TREND|| The market is at a standoff.

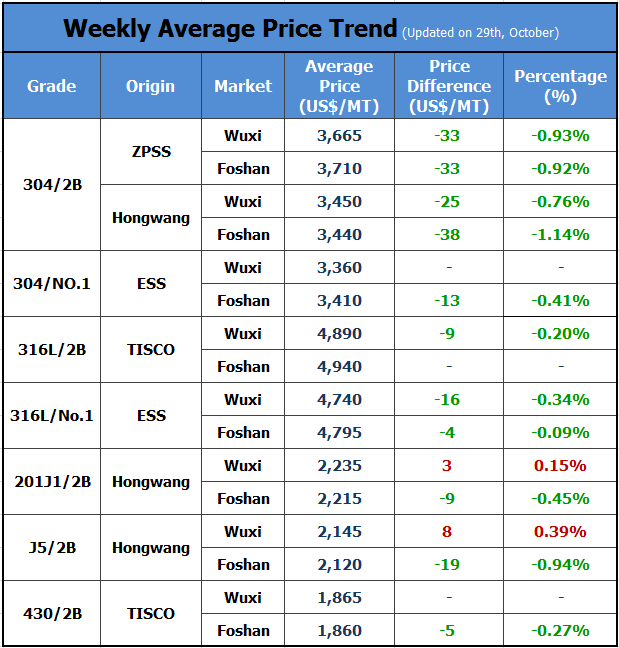

Last week, the stainless steel spot prices were fluctuated to decrease. Compared to two weeks ago, the trading volume last week went lower. Until last Friday, October 29th, the main contract of stainless steel futures closed at US$3,155/MT, which was US$186/MT lower than the price of October 22nd; as for the base price of the CR 304 from the private-owned mills, it decreased by US$15/MT, quoting at US$3,395/MT.

300 series: The austerity measures in macroeconomy drag down the futures prices.

Macroeconomy: On October 13th, the Federal Reserve released that the gradual reduction in debt purchase plans may begin in mid-November or mid-December, and end in mid-2022. The end marks the economic stimulus measures that deal with the pandemic are about to come to an end. The high price premium brought by the loose policies will be reduced probably. In China, to cope with the increasing prices of coal, the Development and Reform Commission continues to strike the hypes of bulk commodities. The carbon futures dropped to the limit. Under the panic vibe, the stainless steel futures also fell.

Last week, the stainless steel futures prices again began to fall. The “golden September and silver October” has passed, the market returned blandly. The government keeps releasing measures against the high price of coal. The carbon futures dropped to the limit. Under the panic vibe, the stainless steel futures also fell. Until last Friday, October 29th, the main contract of stainless steel futures closed at US$3,155/MT, which was US$186/MT lower than the price of October 22nd; as for the base price of the CR 304 from the private-owned mills, because of the low inventory, it did not follow the weakened trend, and only decreased by US$15/MT, quoting at US$3,395/MT.

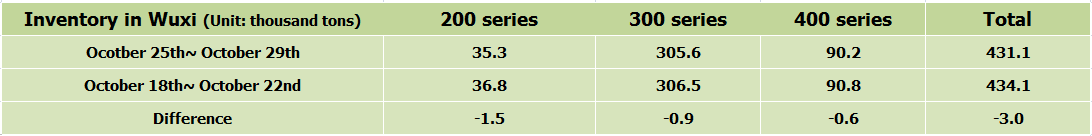

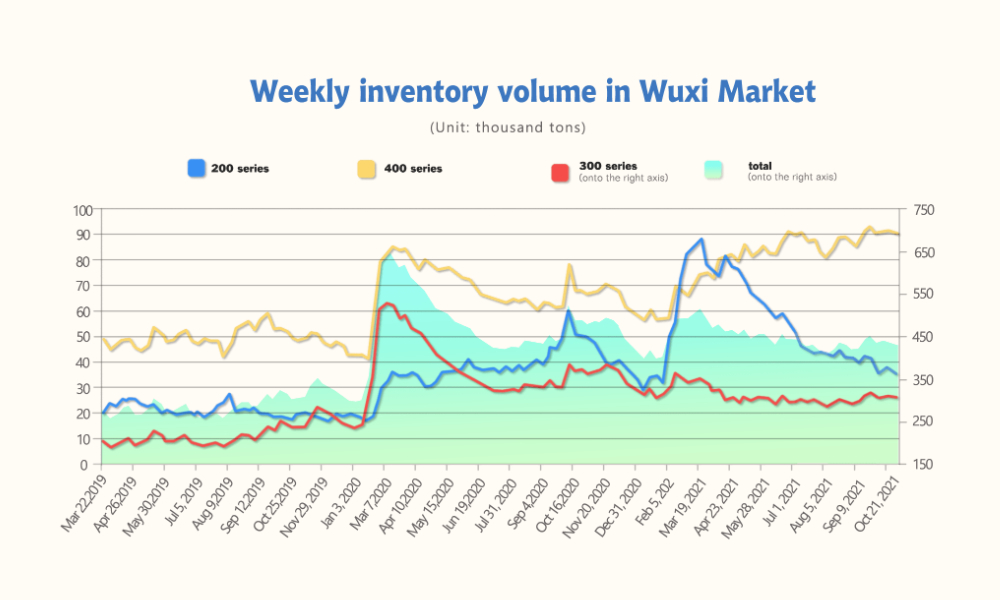

About the inventory, until the end of October, the inventory volume is 305,600 tons which are 1,900 tons lower than mid-October. Under the dual control, the output of stainless steel can hardly increase, and thereby the overall inventory maintains low.

In conclusion, the power limit and production recovery coexist. Compared to September, the power limit policy is looser in October. The government keeps adjusting the prices of coal, which also influences the prices of stainless steel futures. But with the power supply is enlarging, the production and inventory of 300 series are going to increase. It is predicted that the base price of the CR products will reduce by US$45/MT, lowering to around US$3,350/MT.

200 series: Volume of inventory decreases, while that of trading did not turn better.

Last week, the inventory volume is 35,300 tons which decreases by 1,500 tons compared to a week before.

The prices of 200 series in Wuxi market were stable at first but later began to drop. Influenced by the weakened transaction, the prices kept falling. Until October 29th, the average price of the CR mill-edge 201J2 sheet was US$2,145/MT which is about US$8/MT higher. Currently, the price difference of 201J1 between CR and HR widens further to US$215/MT. Earlier, the base price of the mill-edge CR 201J1 maintains at US$2,200/MT; the price of J2 and J5 was US$2,090/MT, and the 5-foot HR products were around 1,985/MT.

Recently, the dual control policy is laxer. In the 4th quarter, to the Chinese market, it is a peak season for the electric appliances makers. Some downstream industries have been recovered but it is yet to influence the stainless steel industry. Not until November, will the trading situation turns better. However, the production control is still working on the steel mills. For example, Guangqing has not met the goal of lower energy consumption. In November, the steel mill will still be in suspension and it is possible that it won’t reopen in the rest of the months of 2021. The prices of 200 series will remain.

400 series: Demand is tepid.

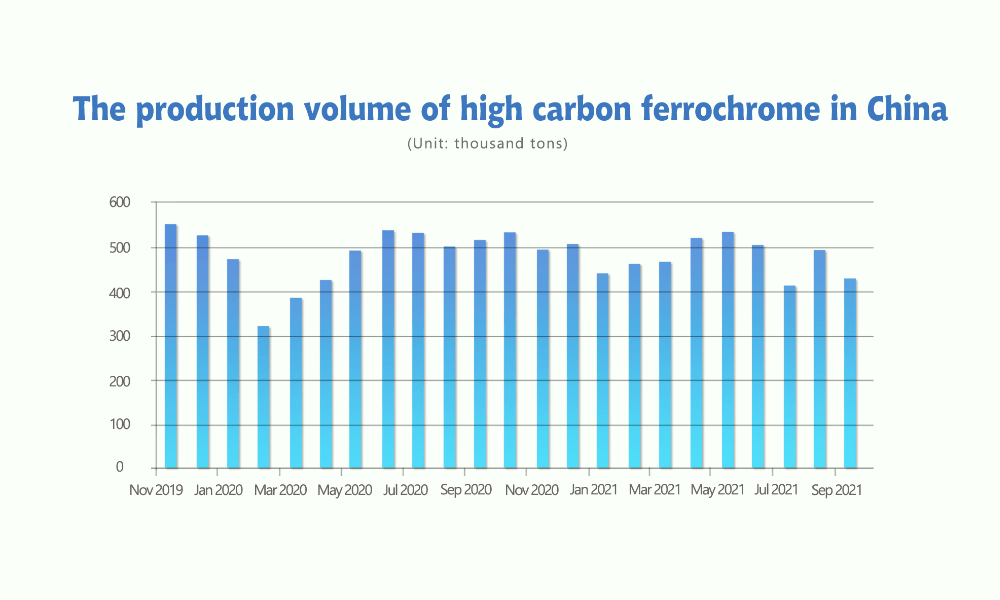

It is reported that in the major high chrome production provinces, the power supply increases. The high chrome production volume will increase significantly in October.

In November, the production lines of stainless steel will recover from the previous shutdown. However, the 400 series has been ineffective in inventory consumption. Though the inventory last week dropped by 60 tons, 90,200 tons of inventory is still large.

The high chrome purchasing price given by Tsingshan Group in November is US$1,658/MT(tax inclusive, to factory in cash), which is MoM increases by US$80/50 base tons. But the price maintains as the market quotation, which is reasonable. The cost of 400 series is high, and the demand is tepid. Therefore, the market will probably sell at lower prices. It is predicted that the price of 430/2B will decline by US$15/MT and the actual trading prices will be US$1,805/MT-US$1,820/MT.

DOWNSTREAM: Is the demand actually stable or facing challenges?

In September 2021, the production of the automobile is 2,186,000 vehicles in one month, MoM increased by 26.07%, and YoY decreased by 13.7%; from January to September, the production is 18,554,000 vehicles per month, MoM increased by 9.4%. The chip supply shortage has eased slightly, but it still cannot meet production needs. Affected by the high base in the same period, it still shows a rapid decline year-on-year.

In the fourth quarter, the consumer demand for the automobile market is expected to remain stable, but the supply-side uncertainty remains large. The overall supply of chips in the fourth quarter is expected to be better than in the third quarter, but the chip supply is still in short supply. Rising electricity charges and the high prices of raw materials will further increase the cost pressure on the enterprises. Except for the chip supply shortage, the global automotive supply chain is also encountering another severe challenge. Because of the congestion of marine shipping, the supply of accessories is delayed, the export of automobiles is blocked, and freight prices have risen sharply. These affect various roles in the industrial chain such as OEMs, accessory dealers, and distributors.

The insufficient chips, cargo, shipments are hidden behind the fast-growing automobile industry.

Summary:

300 series: The government keeps adjusting the prices of coal, which also influences the prices of stainless steel futures. But with the power supply is enlarging, the production and inventory of 300 series are going to increase. It is predicted that the base price of the CR products will reduce by US$45/MT, lowering to around US$3,350/MT.

200 series: So far, the inventory of 201 in Wuxi market is decreasing and meanwhile steel mills keep reducing the output. It is predicted that the price of 200 series will remain and increase slightly.

400 series: For now, the production cost is high. But supply will increase and inventory is large. It is predicted that the price of 430/2B will decline by US$15/MT and the actual trading prices will be US$1,805/MT-US$1,820/MT.

Stainless steel futures:

Last week, the stainless steel futures fluctuated and once dropped below US$3,060/MT Because China struck against the high price of coal and the stainless steel futures maintains at around US$3,140/MT.

From the perspective of stainless steel production, thanks to the governmental operations on the coal price, the power supply shortage will reduce and the steel mills won’t be limited by the power limit. To a certain extent, the stainless steel supply side will recover. If the electricity supply enlarges, the tight supply of ferronickel and ferrochrome will get loose, bringing down the stainless steel cost and prices.

From a demand side, the export market is going to enter the slack season. The high price of Chinese stainless steel is not attractive to abroad buyers. Therefore, it is predicted that the export volume will keep declining.

In summary, in a long term, the supply will be enlarged and the prices will face a declining trend.

INVENTORY|| The inventory is being consumed though the trading is weakening.

According to the inventory data, last week the inventory volume in Wuxi’s sample warehouse decreased to 431,111 tons which are reduced by 3,000 tons compared to a week before. The inventory volume of 200 series decreased by 1,500 tons, declining to 35,300 tons; as for the 300 series, it fell by 900 tons, reducing to 305,600 tons; about 400 series, it decreased by 600 tons, lowering to 90,200 tons.

200 series: Last week, Baosteel Desheng delivered the most, about 5,000 tons of products to the market. Tsingshan and Beigang New Materials also had a small number of new arrivals to the market.

300 series: The inventory again reduces, which is the result of the lack of new products from steel mills. Although the dual control policy is less regulated compared to September, the delivery time is different from the different producing periods and production areas. It was reported that GQJS was planning to recover its production on October 18th, but it did not realize it even a week later. For now, the trading is weakened but since the power supply increases, downstream buyers also begin to work, bringing up the demand for stainless steel. It is known that three ships of products from Beigang New Materials are on the way to the market. This week, the inventory will increase.

400 series: From the inventory reduction of last week, the 400 series is of large inventory. The demand and supply both are weak in this series, and thus the inventory will remain high.

RAW MATERIALS|| Prices increase under better power supply and production.

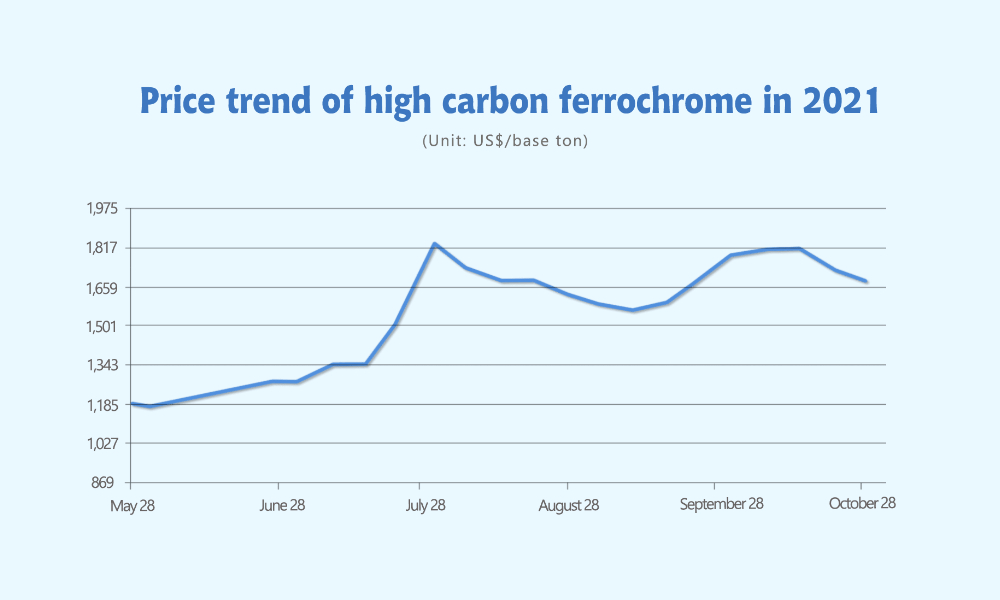

Chrome

Earlier in October, the price of high carbon ferrochrome increased but dropped in the latter part of October. The average EXW price of high chrome in October is US$1,752/50 base tons, compared to the price in September, which was US$1,638/50 base tons, which is US$114 higher, increasing by 7%.

On October 29th, Tsingshan Group settled the purchasing price of high chrome in November at US$1,658/50 base tons (Tax inclusive, to factory in cash), MoM increasing by about US$80/50 base tons.

After the National Holiday in October, the high chrome production volume increased thanks to the increasing power supply to the factories. Although some other areas are still within the power limit, it does not cause a reduction in the chrome output.

As for the import of ferrochrome, in September, China imports 214,300 tons of ferrochrome MoM increased by 64,400 tons, rising by 42.96%.

Entering winter in northern China, the heat supply will cause sharply increasing demand in power supply which will suppress the power supply to the factories. It is predicted that in November, it is difficult to maintain the increase of the high chrome production.

Ferronickel

Last week, the nickel quotation remained around US$242/nickel, which is US$8/nickel higher compared to mid-October.

The price increase lays in the power shortage of the ferronickel factories in various regions. In September, the production of ferronickel fell to 281,100 tons, MoM reducing by 115,400 tons.

Fujian and Jiangsu provinces which are two major production areas are still stuck in the power control. Many factories are yet to recover from the shutdown. Based on this situation, we believe that the production of October is lower than that of September.

The current spot product of ferronickel is tight. Delong, Beigang New materials, ZPSS purchased high nickel-iron in mid-October, which further pushed up the price. The trading price increased from US$237/nickel(tax inclusive, to factory in cash) to US$242/nickel.

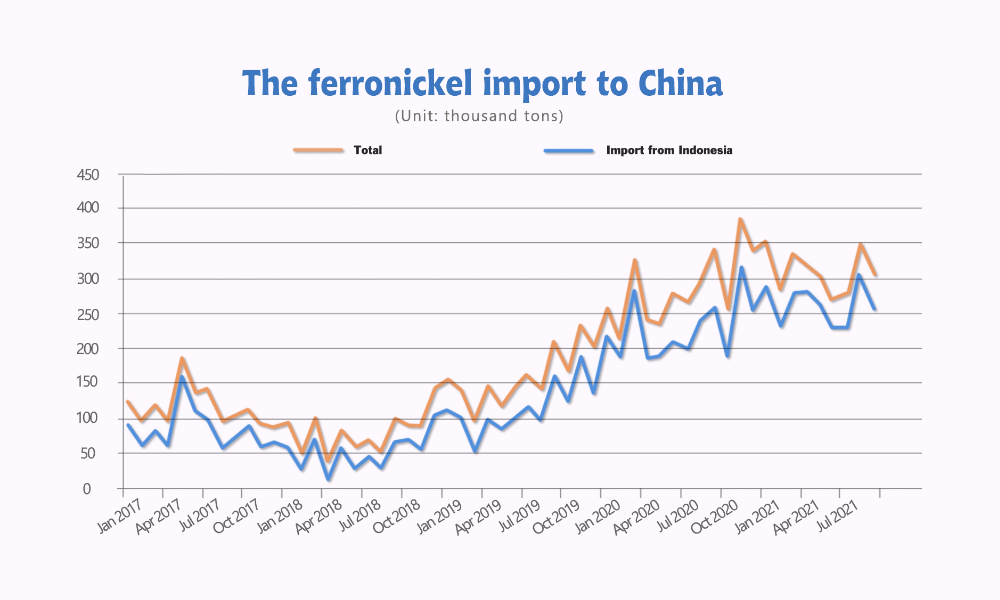

The ferronickel imports from Indonesia also reduce. In September, the import of ferronickel is 306,500 tons, MoM reducing by 12.34%. In October, some ferronickel production lines of Delong Indonesia were shut down because of a power supply error. It is predicted that the imports in October will decrease.

The Philippines is in the rainy season. In the future few months, the import of nickel ore will drop greatly, and thereby the cost will increase. In summary, the supply of ferronickel will tighten up. In a short term, the price of ferronickel will remain expensive.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China