We are back from CNY and immediately the most front-line information is prepared for you to catch up on the market during and after the holiday. Why not make an assumption first, about the stainless steel prices? According to the record, in the past five years, over half of the time, the stainless steel prices tended to rise after the CNY. Having experienced the rocky place last year, after the CNY 2024, the market opened stably. Stainless steel prices remained steady and had a petite rise with trading increased. As for the inventory, legitimately, it rose during the holiday but the production in January also reduced by 270,000 tons, which is larger than last year's holiday. Chinese were having family time while some parts of the world still could not get rid of the war. The constant conflict in the Red Sea influenced the sea freight greatly. It is not settled yet, and it is still a huge threat. However, do you remember the exaggerated hikes of sea freight in 2022? The immense profit attracted the shipping companies to build more ships and these large capacities will rush into the market this year. Analysis sees there will be an oversupply in shipping capacity this year because international transactions might fail to climb up as two years ago. Hey, we are so grateful to you for clicking in and reading our report. If our Stainless Steel Market Summary In China can help you to make a better decision, that is very important to us.

Trend|| Stainless steel market begins stably.

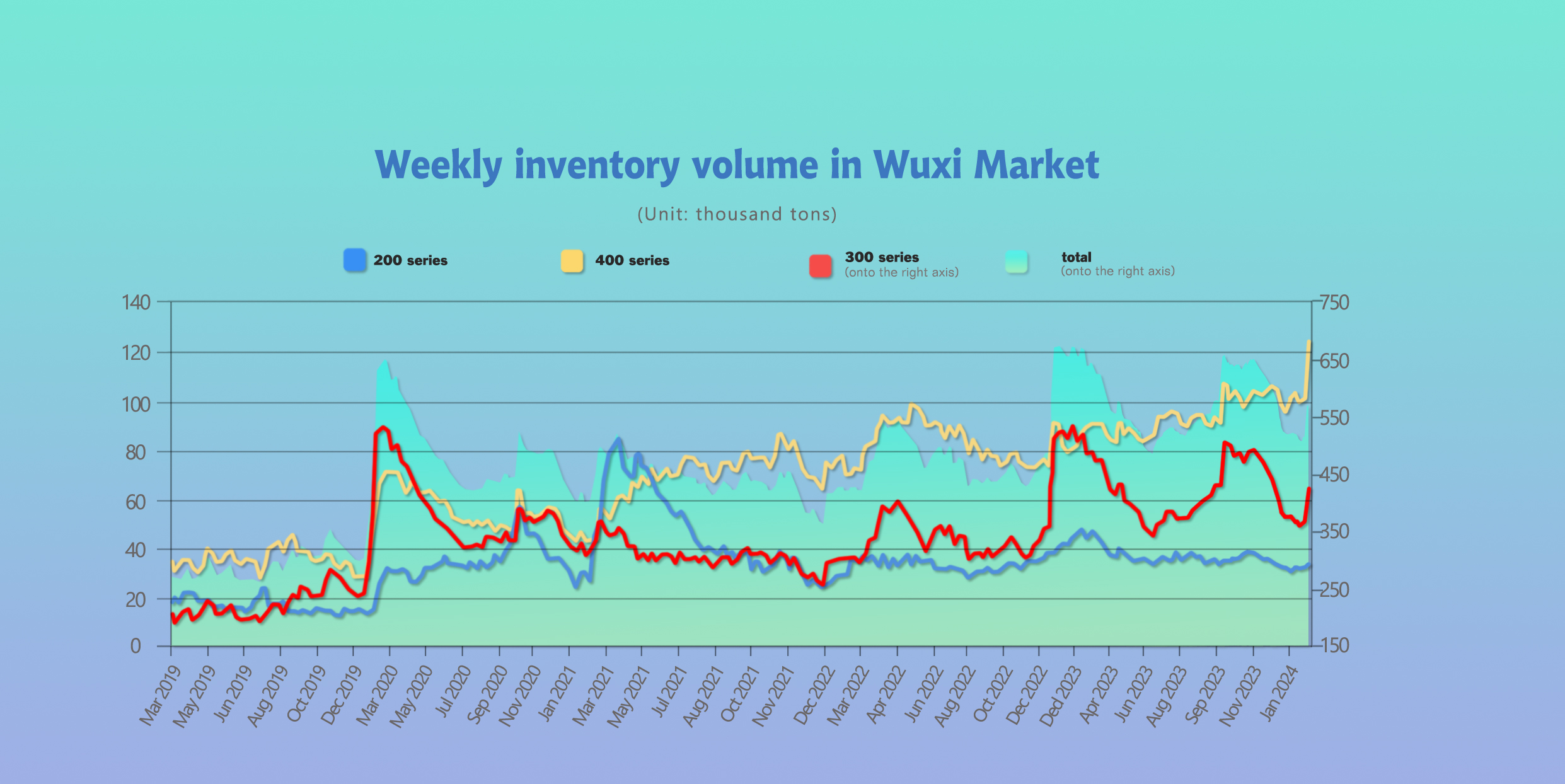

The total inventory at the Wuxi sample warehouse rose by 87,808 tons to 604,095 tons (as of 19th February).

the breakdown is as followed:

200 series: 1,316 tons up to 37,633 tons

300 Series: 59,832 tons up to 425,144 tons

400 series: 26,660 tons up to 141,318 tons

Stainless steel 300 series: CR remained and HR rose a bit.

The market price of stainless steel 304 also remained steady after Chinese New Year: the 4-foot cold rolled stainless steel 304 was quoted unchangeably at US$2025/MT, the private produced hot rolled stainless steel rose by US$7/MT to US$1990/MT.

During the Chinese New Year holiday, TISCO, Delong and Tsingshan continued to delivered resources to the market. Due to sequential maintenance of steel mills before and after the Chinese New Year, the accumulation of inventory during this holiday period was significantly lower than last year (during the 2023 Chinese New Year period, 300 series in the Wuxi area recorded 150,000 tons of stocking). It is reported that due to limited transportation capacity during the holiday, Wuxi still faces continued inventory accumulation pressure.

Stainless steel 200 series: Inventory rose slightly during Chinese New Year.

The spot price of stainless steel 201 remained stable in Wuxi market last week: the most traded base price of cold-rolled stainless steel 201J1 and hot rolled stainless steel 201J1 remain unchanged at US$1390/MT and US$1350/MT respectively.

The total inventory of the 200 series in the Wuxi market increased by 13,000 tons to 37,600 tons last week. Certain amount of resources arrived in the market during the Chinese New Year holiday, leading to a slight increase in inventory. As Steel mills went through maintenance and reduced production before and after the Chinese New Year, supply was cut. One of the major steel mill in South China, which was shut down for maintenance, officially resumed production on January 28th. It is expected that the supply of the 200 series will gradually loosen.

Stainless steel 400 series: Steady as usual.

There was no significance change in spot price of 400 series after the Chinese New Year: last week, the mainstream quote price of cold rolled stainless steel 430 closed at US$1265/MT and hot rolled stainless steel 430 ended at US$1135/MT.

According to inventory data on the first working day after the Chinese New Year holiday, the inventory of 400 series increased by 26,700 tons to 141,300 tons. Both cold-rolled and hot-rolled inventory experienced a significant increase. As the downstream production is gradually recovering, the demand is considerably releasing, which is expected to increase and facilitate destocking.

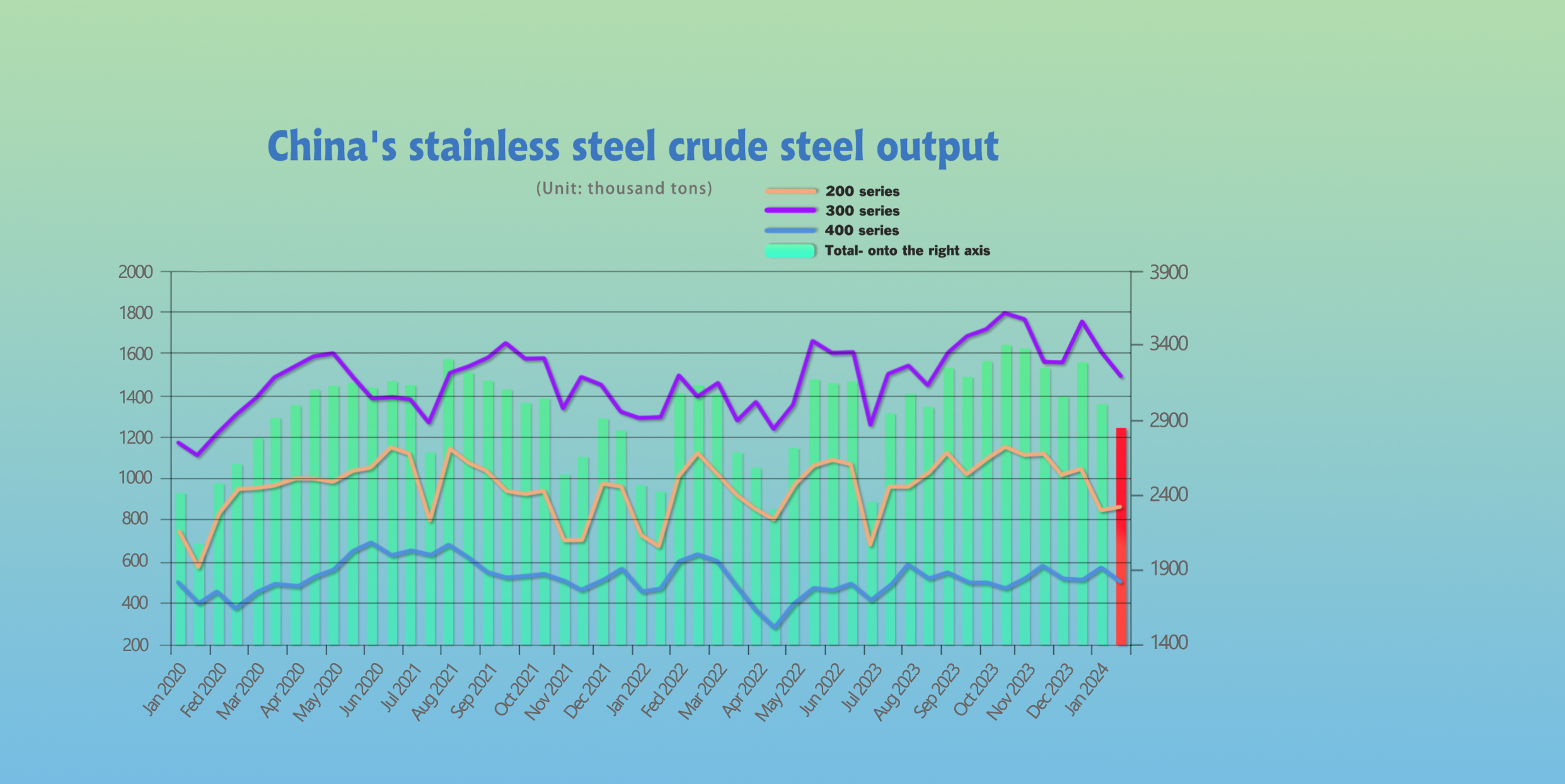

Stainless steel production reduced by 270,000 tons in January.

According to statistics, in January 2024, the crude steel output of domestic stainless steel enterprises above designated size was 3.0212 million tons, a month-on-month decrease of 274,400 tons, a decrease of 8.33%; a year-on-year increase of 671,300 tons, an increase of 28.57%.

The output of each department increased or decreased in January. The details of the output of each department are as follows:

The output of 200 series was 846,700 tons, a month-on-month decrease of 197,000 tons, or 18.87%, and a year-on-year increase of 170,600 tons, or 25.23%.

The output of 300 series was 1.6039 million tons, a month-on-month decrease of 145,900 tons, or 8.34%, and a year-on-year increase of 343,600 tons, or 27.26%.

The output of the 400 series was 570,500 tons, a month-on-month increase of 68,500 tons, an increase of 13.64%, and a year-on-year increase of 157,100 tons, an increase of 38%.

A total of 13 steel plants were inspected before and after the Spring Festival (January to February), affecting nearly 880,000 tons of stainless steel production, including 520,000 tons of 200 series, 300,000 tons of 300 series, and 60,000 tons of 400 series. Looking forward to February, as most steel mills resume production in mid-to-late February for maintenance, the production schedule of various departments in February will further shrink. According to research and statistics, in February, the 200 series production was scheduled to be 860,000 tons, the 300 series was scheduled to produce 1.49 million tons, and the 400 series was scheduled to produce 500,000 tons. The total production schedule was around 2.85 million tons.

Sea Freight Review:

The growth on Global trade slowed down due to low economic recovery and unstable geopolitical situations. Developed economies such as Europe and the United States saw a shift in consumer spending pattern from goods to services, leading to a significant decline in merchandise imports, further impacting trade.

The forecast data from major global consulting firms indicate that in 2023, global container shipping volume increased by less than 1%, with a shortfall of millions of TEUs compared to the peak period in 2021.

Sea freight capacity oversupplied

The container shipping market faced severe overcapacity in 2023. According to statistics from major global consulting firms, global container fleet capacity increased by approximately 8% compared to the previous year, doubling the growth rate of 2022.

On one hand, the delivery of new vessels was concentrated and led to a significant increase in capacity. In 2023, more than 2 million TEUs of new capacity were delivered globally, reaching a historical high. On the other hand, the easing of supply chain congestion further released additional capacity to the market.

According to the statistics from Drewry, a reduction of 4% in effective capacity occurred due to reduced port congestion in 2023, compared to 21% in 2022, representing an effective capacity growth of nearly 30% in 2023 compared to the previous year.

Market freight rates remained at low levels in the past year, resulting a greater shrink in industry profits. Among the major shipping companies, ZIM Shipping and Wan Hai Lines both reported losses in the first three quarters of 2023. Maersk's container shipping business also incurred losses in the third quarter of 2023.

According to Drewry's prediction, in 2023, the overall revenue of the global container shipping market decreased by nearly 60% compared to 2022, and operating profits were only one-tenth of the previous year, equivalent to the level of 2020.

Outlook for the International Container Shipping Market in 2024

Global trade growth will increase from less than 1% in 2023 to 3.3% in 2024, bringing confidence for the recovery of container shipping market demand, WTO predicts.

During 2020-2022, the tightness in pandemic-induced supply chain disrupted the traditional peak and off-peak seasons of shipments in the container shipping market. In 2024, as container logistics supply chains return to normal and the market further recovers from pandemic disruptions, the seasonal and cyclical nature of transportation demand is expected to be restored, facilitating steady demand growth. Based on the forecasts made by major consulting firms, the demand growth rate for the container shipping market in 2024 is expected to land between 3% and 4%.

The downward trend in freight rates is narrowing

Drewry pessimistically predicts that in 2024, the global freight rate (including fuel surcharges) will be around US$758 /TEU, a decrease of 33% compared to the previous year.

Overall, the improvement in freight rates throughout 2024 is project to be limited. However, considering the significant decline in 2023, the downtrend is not likely to extend.

In the short term, impacted by the Panama Canal drought and the escalating tension in the Red Sea, since the end of 2023, the market has faced a certain capacity shortfall, and the supply-demand relationship has tended to be tight, providing a good recovery window for the freight rates.

According to the Shanghai Containerized Freight Index (SCFI), as of January 26, 2024, the comprehensive SCFI index stood at 2179 points, doubling from the beginning of December 2023. The freight rates for Europe-Mediterranean routes were three times higher, and the rates for Trans-Pacific routes were approximately 2.6 times higher compared to the previous period. Unless there is a substantial improvement in the Red Sea crisis, it is expected that freight rates will fluctuate at relatively higher levels in the short term.