Do you know that in damp weather, it is unsafe to process stainless steel typical when it is raw, because the moist in the air accumulates on the surface of the product. On one hand, it pollutes the material. On the other hand, it influences the finish processing and even worse, increases the possibility of corrosion. Foshan, located in Southern China, recently, has been experiencing extreme wet weather. Therefore, many local manufacturers have to pause until the weather gets drier. Well, as for the trading status, last week, stainless steel prices headed down overall. The major reason is the blain demand and the recovering production which will raise the spot inventory largely in late March. According to statistics, the inventory will rebound by 25% from February. The expectation of increasing output of stainless steel will continue to drag down the stainless steel prices in a short term. What do you want to know about China's market? Please tell us. For more latest information, keep going on to Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,190 | -18 | -0.87% |

| Foshan | 2,235 | -18 | -0.86% | ||

| Hongwang | Wuxi | 2,080 | -24 | -1.20% | |

| Foshan | 2,070 | -28 | -1.42% | ||

| 304/NO.1 | ESS | Wuxi | 2,000 | -38 | -1.97% |

| Foshan | 2,015 | -25 | -1.31% | ||

| 316L/2B | TISCO | Wuxi | 3,680 | 6 | 0.16% |

| Foshan | 3,765 | 20 | 0.54% | ||

| 316L/NO.1 | ESS | Wuxi | 3,525 | -8 | -0.25% |

| Foshan | 3,570 | 8 | 0.25% | ||

| 201J1/2B | Hongwang | Wuxi | 1,435 | 0 | 0.00% |

| Foshan | 1,425 | -8 | -0.64% | ||

| J5/2B | Hongwang | Wuxi | 1,340 | -7 | -0.57% |

| Foshan | 1,340 | -6 | -0.46% | ||

| 430/2B | TISCO | Wuxi | 1,265 | 7 | 0.61% |

| Foshan | 1,265 | 0 | 0.00% |

TREND|| Spot price dived again as inventory is pilling up.

Last week, the spot prices of stainless steel 300 series and 200 series saw a slight decline, while the 400 series remained stable with some upward movement. Futures prices fluctuated initially but ended higher, and spot prices followed the market fluctuations. By the end of last week, the main contract price of stainless steel dropped by US$9.8/MT to US$2070/MT compared to the previous week, representing a decrease of 0.5%.

300 Series: Slight accumulation in inventory, market cautious.

Last week, the prices of 304 stainless steel continued to decline. By Friday, the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 in Wuxi dropped to US$2025/MT, and the private produced hot-rolled stainless steel price dropped to US$2000/MT, both down by US$35/MT from the previous Friday. After a rapid increase in futures prices followed by fluctuation and decline, market shipments slowed down. Coupled with some steel mill resources arriving, inventory pressure increased, leading to consecutive weakening of spot prices. The market trading atmosphere was subdued, and the performance of transactions was weak throughout the week.

200 Series: Steel mills resumed production, inventory increased, 201 weak and stable operation.

Last week, the spot prices of stainless steel 201 in Wuxi market fluctuated weakly. By Friday, the mainstream base price of cold-rolled 201J1 in Wuxi market remained unchanged from the previous week, standing at US$1405/MT. However, the base prices of cold-rolled J2/J5 decreased by US$14/MT from the previous week, reaching US$1305/MT, and the price of hot-rolled stainless steel decreased by US$14/MT, reaching US$1350/MT. This week, the prices of stainless steel 201 remained mostly stable or slightly lower, with agents offering discounts of around US$14/MT. Currently, most downstream industries are operating normally, and the market trading atmosphere is active, with traders showing a positive attitude towards purchasing.

400 Series: Inventory increased again, can the price of 430 remain stable?

Last week, the guidance prices for 430 cold-rolled steel from TISCO and JISCO were US$1460/MT and US$1580/MT, respectively, both up by US$7/MT from the previous week. This week, the mainstream price of national cold-rolled stainless steel 430 in Wuxi market was US$1265/MT and US$1270/MT, up by US$7/MT from last week, while the price of hot-rolled stainless steel 430 remained at US$1135/MT to US$1145/MT unchanged from the previous week.

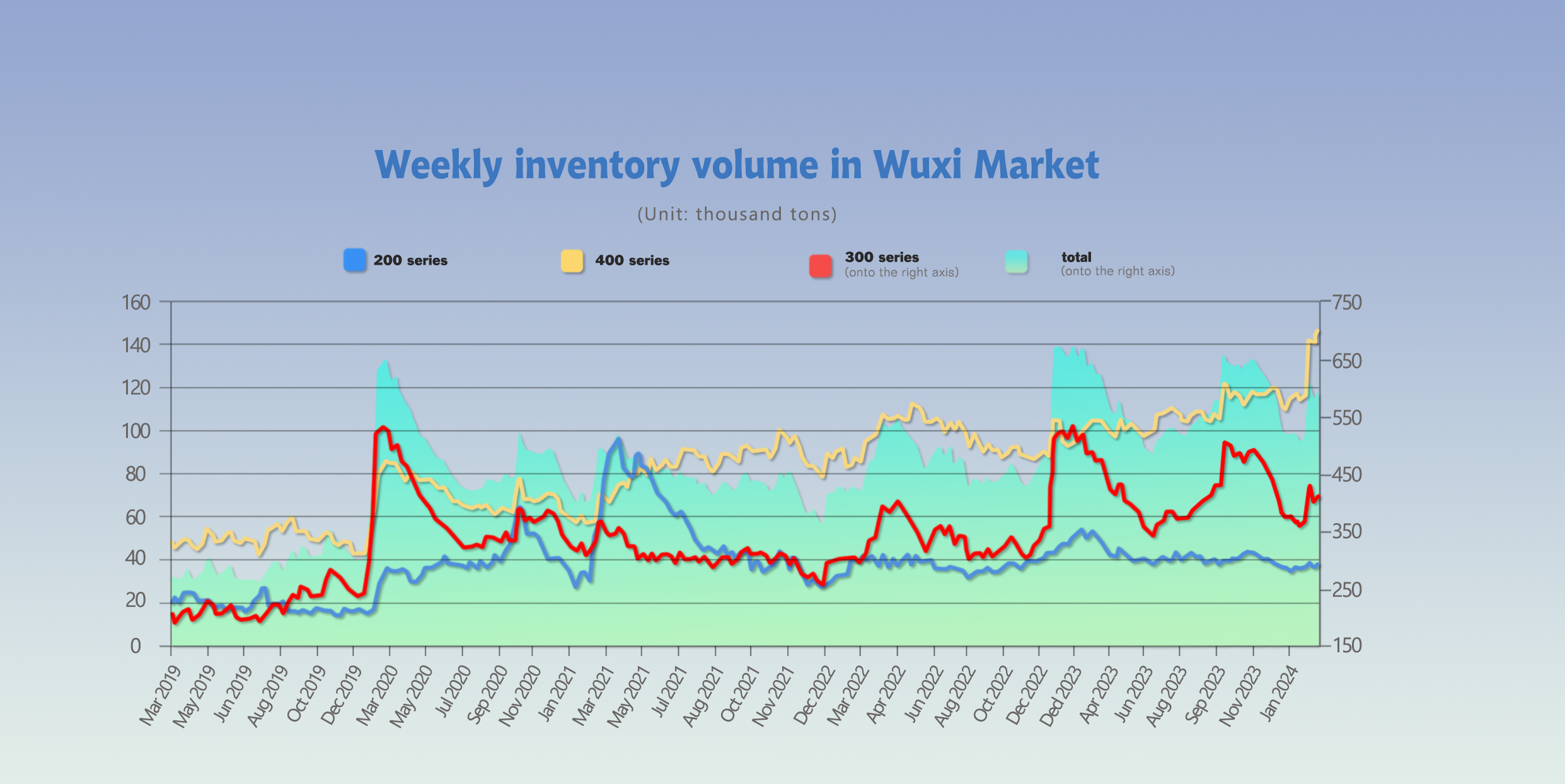

INVENTORY|| Inventory rebounded

Last week, the inventory of the 300 series in the Wuxi market increased by 8,900 tons to 408,900 tons (excluding warehouse receipts), with both cold-rolled and hot-rolled inventory showing a slight accumulation. During last week, steel mills gradually completed production cuts and maintenance, gradually resumed production, and market arrivals increased.

Futures prices fluctuated downward, terminal demand released slowly, coupled with expectations of high production in March, it is likely that the market lacked confidence in the future, and the pace of procurement slowed down, leading to a slight accumulation of inventory amid increasing supply and decreasing demand.

The total inventory of the Wuxi sample warehouse increased by 16,000 tons to 592,700 tons compared to the previous period. Among them, the inventory of the 200 series increased by 1,600 tons to 37,800 tons. Last week, major steel mills that suspended production during the Spring Festival have mostly resumed production, and production has gradually returned to normal levels. With a high level of production, the production of each series in March is expected to increase significantly. According to statistics, the production of the 200 series in March is expected to increase by 940,460 tons, a month-on-month increase of 24.03%. With the increase in steel mill production, market arrivals have also increased, leading to inventory accumulation, which may lead to price declines.

Last week, the inventory of the 400 series in the Wuxi market increased by 5,600 tons to 146,000 tons, with a particularly significant accumulation in cold-rolled inventory. During this inventory cycle, on the one hand, various steel mills received shipments, and on the other hand, last week, the settlement price of cold-rolled steel 430 from state-owned steel mills increased, leading to an increase in costs for traders. Some businesses explored price increases in their quotations, but the market sentiment remained cautious, resulting in on-demand procurement. As a result, the inventory of cold-rolled steel accumulated significantly. Meanwhile, the quotation for hot-rolled stainless steel 430 remained stable, with traders focusing more on shipments to digest inventory and recover funds.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| February 29th | 36,202 | 400,003 | 140,404 | 576,609 |

| March 7th | 37,756 | 408,893 | 146,007 | 592,656 |

| Difference | 1,554 | 8,890 | 5,603 | 16,047 |

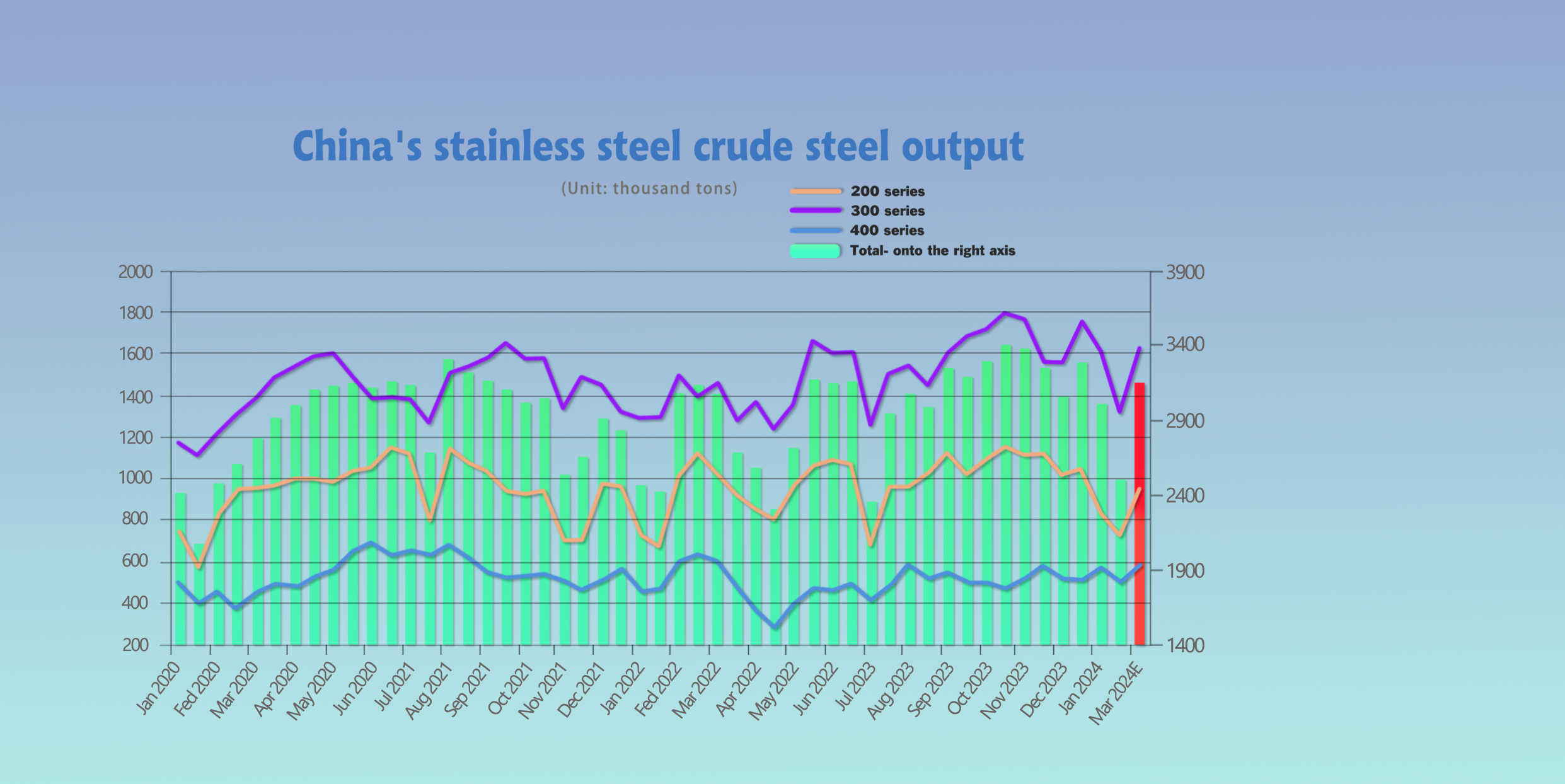

In February, steel mills unexpectedly reduced production by 510,000 tons!

During February, which included the Chinese New Year holiday, market demand was insufficient, leading to successive rounds of maintenance and production cuts at steel mills, resulting in a significant decrease in production compared to January. The reductions were particularly notable in the 200 series and 300 series.

According to statistics, in February 2024, the crude steel production of domestic stainless steel enterprises (above designated size) was 2.5159 million tons, a decrease of 505,200 tons or 16.72% compared to the previous month, and a decrease of 423,700 tons or 14.41% year-on-year.

The production of each series decreased in February, with the details as follows:

200 series: 717,600 tons, a decrease of 129,100 tons or 15.25% compared to the previous month, and a decrease of 242,400 tons or 25.25% year-on-year.

300 series: 1,307,400 tons, a decrease of 296,500 tons or 18.49% compared to the previous month, and a decrease of 189,500 tons or 12.66% year-on-year, reaching a nearly 13-month low.

400 series: 490,900 tons, a decrease of 79,600 tons or 13.95% compared to the previous month, and a decrease of 8,200 tons or 1.7% year-on-year.

It is estimated that in March, steel mills will gradually resume work and production, and with the current profitability of steel mills, production enthusiasm is high, leading to a significant increase in production for each series in March.

According to research statistics, in March, the production of the 200 series is estimated to be around 944,600 tons, the production of the 300 series is estimated to be around 1,622,500 tons, and the production of the 400 series is estimated to be around 580,400 tons, with a total production of around 3.1475 million tons, an increase of 25.10% compared to February.

RAW MATERIALS || Chinese Nickel Ore Inventory Declines Significantly, Market Concerned about Potential Shortage.

There's growing concern in the market regarding the widespread supply of ore, with some analysts predicting an unexpected shortage of nickel ore in 2024 if Indonesia stops issuing any further mining permits.

According to a report from Jiaobao Group on March 4, 2024, Chinese nickel ore inventories have decreased by nearly 24% since November 2023, amounting to approximately 2.4 million wet metric tons. With the arrival of the Asian rainy season, it is expected that Chinese nickel ore inventories will further decline. During the rainy season, many nickel mines are flooded due to open-pit mining, significantly reducing the amount of ore available for shipment.

SUMMARY || No Improvement in Downstream Stainless-Steel Demand.

Currently, downstream demand is mediocre, with steel mills receiving deliveries one after another, leading to significant sales pressure in the market and a gradual increase in social inventory. Although steel mills' profits are shrinking, they are still maintaining high production levels, exerting considerable pressure on stainless steel prices.

Spot resources now are relatively abundant, and specifications are generally complete. It is expected that stainless steel will continue to operate weakly and fluctuate in the near future.

300 Series: Steel mill production in February exceeded expectations, resulting in limited short-term market supply pressure. It is expected that the short-term spot price of 304 cold-rolled stainless steel will remain in the range of US$2015/MT-US$2055/MT. Steel mill production is rapidly recovering in March, and production levels will gradually return to normal by mid-to-late March.

200 Series: With increased steel mill production, there is an accumulation of inventory, leading to price fluctuations due to increased supply. It is expected that 201 will continue to fluctuate narrowly around US$1305/MT-US$1320/MT.

400 Series: Currently, high chromium prices remain strong, and steel production costs are high, leading to a strong willingness to raise prices. However, given the current high inventory levels in the spot market, it is expected that the price of 430 will remain weak and stable in the short term.

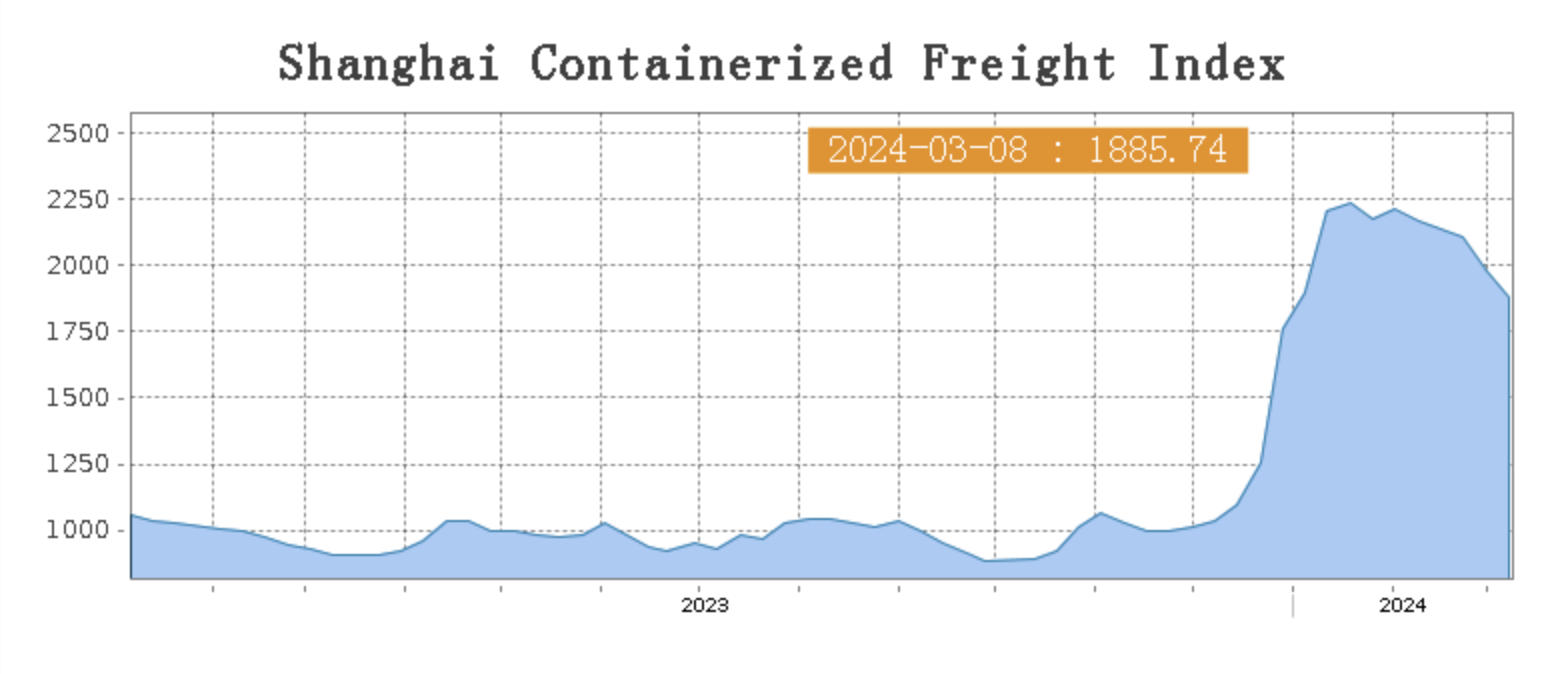

Sea Freight|| Unsolved complication in Red Sea continues.

The performance of China's export container shipping market was relatively weak last week, with transportation demand continuing to slowly recover after the long holiday. Market freight rates continued to adjust, dragging down the composite index. On 8th March, the Shanghai Containerized Freight Index fell by 4.7% to 1885.74.

Europe/ Mediterranean:

The impact of geopolitical tensions on the Asia-Europe shipping routes has gradually stabilized, with supply and demand fundamentals becoming an important factor affecting market freight rates in the near term. Last week, slow growth in transportation demand and an imbalance between supply and demand led to continued downward pressure on market freight rates.

On 8th March, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2134/TEU, which dropped by 6.3%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3138/TEU, which slid by 4.7%.

North America:

On 8th March, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4039/FEU and US$5608/FEU, reporting a 5.2% and 2.4% fall accordingly.

The Persian Gulf and the Red Sea:

On 8th March, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 6.8% from last week's posted US$1599/TEU.

Australia/ New Zealand:

On 8th March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1016/TEU, a 10.3% slump from the previous week.

South America:

On 8th March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2596/TEU, an 1.1% slide from the previous week.