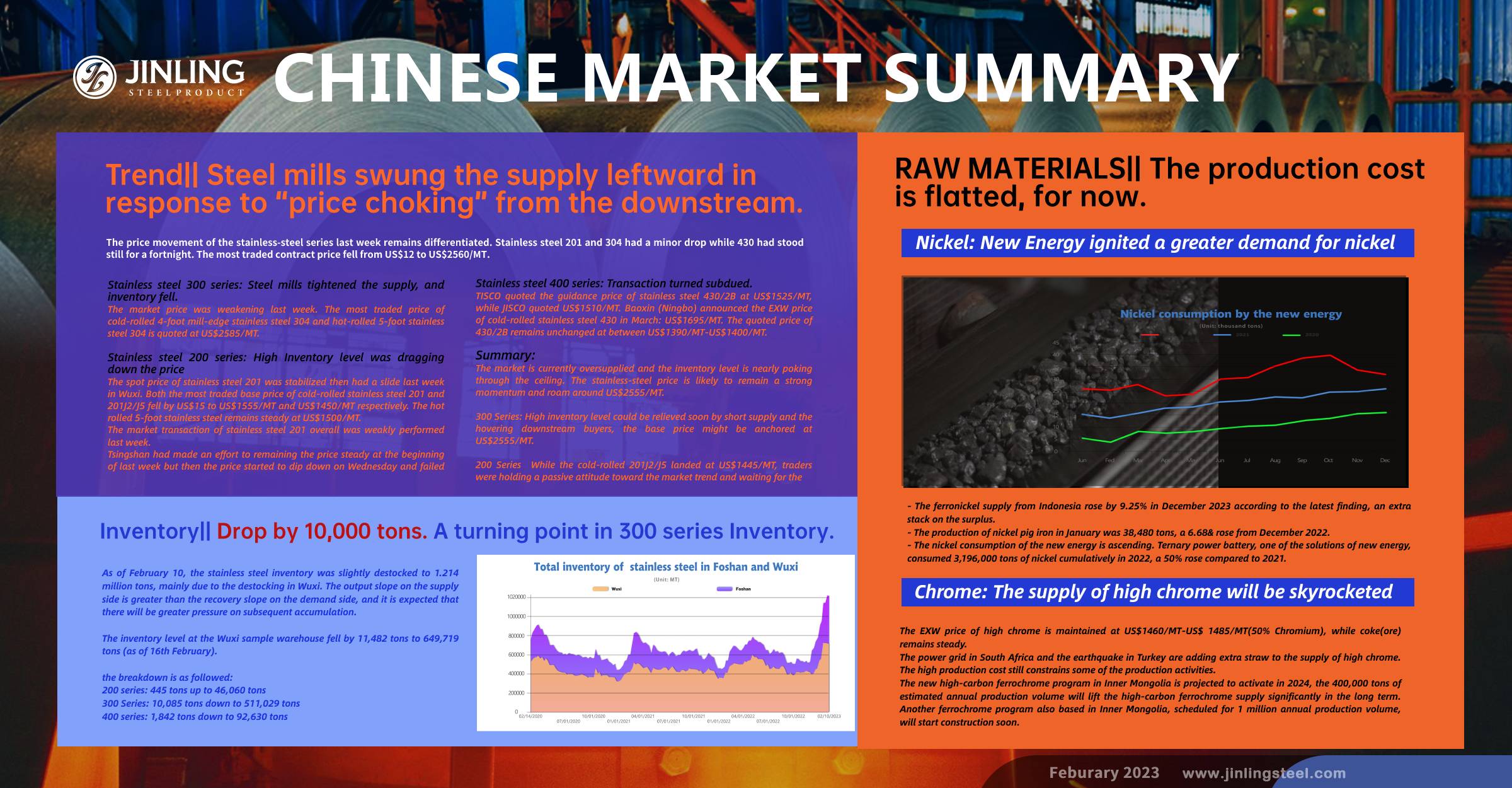

Time to read the Stainless Steel Market Summary in China for last week. The weekly average prices of all major grades of stainless steel declined. One rose the most two weeks ago and fell the greatest. Stainless steel 316L, the weekly average price dropped by US$88/MT in one week. The biggest reason is the sluggish demand which is far lower than people's expectations. The inventory remains high, which also dragged down the prices. To resist the large inventory and prop up the price, steel mills choose to reduce the delivery volume to the market. Nickel, the key element of stainless steel production, is more used in the new energy industry for making batteries in recent years. It is predicted that the consumption of nickel in the battery will keep increasing. It means that there might push up the price of nickel products. As for the sea freight, last week, it slumped all the way down as the global market is tepid currently.