Happy Mid-Autumn Festival! The Chinese market will stay silent for over 8 days and the financial market will stop running until October 8th and officially open on the 9th. The 10 blank days leave many uncertainties in the market. What do you think about the stainless steel market after the long holiday? But the week before the holiday was quite sluggish and the stainless steel prices went down. Although the market tends to turn better after the holiday based on the past ten years, this year, it is hard to say people will have confidence. The spot inventory continued to rise, causing worry about stacking stock in the future. Oversupply is a serious problem. It is not easy to fix because it is extremely costly for steel mills to reduce and stop producing. Not to mention that the closure will undoubtedly cause thousands of unemployment. The stable export volume helps to relieve the stress to a certain extent, but as long as the demand remains like this, production reduction is meant to be the final topic that everyone in the industry has to face. If you want to know more about the market dynamics, please swipe down to Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,330 | -3 | -0.13% |

| Foshan | 2,370 | -3 | -0.12% | ||

| Hongwang | Wuxi | 2,250 | -4 | -0.19% | |

| Foshan | 2,250 | -8 | -0.39% | ||

| 304/NO.1 | ESS | Wuxi | 2,170 | -6 | -0.27% |

| Foshan | 2,190 | -3 | -0.13% | ||

| 316L/2B | TISCO | Wuxi | 4,060 | -7 | -0.18% |

| 4,090 | -8 | -0.22% | |||

| 316L/NO.1 | ESS | Wuxi | 3,900 | -10 | -0.26% |

| Foshan | 3,915 | -8 | -0.22% | ||

| 201J1/2B | Hongwang | Wuxi | 1,405 | 7 | 0.54% |

| Foshan | 1,400 | -1 | -0.11% | ||

| J5/2B | Hongwang | Wuxi | 1,325 | 0 | 0% |

| Foshan | 1,310 | -6 | -0.46% | ||

| 430/2B | TISCO | Wuxi | 1,290 | 0 | 0% |

| Foshan | 1,275 | 0 | 0% |

TREND|| Demand recovery is short of expectations.

The stainless-steel market was running weakly last week, and it is not likely to perform a decent change before the national holiday.

The mainstream contract price of stainless steel closed with a 1.81% drop at US$2220/MT, and it had hit US$2205/MT once during last week.

The spot price of stainless steel was also weakening: stainless steel 201 was stable after a growth and 304 fell after a growth; stainless steel 430 remained stable. There was no significant change in the supply-demand structure as the demand recovery was weaker than expected.

Stainless Steel 300 series: The price movement is still bearing pressure.

The market price of the 300 series had a mixed performance last week: the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 had a US$21 plunge to US$2190, and hot-rolled stainless steel fell US$14 to US$2185/MT. The spot price was in a weak trend but overall stable in the early last week, but it followed the deep dive of the future price on Thursday.

The drama of Indonesia’s mining quota distribution ended in disappointment, the country will not approve any new mining output quotas for the rest of this year, government official Septian Hario said last Tuesday.

Stainless steel 200 series: The market performance is walking contrary to the peak season

The spot price of stainless steel 201 in the Wuxi market closed at a stable trend after growth last week: the mainstream base price of stainless steel 201 and 201J2/J5 rose US$7 to US$1380/MT and US$1295/MT respectively; the 5-foot hot rolled stainless steel remain unchanged at US$1315/MT.

Stainless steel 400 series: Prices remained flat

TISCO lifted US$7 for the market guidance price of stainless steel 430/2B and quoted US$1420/MT, JISCO did not make any adjustment and quoted US$1525/MT.

Baowu Steel’s EXW price for cold-rolled stainless steel 430 was quoted as US$1565/MT.

The quoted price of stainless steel 430/2B in the Wuxi market maintained a stable trend at between US$1290/MT-US$ 1295/MT; the mainstream quote price was US$1135/MT.

INVENTORY|| Over 20,000 tons of increment causing the risk to remain

The total inventory at the Wuxi sample warehouse rose by 21,948 tons to 573,085 tons (as of 21st August).

the breakdown is as followed:

200 series: 671 tons up to 39,635 tons

300 Series: 18,206 tons up to 426,463 tons

400 series: 3,071 tons up to 106,987 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| September 14th | 38,964 | 408,257 | 103,916 | 551,137 |

| September 21st | 39,635 | 426,463 | 106,987 | 573,085 |

| Difference | 671 | 18,206 | 3,071 | 21,948 |

Stainless steel 300 series: The destocking might take longer than expected

The inventory of cold-rolled inventory recorded the 6th consecutive weekly growth which is also the longest growth in 2023. The acceleration of warrants was slowed while the spot goods were stacking up high. Production in September is keeping a high work rate, and numerous steel mills are announcing their maintenance plan for the last quarter. The digestibility will face a serious test in this peak season.

Stainless steel 200 series: transaction was missed forecasts

The short supply of stainless steel 200 series might worsen in the short term as another leading steel mill will suspend production for 40 days due to power switching and equipment maintenance, the halt is estimated to be half the crude steel production of grades 304 and 201.

Stainless steel 400 series: Destocking slowed

The hiking production cost once again forced the producers to lift the guidance price, but the downstream buyers begged to differ with the price, which led to a slow digestion. The downstream demand is estimated to recover to a certain level.

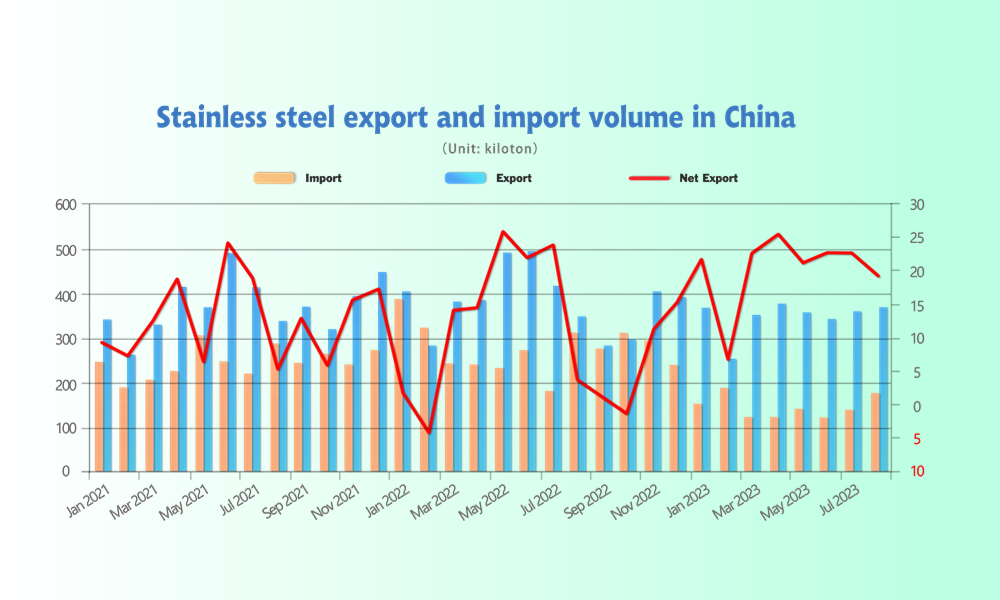

EXPORT|| Oversupply saved by the export figure.

China’s export harvests a decent grade sheet in the first half year of 2023 as the RMB is depreciating against the US dollar.

China’s stainless steel export volume has been roaming around 350,000 tons for 6 months, and it is somewhat relieving the oversupply pressure. In August, there were about 366,200 tons of stainless steel shipped outward, a 1.77% increase month on month and, a 5.63% increase year on year; totaling 2.764 million tons.

Hence, the net export surged to 190,000 tons in August and quadrupled the figure for the same period last year! The total net export from January to August amounts to 1.61 million tons with a 59% year-on-year increase.

RAW Material|| Indonesia to put mining quota distribution on hold.

The global nickel market had a surplus of 28,600 metric tons in July, compared with a surplus of 15,900 tons in the same month last year, data from the International Nickel Study Group (INSG) showed on Thursday. That compares with a surplus of 25,400 metric tons in June 2023, Lisbon-based INSG added.

According to Eskom’s Week 36 system status report, the South African power utility projects that over the next 52-week period, rolling blackouts, known as loadshedding, will be much worse than it has ever been. In a cabinet reshuffle in May, President Cyril Ramaphosa created a ministry of electricity to deal with the country’s power woes. Last month, Ramaphosa stated that the work of the ministry would ensure that loadshedding was a thing of the past by 2024.“Energy has been a great drawback to us, but we are working on it, and we are certain that by 2024, the energy crisis will be over,” he said.

Indonesia will not approve any new mining output quotas for the rest of this year, the government official Septian Hario said last Tuesday.

There was no significant movement in ShFe nickel and stainless steel future on Wednesday despite the drama in Indonesia, the mainstream contract price close at US$2260/MT with a 0.56% (or US$5.5) growth, and ShFE nickel lifted by 1.26%(or US$282/MT) to US$22895/MT.

MACRO|| Mexico and Brazil raised the tax on stainless steel product

Brazil to end import tax reduction for some steel products

The Brazilian foreign trade chamber(Camex)announced that the import tax for some steel products will be increased by 10 percent on September 30.

By request of steel-consuming sectors, Camex had authorized 2022 a 10-percent import tax reduction due to accusations of"abusive steel prices” in the Brazilian domestic market.

The tax reduction was originally established to be valid until Dec. 31, 2023, but the government accepted a request by steel producers to end the program earlier, based on claims that the country's steel imports have increased by a wide margin,” with variations of up to 714 percent,” according to Camex.

According to the country's steel institute IABr, Brazilian steel imports during the January-August period of 2023 increased on a yearly basis by 49.5 percent to 3.19 million mt.

With the decision, the import tax for most steel products will return to the 9.6 to 12.8 percent range, covering plates, coils, HRC, CRC, galvanized flat products, aluminum-zinc coated products, wire, rod, stainless steel long products, seamless pipes, and seamed pipes.

Below are the current and new tax rates related to stainless steel:

7219: increasing from 11.2% to 14%

7210: increasing from 9.6% to 12%

7304: increasing from 12.8% to 16%

As for Mexico...

On 15 August 2023, the President of Mexico, Andres Manuel Lopez Obrador, published a Decree amending the Tariff Schedule of the General Import and Export Duties Law. The decree focuses on the implementation of temporary import duties ranging between 5% and 25% on goods classified in 392 tariff items covering steel, aluminum, bamboo, rubber, chemical products, oils, soap, paper, cardboard, ceramic products, glass, electrical material, musical instruments, and furniture. These temporary duties are applicable as of 16 August 2023 and until 31 July 2025.

Among the products listed in the decree, are stainless steel and coated steel from China and Taiwan China, cold-rolled plates from China and South Korea will be deeply affected by the tariff.

It is understood that stainless steel from China and Taiwan China is taking up 1.3% of the total export volume to Mexico.

Sea Freight|| Affected by the powerless demand, Feight rate continued to slide.

China’s Containerized Freight market was overall stabilized, but the demand recovery hit a bottleneck. On 22nd September, the Shanghai Containerized Freight Index fell by 3.9% to 911.71.

Europe/ Mediterranean:

The CPI in the eurozone has been lifted up for August to 5.2%, according to the latest figures from Eurostat, and it is the 10th times for Eurostat to revises the interest rate.

On 22nd September,, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$623/TEU, which fell by 5.3%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1217/TEU, which fell by 2.5%

North America:

On 22nd September, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1790/FEU and US$2377/FEU, reporting a 5.2% and 6.8% decline accordingly.

The Persian Gulf and the Red Sea:

Until 22nd September, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 5.7% from last week's posted US$815/TEU.

Australia/ New Zealand:

Until 22nd September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$610/TEU, a 1.1% dive from the previous week.

South America:

The freight market had a slight rebound. on 22nd September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1793/TEU, an 1.3% fall from the previous week.