Hello, lucky us. Thanks for clicking on the last market roundup before the Chinese New Year holiday. Everything went stably last week as trading was bland when many factories tuned on their holiday. Regarding the CNY holiday, steel mills' suspension will influence about 800,000 tons. The suspension will mostly last until mid-February. There is one factor that might affect the market when we are back. That is the delay in Indonesian RKAB evaluation might trigger a new round of price of nickel products hikes. As for the hot issue, the Red Sea crisis is still shocking the world every day, ocean freight rates are headed down on key trade routes. Well, there is not much left for us to discuss, with the approaching rest. We will meet you in mid-February with first-hand and helpful news for you. For more about the market last week, and forecast for the future, please keep watching our Stainless Steel Market Summary In China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,165 | 8 | 0.41% |

| Foshan | 2,205 | 8 | 0.41% | ||

| Hongwang | Wuxi | 2,085 | 13 | 0.65% | |

| Foshan | 2,085 | 15 | 0.79% | ||

| 304/NO.1 | ESS | Wuxi | 2,010 | 27 | 1.44% |

| Foshan | 2,025 | 20 | 1.04% | ||

| 316L/2B | TISCO | Wuxi | 3,625 | 6 | 0.16% |

| Foshan | 3,790 | 31 | 0.85% | ||

| 316L/NO.1 | ESS | Wuxi | 3,620 | 14 | 0.41% |

| Foshan | 3,575 | 8 | 0.25% | ||

| 201J1/2B | Hongwang | Wuxi | 1,425 | 25 | 1.97% |

| Foshan | 1,415 | 14 | 1.09% | ||

| J5/2B | Hongwang | Wuxi | 1,340 | 23 | 1.87% |

| Foshan | 1,330 | 13 | 1.05% | ||

| 430/2B | TISCO | Wuxi | 1,260 | 0 | 0.00% |

| Foshan | 1,255 | 0 | 0.00% |

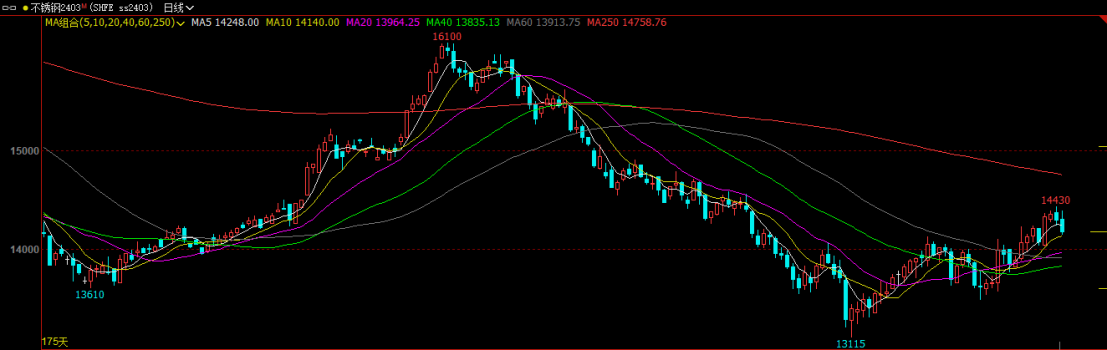

TREND|| Stainless steel price harvest a small gain before Chinese New Year.

The spot price of stainless steel 200, 300, and 400 series in the Wuxi market last week maintained a robust growth. The market performance had a decent beginning at the top half of last week, but then back to sedated as the most traded contract price closed at US$2115/MT eventually.

Stainless steel 300 series: price up, inventory down.

The market price of stainless steel 304 had a steady weekly growth last week. The most traded base price of cold-rolled 4-foot mill-edge stainless steel 304 gained US$7/MT from last week and closed at US$2045/MT; the private-produced hot rolled-stainless steel rose by US$28/MT to US$2020/MT. The price margin between cold and hot-rolled stainless steel was once again narrowed due to the shortage of hot-rolled resources.

Stainless steel 200 series: Prices traveled upward gingerly.

Until last Friday, The spot price of stainless steel 201 had a steady growth last week: the most traded base price of cold rolled stainless steel 201J1 and 201J2/J5 rose by US$14/MT to US$1395/MT and US$1310/MT respectively; the 5-foot hot roll stainless steel had a US$42 hike to US$1355/MT.

Stainless steel 400 series: Prices stabilized.

Last week, TISCO and JISCO maintained their market guidance price of stainless steel 430 at US$1450/MT and US$1570/MT accordingly.

The mainstream quote price of cold rolled stainless steel 430 in the Wuxi market also remained unchanged at between US$1260/MT and US$1270/MT; the hot rolled stainless steel closed at US$1145/MT.

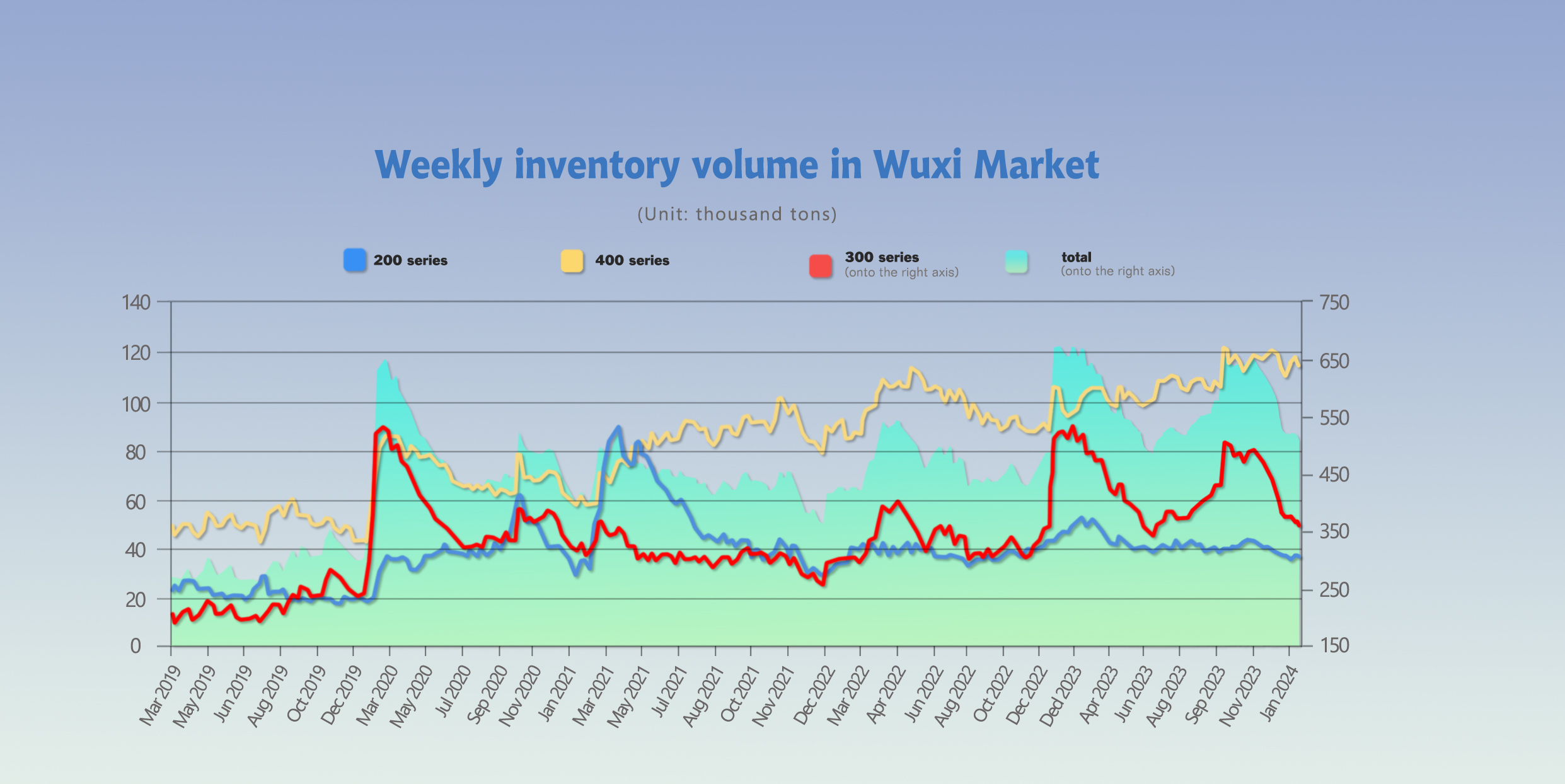

INVENTORY|| Supply was lower than market expectations.

The total inventory at the Wuxi sample warehouse downed by 11,082 tons to 505,680 tons (as of 25th January).

the breakdown is as followed:

200 series: 509 tons down to 35,365 tons.

300 Series: 7,097 tons down to 357,004 tons.

400 series: 3,476 tons down to 113,311 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| January 18th | 35,874 | 364,101 | 116,787 | 516,762 |

| January 15th | 35,365 | 357,004 | 113,311 | 505,680 |

| Difference | -509 | -7,097 | -3,476 | -11,082 |

Stainless steel 300 series: Transaction volume rose while the prices lifted.

The inventory of cold rolled stainless steel had a small adjustment last week, because there were more warehouse receipts registered. The purchase activities seemingly turned quite as the Chinese New Year is approaching, and more steel mills begins their routine maintenance.

Stainless steel 200 series: Price was bubbling by rumor.

While Beigang New Material and Jinhui had begun their annual maintenance, the supply will be greatly reduced. The price continued to hike as a series of rumors is spreading in the market that the meeting will be held between the prime producers of 200 series.

Stainless steel 400 series: prices was stabilized.

The market performance of 400 series is getting quite as Chinese New Year is approaching, the supply is also shrunken. The supply pressure is likely to be sustained in a low level.

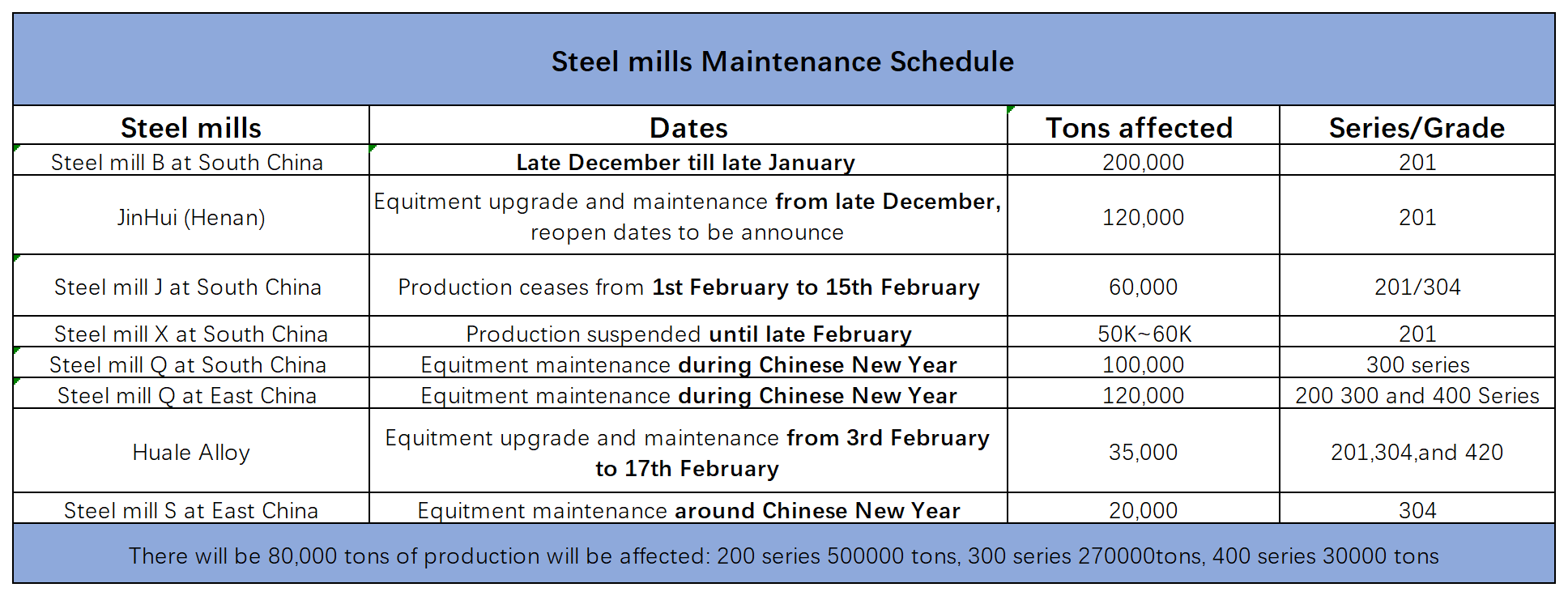

Maintenance: There will be 800,000 tons of supply wiped out due to the annual maintenance.

According to the statistic, the maintenance until late February will reduce about 800,000 tons of stainless steel production and 200 series takes parts of 62.5% of total.

RAW Material|| Delay in RKAB evaluation might trigger a new round of price hikes.

The EXW price of high-carbon ferronickel was stabilized last week, the mainstream price was quoted as US$240/Nickel Point.

he Ministry of Energy and Mineral Resources (ESDM) revealed that there are still many problems with submitting work plans and budgets (RKAB) specifically for mineral mining companies in Indonesia.

Minister of Energy and Mineral Resources Arifin Tasrif said, although currently the RKAB submission process has been simplified, it turns out that there are still many companies that do not fully understand the technical procedures.

"There were previously a lot of requirements, there are now 10 RKAB submission rules. Of the 27, we have simplified them, is that still not enough?" said Arifin.

The Ministry of Energy and Mineral Resources itself has previously issued Ministerial Regulation (Permen) ESDM No. 10/2023 concerning Procedures for Preparing, Submitting and Approving Work Plans and Cost Budgets as well as Procedures for Reporting on the Implementation of Mineral and Coal Mining Business Activities.

The new rules are said to make it easier for companies to submit RKAB. One of them, from previously having to submit once a year, is now once every 3 years.

Substantially, the main points of other conveniences regulated in the regulation signed in September 2023 are the fulfillment of essential aspects in preparing the RKAB and the efficiency of time management.

With the approaching Indonesian elections, policy uncertainties are affecting the sentiment in the Ferronickel market to some extent. It is understood that some nickel-iron factories in Indonesia have experienced overselling, and nickel-iron prices may stabilize with a tendency to strengthen in the first quarter.

In addition to factors such as the delay in RKAB audits and the presidential elections causing iron factories and traders to raise their quotes, domestic major steel mills have already placed orders for Ferronickel at US$235/Nickel Point. extending up to March. Furthermore, the downstream stainless steel stocking is not as expected, and a bullish sentiment is gradually growing in the market after the New Year.

Summary|| Price stayed calm as the holiday approached.

Stainless steel prices experienced a slight increase last week, with futures prices rising and then retreating. Overall market trading weakened, approaching the year-end with transactions slowing down. More steel mills are entering maintenance states, resulting in limited market arrivals. The specifications are generally relatively complete, and social inventories are not under significant pressure. The market has entered a wait-and-see mode, and it is expected that there won't be significant changes in the fundamentals before the holiday season.

300 Series: After consecutive destocking, there is limited pressure on current circulating goods. The market inventories are accumulated less than expected, and traders have a relatively strong mindset to support prices. However, as pre-holiday purchases are about to conclude, sustained follow-up transactions are challenging. The short-term expectation is for private cold-rolled prices to fluctuate between US$2020/MT and US$2060/MT.

200 Series: It is expected that 201 prices will maintain a stable and upward trend in the short term due to multiple positive factors, including steel mill maintenance and price limits imposed by some companies, which support stable upward price movements.

400 Series: Approaching the Spring Festival, traders and downstream stocking are close to completion, and the market's transaction atmosphere is not as active as in early January. It is anticipated that the price of 430 stainless steel will remain stable before the holiday.

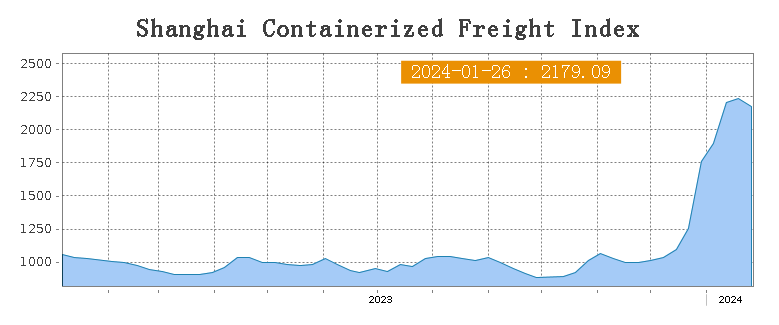

Sea Freight|| Despite the Red Sea crisis inflation shock, ocean freight rates are headed down on key trade routes.

The impact of the Red Sea riot is now diminishing, and China’s Containerized Freight market overall is stabilized as the Chinese New Year approaches, dropped by 2.7% to 2179.09.

Europe/ Mediterranean:

The Asia-Euro freight line continues to be tested by the Red Sea tension as most of the cargo ships were forced to detour. Last week, the booking price experienced a slight decrease.

On 26th January, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2861/TEU, which dropped by 5.6%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$4037/TEU, which decrease by 4.0%

North America:

The S&P Global US Composite PMI surged to 52.3 in January 2024, marking a notable increase from the previous month's 50.9 and indicating the most rapid rise in business activity since June 2023.

The overall freight demand was stable as the average loading rate in Shanghai Port reached 95%.

On 26th January, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4412/FEU and US$6413/FEU, reporting a 2.1% and 2.4% increase accordingly.

The Persian Gulf and the Red Sea:

On 26th January, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 16.1% from last week's posted US$1662/TEU.

Australia/ New Zealand:

On 26th January, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1266/TEU, a 0.6% jump from the previous week.

South America:

On 26th January, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2666TEU, an 1.8% slide from the previous week.