Stainless steel was climbing up in price. Raw materials like nickel and chrome has driven the stainless steel futures and spot prices to increase. The scheduled stainless steel production in March is high, which suppresses market confidence. However, because the nickel output is still unclear and insufficient in Indonesia, this will strongly set a limit to keep the stainless steel prices from falling too much. Until March 1st, the mainstream base price of private cold-rolled stainless steel 304 in the Wuxi area was reported at US$2065/MT, increasing by US$21/MT compared to last week. Influenced by the Spring Festival and holiday, the manufacturing PMI in February was 49.1%, down by 0.1% from January in China. It was not a happy beginning, the Chinese government set a goal of 5% growth in GDP in 2024 according to the "TWO SESSIONS" which is holding in Beijing. Quiet mild progress compared to the past performances of China's economic development. Many experts think that 2024 is a big challenge for China to maintain its momentum. What are your opinions? For more about China's economic indicators in the industry, please keep reading our Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,210 | 59 | 2.90% |

| Foshan | 2,250 | 59 | 2.84% | ||

| Hongwang | Wuxi | 2,100 | 31 | 1.58% | |

| Foshan | 2,100 | 28 | 1.44% | ||

| 304/NO.1 | ESS | Wuxi | 2,040 | 41 | 2.16% |

| Foshan | 2,040 | 25 | 1.33% | ||

| 316L/2B | TISCO | Wuxi | 3,675 | 22 | 0.64% |

| Foshan | 3,745 | -11 | -0.31% | ||

| 316L/NO.1 | ESS | Wuxi | 3,535 | 8 | 0.25% |

| Foshan | 3,560 | 14 | 0.41% | ||

| 201J1/2B | Hongwang | Wuxi | 1,435 | 7 | 0.53% |

| Foshan | 1,430 | 13 | 0.97% | ||

| J5/2B | Hongwang | Wuxi | 1,350 | 8 | 0.69% |

| Foshan | 1,345 | 8 | 0.69% | ||

| 430/2B | TISCO | Wuxi | 1,255 | 0 | 0.00% |

| Foshan | 1,265 | 7 | 0.61% |

TREND||Stainless steel future peaked at US$2110/MT

Last week, the spot prices of stainless steel in the Wuxi market remained stable with a slight increase. The 300 series of cold-rolled and hot-rolled stainless steel saw a small rise compared to the previous period, while the 200 series and 400 series remained stable.

The futures market reached a high of US$2115/MT, but fell at the end of Friday's session, closing lower. As of the end of last week, the main stainless steel contract price fell by US$16/MT to US$2075/MT, a decrease of 0.82% compared to the previous week.

300 series: Exceeding expectations in destocking, prices stabilize and rise! This week, the price of stainless steel 304 in the market saw a slight increase. As of today, the mainstream base price of private cold-rolled stainless steel 304 in the Wuxi area was reported at US$2065/MT, an increase of US$21/MT compared to last week; the private hot-rolled price was reported at US$2035/MT, an increase of US$14/MT compared to the previous week.

200 series: Steel mills hold prices steady, active trading for 201 The spot price of stainless 201 in the Wuxi market remained stable last week. As of Friday, the mainstream base price of cold-rolled stainless steel 201J1 in Wuxi was at US$1405/MT; the mainstream base price of cold-rolled stainless steel J2/J5 was at US$1320/MT; and the price of five-foot hot-rolled stainless steel 201J1 was at US$1365/MT, all unchanged from last week's prices.

400 series: Increased demand, inventory digestion, the price of stainless steel 430 temporarily stable. Last week, the spot market in the Wuxi market remained stable. As of Friday, the mainstream price of cold-rolled stainless steel 430 was reported at US$1265/MT, and the mainstream price of hot-rolled stainless steel 430 was reported at US$1135/MT, both unchanged from last week.

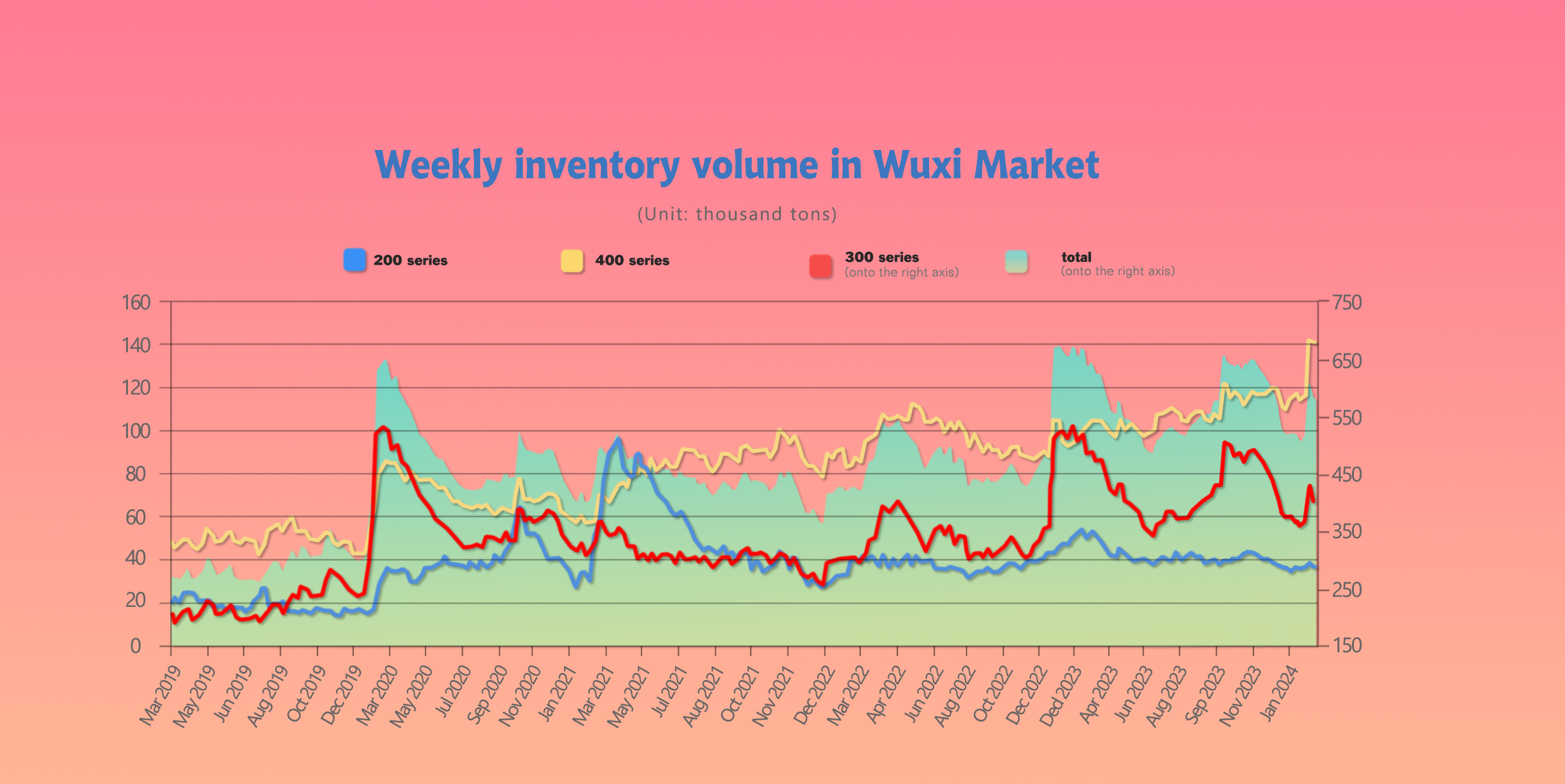

INVENTORY|| The inventory is significantly reducing amid rising prices.

The total inventory at the Wuxi sample warehouse downed by 27,486 tons to 576,609 tons (as of 29th February).

the breakdown is as followed:

200 series: 1,431 tons down to 36,202 tons

300 Series: 25,141 tons down to 400,003 tons

400 series: 914 tons down to 140,404 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| February 19th | 37,633 | 425,144 | 141,318 | 604,095 |

| February 29th | 36,202 | 400,003 | 140,404 | 576,609 |

| Difference | -1,431 | -25,141 | -914 | -27,486 |

300 series: Last week, the inventory of the 300 series in the Wuxi market had a significant reductions in both cold and hot rolled inventories. The price of nickel iron at the raw material end continued to rise, leading to an increase in the cost of stainless steel. It is understood that the market's arrivals were reduced due to steel mill maintenance and adverse weather conditions in the northern region. Additionally, the unexpected rise in the opening price of Tsingshan futures stimulated speculative sentiment in the market. Both futures and spot prices increased slightly last week, boosting confidence for enterprises to make purchases. Terminal enterprises increased their procurement efforts, resulting in a better-than-expected decline in inventory.

200 series: During last week, steel mills continued to hold prices firm, and downstream customers actively entered the market with a mindset of buying higher but not lower, making procurement arrangements for the new year's production. With both supply and demand increasing, transactions were good, and attention will be given to market transactions and steel mill arrivals in the future.

400 series: Last week, the inventory of the 400 series in the Wuxi market decreased by 900 tons to 140,400 tons. Both cold and hot rolled inventories saw slight reductions. TISCO resources showed a significant reduction in inventory last week, while JISCO resources had a small number of arrivals. Post-holiday market traders are gradually settling and picking up goods, downstream production is resuming, and demand is gradually being released. It is expected that demand will increase, facilitating inventory digestion. Given the current high inventory levels in the market, prices are expected to remain stable in the short term.

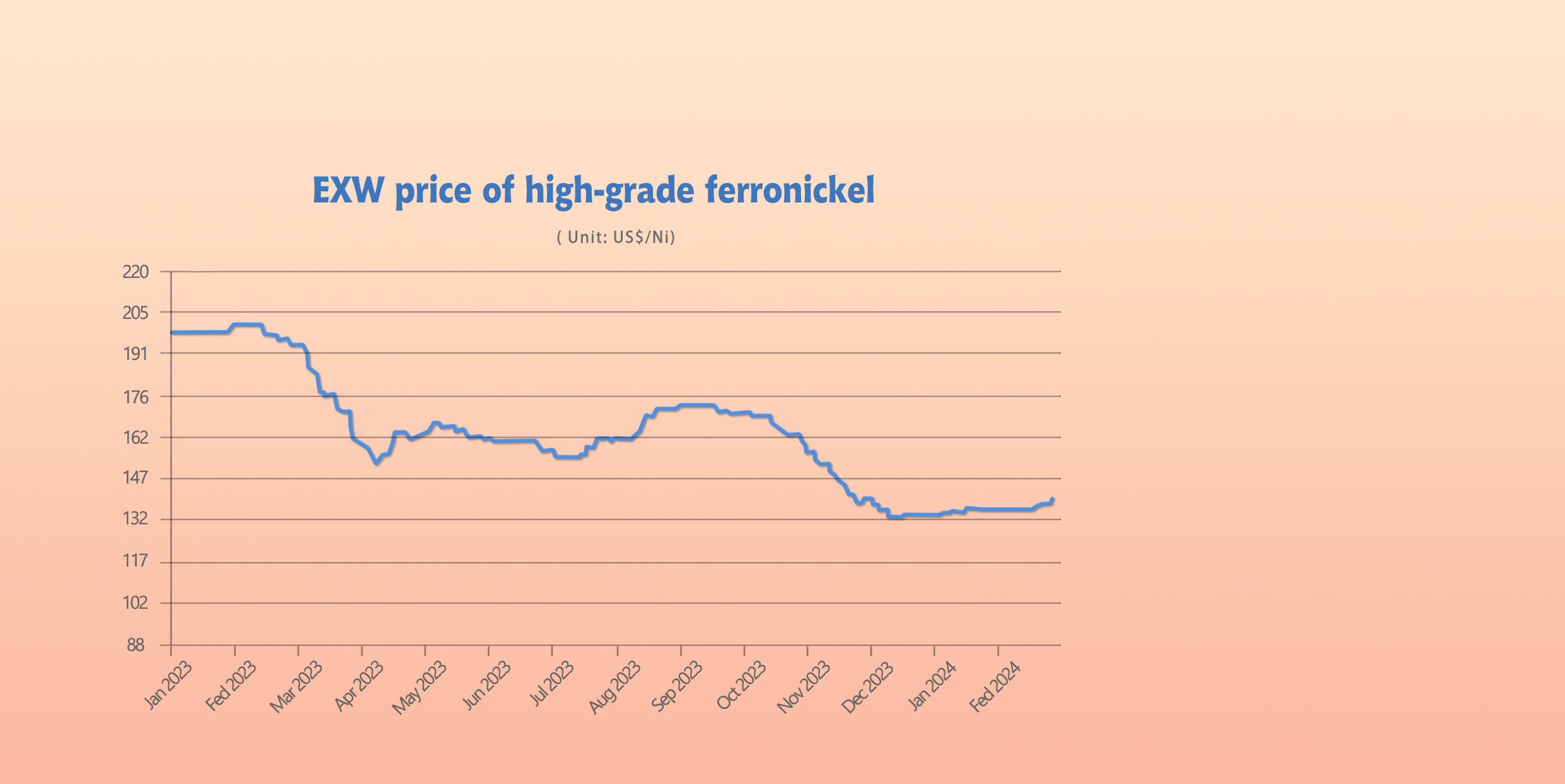

RAW MATERIAL|| The rise in raw material prices will drive up stainless steel prices.

Chrome: High-carbon chromium iron prices remain stable

Both domestic and international prices of chrome ore have remained strong, with chrome ore merchants increasing their price support in anticipation of growing demand from downstream chromium iron factories. Recently, international prices of chrome ore have generally risen by US$5-10/MT(CIF). It is reported that the latest transaction price for 40-42% concentrate chrome from large mines in South Africa with long-term customers is US$292/MT (CIF), an increase of US$7 per ton compared to the previous period. Calculations show that the current production cost of high-carbon chromium iron is around US$1380/MT (50% chromium), providing strong cost support.

Nickel: Tight supply of Indonesian nickel ore

The Indonesian Ministry of Mining has approved mining quotas for 145 million tons of nickel ore over the next three years, which can only meet 25% of the demand. In 2023, Indonesia's nickel ore consumption is estimated to be around 190 million tons, and with the current low grade of ore, the future demand gap is significant. Many nickel iron factories in Indonesia were basically in a state of reduced production in February. However, according to news from Bloomberg on February 29th, Irwandy Arif, special staff member of the Indonesian Ministry of Energy and Mineral Resources, stated that the government's goal is to resolve all remaining mining permits (locally known as RKAB) issues by the end of March, which may alleviate the dilemma in the nickel market. Indonesian smelters maintain ore inventories to meet nickel production for approximately three months.

According to Macquarie Group, the global nickel market may face unexpected shortages this year if Indonesian production growth is constrained by slow mining permit approvals. Tsingshan, which opened for the first time after the holiday, had prices higher than market expectations. Currently, domestic steel mill raw material inventories are tight, and nickel iron prices remain firm due to the slow approval of RKAB in Indonesia.

SUMMARY|| Stainless steel uptrend sprouts

In recent period, the strong performance of nickel and raw material prices has driven the continued rise in stainless steel prices. However, the downstream demand for stainless steel has been mediocre, with insufficient momentum in futures price increases, resulting in another round of correction in spot prices. Currently, the supply issues at the nickel ore end have eased slightly, while steel mills maintain a high level of production in March and maintain a price pressure attitude towards stainless steel raw material procurement. As market spot circulation gradually loosens, the market is currently under slight pressure, but given the strong performance of the raw material end in the short term, there is still support for stainless steel below.

300 Series: Current raw material prices have slightly explored upward, pushing up stainless steel costs, with a positive macro atmosphere and improved market sentiment. Downstream steel mills are gradually resuming production cuts, increasing supply pressure, and terminal enterprise demand is gradually releasing. It is expected that the base price of 304 cold-rolled stainless steel will operate in the range of US$2040/MT to US$2085/MT, and the progress of Indonesia's RKAB approval and domestic demand conditions might be the main deriver of the price movement in the short term.

200 Series: As we are about to enter March, with the increase in steel mill production, market arrivals are expected to increase. With the warming demand from downstream customers, the price of 201 may fluctuate. The current trend is unclear, with cautious market supply and demand. The market is expected to treat the short-term fluctuation sentiment, and the 201J2/5 cold-rolled stainless steel base may fluctuate around US$1305MT-US$1375/MT, with subsequent focus on market transactions and steel mill arrivals.

400 Series: The long-term procurement price of high-carbon chromium iron for March 2024 by TISCO and JISCO remains unchanged, with the cost of 430 cold-rolled stainless steel estimated to be around US$1265/MT-US$1280/MT, providing cost support, and steel mills have a strong willingness to support prices. It is understood that some steel mills have already filled orders, and production is expected to increase in March. Terminal orders are gradually being released, leading to increased demand, but given the high inventory in the Wuxi market, it is expected that the price of 430 cold-rolled stainless steel will remain stable in the short term.

Macro|| China’s PMI remained under 50%, GPD growth of 2024 set at 5%.

According to the latest data released by the National Bureau of Statistics, the comprehensive Purchasing Managers' Index (PMI) for February was 50.9, unchanged from the previous month. Specifically, the manufacturing PMI for February slightly declined due to the impact of the Chinese New Year holiday, with the Manufacturing Purchasing Managers' Index (PMI) standing at 49.1%, a decrease of 0.1 percentage points compared to January.

The National People’s Congress, together with the Chinese People’s Political Consultative Conference, are jointly known as “Two Sessions”, the biggest annual political gathering of the country.

China’s Premier Li Qiang placed the development of “new productive forces,” which means a systematic shift to high-end, smart and clean manufacturing industries, on top of the government’s 2024 agenda, according to his speech at the National People’s Congress opening meeting on March 5.

In the speech, Li announced a relatively modest GDP growth target of “around 5%,” which was close to last year’s growth rate of 5.2%. He also highlighted some critical challenges for the country to sustain its economic growth, notably debt of local governments, weak domestic demand, subdued export activity and the real estate sector’s crisis.

Li listed 10 things for the government to complete in 2024, among which he placed “accelerated industry modernization and development of new productive forces” above other targets like maintaining security, stimulus for international trade and domestic consumption, coordination of urban and rural development, medical and social welfare.

Traditional industries also need to accelerate transformation to enable smarter and greener production, he said, adding that the government plans to establish pilot industrial clusters for demonstration projects of frontier technologies.

Li also reaffirmed the importance of energy security. He called for accelerating exploration and development of oil, gas and strategic mineral resources and reaffirmed coal’s role as the ballast of the energy system to ensure sufficient energy supplies.

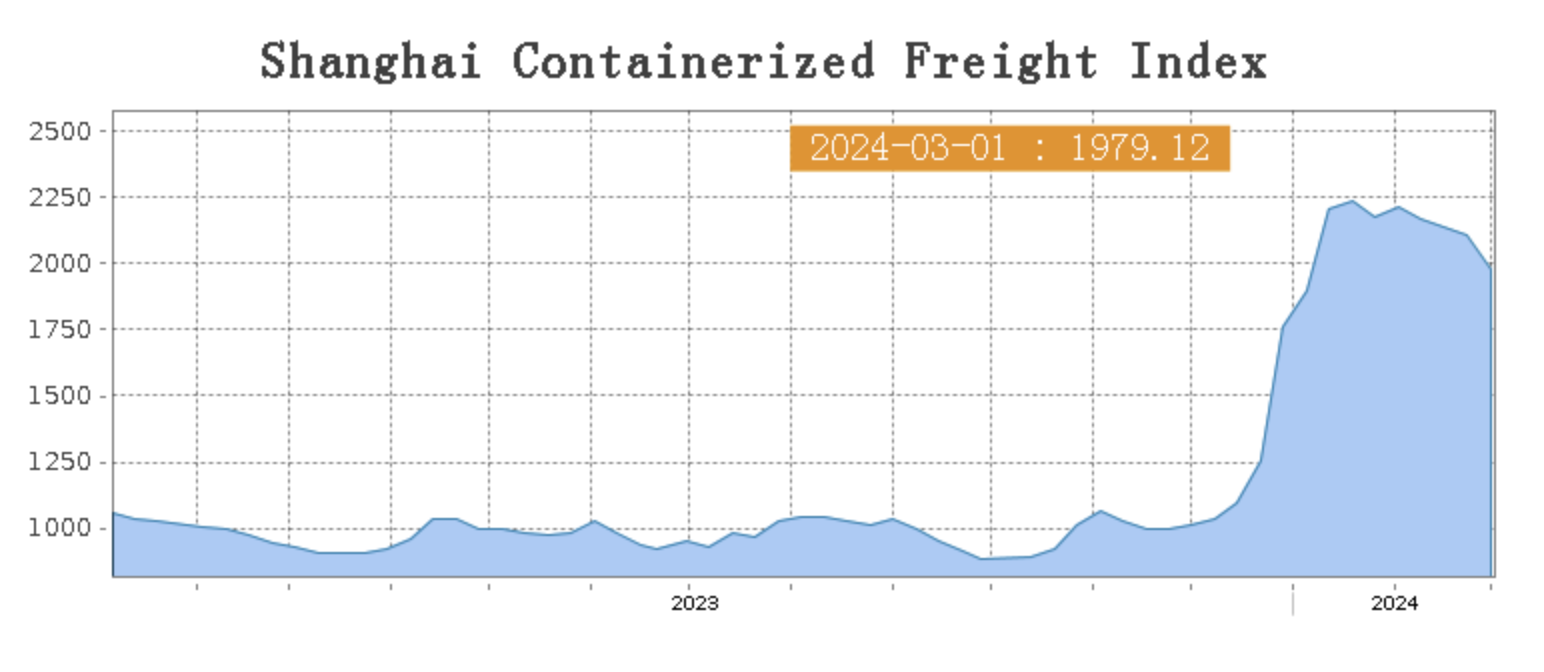

Sea Freight|| Freight market saw a sluggish recovery.

China’s Containerized Freight market had a certain level of recovery, but it somehow developed slowly after the Chinese New Year. On 1st March, the Shanghai Containerized Freight Index fell by 6.2% to 1979.12.

Europe/ Mediterranean:

The freight rate of European freight line fortuitously drop as the Red Sea rumble continued.

On 1st March, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2277/TEU, which dropped by 9.2%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3292/TEU, which fell by 5%.

North America:

According to data released by the US Department of Commerce, durable goods orders in the United States fell by 6.1% in January compared to the previous month, significantly below market expectations. This marks the largest decline since April 2020 and is expected to adversely affect transportation demand on North American routes.

On 1st March, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4262 FEU and US$5747/FEU, reporting a 9.1% and 6.2% loss accordingly.

The Persian Gulf and the Red Sea:

On 1st March, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf rose by 0.8% from last week's posted US$1715/TEU.

Australia/ New Zealand:

On 1st March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1133/TEU, a 6.6% decline from the previous week.

South America:

On 1st March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2625/TEU, it remained unchanged from previous week.