,310 | -2 | -0.18% | ||

| 430/2B | TISCO | Wuxi | 1,250 | 2 | 0.16% |

| Foshan | 1,255 | 0 | 0.00% |

TREND|| Stainless steel future slid US$70 amid Destocking spree.

The spot price of stainless steel of 200 series fell and 400 series rose last week. The stainless steel future once touched US$2100/MT last Thursday, but it had a sudden US$65/MT drop to US$2035/MT. The most traded stainless steel future fell US$9.9/MT to US$2040/MT.

Stainless steel 300 series: Caught up with turbulence.

Until Last Friday, the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 dropped by US$14/MT to US$2010/MT, the hot-rolled stainless steel dived US$21/MT to US$1910/MT. The future price recovered in the first two working days after the New Year, and the market harvested a modest result. However, on Thursday, the future price fell again, and the market back to sluggish.

Stainless steel 200 series: Prices had a solid rebound.

Last Friday, the most treaded base price of stainless steel 201J1conclued a US$14/MT drop to US$1355/MT; stainless steel 201J2/J5 and 5-foot hot rolled stainless steel fell US$7 to US$1280/MT and US$1305/MT respectively.

Affected by the price limitation from Tsingshan last week, the price trend of stainless steel 201 was sluggish. It is understood that there was about US$7 difference between the quotation and final price.

Stainless steel 400 series: Prices remained steady.

The spot prices of cold rolled and hot rolled stainless steel 430 were stabilized at US$1150/MT and US$1255/MT accordingly.

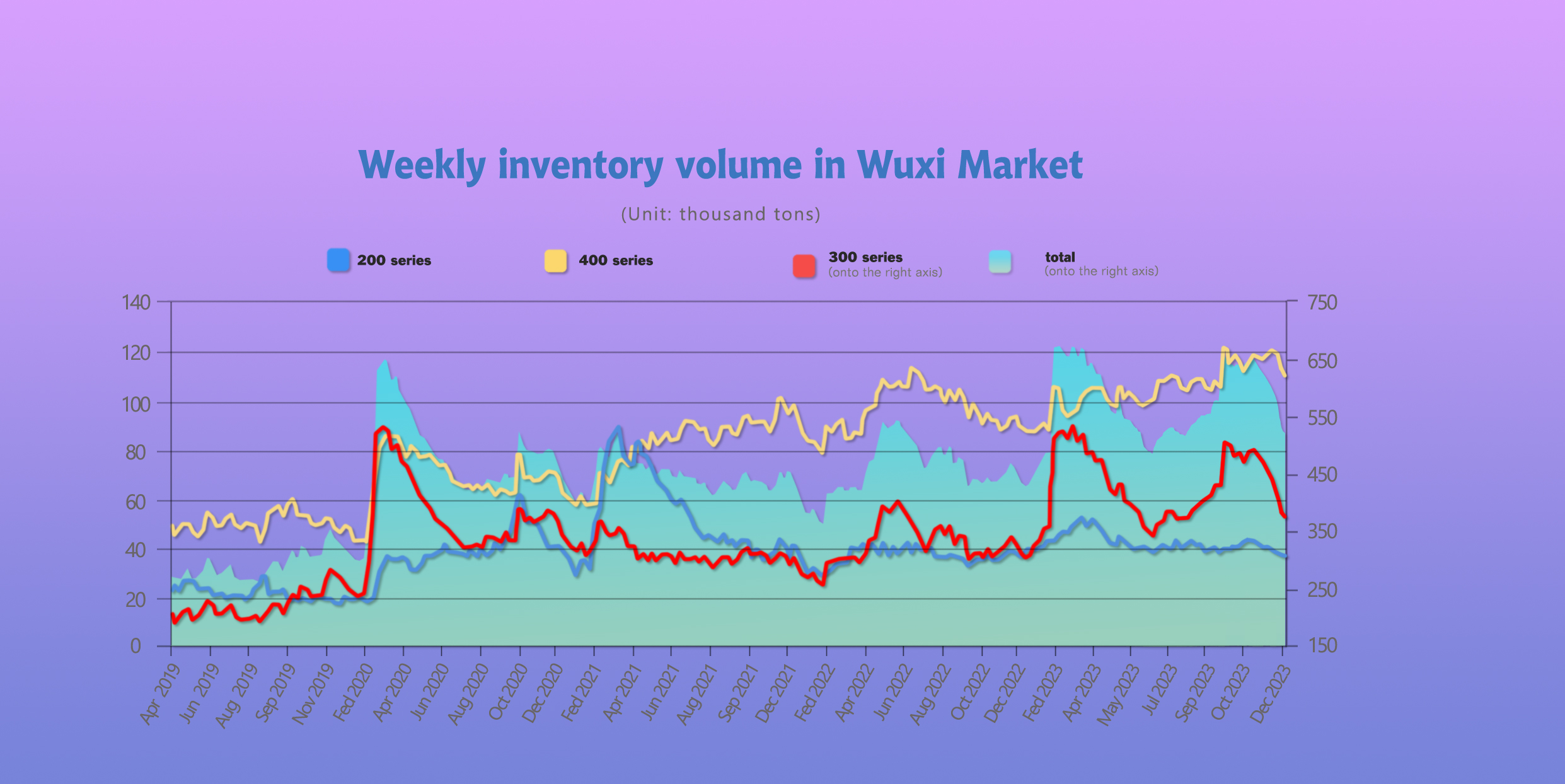

INVENTORY|| Destock record extended.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| December 28th | 36,180 | 380,587 | 111,731 | 528,498 |

| January 4th | 35,659 | 372,155 | 109,136 | 516,950 |

| Difference | -521 | -8,432 | -2,595 | -11,548 |

The total inventory at the Wuxi sample warehouse downed by 11,548 tons to 516,950 tons (as of 4th January).

the breakdown is as followed:

200 series: 521 tons down to 35,659 tons

300 Series: 8,432 tons down to 372,155 tons

400 series: 2,595 tons down to 109,136 tons

Stainless steel 300 series: A slight destock.

Due to the New Year holiday, destocking had decelerated and some of the spot goods were registered as warrants. While Tsingshan continued to send resources to Wuxi, Delong recovered their production to a certain level.

Stainless steel 200 series: Aiming for the tenth consecutive week of destocking.

Last week was the ninth consecutive week of destocking, the social inventory level is reaching a lower end.

One of the major steel mills in South China had closed down its furnace for annual maintenance, the stainless steel market received less stock than the previous week.

Stainless steel 400 series: Inventory dropped after the holiday.

The steady performed quote price of stainless steel 430 boot the transaction a little last week, some specifications of cold and hot rolled stainless steel were reportedly out of stock. It is believed that a large volume of orders will be made downstream soon for the preparation of the Chinese New Year.

RAW Material|| Prices rose a little.

While the price of iron ore was losing support, the most traded EXW price of High-carbon Ferrochrome remained steady between US$1315/MT and US$1340/MT. The price trend of the High-carbon Ferrochrome is likely to be stable as the supply increases after the new year.

It is understood that the producers of high-carbon ferrochrome will not lower the price in the short term.

Summary|| “Pre-Holiday Stocking” could boost the market.

The stainless steel prices weakened last week. Futures prices dropped again on Friday, but spot prices remained relatively strong throughout the week. Downstream demand still showed weakness, and although there was good transaction activity at the beginning of the week when futures rose, there is now a cautious atmosphere in the market. Anticipation for pre-holiday stocking is present, and the pressure on agent deliveries remains significant. The market is adopting a cautious stance. Future developments will closely monitor the stocking activities of traders and downstream players. The expectation is that stainless steel will continue to fluctuate.

300 series: Reduced arrivals before the holidays, coupled with concentrated buying in the market, led to continuous destocking. Some specifications are now experiencing shortages, but traders have a low willingness to sell at low prices. However, due to the expected increase in arrivals from some steel mills at the beginning of the month, limiting the space for price rebound, it is expected that the short-term private cold-rolled prices will fluctuate around US$1980/MT to US$2040/MT.

200 series: The spot prices of 201 were mainly weak last week. Currently, due to the impact of steel mill maintenance, the arrival resources of steel mills have decreased, and traders have limited inventories. Added to this is the Qingshan price limit, supporting the price to remain weak and stable. In the short term, the price of 201 will still maintain a weak and stable situation, and future attention will be focused on the arrival of steel mills.

400 series: Good transaction atmosphere after the New Year. Currently, there is a shortage of some specifications in both cold-rolled and hot-rolled, and it is expected that downstream will release orders for holiday stocking, stabilizing and possibly pushing up the price of 430 cold-rolled.

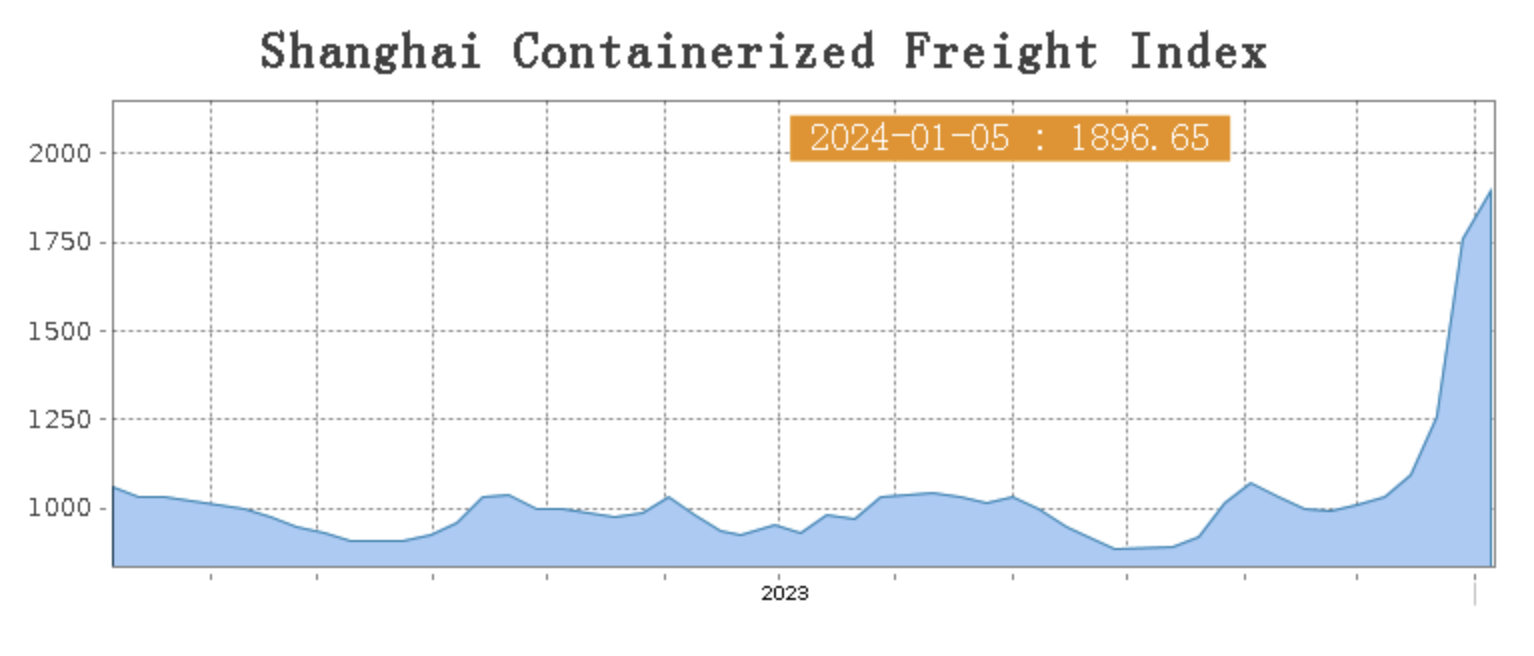

Sea Freight|| Red Sea’ s rumble continues.

The containerized freight market is still tested by the tension in Red Sea, Freight rate continued to surge. On 5th January, the Shanghai Containerized Freight Index rose by 7.8% to 1896.65.

Europe/ Mediterranean:

Some of the sea freight companies rescinded their decision of resuming sail on the Red Sea as the conflict is escalated.

On 5th January, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2871/TEU, which rose by 6.6%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3620/TEU, which lifted by 3.7%

North America:

On 5th January, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$2775/FEU and US$3931/FEU, reporting a 8.7% and 10.5% spike accordingly.

The Persian Gulf and the Red Sea:

On 5th January, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 14.3% from last week's posted US$2338/TEU.

Australia/ New Zealand:

On 5th January, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1084/TEU, a 3.9% jump from the previous week.

South America:

On 5th January, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2901/TEU, an 3.9% growth from the previous week.