TREND|| The supply increases, and the future price trend tends to decrease.

Last week, the stainless steel price remains to decrease. When the stainless steel supply is recovering as expected, all grades of stainless steel reduces, but the trade was light.

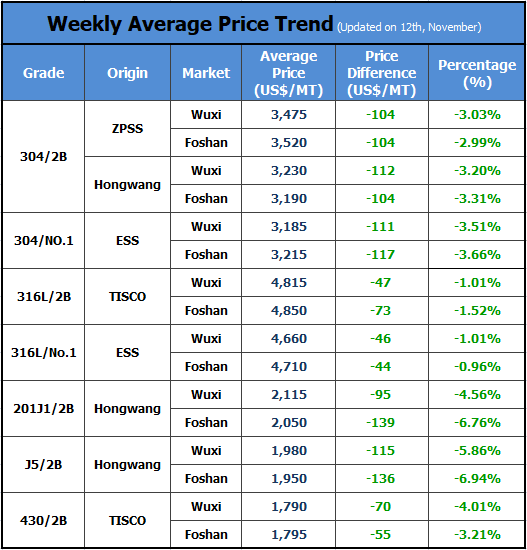

300 series: The price of futures maintains, while the price of spot is weakening.

From the policy side, the real estate tax has awoken the pessimistic emotion towards the market. But recently, the application for a real estate loan is said to be loosened, which eases the negativity to some extend. Besides, with the winter Olympics approaching, the dual control returns to some of the energy-oriented enterprises that have received oral notice from the local government. When the policy begins, the ferrochrome in Inner Mongolia and stainless steel production in Northern China will be reduced.

In the futures market, the futures prices of stainless steel continue to fall, until Friday, November 12th, the main contract fell by US$170/MT, down to US$2,840/NT compared to the price on November 5th. As for the spot market, the price of 304 was fluctuating to drop. Until November 12th, the CR 304 by the private-owned mills in Wuxi market was cut down by US$63/MT, falling to US$3,160/MT. Last week, Guangqing suddenly stopped production and Tsingshan increased the prices of CR/HR 304 excluded to their agents, influencing the market trading price to rise. However, steel mills reduce the price, which depresses the purchasing mood. Until November 12th, the price of HR 304 was down to US$3,140/MT, lowering by US$110/MT.

From the perspective of the raw materials, the EXW quotation of high nickel-iron slightly declined by US$2/nickel, decreasing to US$237/nickel. The price of ferrochrome dropped too, reducing by US$47/50 base ton, to US$1,596/50 base tons. Theoretically, the production cost of CR 304 is around US$2,984/MT. The profit per ton left for the mills is only US$33. The profit is lower and thereby recycling the metal scrap is more profitable. However, it is not easy to buy the 304 scraps. Some steel mills choose to produce 201. The rising production cost of 304 starts to affect the price to increase as well.

Last week, the inventory volume in Wuxi market increased to 425,900 tons, which is 9,300 tons more than a week before. The inventory of 300 series increased by 5,200 tons, reaching 299,600 tons. The trade was bland last week, accelerating the risk of backlog.

200 series: Trading volume heated up and the inventory volume dropped.

Last week, the sample inventory volume of 200 series in Wuxi market was 35,700 tons, which was 600 tons lower than a week before. The 200 series arrival of last week was reduced and meanwhile, the transaction turns better. As a result, the inventory dropped.

The price of 200 series fell last week. Until November 15th, the CR 201J2 coil of mill edge in Wuxi market decreased by US$125/MT in a week and the average price was around US$1,980/MT which was US$115/MY lower than the average price a week ago. As for the HR 5-foot product, the price dropped by US$95/MT during the week, and the average price fell to US$1,965/MT from US$1,955/MT. The price difference between CR and HR narrowed, and not it is around US$205/MT.

At the beginning of the week, the market presented well. The delivery volume of the CR products was 2~3 times over the usual volume. However, it only lasted for one day. Tsingshan opened a new spot price which was US$80/MT lower, which dragged down the market prices. In the following two days, the CR 201 was cut down by US$63/MT. The prices seem to keep decreasing, and Tsingshan again adjusted the price. This time, the price was increased by US$15/MT, which boosted the market and the price stopped falling. As for the 5-foot HR, it showed to be more stable compared to the CR and steadily rose. But the trade was too light to maintain the increasing price trend. Among the decreasing mode, the 5-foot HR 201 can hardly escape from the trend.

400 series: Larger supply and weaker demand made the price go lower.

Last week in the major production areas for high chrome, the power supply was stable, which guarantee the production of high chrome. The spot of high chrome was enough for production. The high chrome production in November keeps rising. It is predicted that the output will increase by 20,000 tons.

Downstream: Higher profitability promotes the industry of integrated cooker.

The sharp increase in the price of raw materials such as stainless steel this year has put a lot of pressure on the integrated cooker industry. Even if listed companies adopt various measures to increase the average price of products, they cannot fully offset the pressure brought by rising costs.

However, in terms of sales and profitability, the situation is fairly good. The retail volume of integrated cookers in the first half of 2021 was 1.37 million units, YoY increasing by 56.3%. From the financial reports of the four listed companies in the third quarter of this year, revenue and net profit have achieved growth. Companies like Martian and Zhejiang Meida are expected to exceed the 2 billion of sales volume by the end of this year. It is expected that the annual growth rate of integrated stoves will be more than 35% in 2021.

Summary:

At present, the pressure on the stainless steel market comes from two aspects: one is the supply shortage. The short power supply in September and October influences the supply to drop significantly. Until November and December, the power supply recovers, and the supply margin has improved significantly. If the discount is narrowed, the market will face settlement pressure. Second, the current spot market is under heavy selling pressure. The market is overwhelmed with the atmosphere of decreasing prices, most people focus on selling and delivering.

In summary, the stainless steel market has already reflected expectations of future cost declines, but under the heavier influence of supply pressure and market selling pressure, spot prices will remain low, and market futures prices are also gloomy.

300 series: The loosened dual control brings a sudden increase to the production, resulting in a reduction in price. Steel mills’ profit margin is narrowed. It is predicted that the CR price by the private-owned mills will keep decreasing. The price will fall at US$3,140/MT~US$3,220/MT.

200 series: So far, the market inventory volume is decreasing, but in the future, steel mills will recover production and the supply will increase. Currently, the price is in a falling tendency, and it is predicted that it will remain.

400 series: Last week, Tisco, Baosteel Desheng, Jisco have given their purchasing price for high chrome, which mostly increased by around US$80/50 base tons. The cost of producing 400 series is getting higher. However, the weak demand and large inventory are suppressing the price. The price of 400 series will decrease as well, down to US$1,690/MT~US$1,705/MT.

Opinion|| Good news, Bad news?

Trading price keeps breaking a new low. On November 12th, the mill-edge CR304 by Delong fell to US$3,060/MT~US$3,080/MT.

Steel mills tried to boost the prices, by lifting up the pickup price to US$3,125/MT. However, the market maintains. The actual pickup prices have been slightly decreased. A source said that if the average pickup price is up to US$3,095/MT, the products are available. But the reality is, merchants won’t accept the price of US$3,095/MT because the spot price in the market has gone below it. A pickup price of US$3,095/MT means an instant loss.

Whether Guangqing is going to recover from suspension is gradually losing its impact on the market. With the weakening demand, people are losing faith. But to some other people, they still hold an optimistic view towards the market, believing the prices will have chances to increase.

Firstly, due to the Winter Olympic Games which will be hosted in Beijing, provinces nearing Beijing will carry out the production suspension to keep the environment clean. Some raw material factories in Northern China have received oral notice from the government, saying that they closedown from January 20 to February 20. It is a good chance for the market to hype. Besides, downstream inventory is decreasing. The future purchase demand will support the prices to increase. What’s more, from the perspective of futures, the current stainless steel futures drop way too much. The copper futures are rising, which will bring the metal market up. The stainless steel market will not be an exception.

On the other side, people who are against the forecast of rising trends feel gloomy because they think the hype is meaningless when it is now the end of 2021 if you don’t earn it actually.

The agents of the large stainless steel mills are holding large inventories. But before the new year, it is expected that the supply will keep increasing. “Stainless steel mills in Northeastern China will have a production plan for 304. We will not worry about lack of supply but loss the confidence of the price”, a source said.

On, November 16th, some people noticed that the futures have a tendency to rise, and they guess the price of stainless steel has hit the bottom low and will start to increase soon.

Raw Material|| Dual control is making a comeback.

Chrome: Steel mills shall stock up now.

On November 12th, the dual control returns to Inner Mongolia because of the winter Olympics. Some high chrome producers in Zhendi, Inner Mongolia have received an oral notice from the government, announcing that the production will be stopped from January 20th to February 20th. The official document is yet to issue.

The winter Olympics is approaching. Concerns about dual control are rising in the stainless steel industry.

From February 4th to 20th, 2022, the Winter Olympics will be held in Beijing for 17 days. This is the first time China holding the Winter Olympics which is of great significance.

Now that the northern region will enter winter, and the demand for heating will increase. The use of coal and electricity will continue to rise, coupled with the increase in windy weather in northern winter, it is possible to cause pollution and smog. We can see the dual control is on the corner to maintain the air clean during the Spring Festival and Winter Olympics. Even in the area around Beijing, the "dual control" will alarm in advance.

There are two months from the Game, but the dual control has been overwhelmed in the market. Inner Mongolia, the biggest ferrochrome production area in China, will be the emphasis of the control. Although the official document did not issue yet, various news is spreading already. Some said the control will begin on December 31st, lasting for 45 days; while others said it will start on January 24th. Lasting for 30 days. The production to be stopped fully or partly is still unclear now, but the news has reached more provinces such as Shandong.

Currently, the dual control seems to be set in stone to the energy-oriented factories in Inner Mongolia, Shanxi, Shandong, Hebei, Liaoning, and other provinces nearby Beijing. To steel mills, it is necessary for them to stock up now.

Nickel: The decreasing trend is conveyed to nickel from stainless steel.

Nickel in Shanghai Metal Exchange was fluctuated to increase last week. The price returned above ¥145,000.

About the nickel ore, the price was stable last week; the inventory remains the same as the same period of last year. Purchasing desire is low, and the cost of ferronickel is high, which will bring down the price of nickel ore.

The price of ferronickel slightly decreased last week, at around US$235/nickel. Due to the gloomy stainless steel market, it is predicted that the price of ferronickel will fall in a short term.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China