The stainless steel market in China remains stably, weak. According to our average prices on a one-week basis, all major grades of stainless steel fell in price except for the price of stainless steel 400 series which was boosted by the increasing cost of chromium products. Most people are pessimistic about the future demand, and what is reflected in the market is the tepid transaction and slower de-stocking pace. It concerns us a lot because the stainless steel production is to enlarge in May, but now, the new production is yet to arrive in the spot market, we can already see the circulation in the inventory slowing down. It is predicted that in the near future when the newly-produced materials arrive on the market, the inventory and stainless steel prices will face great pressure. As the stainless steel prices keep declining, the selling price has already gone below the production cost. Steel mills are losing profit. They have to push the ore suppliers to seek a lower cost. Nickel products might continue to go low in the next few days. Facing the tepid China domestic demand, China's stainless steel import volume in April breaks a new low recond since 2020. As for the export volume, although it did increase from March, from January to April, the total export volume is year-on-year lower by 10%. If you want more specific analysis and data, acquire from the below Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,420 | -38 | -1.61% |

| Foshan | 2,465 | -38 | -1.58% | ||

| Hongwang | Wuxi | 2,340 | -48 | -2.11% | |

| Foshan | 2,350 | -27 | -1.22% | ||

| 304/NO.1 | ESS | Wuxi | 2,250 | -58 | -2.65% |

| Foshan | 2,295 | -38 | -1.70% | ||

| 316L/2B | TISCO | Wuxi | 4,050 | -55 | -1.39% |

| Foshan | 4,100 | -49 | -1.23% | ||

| 316L/NO.1 | ESS | Wuxi | 3,850 | -133 | -3.46% |

| Foshan | 3,925 | -107 | -2.75% | ||

| 201J1/2B | Hongwang | Wuxi | 1,500 | -6 | -0.42% |

| Foshan | 1,505 | -1 | -0.10% | ||

| J5/2B | Hongwang | Wuxi | 1,430 | -6 | -0.44% |

| Foshan | 1,430 | -1 | -0.11% | ||

| 430/2B | TISCO | Wuxi | 1,240 | 1 | 0.13% |

| Foshan | 1,240 | 1 | 0.13% |

Trend|| Stainless steel glut continued

The transaction of stainless steel remained weak last week. Stainless steel 201 fell after stabilized, Stainless steel 304 was fluctuated downward and 430 remained flat. The mainstream contract price fell US$52/MT(or 2.36%) to US$2285/MT.

Stainless steel 300: Transaction back to sedation

The mainstream price of cold-rolled 4-foot mill-edge stainless steel 304 was quoted US$2275/MT with US$58/MT drop while the mainstream price of hot rolled 5-foot stainless steel fell US$51/MT to US$2230/MT.

Most of the investors are taking “wait-and-see” approach since the stainless-steel future price followed the falling momentum of the spot price.

Stainless steel 200 series: The turning point still be hardly seen.

The spot price of stainless steel 201 still remained weak last week. Almost all the mainstream base price of Series 200 specifications were downed US$7/MT last week. cold rolled stainless steel 201 was quoted US$1470/MT; 201J2 closed at US$1400/MT and 5-foot hot rolled closed at US$1425/MT.

Stainless steel 400 series: prices were untouched.

There was no significant movement for the guidance price of stainless steel 430/2B last week: TISCO quoted US$1390/MT and JISCO quoted US$1485/MT. The spot price of stainless price 430/2B in Wuxi market rallied between US$1240/MT and US$1245/MT.

Summary:

Stainless steel market transactions remain weak, with steel mill profits reversing and downstream consumer demand showing no signs of improvement. The pressure to increase production in May is suppressing stainless steel prices. The market is expected to experience weak and volatile conditions in the near future.

Stainless steel 300 series: After concentrated replenishment following the holidays, transactions have gradually declined. With the recovery of supply from steel mills, the pressure of future supply is expected to gradually manifest in the market, creating increasing supply pressure. As nickel prices fall and stainless steel costs decline, short-term stainless steel prices are expected to remain weak, at around US$2295/MT.

Stainless steel 200 series: Although inventory continues to decline, current downstream demand is sluggish, and spot market transactions remain weak. There are no signs of a turnaround in the short term, and traders have a low willingness to replenish inventory. It is expected that spot prices will continue to be weak, with a fluctuation range of US$1375/MT to US$1405/MT for 201J2/J5 cold-rolled stainless steel.

Stainless steel 400 series: Transactions in the 400 series stainless steel market in Wuxi slowed down during the week, and spot inventory accumulation reappeared. There was no significant improvement in market transactions. After the rise in prices of chrome-iron raw materials, the 400 series stainless steel market adopted a wait-and-see approach, and the willingness of manufacturers to sell at low prices decreased. It is expected that the price of 430/2B will remain stable next week.

INVENTORY|| De-stocking pace slows down; concerns arise when the production to enlarge

The total inventory at the Wuxi sample warehouse fell by 2,982 tons to 539,562 tons (as of 18th May).

the breakdown is as followed:

200 series: 1,250 tons down to 40,550 tons

300 Series: 3,549 tons down to 396,759 tons

400 series: 1,817 tons up to 102,253 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| May 11 | 41,800 | 400,308 | 100,436 | 542,544 |

| May 18 | 40,550 | 396,759 | 102,253 | 539,562 |

| Difference | -1,250 | -3,549 | 1,817 | -2,982 |

Stainless steel 300 series: slowed consumption adding pressure to supplier.

The digestion of the inventory was slowed by the weak-performed market, the transaction had a down fall in the later time last week. The goods arrival also shrunken; Delong cut at least 30% of their hot rolled stainless steel distribution.

Stainless steel 200 Series: Weak supply and demand

The slight destocking mainly occurred in cold-rolled stainless steel in circulation, while there was a slight increase in inventory for hot-rolled stainless steel. During last week, steel mills had sparse stainless-steel goods arrivals, and some resources in transit had not yet arrived in Wuxi. There was a noticeable shortage of cold-rolled thin materials in the spot market, while other specifications faced tight inventory situations. The trading activity in the market was relatively weak during the week, with low willingness among traders to replenish their stocks. With sluggish market transactions, the overall destocking volume narrowed compared to the previous week.

400 Series: Weak transactions, slight accumulation of spot inventory

The 400 series stainless steel market had average trading activity last week, and the destocking of spot inventory also hit a speed bump. However, as the price of chromium and iron raw materials has risen in recent days, stainless steel manufacturers in the 400 series have reduced their willingness to sell at low prices. This has led to increased market caution and, with the increase in arrivals, inventory levels have risen. It is expected that there will be a slight increase in spot inventory in short period.

RAW Material|| Steel mill suffering losses despite the drop in nickel prices.

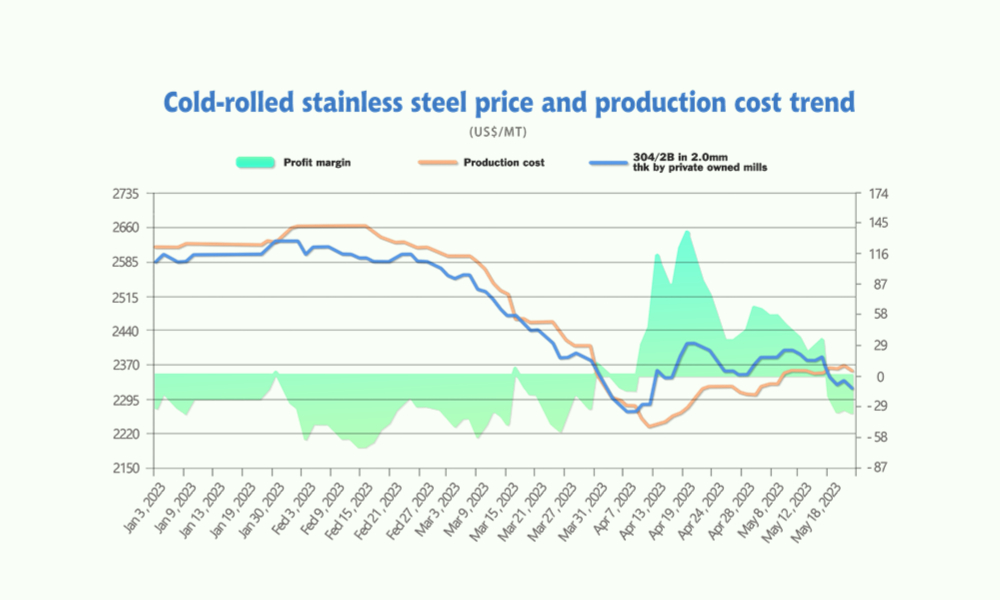

The mainstream EXW price of high chrome had a significant rose last week, growing US$43/MT (50% Chromium) to US$1465/MT in which signaling a further spike in production cost, the theoretical production cost of cold-rolled stainless steel 304 was reported US$2355/MT.

The price of ferrochrome also dropped by US$43/MT while the mainstream EXW price of nickel, on the other hand, dropped slightly.

One of the major steel mills in South China settled a purchase deal involving over 100,000 tons of ferronickel at the price of US$275/nickel unit earlier last week, but later on Thursday, another steel mill in East China shook hand at a lower price, resulted in the falling price of ferronickel.

Last week, stainless steel prices continued to decline, and at the beginning of the week, steel mills had already shifted from profit to loss. Based on the current price of US$270/nickel unit for nickel-iron and US$1345/MT for chrome-iron, the production cost of private 304 cold-rolled stainless steel is around US$2355/ton, with a per-ton loss of around US$36. The break-even point so far is US$265/MT.

MACRO|| Stainless steel export recorded 7.7% growth

UK to ban nickel product from Russia

On May 19th, British Prime Minister Rishi Sunak announced plans for new import bans on Russian copper, aluminum, nickel, and diamonds.

Import

According to China Customs, the total import volume of stainless steel in April was around 122,100 tons, the lowest level since April 2020, 1% lower than in March, and 48.9% less than the same period last year. Accumulating 583,000 tons of total import from January to April, the amount shrank up to 50% compared to the last year’s figure. It is believed that the major cut in imports from Indonesia resulted in the huge gap.

Export

The stainless steel export, on the other hand, recorded 7.7% growth and merely a 1.4% drop compared to last year. The total export amount so far had piled up to 1,343,500 tons, about a 7% drop from the same period last year.

Sea Freight|| Sea freight market stabilized

Freight rates overall on multiple sea routes varied differently last week. On 19th May, the Shanghai Containerized Freight Index fell by 1.1% to 972.45.

Europe/ Mediterranean:

The ZEW economic research institute said on Tuesday that its economic sentiment index fell to -10.7 points from 4.1 points in April which is much lower than the market expectation and the first negative value since January. The figure raises a red flag of greater economic recession.

Until 19th May, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$869/TEU, which fell by 0.1%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1628/TEU, which rose by 0.2%

North America:

While the banking crisis is outspreading in US finance industries, the negotiations over raising the debt ceiling are also writhing Wall Street.

Until 19th May, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,329/FEU and US$2,365/FEU, 4% and 0.7% drop accordingly.

The Persian Gulf and the Red Sea:

Until 19th May, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 4.8% fall from last week's posted US$1261/TEU.

Australia/ New Zealand:

Until 19th May, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$279/TEU, a 24% spike from the previous week.

South America:

The freight market had a slight rebound. on 19th May, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2009/TEU, an 2.8% growth from the previous week.