Increasing production—— Not a good sign for the bearish market. If you have followed our news, try to think for a second how we should sum up the market. In our way, it is that steel mills have kept trying but fail to raise the price due to the tepid demand. There was a small rebounce in price in April, and it did raise up the transaction, which has attracted the steel mills to recover their production in May. To review, steel mills have done everything to boost the price, by setting lowest price limit for their agents to stop the price from falling too low, by reducing arrival volume to the market, and by shrinking the crude steel production. But the increasing scheduled production in May just increases much concerns becasue we doubt that if the market is able to digest such a sharply increase in supply when the global demand is shrinking significantly. Otherwise, the market will face serious oversupply and the stainless steel prices will again have to go lower. For more information about Stainless Steel Market Summary in China, please keep reading.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,475 | 3 | 0.12% |

| Foshan | 2,515 | 3 | 0.12% | ||

| Hongwang | Wuxi | 2,400 | 4 | 0.19% | |

| Foshan | 2,395 | -3 | -0.13% | ||

| 304/NO.1 | ESS | Wuxi | 2,320 | 2 | 0.09% |

| Foshan | 2,345 | 10 | 0.44% | ||

| 316L/2B | TISCO | Wuxi | 4,130 | -63 | -1.56% |

| Foshan | 4,170 | -73 | -1.77% | ||

| 316L/NO.1 | ESS | Wuxi | 4,010 | -85 | -2.16% |

| Foshan | 4,055 | -53 | -1.34% | ||

| 201J1/2B | Hongwang | Wuxi | 1,515 | 5 | 0.35% |

| Foshan | 1,515 | 7 | 0.49% | ||

| J5/2B | Hongwang | Wuxi | 1,445 | 5 | 0.37% |

| Foshan | 1,440 | 5 | 0.41% | ||

| 430/2B | TISCO | Wuxi | 1,245 | 13 | 1.18% |

| Foshan | 1,245 | 13 | 1.18% |

TREND|| Stainless steel transactions went weaker.

Stainless steel futures price rushed high during the first three trading days from May 8th to May 10th but the transactions did not increase as the price. Thereby, the price slumped on May 11th, last Thursday, and continued on the last two trading days. Until May 11th, the most-traded contract of stainless steel futures decreased by US$23/MT to US$2,350/MT. As for the spot market, the price remained stable with a slight decline.

Stainless steel 300 series: Prices run weakly.

The prices fluctuated weakly. Until May 11th, the cold-rolled stainless steel of 4 feet in Wuxi was US$7/MT lower than a week ago, quoted at US$2,345/MT by the mainstream steel mills. As for the hot-rolled stainless steel price, it was around US$2,295/MT, and weekly fell by US$29/MT. Earlier last week, the transaction was active but the heat dispensed as the futures price dropped.

Stainless steel 200 series: Prices steadily rise amid the bland transaction

Until May 11th, the cold-rolled stainless steel 201 in Wuxi was around US$1,485/MT, increasing by US$7/MT within a week. Cold-rolled stainless steel J2 and hot-rolled 5-foot products also rose by US$7/MT, to US$1,451/MT and US$1,445/MT respectively.

The bland trading situation has lasted for a long time and there is no signal indicating it will warm up. But it seems that steel mills are not giving up. On May 9th, Beigang New Materials stopped selling products of the 200 series. Although no other steel mills had similar operations, they still held the prices stably.

Stainless steel 400 series: Prices rise and remain, thanks to the cost propping up.

Stainless steel 430/2B price was diverse in the two giants. TISCO remained the price at US$1,400/MT as a week before; while JISCO raised it to US$1,495/MT, increasing by US$15/MT in a week.

The guidance prices by steel mills were way higher than the general price in Wuxi which was around US$1,245-US$1,250/MT, though it has increased by US$15/MT from last week.

Summary:

300 series: Although the transaction has been gloomy, due to the low inventory which has offset the pressure on lower price, the stainless steel price will fluctuate in a large range recently. But as the nickel price declines, the stainless steel production in May enlarges to a historical high, and the stainless steel prices will suffer great downward stress.

200 series: The spot inventory volume remains low, but the shortage cannot boost the price because of the tepid demand. It is predicted that the price will remain weak, and the cold-rolled stainless steel 201/J2/J5 will fluctuate around US$1,400/MT ~ US$1,430/MT.

400 series: Due to the increasing price of chromium products, the stainless steel 430 rose in price as well. It’s expected that the price of 430 will stay stable thanks to the rising cost.

INVENTORY|| Scheduled production in May reaches new high.

The inventory level at the Wuxi sample warehouse fell by 32,500 tons to 542,500 tons (as of 11th May).

the breakdown is as followed:

200 series: 1,700 tons down to 41,800 tons

300 Series: 26,900 tons down to 400,300 tons

400 series: 3,900 tons down to 100,400 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| May 5 | 43,530 | 427,183 | 104,326 | 575,039 |

| May 11 | 41,800 | 400,308 | 100,436 | 542,544 |

| Difference | -1,730 | -26,875 | -3,890 | -32,495 |

Stainless Steel 300 series: Expectation of supply to rise.

From May 8th to 12th, the stock volume of the 300 series drops to 400,300 tons, 26,900 tons lower in a week. Market transactions were performed actively after the holiday. Moreover, Delong even cut down 20% of its usual weekly supply volume because, in April, steel mills’ production of 300 series MoM decreased by over 100,000 tons. But this situation is believed to reverse as, in May, the output of stainless steel will rise according to the production schedule. The stress brought by large supply will soon reflect on the market.

Stainless Steel 200 series: Steel mills reduce arrivals.

The inventory in Wuxi slightly decreased by 1,700 tons to 41,800 tons, and the cold-rolled resources took the majority. Some specifications remain short. But steel mills did not increase the new arrivals to the market. In contrast, steel mills even reduced the shipping volume to the market.

Stainless Steel 400 series: Inventory drops obviously.

From May 8th to 12th, the stainless steel 400 series inventory in Wuxi decreased to 100,400 tons which was 3,900 tons lower than a week ago. The reduction accelerated after the Labor Day holiday. However, as the price increased later, buyers tended to wait. It is predicted that the spot inventory will continue to decrease slightly.

RAW MATERIALS|| ShFE nickel fell for 4 times and stainless steel price was suppressed.

Last week, Shanghai Futures Exchange nickel fell significantly, continuously decreasing 4 times, and the lowest once declined to US$24,412/MT which is the lowest point during recent 8 months. Until Friday, the most-traded contract of ShFE nickel closed at US$24,587/MT, and weekly shrank by US$2,089/MT (7.83%).

The US dollar index was quite strong and the expectation of the global market was weak. From a domestic aspect, the increasing capacity and import of nickel have relieved the stress of the shortage of pure nickel. Meanwhile, the demand for new energy has entered the slack season, and thereby, the nickel price fell. Stainless steel prices soon followed suit, drawing back the increases in the two days after the Labor Day holiday.

The price of ferronickel also went down. Steel mills cut down the purchasing price from US$165/Ni at the beginning of the week to US$166/Ni last Friday.

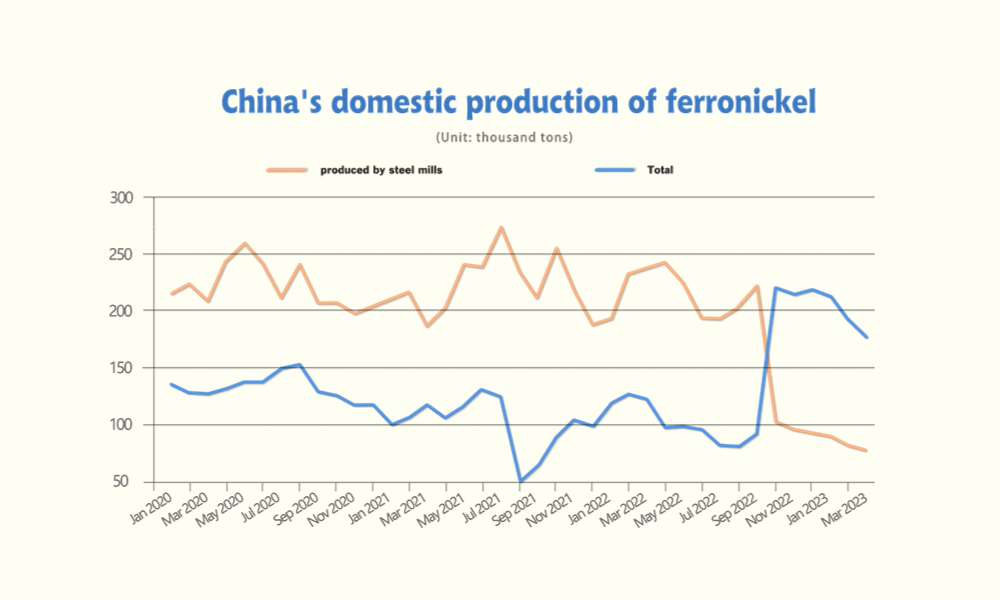

In April, the total production of high ferronickel produced by Chinese major ferronickel producers and steel mills totaled about 254,200 tons, decreasing by 19,900 tons from 274,100 tons in March, and the output of steel mills and iron factories both declined. At the beginning of April, the price of ferronickel fell quickly, falling to US$150/Nil, a record low in the past two years. Although the price of nickel ore also fell, Chinese iron factories still suffered serious losses. Iron factories reduced production to cope with the losses. In mid-April, the price of stainless steel stopped falling and rebounded. Due to the tight supply of ferronickel in the early stage, the price also rose all the way. Currently, factories resume production as their profit margin has increased. In May, it is possible that the ferronickel will oversupply.

MACRO|| China and Ecuador will cancel tariffs on 90% of tax items

China and Ecuador sign free trade agreement

On May 11, the "Free Trade Agreement between the Government of the People's Republic of China and the Government of the Republic of Ecuador" was officially signed.

The China-Ecuador Free Trade Agreement is China's fourth free trade partner in Latin America after Chile, Peru and Costa Rica.

According to the concession arrangement, China and Ecuador will mutually cancel tariffs on 90% of tax items, of which about 60% of tax items will cancel tariffs immediately after the agreement takes effect.

In terms of exports that foreign traders are generally concerned about, Ecuador will implement zero tariffs on China's main export products, including China-made plastic products, chemical fibers, steel products, mechanical appliances, electrical equipment, furniture and decoration, automobiles and parts. Imported from China to Ecuador, the tariffs will be gradually reduced by 5%-40% or eliminated.

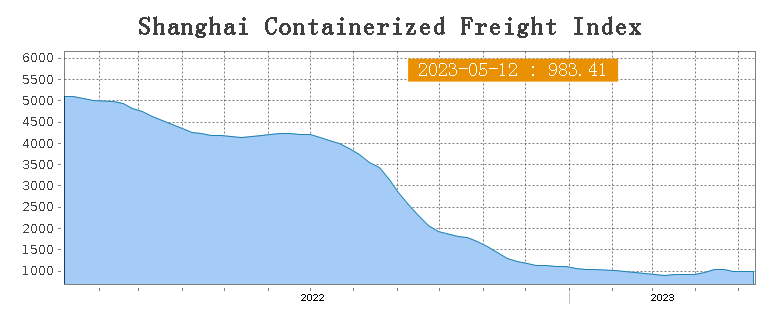

Sea Freight|| Freight rate stabilized in the first week of May.

Freight rates overall on multiple sea routes increased slightly last week, despite the demand dropped. On 12th May, the Shanghai Containerized Freight Index fell by 1.5% to 983.41.

Europe/ Mediterranean:

According to data released by Eurostat, retail sales in the euro zone fell by 3.8% year-on-year in March, down by 1.2% month-on-month, lower than market expectations, and the retail industry in the euro zone continued to slump. This week, the transportation demand is generally stable, the market freight rate continues to fluctuate slightly, and the spot booking price drops slightly this week. Until 12th May, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$870/TEU, fell by 0.6%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1624/TEU, which rose by 0.5%.

North America:

According to the latest data from the General Administration of Customs, China’s exports to the United States fell by 7.5% in the first four months of 2023, which exerted downward pressure on the market freight rates of North American routes. Last week, the transportation market was weak, the balance between supply and demand was not satisfactory, and the market freight rate showed a trend of adjustment. Until 12th May, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,385/FEU and US$2,381/FEU, fell by 4.7% and 0.6% accordingly.

The Persian Gulf and the Red Sea:

The transportation demand showed a steady recovery after Ramadan, the fundamentals of supply and demand were solid, and spot booking prices rose slightly. Until May 12th, the freight rate (sea freight and sea freight surcharges) for exports from Shanghai Port to the basic port market in the Persian Gulf was US$1,298/TEU, an increase of 0.1% from the previous period.

Australia/ New Zealand:

The demand for various materials in the local market showed signs of stabilization, and the relationship between supply and demand tended to be balanced. This week, the market freight rate rebounded after continuous adjustment. Until 12th May, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$225/TEU, which rose by 3.2% from the previous week.

South America:

The transportation demand remains stable, the fundamentals of supply and demand are basically balanced, and the market freight rate continues to rise slightly this week. On May 12, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1955/TEU, a 1.3% rose from the previous week.