With the slack season coming, more steel mills will reduce their production to make a balance. Currently, as far as we know, about 12,000 tons of stainless steel output will be reduced in June as steel mills begin their maintenance plans. Similarly, from the aspect of stainless steel crude steel, in June, it is to cut down in output as well according to the scheduled production, with MoM falling by 70,000 tons to 3.19 million tons. However, future production remains under pressure to the sluggish market. What boosted the price is that steel mills control the delivery volume, which results in a shortage in the market. If you want to know more about the latest market dynamics, please keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,350 | 11 | 0.51% |

| Foshan | 2,395 | 11 | 0.50% | ||

| Hongwang | Wuxi | 2,290 | 26 | 1.19% | |

| Foshan | 2,280 | 6 | 0.26% | ||

| 304/NO.1 | ESS | Wuxi | 2,190 | 10 | 0.48% |

| Foshan | 2,215 | 4 | 0.20% | ||

| 316L/2B | TISCO | Wuxi | 4,070 | 108 | 2.82% |

| Foshan | 4,070 | 51 | 1.32% | ||

| 316L/NO.1 | ESS | Wuxi | 3,825 | 54 | 1.48% |

| Foshan | 3,870 | 40 | 1.08% | ||

| 201J1/2B | Hongwang | Wuxi | 1,465 | -2 | -0.21% |

| Foshan | 1,450 | 0 | 0% | ||

| J5/2B | Hongwang | Wuxi | 1,380 | -3 | -0.22% |

| Foshan | 1,375 | -3 | -0.23% | ||

| 430/2B | TISCO | Wuxi | 1,245 | 24 | 2.18% |

| Foshan | 1,240 | 20 | 1.80% |

TREND|| Price remained a slight and steady growth

The future price of the stainless-steel series fluctuated, the mainstream contract price reached US$2295/MT then closed at US$2280/MT with a 0.16% growth on Friday. The spot price of the stainless-steel series was overall positive: 201 dropped slightly, 304 stabilized after growth, and 430 recorded the steepest upward trajectory since the Chinese New Year.

Stainless steel 300 series: Lose weight in inventory, the price goes up.

Last Friday, the mainstream base price of cold-rolled 4-foot mill-edge stainless steel closed at US$2255/MT with a US$14 increase, the hot-rolled 304 fell US$7 to US$2190/MT. Last week, the 300 series buyers express a strong interest in the volatility of the spot price which led to a significant destock.

Stainless steel 200 series: price remained weak.

There were no more than 0.23% of changes sighted in the spot price of 200 series until last Friday: the mainstream base price of cold-rolled 201 was quoted at US$1435/MT and 201J2 reported US$1350/MT, the hot-rolled 5-foot 201 closed at US$1375/MT.

The spot transactions for 201 series stainless steel remain weak, with traders' daily shipments mostly staying below one hundred tons. Currently, downstream demand continues to be sluggish, and traders have low intentions to replenish their inventories. In the market, there are cases where J2/J5 cold-rolled products are sold at a discount of US$7/MT. However, most of the transactions are focused on flat orders, while there is greater resistance in selling coil materials. Overall, the outgoing volume is not significant, and the spot inventory is accumulating.

Stainless steel 400 series: Spot inventory dropped, and the price rose again

Both TISCO and JISCO rose US$14 on the guidance price of stainless steel 430/2B, closed at US$1395/MT and US$1485/MT respectively. The spot price in the Wuxi market rose from US$21 to US$1265/MT.

Summary:

Stainless steel prices have remained strong in the short term due to the influence of steel mills supporting prices. However, in the medium to long term, steel mill production remains high, and the supply-demand situation remains unchanged. As a result, the upside potential for stainless steel prices in the future is limited, and it is expected that the stainless steel market will continue to fluctuate.

300 series: In May, the output of various series showed signs of recovery, but market trading confidence was moderate. Persistent low profitability in steel production is also limiting production in June, with many steel mills announcing maintenance plans. In addition, the availability of circulating resources in spot markets remains low. In the short term, prices of private cold-rolled products are expected to fluctuate around US$2255/MT.

200 series: The current market situation is dull, with low purchasing intentions from downstream and market participants. Overall, the market's spot inventory has seen a slight accumulation for two consecutive weeks, and the overall outlook is not optimistic. With lower-than-expected downstream demand, it is difficult to see a short-term improvement in the market. It is expected that next week, the spot price of the 201 series will continue to operate on the weaker side, with the base price of 201J2/J5 cold-rolled products fluctuating in the range of US$1335/MT to US$1365/MT.

400 series: In the Wuxi market, transactions in the 400 series stainless steel market still revolve around essential demands. Spot inventory has seen a slight decrease, but there is no visible "buying momentum" in the market following the price increase. It is expected that next week, the price of 430/2B will stabilize.

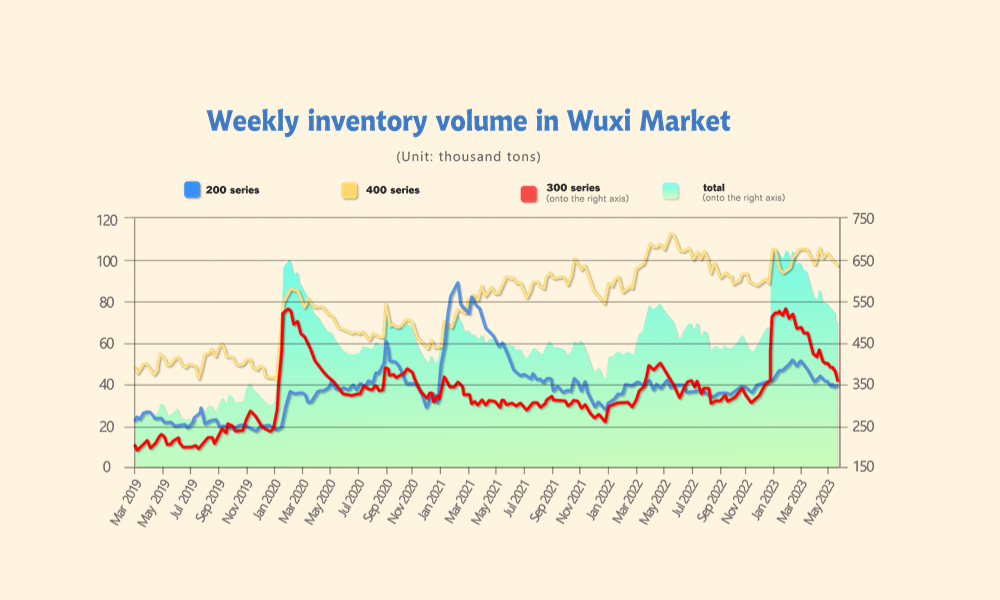

INVENTORY|| Inventory continued to slide

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| June 1 | 39,260 | 381,094 | 98,102 | 518,456 |

| June 8th | 39,828 | 357,353 | 97,113 | 494,294 |

| Difference | 568 | -23,741 | -989 | -24,162 |

The total inventory at the Wuxi sample warehouse fell by 24,162 tons to 494,294 tons (as of 8th June).

the breakdown is as followed:

200 series: 568 tons up to 39,828 tons

300 Series: 23,741 tons down to 357,353 tons

400 series: 989 tons down to 97,113 tons

Stainless steel 300 series: Inventory dropped 5 weeks in a roll.

The 23,000 tons of destocking mainly occurred in the preposition warehouse and warehouse agents. The production halt caused by peaking costs is now escalating to a larger scale, Based in Xiangshui and Dainan, steel mill Delong had suspended their cold-roll production intermittently and shrank the production volume to around 200,000 tons (40% reduction). Hence, they had been imposing restrictions on the goods distribution to Wuxi for over a month which added chemical reaction to the inventory consumption.

Stainless steel 200 series: Accumulation continues

Another major producer in Jiangsu, Huale Alloy, scheduled maintenance for in the second half of June, but Wuxi market will embrace limited impact from it. Beigang New Materials had sent their last shipment to Wuxi market before the full closure of the production lines on 9th June, as the collateral result of the continual rainstorm.

Stainless steel 400 series: Maintenance to affect the inventory

Inventory consumption will be accelerated as major steel mills are scheduled for maintenance.

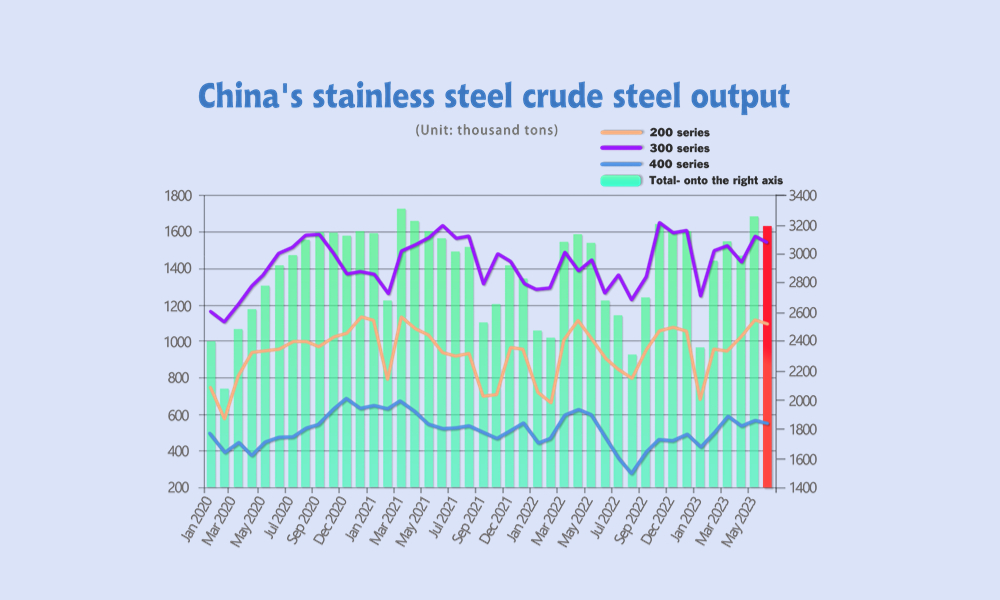

Production: 270,000-tons increase in output in May

In May 2023, the crude steel production of domestic stainless-steel enterprises with a scale above a certain threshold reached 3.264 million tons, an increase of 267,000 tons compared to the previous month, with a growth rate of 8.91%. Compared to the same period last year, it increased by 188,800 tons, with a growth rate of 6.14%. In May, the production of stainless steel in each series increased compared to the previous month.

The details of series-wise production are as follows:

200 series:

1.1155 million tons, an increase of 91,900 tons compared to the previous month, with a growth rate of 8.98%.

Compared to the same period last year, it increased by 94,100 tons, with a growth rate of 9.21%.

300 series:

1.5824 million tons, an increase of 148,900 tons compared to the previous month, with a growth rate of 10.39%.

Compared to the same period last year, it increased by 132,100 tons, with a growth rate of 9.11%.

400 series:

566,200 tons, an increase of 26,100 tons compared to the previous month, with a growth rate of 4.84%.

Compared to the same period last year, it decreased by 37,400 tons, with a decrease rate of 6.2%.

Stainless steel plants plan to reduce production during the off-season

Recently, stainless steel prices have been fluctuating near the cost line, and downstream end-user purchases have been inconsistent. June is the traditional off-season for stainless steel, and several steel mills already have plans to reduce production for maintenance.

Currently, the known steel mills that are going to reduced the production in June due to maintenance include, Huale Alloy, Jinhai and JISCO.

| Steel mills that scheduled maintenance in June | |||

|---|---|---|---|

| Mill | Details | Influencced production (ton) | Influenced grades |

| Huale | From June 21st to 25th, the steel mill will start the maintenance on the whole production line including smelting, hot-rolled, pickling, etc. | 15000 | 200 sereis |

| Jinhai | To build its own electric station, all works will have to stop for 25 days before the late-July. | 60000 | 200 series and 300 series |

| JISCO | Annual maintenance will take place from June 25th to July 25th. | 20000 | 400 series |

In summary, the planned maintenance and production reduction by steel mills in June will affect stainless steel output by 120,000 tons, with a focus on the 300 series. In addition to the steel mills with maintenance and production reduction plans, some mills have been operating at low capacity for several months. For example, Jiangsu Delong Steel Mill has been in a reduced or halted production state for consecutive months, with a total output of around 200,000 tons at its Xiangshui and Dainan bases, a reduction of nearly 40% compared to the previously high levels of production.

Low demand and low profitability constrain production in June

In June 2023, domestic crude stainless steel production is expected to decrease by 70,000 tons to around 3.19 million tons.

Among them:

300 series is expected to decrease by 40,000 tons to 1.54 million tons,

200 series is expected to decrease by 14,000 tons to 1.1 million tons,

and 400 series is expected to decrease by 15,000 tons to 550,000 tons compared to the previous month.

Raw Materials || Slight decrease

Until last Friday, the EXW price of high ferronickel dropped US$0.71 to US$260/nickel unit and ferrochrome fell US$14 to US$1475/MT (50% chromium). The spot prices of chrome ore have fallen, while the prices of coke have dropped by US$14/MT(50% chromium). As a result, the overall production costs of high-chromium materials have slightly decreased.

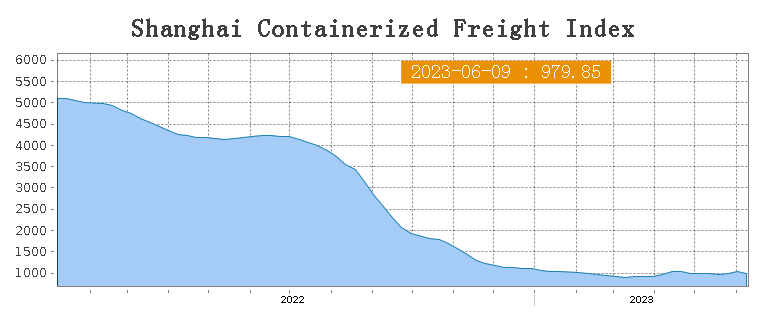

Sea Freight|| Sea freight market stabilized.

According to the latest data released by China Customs, exports in May, when measured in US dollars, declined by 7.5% compared to the same period last year. This is the first decline in three months, and the downturn in foreign trade exports has exerted certain pressure on China's export consolidation market. Freight rates overall on multiple sea routes faced downward last week. On 9th June, the Shanghai Containerized Freight Index fell by 4.7% to 979.85.

Europe/ Mediterranean:

Sentix Investor Confidence dropped to the lowest levels in five months to -17.1 for June versus -9.2 expected and -13.2 prior. Until 9th June, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$831/TEU, which fell by 1.8%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1626/TEU, which fell by 0.7%

North America:

According to China Customs, the export From China to the US had fallen 18% in the previous month, and the freight rate could not last the upward momentum from the week before last week.

Until 9th June, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,388/FEU and US$2,435/FEU, 16.7% and 7.6% drop accordingly.

The Persian Gulf and the Red Sea:

Until 9th June, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 1.3% fall from last week's posted US$1280/TEU.

Australia/ New Zealand:

Until 9th June, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$273/TEU, a 7.5% spike from the previous week.

South America:

The freight market had a slight rebound. on 9th June, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2305/TEU, an 3.1% growth from the previous week.