The People's Bank of China issued an additional 1 trillion yuan in government bonds last week, boosting short-term confidence in the commodity market. However, raw material prices such as nickel-iron and chrome iron have eased, and cost support continues to decline. Stainless steel prices maintained weak. Spot price was falling to a new bottom line last week although stainless steel mills have kept cutting output down to reduce the stress on the inventory. But stainless steel 316 was seemed to be robust last week, which increased by US$52/MT on a weekly basis. As the traditional peak season passes, it is predicted that the stainless steel prices will remain low. From the export perspective, the export volume in September dropped by 23,200 tons from August to 343,000 tons. If you want to know more about the market dynamics, please keep reading our Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,245 | -22 | -1.03% |

| Foshan | 2,285 | -22 | -1.01% | ||

| Hongwang | Wuxi | 2,175 | -10 | -0.47% | |

| Foshan | 2,180 | -12 | -0.60% | ||

| 304/NO.1 | ESS | Wuxi | 2,085 | -18 | -0.90% |

| Foshan | 2,105 | -21 | -1.03% | ||

| 316L/2B | TISCO | Wuxi | 3,830 | 52 | 1.44% |

| 3,880 | 22 | 0.59% | |||

| 316L/NO.1 | ESS | Wuxi | 3,640 | 40 | 1.15% |

| Foshan | 3,645 | -7 | -0.20% | ||

| 201J1/2B | Hongwang | Wuxi | 1,365 | -7 | -0.55% |

| Foshan | 1,365 | 0 | 0% | ||

| J5/2B | Hongwang | Wuxi | 1,275 | -7 | -0.59% |

| Foshan | 1,275 | -3 | -0.24% | ||

| 430/2B | TISCO | Wuxi | 1,285 | -1 | -0.12% |

| Foshan | 1,265 | -8 | -0.27% |

TREND|| The Spot price is now challenging a new bottom line.

Influenced by the weak market performance and the price limitation, the spot price of the stainless steel series had a clam movement last week: grade 201 fell slightly; 304 and 430 remained stable but weak. The mainstream contract price of stainless steel rose from US$5.5/MT to US$2135/MT.

Stainless steel 300 series: Trading volume experienced a hardship.

Until last Friday, the mainstream base price of private produce cold-rolled 4-foot mill-edge stainless steel 304 was quoted as US$2130/MT with a US$7 drop while hot-rolled stainless steel remained unchanged at US$2085/MT.

The stainless steel market harvested a decent performance last Tuesday, but then it turned quiet in the rest of the week as the end users still remained discretion on purchasing. Besides, Tsingshan continued to place limitations on the market price.

Stainless steel 200 series: The price trend went against the market prediction.

The spot price of stainless steel 201 ran smoothly but weak until last Friday: the mainstream base price of stainless steel 201J1 and 201J2/J5 fell US$7/MT to US$1335/MT and US$1245/MT accordingly, the 5-foot hot rolled stainless steel copied the same decline from others to US$1280/MT.

Stainless steel 400 series: Price was stable but weak

The JISCO and TISCO made a 0% change for the market guidance price of stainless steel 430/2B at US$1420/MT and US$1525/MT respectively.

The mainstream quote price of stainless steel 430/2B in the Wuxi market was presented as US$1285/MT, and stainless steel 430/No.1 was quoted as US$1135/MT.

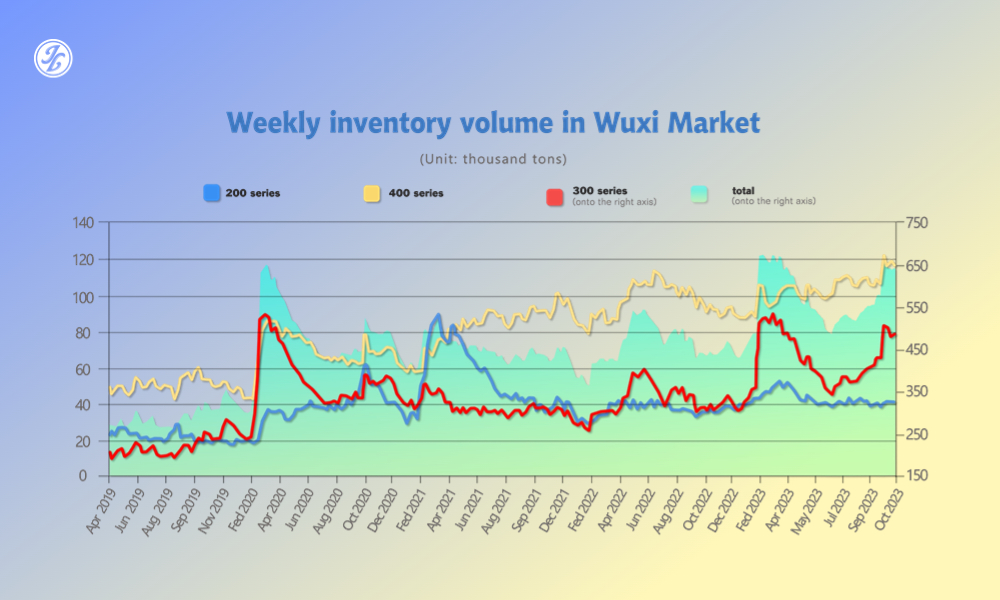

INVENTORY|| Production cut continues

The total inventory at the Wuxi sample warehouse increased by 3,211 tons to 638,779 tons (as of 26th October).

the breakdown is as followed:

200 series: 48 tons down to 39,984 tons

300 Series: 5,377 tons up to 483,400 tons

400 series: 2,118 tons down to 115,395 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| October 19th | 40,032 | 478,023 | 117,513 | 635,568 |

| October 26th | 39,984 | 483,400 | 115,395 | 638,779 |

| Difference | -48 | 5,377 | -2,118 | 3,211 |

Stainless steel 300 series: Cold rolled down, hot rolled up.

The inventory of cold rolled stainless steel extended the downtrend from the previous week while the hot rolled stainless steel inventory accumulated over a thousand tons. Moreover, steel mills are cutting their production till November in response to the current high inventory level.

Stainless steel 200 series: Excessive inventory ceased, for now.

The slight destocking last week was mainly hot-rolled stainless steel resources, and the cold-rolled stainless steel had a minor increment. Affecting the stainless steel 304’s volatility, stainless steel 201’s 3-week accumulation in inventory ceased.

Stainless steel 400 series: slight reduction in inventory.

The market performance of the 400 series took a turn for the better, underselling was adopted by some of the stainless-steel sellers and the inventory also had a minor decrease. In the short term, the spot inventory might experience a small fluctuation due to the short supply in October.

RAW Material|| Iron ore depreciated amid Output reduction.

The oversupply in the stainless steel market is somewhat relieved by the progressive establishment of production cuts for steel producers from October to November. It is understood that producers are now suffering a loss from input to output.

Last week, the mainstream quote price of ferronickel fell US$1.38/Nickel point to US$260/Nickel point; the quoted price of high carbon ferrochrome was roaming from US$1285/MT-US$1315/MT(50% chromium); the theoretical production cost of cold-rolled stainless steel 304 was US$2230/MT.

Summary: stainless steel prices tend to remain weak

The stainless-steel market maintains a cautious attitude towards the current low prices, with average transaction volumes. The market's performance is more influenced by changes in production plans on the steel mill side, as the demand side is unlikely to produce the optimism factor to stimulate the market. Most steel mills are currently operating at a loss, maintaining normal shipments under inventory pressure. While there is ample market supply, spot inventory has decreased, and production has also declined. These are positive signs, but they seem to only provide motivation for low-level restocking in the current market. It is expected that in the short term, the supply will continue to take the initiative to reduce production to alleviate supply and demand contradictions.

300 Series: The People's Bank of China issued an additional 1 trillion yuan in government bonds last week, boosting short-term confidence in the commodity market. However, raw material prices such as nickel-iron and chrome iron have eased, and cost support continues to decline. Downstream companies are mainly making just-in-time purchases, and there is a strong wait-and-see attitude. The market's shipment situation is moderate. It is expected that the mainstream cold-rolled base price of the 300 series for the next week will fluctuate between USD$2110/MT-US$2165/MT.

200 Series: Overall, 201 saw a small decrease in inventory last week, and market demand was relatively stable, with minimal impact on prices. Last Friday, steel mills have not yet issued new contract prices, and traders are quoting in line with mainstream prices. In the future, focus on steel mill contract price information, and it is expected that the 201 market will remain relatively stable or slightly weak in the coming time.

400 Series: The primary raw material, high-chromium, market prices were relatively weak. Last week, Tsingshan confirmed the purchase price for high-chromium in November at US$1315/MT(50% chromium), which is a reduction of US$41/MT compared to the previous week. It is expected that 430/2B prices will range from US$1260/MT- US$1285/MT in the short term.

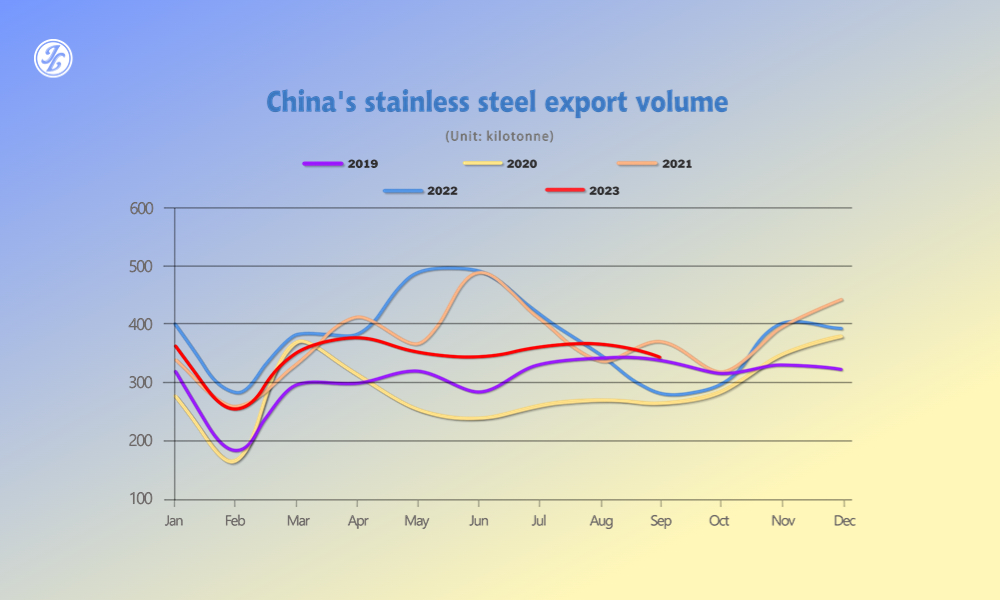

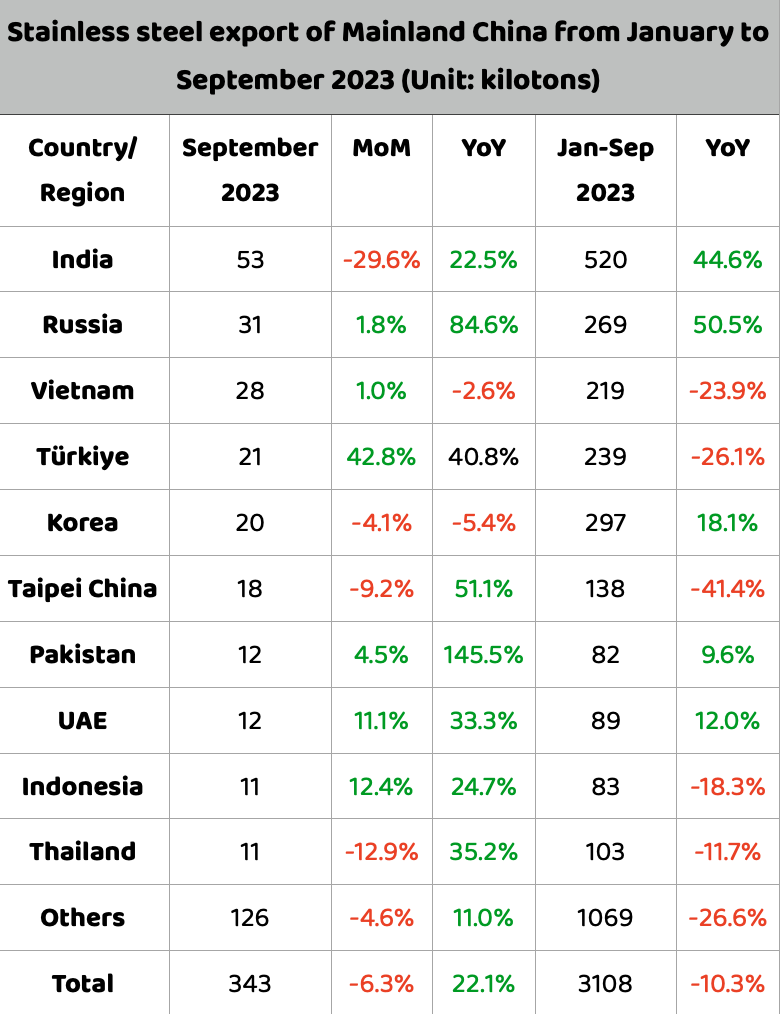

EXPORT|| 6.3% drop in stainless steel export.

According to China Customs: The export volume of stainless steel in September was about 343,000 tons, 23,200 tons (or 6.3%) decrease MoM and 62,200 tons (or 22.1%) increase YoY. The total stainless-steel export until September was summed up as 3,108,100 tons, 356,000 tons (10.3%) drop YoY.

The export volume from the top 10 areas in China was about 217,500 tons, a proportion of 63.4% of the total. From January to September, the cumulative quantity is about 2,038,700 tons, making up approximately 65.59% of the total.

The stainless steel export to the EU in September had a rebound of 17.1% MoM, but it is still considered as low as it had 16.4% less than the same period last year. For the period from January to September in 2023, the cumulative quantity is approximately 106,000 tons, representing a 71.2% decrease compared to the previous year.

Sea Freight|| The Freight market acquired a positive turnabout.

The containerized freight market sustain robust growth, and freight rate in multiple sea route becoming more valuable.

China’s Containerized Freight market was overall stabilized, on 27th October, the Shanghai Containerized Freight Index rose by 10.3% to 1012.6.

Europe/ Mediterranean:

HCOB's flash euro zone Composite Purchasing Managers' Index (PMI), compiled by S&P Global and seen as a good guide to overall economic health, fell to 46.5 in October from September's 47.2 and its lowest since November 2020.

As we are entering the contracting season, shipping companies have begun to control their capacity deployment, leading to a significant increase in market freight rates last week.

Until 27th October, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$769/TEU, which surged by 32.4%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1221/TEU, which fell by 10.1%

North America:

The economic activity in the US private sector continued to expand at a modest pace in early October, with the S&P Global Composite PMI rising to 51 from 50.2 in September.

Assessing the survey's findings, “hopes of a soft landing for the US economy will be encouraged by the improved situation seen in October," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

Until 27th October, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1916/FEU and US$2361/FEU, reporting a 9.7% and 7.4% growth accordingly.

The Persian Gulf and the Red Sea:

Until 27th October, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 14.4% from last week's posted US$1101/TEU.

Australia/ New Zealand:

Until 27th October, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$792/TEU, a 11.7% jump from the previous week.

South America:

The freight market had a slight rebound. on 27th October, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2425/TEU, an 12.1% increment from the previous week.