Elon's trip to China seems to gain a lot. Will Tesla's super factory in Shanghai bring some confidence to foreign investment in China? As Beijing is getting comparatively engaged in abroad businesses, perhaps it is a sign of a call-back of a manufacturing boom. Last week, prices of stainless steel 200 series and 300 series remained to rise before the May Day holiday. The most traded contract hit the highest point since 2024, reaching US$2160/MT. Spot inventory declined as the demand and prices went up. Inventory in Wuxi dropped by over 30,000 tons in a week. However, the consumption before the holiday falls short of expectations. This might offset the strong support from the ore prices, and the stainless steel prices tend to fluctuate. Global demand for stainless steel in March increased. China's export volume, in terms of stainless steel flat products, rose by 41,000 tons month-on-month, greatly increasing by 84.5%. Sea freight also gone wild lately because of the unsolved problems in the Suez Canal and the Panama Canal. A report even predicts the sea freight a rise of over 2.5 times from 2024 to 2025. Keep reading our Stainless Steel Market Summary in China, if you want to know the details about the market.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,180 | 35 | 1.72% |

| Foshan | 2,220 | 35 | 1.68% | ||

| Hongwang | Wuxi | 2,090 | 33 | 1.72% | |

| Foshan | 2,080 | 26 | 1.37% | ||

| 304/NO.1 | ESS | Wuxi | 2,020 | 29 | 1.56% |

| Foshan | 2,015 | 36 | 1.95% | ||

| 316L/2B | TISCO | Wuxi | 3,645 | 58 | 1.69% |

| Foshan | 3,715 | 56 | 1.58% | ||

| 316L/NO.1 | ESS | Wuxi | 3,535 | 58 | 1.75% |

| Foshan | 3,545 | 71 | 2.12% | ||

| 201J1/2B | Hongwang | Wuxi | 1,390 | 11 | 0.88% |

| Foshan | 1,385 | 7 | 0.55% | ||

| J5/2B | Hongwang | Wuxi | 1,305 | 11 | 0.94% |

| Foshan | 1,300 | 7 | 0.59% | ||

| 430/2B | TISCO | Wuxi | 1,225 | -1 | -0.12% |

| Foshan | 1,235 | 0 | 0.00% |

TREND|| Stainless steel futures hit US$2,160/MT, highest of the year.

Last week, the spot prices for the three series of stainless steel in the Wuxi market remained stable with slight increases observed in the 200 series, while the 300 and 400 series maintained stable operations. Steel mills implemented price limits, resulting in fluctuating prices for futures and spot products, with the highest point reaching US$2160/MT, a new high for the year. Demand gradually recovered, and inventory decreased noticeably. As of last Friday, the main contract price for stainless steel decreased to US$2125 per lot, a fall of 0.07%.

300 series: futures prices surged before falling back.

Last week, prices in the 304 market in Wuxi fluctuated and retreated. As of Friday, the mainstream base price for cold-rolled 4-foot mill-edge stainless steel 304 in Wuxi remained unchanged at US$2040/MT, and the price for hot-rolled coils was US$2015/MT, both from last Friday. The market experienced fluctuations during the week, with futures prices initially rising before falling back. Most traders' prices declined, influenced by macroeconomic news. Raw material prices rose, and Tsingshan continuously raised opening prices. Spot prices fluctuated and adjusted during the week, with market sentiment dominated by observation. Purchases were mostly made on dips, and transactions for the week were average.

200 series: prices boosted by pre-holiday stockpiling.

Spot prices for 201 in the Wuxi market mostly rose. As of last Friday, the mainstream base price for cold-rolled 201J1 in Wuxi rose by US$7/MT from last Friday to US$1360/MT; the base price for J2/J5 cold-rolled coils rose by US$7/MT to US$1275/MT; and the mainstream price for five-foot hot-rolled stainless steel rose by US$7/MT to US$1340/MT. Stimulated by the significant increase in non-ferrous metals, stainless steel followed suit, stimulating consumer buying desires. Pre-holiday stocking demands were released, resulting in good market transactions in recent times.

400 series: prices remained stable.

Last week, TISCO's guide price cold-rolled for 430 was US$1465/MT, and JISCO’s guide price for cold-rolled 430 was US$1585/MT, both up US$7/MT from last week. The mainstream price for national 430 cold-rolled stainless steel in Wuxi was US$1225/MT-US$1235/MT, and the price for hot-rolled 430 was US$1130/MT, both unchanged from last week.

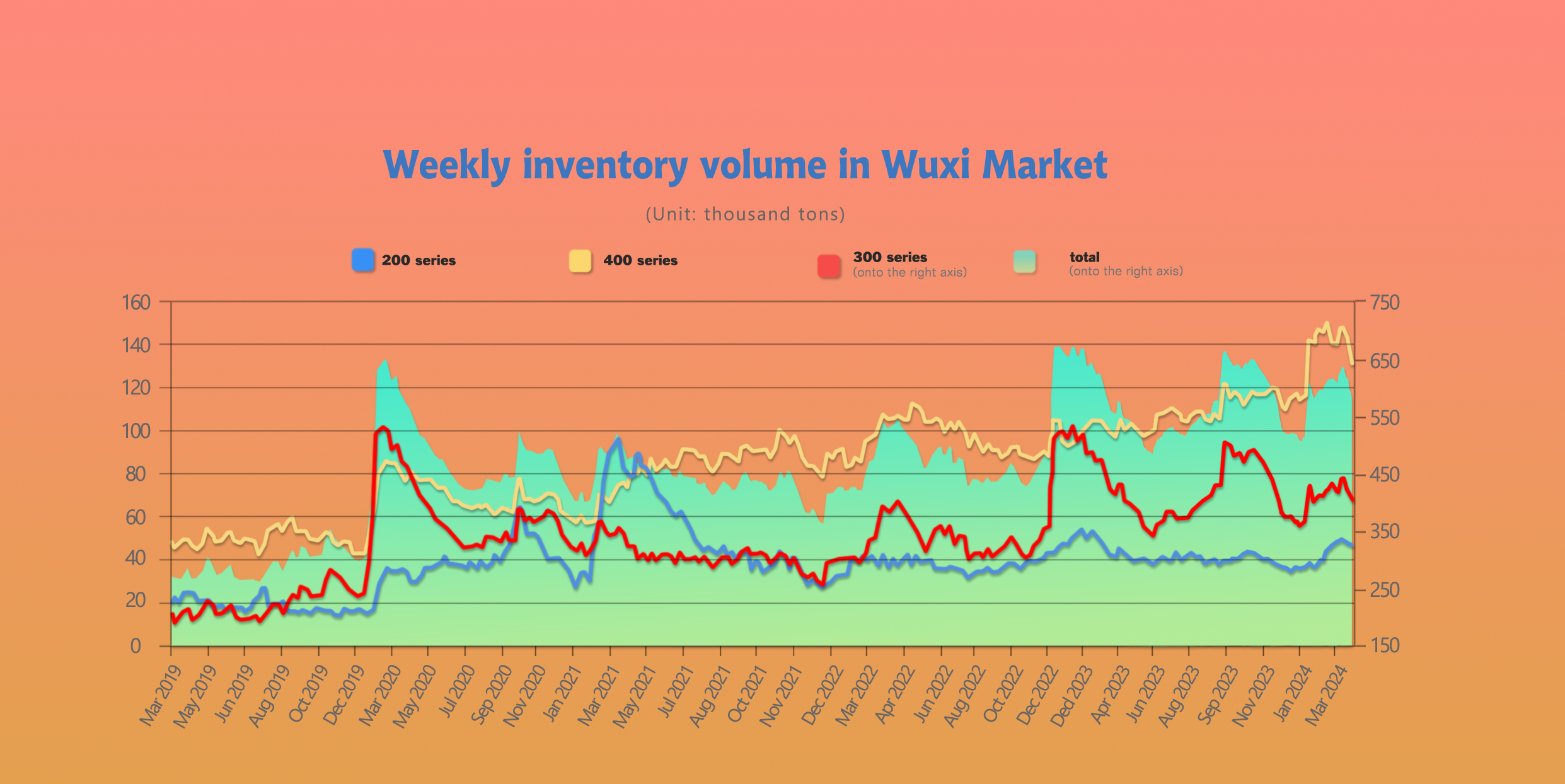

INVENTORY|| The supply-demand relationship has improved, with a decrease in inventory by 30,600 metric tons.

The total inventory at the Wuxi sample warehouse downed by 30,581 tons to 581,479 tons (as of 25th April).

the breakdown is as followed:

200 series: 1,050 tons down to 46,416 tons,

300 Series: 17,385 tons down to 404,253 tons,

400 series: 12,146 tons down to 130,810 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| April 18th | 47,466 | 421,638 | 142,956 | 612,060 |

| April 25th | 46,416 | 404,253 | 130,810 | 581,479 |

| Difference | -1,050 | -17,385 | -12,146 | -30,581 |

300 Series: Increase in arbitrage on the market, reduction in cold-rolled inventory!

Steel prices rollercoastered last week. Futures prices hit a yearly high, and spot prices followed suit with a jump in the first half. However, excitement faded in the latter half, leading to a retreat and range-bound volatility.The price surge enticed steel mills to buy for arbitrage, expecting more cold-rolled resources to enter the market. Spot market sentiment also rose with the price increase, leading to more transactions compared to the previous week. Additionally, social inventory continued to decline due to lower arrivals. Profit margins for steel mills improved based on current raw material and sales prices. This comes after a period of discounts and production control by mills in April, which helped demand recover gradually. Inventory is expected to continue falling next week.

200 Series: Improved demand, continuous inventory reduction for 201!

Steel mills received fewer deliveries last week, easing pressure on supply. This coincided with a gradual improvement in the overall economy, which boosted demand and led to a reduction in stockpiles. Price volatility, with an initial surge followed by a retreat, kept market participants cautious. As a result, there was little speculative buying activity. Looking ahead, expect short-term spot prices for 201 steel to experience some fluctuations, potentially with an upward trend.

400 Series: High-level inventory reduction, stable price operation!

Business in Wuxi's steel market picked up last week, driven by a gradual recovery in downstream demand. Steel mills also encouraged settlements and deliveries, leading to a significant reduction in pre-stocked inventory. This resulted in a noticeable decrease in inventory pressure, particularly for the 400 series.

RAW MATERIAL|| The prices of ore materials are rising.

High-chromium prices remained flat last week. The mainstream EXW price for primary materials held steady at $1310-$1340 per 50 reference tons, similar to the previous week. While chromium iron prices stayed stable, coke prices continued to climb. This slight increase in overall production costs was offset by stable chromite ore spot prices, thanks to recent expectations of rising domestic production and imports.

May is expected to see mainstream steel mills initiate bidding and purchasing activities. The industry also anticipates new steel procurement policies before the upcoming holiday. These combined factors are putting the high-chromium market in a wait-and-see mode for May, with prices likely to remain temporarily stable.

SUMMARY|| Pre-holiday stocking of stainless-steel falls short of expectations, attention shifts to steel mill output.

Mainstream steel mills are controlling prices, and the performance of the raw material market remains relatively strong. Therefore, stainless steel still has support in the short term. However, it ultimately depends on downstream consumption capacity. Hence, future focus will be on the pressure brought by steel mills to the supply side, changes in social inventory, and the extent of downstream demand recovery. Given the weak background of pre-holiday stocking, prices are expected to have minimal fluctuations.

300 Series: Rising raw material costs are boosting steel mill profits and price support. Combined with the May Day holiday, demand may rise, leading to short-term price volatility for cold-rolled 304. Focus will then shift to post-rebound transactions and inventory levels.

200 Series: Prices for 201 are rising with depleting inventory. May's purchasing activity will test market acceptance. Price trends depend on future transaction conditions. Expect short-term spot prices for cold-rolled 201J2 to range from US$1270/MT to US$1340/MT.

400 Series: Most steel mills are operating at a loss and desire price hikes, but market sentiment remains cautious with demand-driven purchases. With downstream demand slowly recovering, expect short-term prices for 430 to remain stable.

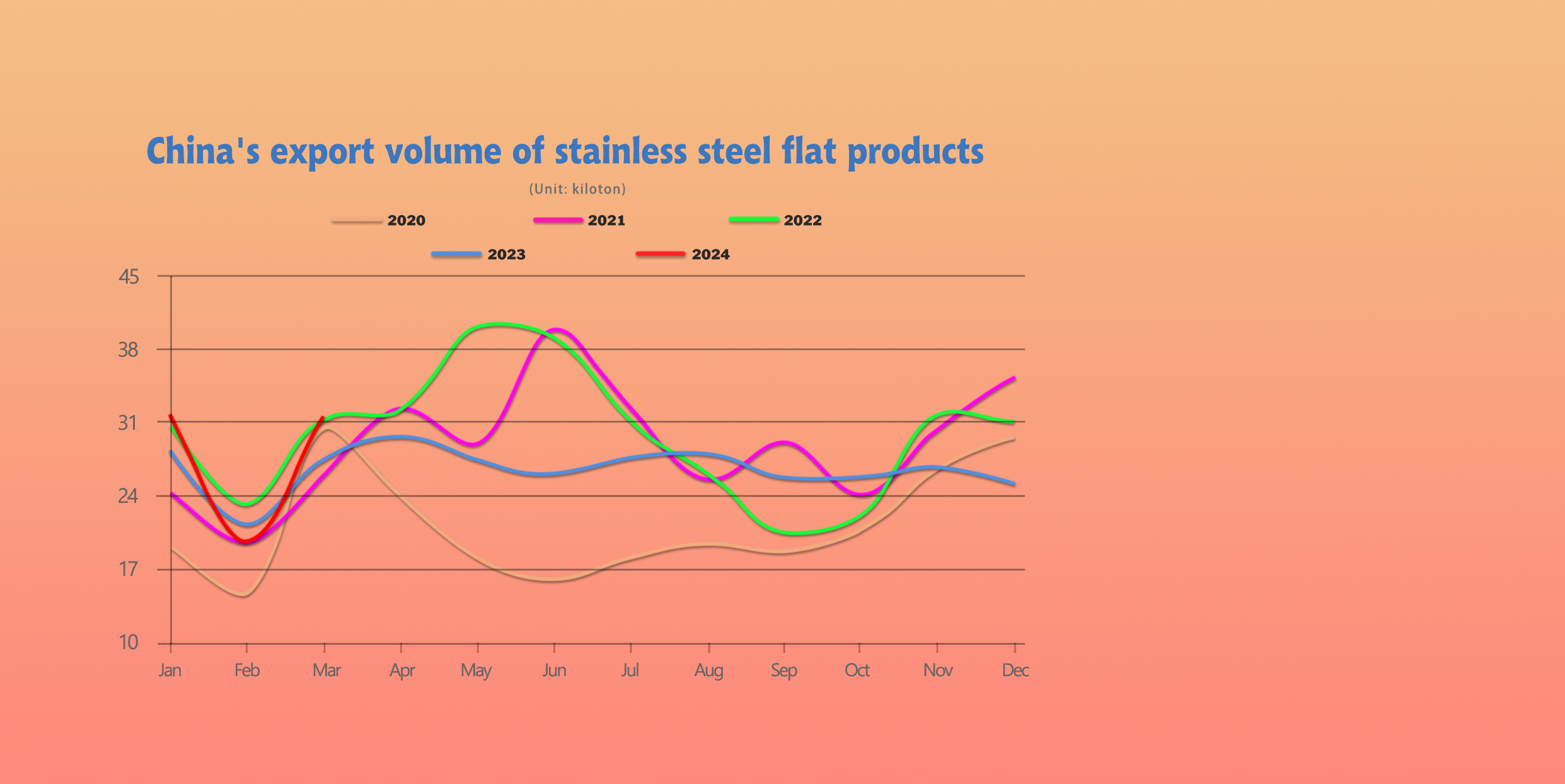

EXPORT|| Stainless Steel Coil Exports Grow in March.

Stainless steel coil exports from China increased in March, driven by a surge in shipments of coils with a width of 600mm or more. Hot-rolled coil exports rose by 41,000 tons month-on-month, an increase of 84.5%, while cold-rolled coil exports increased by 70,000 tons month-on-month, a gain of 55.5%.

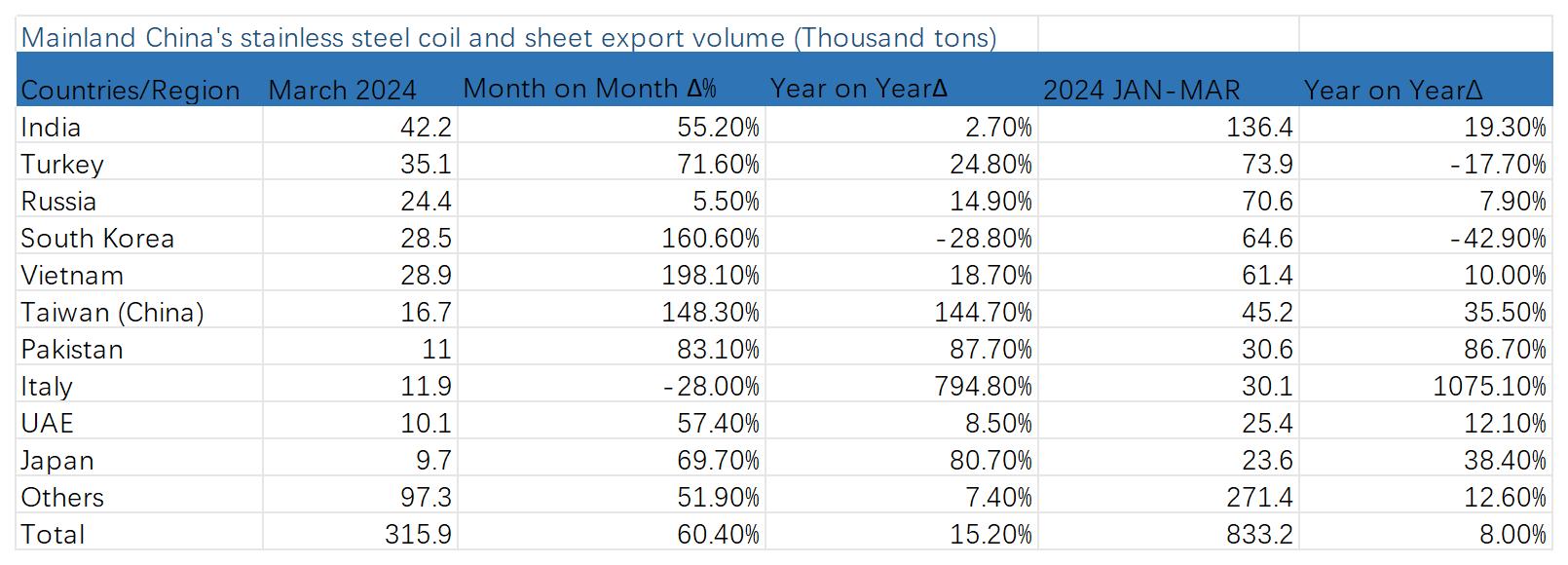

Top 10 Export Destinations.

In March 2024, the top 10 destinations for stainless steel coil exports from mainland China accounted for approximately 218,600 tons of volume, or 69.19% of the total.

For the first three months of 2024, the cumulative volume of stainless-steel coil exports to these top 10 destinations reached approximately 561,800 tons, representing 67.43% of the total.

Sea Freight|| freight rates for long-haul routes.

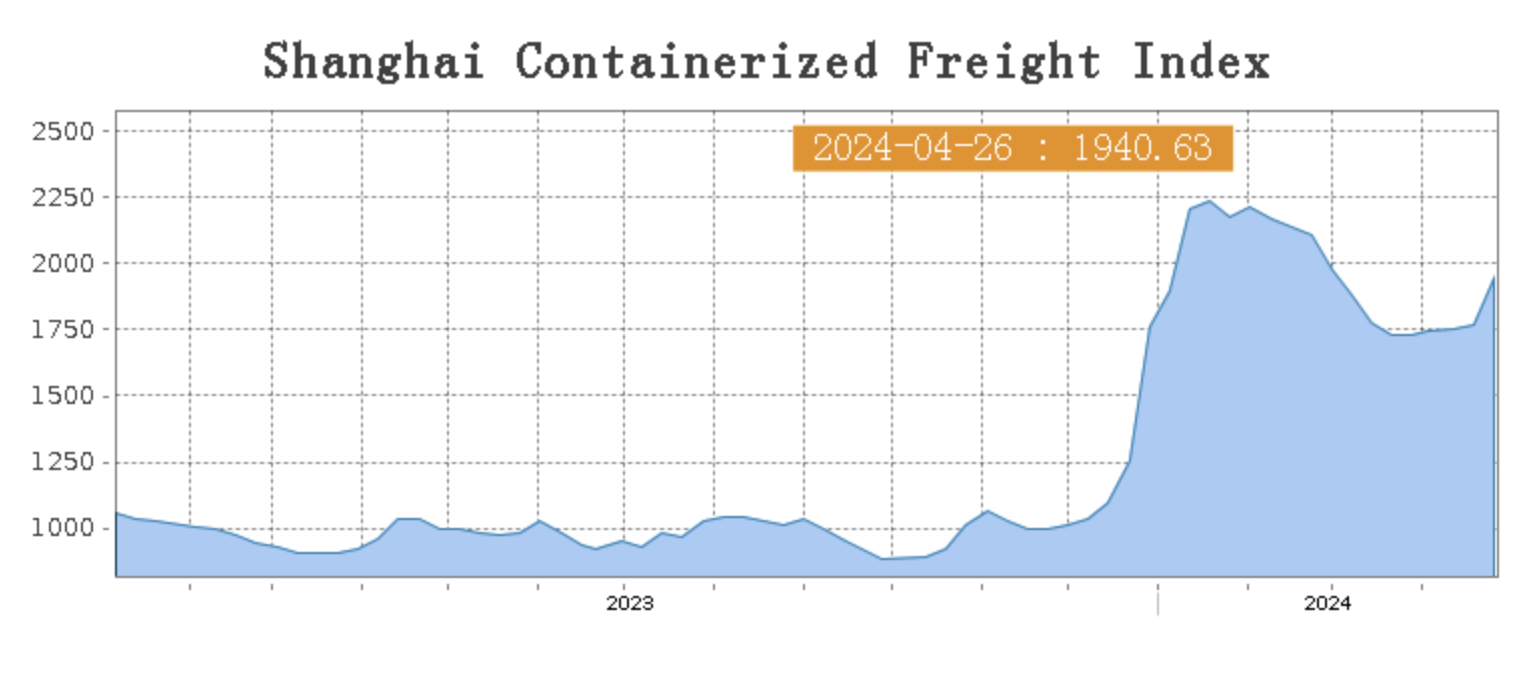

China's Containerized Freight market continued to be interrupted by the regional fluctuation. On 26th April, the Shanghai Containerized Freight Index rose by 9.7% to 1940.63.

Europe/ Mediterranean:

Recently, several liner companies have announced that they will raise freight rates for voyages on the Europe-Mediterranean route starting from May 1. The rate increases will range from US$100 to US$500/TEU.

On 26th April, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1971/TEU, which slide by 1.3%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3235/TEU, which lifted 6.1%.

North America:

According to data released by the US Department of Commerce, US durable goods orders increased by 2.6% month-on-month in March, exceeding market expectations.

On 26th April, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$3602/FEU and US$4661/FEU, reporting a 13.4% and 14.5% surge accordingly.

The Persian Gulf and the Red Sea:

On 26th April, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 0.7% from last week's posted US$2047/TEU.

Australia/ New Zealand:

On 26th April, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$929/TEU, a 8.9% jump from the previous week.

South America:

On 26th April, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$4623/TEU, an 11.3% growth from the previous week.