Updated on December 15th: The stainless steel market in China is volatile. According to the latest market situation, the prices are going up because steel mills reunite to cut down the stainless steel output of 200 series. Three days ago, before steel mills take action, the stainless steel price had remained decreasing for almost 6 weeks and most people were pessimistic about the market. Within only two months, the price of stainless steel 304 has dropped by US$879/MT compared to the highest price in October which is US$3,570. About the stainless steel market summary in China, we took a look back to the sluggish market last week. Is it a good time to purchase when the prices seemed to be waken?

Last week, the prices of stainless steel remained the decreasing tendency. Steel mills did not stop producing and their productivity has recovered, resulting in a large inventory of stainless steel stacked in the market. The prices of stainless steel spots decreased as well as the prices of futures. Until last Friday, December 10th, the main contract of stainless steel futures dropped by US$167/MT, to US$2,655/MT.

Last week, the prices of stainless steel futures remained to fall. Until last Friday, the price of the stainless steel futures decreased by US$167/MT to US$2,655/MT compared to December 3rd. On December 9th, Tsingshan opened the price of cold-rolled stainless steel at US$2,655/MT which was US$223/MT lower than the last opening price. Influenced by the low opening price, the prices of spots started to decrease. Until Friday, in Wuxi market, the price of the cold-rolled stainless steel 304 of the private-owned mill has dropped by US$159/MT to US$2,670/MT. Rumor has it that there will be more cold-rolled stainless steel coils imported from Indonesia recently. Thereby, the futures prices fell and the price difference between futures of January and February narrowed down.

As for the inventory, the total inventory of the Wuxi’s sample warehouse increased by 13,400 tons, to 436,600 tons. Among, the inventory of stainless steel 300 series increased by 7,700 tons, to 299,700 tons. The increase in the inventory is the cold-rolled stainless steel.

Until December 10th, the cold-rolled stainless steel 201 in Wuxi market dropped by US$56/MT, quoted at US$1,610/MT; as for the price of 5-foot and hot-rolled stainless steel 201 remained as last week, at around US$1,590/MT.

The inventory of the stainless steel 200 series in Wuxi’s sample warehouse increased by 3,300 tons to 40,200 tons last week.

In November, the crude steel output of stainless steel 200 series by the stainless steel mills that are above-designated size increased by 254,400 tons (38.87%), to 909,000 tons. So far, the increase in production has already influenced the market. The spot inventory increased a bit although the trading volume of last week increased.

Last week, a steel mill announced that the production of hot-rolled 5-foot stainless steel 201 will be reduced. It is not the first steel mill to announce the reduction in stainless steel 201. Earlier, Baosteel has announced that the production of hot-rolled 5-foot 201 is ceased in December. The price of hot-rolled 5-foot stainless steel 201 remained stable because it is still out of stock. As for the cold-rolled stainless steel, affected by the hot-rolled market, the transaction has been boosted.

Generally, the price of stainless steel 201 is still falling, but the decrease started to slow down.

Due to the larger supply of high chrome, the decreasing trend is getting severe. In November, the production of high chrome rose by 175,000 tons to 644,500 tons. As for the stainless steel 400 series, the supply increased by 39,000 tons compared to the production of October. Last week, the inventory increased, by 2,400 tons, reaching 94,200 tons.

About the stainless steel futures, the main contract kept falling last week, decreasing down below US$2,685/MT.

In a short term, stainless steel prices will remain to decrease. Firstly, it is because the cost of raw materials is decreasing. Due to the continuous drop in stainless steel prices, steel mills keep pushing the raw material side to decline. For now, the prices of raw materials have decreased though, but the prices are still far beyond the acceptable line of steel mills. Therefore, it is believed that steel mills will keep pushing the raw material prices to decrease. When the raw material cost is reduced further, the steel mills will open the futures of February and March. Second, from the perspective of supply, some steel mills have announced a reduction in stainless steel output, but the overall production volume arranged in December is larger than that during the previous power shortage period. Lastly, it is about the demand. Demand has been tepid and buyers lose confidence in the ongoing decline in prices.

Therefore, the market is overwhelmed with negativity because the supply is way beyond the demand. The stainless steel will continue to go down. It is predicted that the futures of January will be around US$2,525/MT ~ US$2,765/MT.

Last week, China’s Central Political Work Conference emphasized the power supply which must remain stable and sufficient. This provides a stable background for steel mills to produce and thereby the stainless steel output will increase. Moreover, the raw material prices start to reduce as well, which will further push the stainless steel prices down. It is predicted that the base price of cold-rolled stainless steel of the private-owned mills will be US$2,605/MT.

The decrease is slowing down. The transaction was lit up last week. However, the inventory of cold-rolled stainless steel is large and the weak demand fails to boost the market. It is predicted that the prices of the stainless steel 200 series will keep declining. As for the one and only hot-rolled 5-foot stainless steel 201 has remained the same price for more than 2 weeks. It is predicted that it will probably increase.

The price of high chrome fell last week, down to US$1,449/MT~ US$1,481/MT. Meanwhile, the inventory of the stainless steel 400 series is so large that it has damaged the market confidence. Some predicted that the production limit would return because of the Winter Olympics. However, no official news is announced. For now, the selling price of stainless steel 430/2B is lower than the production cost. It is predicted that the price will keep falling to US$1,545/MT~US$1,560/MT.

However, according to the latest news update on December 14th, Baosteel Desheng, Beigang New Materials, and Tsingshan announced to stop the decreasing trend and maintain the stainless steel prices by cutting down the production of stainless steel 200 series. The union of steel mills instantly brings up the market prices. Influenced by the increase of stainless steel 200 series prices, the prices of 300 series stainless steel also show a tendency to rise. Will the cooperation of steel mills work and maintain the effect? We will keep following the news.

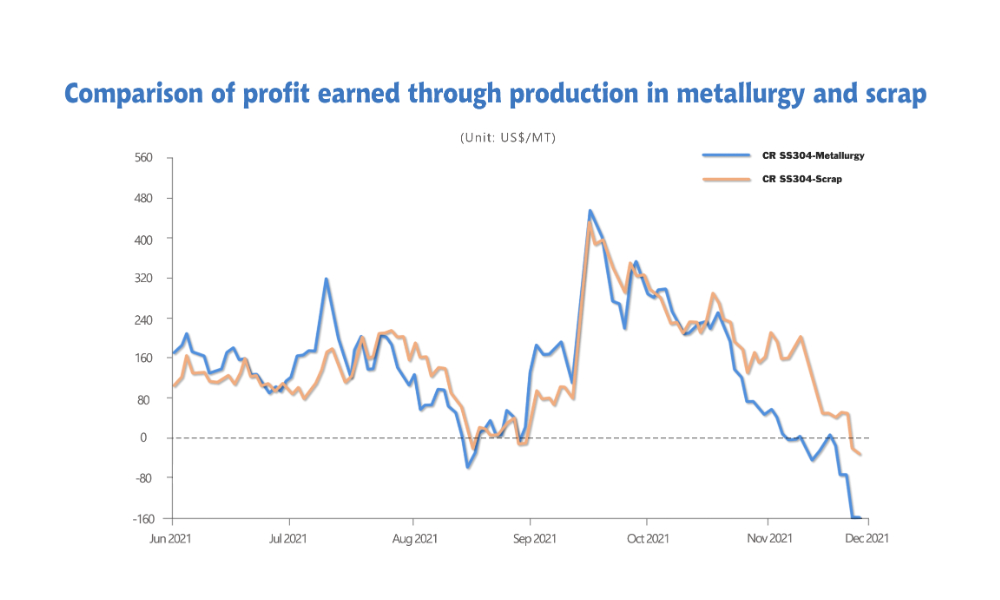

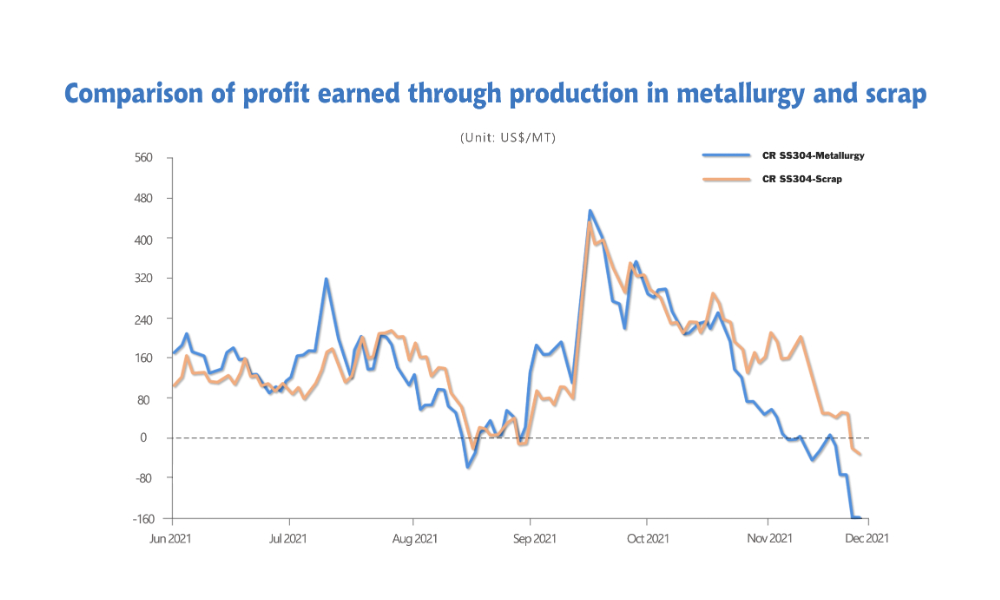

Within only two months, the price of stainless steel 304 has dropped by US$879/MT compared to the highest price in October which is US$3,570. However, the nickel price remains at US$20,000 and the price of ferronickel only fell by 6%.

Both costs of scrap and metallurgy have been over the selling price. Compared to metallurgy production, scrap production is more advantaged. Therefore, many steel mills are buying stainless steel scrap. But the inventory of steel scrap is low, and the stainless steel prices keep reducing, so scrap sellers are reluctant to sell at a low price.

On December 10th, the high nickel-iron decreased by US$5/nickel to US$221/nickel. Because of the maintenance at the end of the year, the demand for raw material reduces, which releases the intense of the tight ferronickel supply.

In summary, the price of cold-rolled stainless steel 304 continues to drop. Along with the maintenance and production reduction of steel mills, the price of raw materials will decrease.

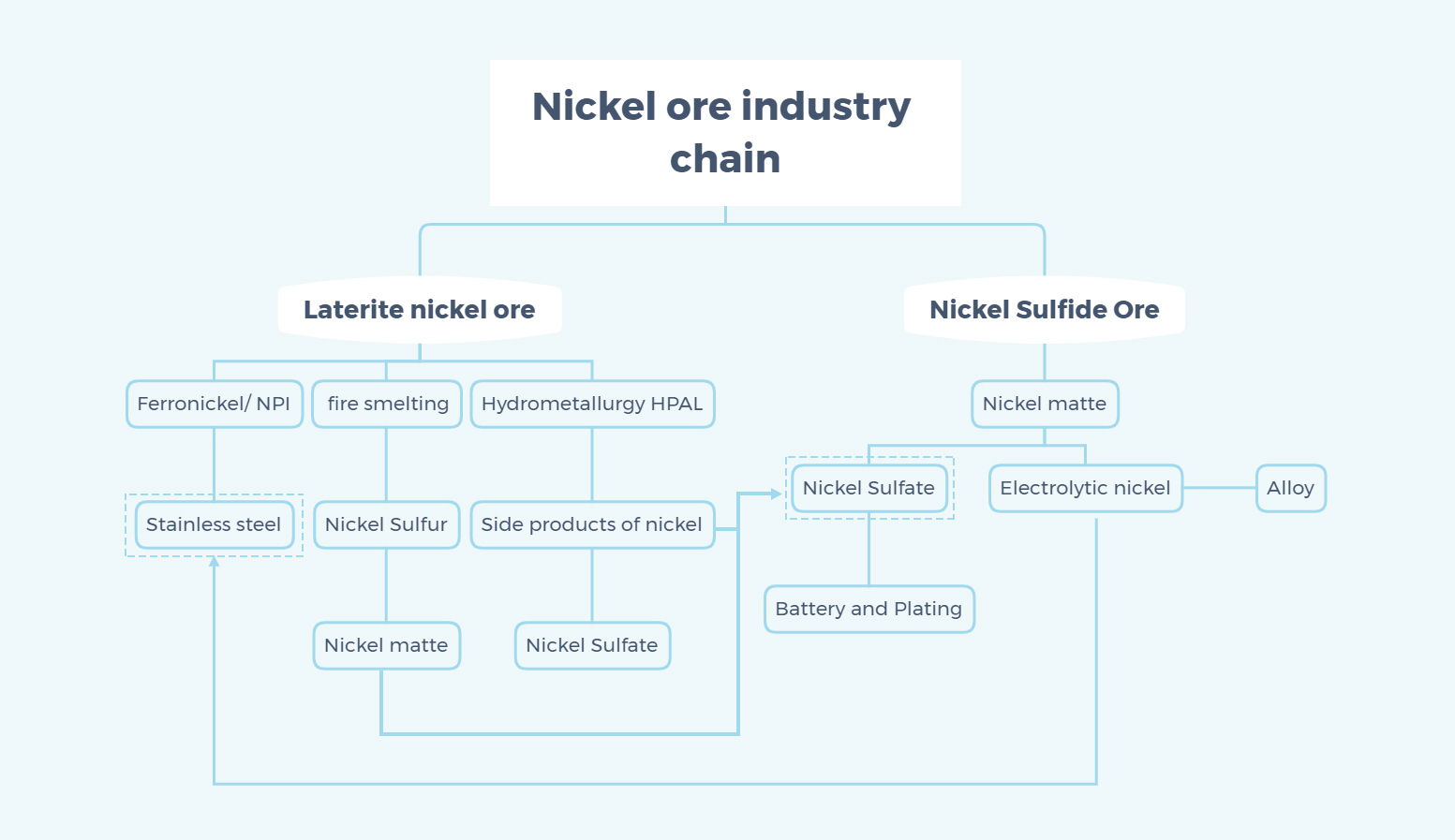

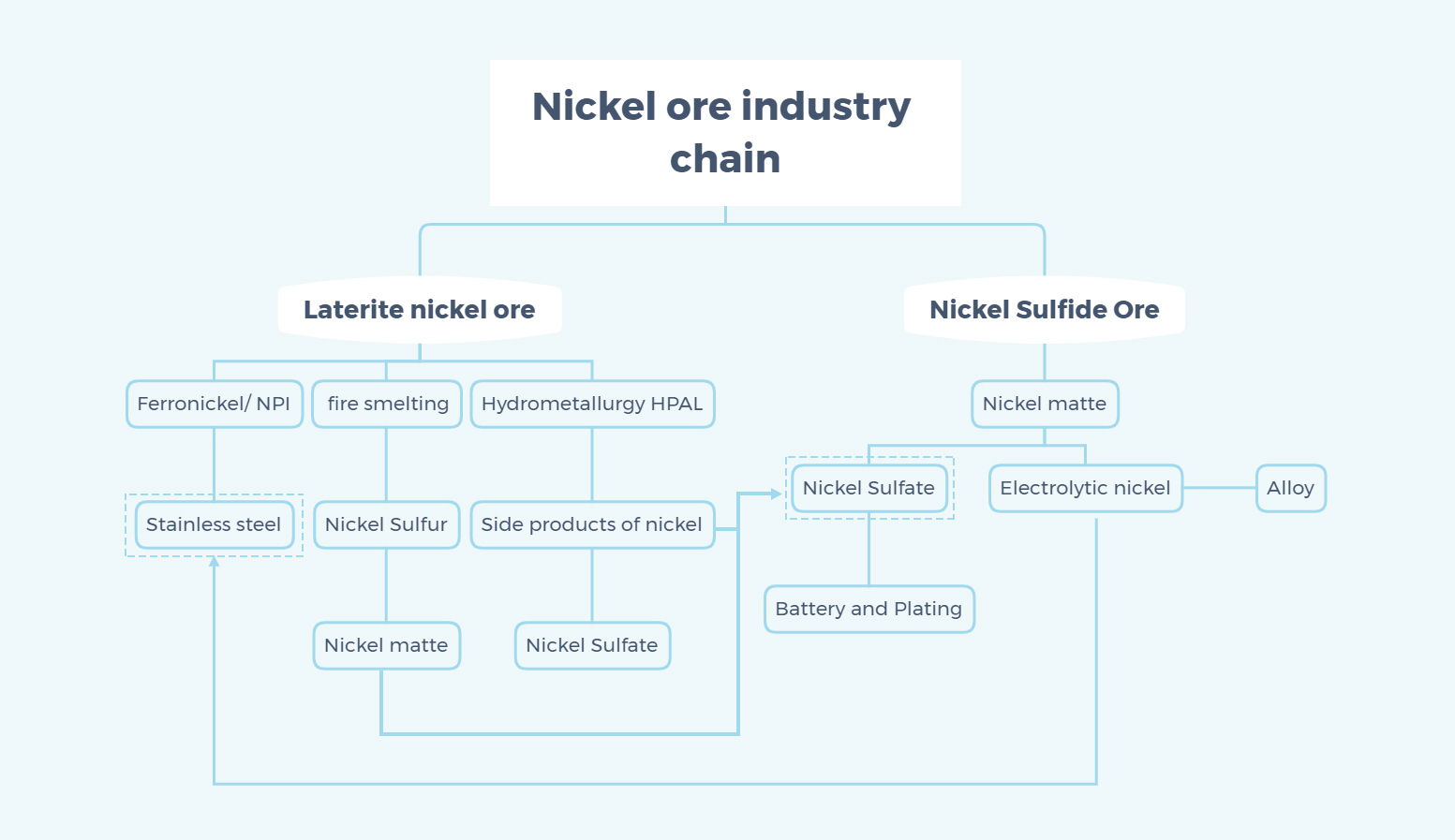

Related article about Tsingshan's road to nickel matte: Tsingshan changes the production line from ferronickel to nickel matte.

On December 8th, Tsingshan Indonesia announced that the first nickel matte production line started to produce. Instantly, the nickel price dived.

Tsingshan successfully produced the molten iron of the nickel matte, marking that Tsingshan might turn the supply chain around with this new production line.

This new production method will greatly alleviate the shortage of nickel raw material structure caused by the vigorous development of new energy vehicles in the future. As soon as the news came out, LME Nickel, which had been running strongly, followed suit. Until 15:00 on the 10th, LME Nickel reduced to $1,940/MT, down by 1.36% from the previous trading day. In the future, the price of ferronickel may move downward simultaneously with the price of nickel.

Last week, the nickel price of Shanghai Futures Exchange remained to drop, breaking down to US$23,408. Influenced by the production limit and the nickel matte, the price tends to fall still.

As for the nickel ore, the price was stable last week. China’s ferronickel producers are facing loss because the price of ferronickel keeps decreasing. The current nickel ore price is too high to the ferronickel producers. It is predicted that the price of nickel ore will drop in a short term.

From the perspective of ferronickel, the price kept falling, decreasing to US$218/nickel. However, this price fails to satisfy the steel mills. Steel mills continue to pushing down the price. It is predicted that the price of ferronickel will go down probably.

To sum up, if the stainless steel prices keep decreasing, the raw materials will suffer greater pressure to fall. Although the inventory of the LME nickel has been decreased to 108,600 tons, the mass production of nickel matte in the next year will bring down the futures price. It is predicted that the nickel of Shanghai Futures Exchange will decrease to US$21,975~US$23,408.

Returning to the Chinese chrome market, the price of high carbon ferrochrome decreased to US$1,465/50 base tons~ US$1,497/50 base tons because the output of ferrochrome keeps enlarging.

Currently, the supply of high chrome is sufficient. The spot inventory volume is too large to weaken the selling price. Some transaction prices even went down to US$1,433/50 base tons.

The production cost has reduced sharply because the electricity price is decreased and the price of coke fell as well. The lower cost offsets the low selling price, boosting the productivity of the factories. The supply will keep increasing. Therefore, the price of high chrome tends to remain and decrease slightly.

Stainless steel average prices of last week

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 3,015 | -164 | -5.40% |

| Foshan | 3,060 | -164 | -5.31% | ||

| Hongwang | Wuxi | 2,810 | -150 | -5.10% | |

| Foshan | 2,780 | -169 | -6.00% | ||

| 304/NO.1 | ESS | Wuxi | 2,765 | -131 | -4.73% |

| Foshan | 2,795 | -150 | -5.33% | ||

| 316L/2B | TISCO | Wuxi | 4,455 | -102 | -2.31% |

| Foshan | 4,485 | -111 | -2.51% | ||

| 316L/NO.1 | ESS | Wuxi | 4,250 | -81 | -1.94% |

| Foshan | 4,300 | -81 | -1.92% | ||

| 201J1/2B | Hongwang | Wuxi | 1,775 | -91 | -5.22% |

| Foshan | 1,760 | -91 | -5.27% | ||

| J5/2B | Hongwang | Wuxi | 1,655 | -91 | -5.62% |

| Foshan | 1,665 | -97 | -5.95% | ||

| 430/2B | TISCO | Wuxi | 1,620 | -53 | -3.41% |

| Foshan | 1,595 | -68 | -4.46% |

Trend|| Stainless steel prices go down.

Last week, the prices of stainless steel remained the decreasing tendency. Steel mills did not stop producing and their productivity has recovered, resulting in a large inventory of stainless steel stacked in the market. The prices of stainless steel spots decreased as well as the prices of futures. Until last Friday, December 10th, the main contract of stainless steel futures dropped by US$167/MT, to US$2,655/MT.

300 series of stainless steel: The opening price of Tsingshan was cut down more than US$220/MT.

Last week, the prices of stainless steel futures remained to fall. Until last Friday, the price of the stainless steel futures decreased by US$167/MT to US$2,655/MT compared to December 3rd. On December 9th, Tsingshan opened the price of cold-rolled stainless steel at US$2,655/MT which was US$223/MT lower than the last opening price. Influenced by the low opening price, the prices of spots started to decrease. Until Friday, in Wuxi market, the price of the cold-rolled stainless steel 304 of the private-owned mill has dropped by US$159/MT to US$2,670/MT. Rumor has it that there will be more cold-rolled stainless steel coils imported from Indonesia recently. Thereby, the futures prices fell and the price difference between futures of January and February narrowed down.

As for the inventory, the total inventory of the Wuxi’s sample warehouse increased by 13,400 tons, to 436,600 tons. Among, the inventory of stainless steel 300 series increased by 7,700 tons, to 299,700 tons. The increase in the inventory is the cold-rolled stainless steel.

200 series of stainless steel: The decrease slows down and the inventory increases.

Until December 10th, the cold-rolled stainless steel 201 in Wuxi market dropped by US$56/MT, quoted at US$1,610/MT; as for the price of 5-foot and hot-rolled stainless steel 201 remained as last week, at around US$1,590/MT.

The inventory of the stainless steel 200 series in Wuxi’s sample warehouse increased by 3,300 tons to 40,200 tons last week.

In November, the crude steel output of stainless steel 200 series by the stainless steel mills that are above-designated size increased by 254,400 tons (38.87%), to 909,000 tons. So far, the increase in production has already influenced the market. The spot inventory increased a bit although the trading volume of last week increased.

Last week, a steel mill announced that the production of hot-rolled 5-foot stainless steel 201 will be reduced. It is not the first steel mill to announce the reduction in stainless steel 201. Earlier, Baosteel has announced that the production of hot-rolled 5-foot 201 is ceased in December. The price of hot-rolled 5-foot stainless steel 201 remained stable because it is still out of stock. As for the cold-rolled stainless steel, affected by the hot-rolled market, the transaction has been boosted.

Generally, the price of stainless steel 201 is still falling, but the decrease started to slow down.

400 series of stainless steel: Transaction heats up.

Due to the larger supply of high chrome, the decreasing trend is getting severe. In November, the production of high chrome rose by 175,000 tons to 644,500 tons. As for the stainless steel 400 series, the supply increased by 39,000 tons compared to the production of October. Last week, the inventory increased, by 2,400 tons, reaching 94,200 tons.

About the stainless steel futures, the main contract kept falling last week, decreasing down below US$2,685/MT.

In a short term, stainless steel prices will remain to decrease. Firstly, it is because the cost of raw materials is decreasing. Due to the continuous drop in stainless steel prices, steel mills keep pushing the raw material side to decline. For now, the prices of raw materials have decreased though, but the prices are still far beyond the acceptable line of steel mills. Therefore, it is believed that steel mills will keep pushing the raw material prices to decrease. When the raw material cost is reduced further, the steel mills will open the futures of February and March. Second, from the perspective of supply, some steel mills have announced a reduction in stainless steel output, but the overall production volume arranged in December is larger than that during the previous power shortage period. Lastly, it is about the demand. Demand has been tepid and buyers lose confidence in the ongoing decline in prices.

Therefore, the market is overwhelmed with negativity because the supply is way beyond the demand. The stainless steel will continue to go down. It is predicted that the futures of January will be around US$2,525/MT ~ US$2,765/MT.

Summary:

300 series of stainless steel:

Last week, China’s Central Political Work Conference emphasized the power supply which must remain stable and sufficient. This provides a stable background for steel mills to produce and thereby the stainless steel output will increase. Moreover, the raw material prices start to reduce as well, which will further push the stainless steel prices down. It is predicted that the base price of cold-rolled stainless steel of the private-owned mills will be US$2,605/MT.

200 series of stainless steel:

The decrease is slowing down. The transaction was lit up last week. However, the inventory of cold-rolled stainless steel is large and the weak demand fails to boost the market. It is predicted that the prices of the stainless steel 200 series will keep declining. As for the one and only hot-rolled 5-foot stainless steel 201 has remained the same price for more than 2 weeks. It is predicted that it will probably increase.

400 series of stainless steel:

The price of high chrome fell last week, down to US$1,449/MT~ US$1,481/MT. Meanwhile, the inventory of the stainless steel 400 series is so large that it has damaged the market confidence. Some predicted that the production limit would return because of the Winter Olympics. However, no official news is announced. For now, the selling price of stainless steel 430/2B is lower than the production cost. It is predicted that the price will keep falling to US$1,545/MT~US$1,560/MT.

Steel mills take action to boost the prices.

However, according to the latest news update on December 14th, Baosteel Desheng, Beigang New Materials, and Tsingshan announced to stop the decreasing trend and maintain the stainless steel prices by cutting down the production of stainless steel 200 series. The union of steel mills instantly brings up the market prices. Influenced by the increase of stainless steel 200 series prices, the prices of 300 series stainless steel also show a tendency to rise. Will the cooperation of steel mills work and maintain the effect? We will keep following the news.

Raw Material|| Costs have to fall as the stainless steel prices decrease.

Within only two months, the price of stainless steel 304 has dropped by US$879/MT compared to the highest price in October which is US$3,570. However, the nickel price remains at US$20,000 and the price of ferronickel only fell by 6%.

Both costs of scrap and metallurgy have been over the selling price. Compared to metallurgy production, scrap production is more advantaged. Therefore, many steel mills are buying stainless steel scrap. But the inventory of steel scrap is low, and the stainless steel prices keep reducing, so scrap sellers are reluctant to sell at a low price.

On December 10th, the high nickel-iron decreased by US$5/nickel to US$221/nickel. Because of the maintenance at the end of the year, the demand for raw material reduces, which releases the intense of the tight ferronickel supply.

In summary, the price of cold-rolled stainless steel 304 continues to drop. Along with the maintenance and production reduction of steel mills, the price of raw materials will decrease.

Nickel: Tsingshan officially puts the nickel matte into production.

Related article about Tsingshan's road to nickel matte: Tsingshan changes the production line from ferronickel to nickel matte.

On December 8th, Tsingshan Indonesia announced that the first nickel matte production line started to produce. Instantly, the nickel price dived.

Tsingshan successfully produced the molten iron of the nickel matte, marking that Tsingshan might turn the supply chain around with this new production line.

This new production method will greatly alleviate the shortage of nickel raw material structure caused by the vigorous development of new energy vehicles in the future. As soon as the news came out, LME Nickel, which had been running strongly, followed suit. Until 15:00 on the 10th, LME Nickel reduced to $1,940/MT, down by 1.36% from the previous trading day. In the future, the price of ferronickel may move downward simultaneously with the price of nickel.

Last week, the nickel price of Shanghai Futures Exchange remained to drop, breaking down to US$23,408. Influenced by the production limit and the nickel matte, the price tends to fall still.

As for the nickel ore, the price was stable last week. China’s ferronickel producers are facing loss because the price of ferronickel keeps decreasing. The current nickel ore price is too high to the ferronickel producers. It is predicted that the price of nickel ore will drop in a short term.

From the perspective of ferronickel, the price kept falling, decreasing to US$218/nickel. However, this price fails to satisfy the steel mills. Steel mills continue to pushing down the price. It is predicted that the price of ferronickel will go down probably.

To sum up, if the stainless steel prices keep decreasing, the raw materials will suffer greater pressure to fall. Although the inventory of the LME nickel has been decreased to 108,600 tons, the mass production of nickel matte in the next year will bring down the futures price. It is predicted that the nickel of Shanghai Futures Exchange will decrease to US$21,975~US$23,408.

Chorme: Production cost reduces.

Returning to the Chinese chrome market, the price of high carbon ferrochrome decreased to US$1,465/50 base tons~ US$1,497/50 base tons because the output of ferrochrome keeps enlarging.

Currently, the supply of high chrome is sufficient. The spot inventory volume is too large to weaken the selling price. Some transaction prices even went down to US$1,433/50 base tons.

The production cost has reduced sharply because the electricity price is decreased and the price of coke fell as well. The lower cost offsets the low selling price, boosting the productivity of the factories. The supply will keep increasing. Therefore, the price of high chrome tends to remain and decrease slightly.