It seems that the world economy is in a strange loop. China's manufacturing PMI in July was 49%, declined by 1.2% from June, returning down below 50%, showing a contractionary tendency in the manufacturing industry. The S&P Global Eurozone Manufacturing PMI fell to 49.8 in July of 2022 from 52.1 in June, pointing to the first contraction in factory activity. The US Manufacturing PMI also fell slightly to 52.2 in July of 2022, pointing to the lowest factory growth since July of 2020. The demand for stainless steel has stayed tepid in China and abroad. But last week, as the Fed said the interest rate hike will be smoother, the market was once lightned up. However, under the bearish market, we could not hope for more but stability. For more about the stainless steel prices and forecast, please keep reading Stainless Steel Market Summary in China for last week.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,765 |

-54 |

-2.01% |

|

Foshan |

2,810 |

-54 |

-1.97% |

||

|

Hongwang |

Wuxi |

2,645 |

-40 |

-1.58% |

|

|

Foshan |

2,600 |

-51 |

-2.02% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,535 |

-30 |

-1.23% |

|

Foshan |

2,565 |

-36 |

-1.45% |

||

|

316L/2B |

TISCO |

Wuxi |

4,265 |

-48 |

-1.15% |

|

Foshan |

4,310 |

-48 |

-1.14% |

||

|

316L/NO.1 |

ESS |

Wuxi |

3,955 |

-48 |

-1.24% |

|

Foshan |

4,000 |

-48 |

-1.23% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,515 |

-21 |

-1.48% |

|

Foshan |

1,505 |

-13 |

-0.96% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,440 |

0 |

0% |

|

Foshan |

1,440 |

-9 |

-0.68% |

||

|

430/2B |

TISCO |

Wuxi |

1,205 |

-16 |

-1.49% |

|

Foshan |

1,190 |

-18 |

-1.65% |

Trend|| LME nickel price soars. Stainless steel prices to remain steady.

From July 25th to July 29th, all series of stainless steel stopped declining and tend to be steady. Influenced by the Fed’s interest rate hike, China’s stainless steel futures price increased. Until July 29th, the most-traded contract of stainless steel futures dropped by US$36/MT to US$2,490/MT. On the same day, at night, LME nickel rose by almost 10%, and ShFE nickel also went up over US$26,946 (CNY¥180,000). Stainless steel prices increased steadily as nickel price rose.

300 series of stainless steel: Macro releases good news. Stainless steel price decrease slows down.

Earlier last week, Tsingshan and Delong reduced the prices to promote sales. The prices of stainless steel in Wuxi and Foshan continued to drop; the price of futures fluctuated to fall. The transaction was bland. On July 28th, the Fed raised the rate by 75BP which was within expectation. Bowell said that the rate hike will be slowed down in the future. In response, the futures price rebounded and the spot prices also slowed down the decreasing pace. Until July 29th, the main quoting price of the cold-rolled 4-foot stainless steel was US$2,585/MT which declined by US$52/MT; the hot-rolled stainless steel was quoted at US$2,525/MT which decreased by US$30/MT on-week basis.

Because the prices of high-nickel iron and ferrochromium reduce, in theory, the production cost of cold-rolled stainless steel 304 drops by US$34/MT.

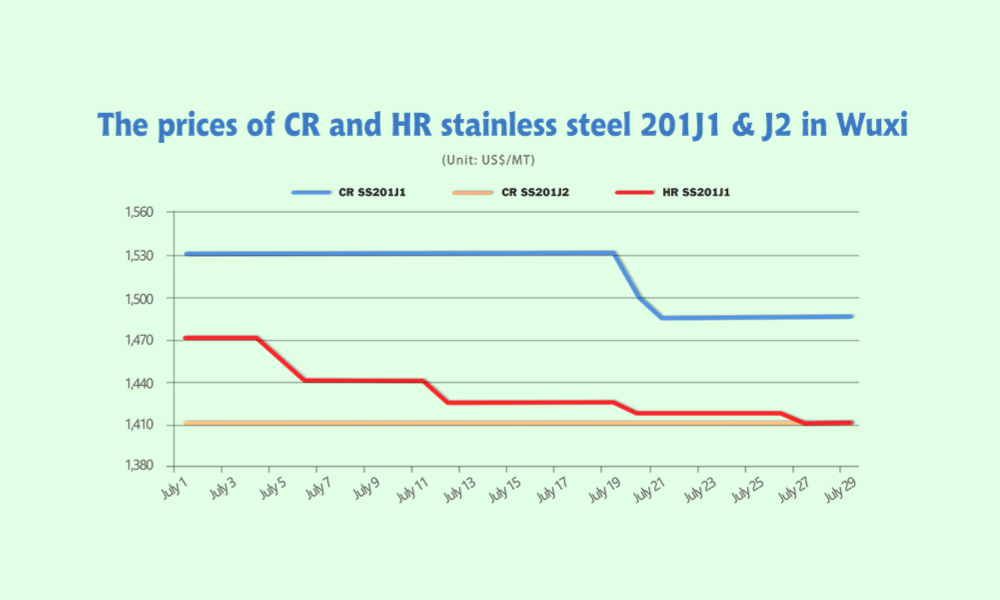

200 series of stainless steel: Transaction is weak, the price remains steady.

Last week, the price of cold-rolled stainless steel 201 was generally weak but tended to be weak. Until last Friday, the base price of cold-rolled stainless steel 201 remained at US$1,485/MT. The price of cold-rolled stainless steel 201J1 also maintains stable at US$1,410/MT; but the hot-rolled 5-foot stainless steel decreased by US$7/MT on-week basis, falling to US$1,410/MT.

The prices have been propping up and remained stable in July.

In July, the price of stainless steel 201 in Wuxi was weak. The spot prices were too low to earn a margin and even there was a deficit. Steel mills united to prop up the prices, and traders followed suit. The prices remained steady generally.

From July 25th to July 29th, the price of cold-rolled stainless steel 430 decreased by US$15/MT, to US$1,205/MT in Wuxi on July 28th.

400 series of stainless steel: Prices are open to increasing.

On July 27th, rumor already has it that the price of cold-rolled stainless steel 430 would increase because the 400 series of stainless steel were in great deficit, and in August, the production will continue to be reduced. On July 29th, news about JISCO closing the stock was spread in the market. The spot price of cold-rolled stainless steel 430 rose. Before this increase, the price dropped for three months. On 29th, the quotation of JISCO and TSICO’s CR SS430 increased to US$1,220/MT ~ US$1,255/MT which was US$15/MT ~ US$30/MT over a day before.

Summary:

The most-traded contract of stainless steel futures was stable and started to rebound, and went up to above US$2,525/MT, which boosted the volume of positions.

The stainless steel stock tends to be stable in a short term. It is because the stock price dropped by a large range recently, but there shows an upward tendency lately and the discount will be difficult to enlarge. Besides, the raw materials of stainless steel production have dropped for rather a long time, which has little room to bear for the prices to further decrease. In a broader view, Beijing will remain a loose monetary policy which will benefit the manufacturing industry to recover.

Although the stock is working toward stability, there won’t be a large scale of increases, because, the most important, is that the demand has remained tepid and buyers are cautious in stocking up. What’s more, steel mills have plans to reduce production in August, but 200 series and 400 series take the major part. We can’t see an obvious reduction in the production of 300 series. The profit margin of the stainless steel 300 series is relatively larger, and thereby, some steel mills even have plans to expand the production of 300 series, which will cause some pushback to the digestion of the spot inventory. Except for the domestic situation, imports from Indonesia will continue to rise. The new cold-rolled capacity of Yongwang Indonesia will be delivered to China in September.

In a short term, the production cost will remain and stop the stainless steel prices from falling. With the governmental boost, stainless steel prices might increase a bit. However, the whole market is still stuck in the mud of oversupply.

300 series of stainless steel: After this round of pandemics, the domestic and abroad demand for stainless steel returns slowly. To promote sales, the prices have to maintain low. The bearish sentiment brought by the rate hike contemporarily fades and the investment vibe warms up. The price of stainless steel futures rebounded along with the trend of nickel price. In a short term, the stainless steel spot price will fluctuate to return steadily. The base price of the cold-rolled stainless steel 304 by the private-owned mills will stay above US$2,525/MT.

200 series of stainless steel: The transaction of stainless steel 201 in Wuxi was weak. The market is rather rigid. Traders tend to wait and follow steel mills’ dynamics. Lately, the spot prices are stable, because steel mills are yet to open and the production cost maintains high. It is predicted that the price of stainless steel 201 will remain steady and the cold-rolled 4-foot stainless steel 201J2 and J5 will fluctuate between US$1,410/MT and US$1,440/MT.

400 series of stainless steel: The cost of producing 400 series keeps decreasing, but it is still losing money at the current selling price. Steel mills are propping up the prices. It is predicted that the price tends to rise between US$1,225/MT and US$1,270/MT.

Inventory|| While steel mills keep cutting productions, the inventory is increasing.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| July 22nd | 35,665 | 349,474 | 104,450 | 489,589 |

| July 29th | 35,548 | 355,970 | 103,189 | 494,707 |

| Difference | -117 | 6,496 | -1,261 | 5,118 |

Until July 28th, the inventory volume in the Wuxi sample warehouse increased by 5,100 tons to 494,700 tons. 200 series inventory decreased by 100 tons, to 35,500 tons; 300 series increased by 6,500 tons, to 356,000 tons; 400 series decreases by 1,300 tons to 103,200 tons.

200 series of stainless steel: Less delivery to the market, spot inventory reduces slightly.

The inventory of stainless steel 200 series in Wuxi was reduced by 100 tons, to 35,500 tons. The new arrival of stainless steel was less than usual, and resources of Baosteel Desheng and Beigang New Materials still took the majority of the goods. There are some resources from other steel mills that are shipping to Wuxi. The transaction of last week was bland. Although transportation has returned to normal, the feeble downstream demand is too weak to awaken the purchasing intention of the manufacturers. For now, both parties—— steel mills and the stock market are prone to prop up the stainless steel price. It is predicted that the spot prices will maintain steady.

Throwing back to July, the inventory of 200 series in Wuxi reduced on a whole. In the first week of June, all stainless steel markets shut down and transportation was suspended due to the pandemics. The trading market almost bogged down and thereby the inventory volume did not change much compared to that at the end of June. During the second week, the transportation started to recover, and steel mills sent resources to replenish the stock. The inventory of 200 series rose. In the rest two weeks, all steel mills reduced the delivery volume, and Wuxi was also back on track. The market activities warmed up, which consumed the inventory.

300 series of stainless steel: AOG kept on board, and inventory continued to rise.

From July 25th to July 29th, the inventory of stainless steel 300 series in Wuxi continued to increase, which rose by 6,500 tons on-week basis, reaching 356,000 tons. The increase of inventory was concentrated in the pre-inventory, while it has slight ups and downs in other social inventory. Resources of Delong took the majority of the new arrivals last week. Considering that stainless steel 300 series is around the profit equilibrium, which still has some profit margin compared to 200 series and 400 series which have been losing money, some steel mills have shifted the production from 200 series and 400 series to 300 series. The output of the stainless steel 300 series might continue to rise.

400 series: Steel mills cut down output and delivery

The oversupply situation is relieved a bit since steel mills cut down the production. Particularly, JISCO reduced about 40,000 tons of stainless steel 400 series output in July. Last week, the spot inventory of stainless steel 400 series dropped by 1,300 tons from a week ago, decreasing to 103,200 tons.

The inventory decreased and output reduced because steel mills are losing money on it. JISCO is going to keep cutting down the production of stainless steel 400 series by half in August. Other steel mills will maintain low productivity due to the high production cost. The delivery volume will be influenced, if the profit margin fails to recover.

Raw material|| ShFE nickel once went above US$2,825 (CNY¥180,000)

Nickel: The price of ferronickel will remain weak.

The Fed raised the interest rate by 75bp and said that the future rate hike will be smoother, which boosted the stock market. The ShFE nickel once went above US$2,825 (CNY¥180,000).

The price of nickel ore remained last week. The nickel ore price maintains weak because China’s price of ferronickel has been gloomy. However, the price of nickel ore can hardly go any lower. The price will probably keep in this impasse. It is predicted that the price of nickel ore will tend to weaken in a short term.

Steel mills keep suppressing the price of ferronickel. The price continued to fall, and last week it dropped to US$192/Ni. The bad news is that stainless steel production is to reduce further in China in August. Meanwhile, the import of Indonesian ferronickel is rising recently. We can see an oversupply of ferronickel in China. The price of ferronickel will run weakly in a short term.

But refined nickel has an upward tendency because the LME nickel inventory keeps decreasing and hits a historic low, declining to 57,800 tons. In China, the rising nickel price did not appeal to more purchases. Therefore, the increase soon slowed down and the situation will remain as the importing goods will replenish the domestic demand in August. As the Fed said that the rate hike will be smoother, the USD index declined, and it is beneficial for the nickel price to improve.

Chrome: The import of chromium ore was less by 158,800 tons in June, but the price keeps falling.

The price of chromium ore continued to drop because the demand is weak. Steel mills lowered the purchasing price of high chromium which decreased significantly by US$97/MT (with 50% of chromium content) and reduce the purchasing scale. The market is getting bearish.

On the other side, the import of chromium ore decreased though, the price was weak still. According to the customs data, in June 2022, China’s importing volume of chromium ore was 1,268,300 tons, MoM decreased by 158,800 tons which accounted for 11.13%, and YoY increased by 3.57%. The import from South Africa even dropped greater. It was 887,600 tons which were 313,800 tons less than that of May this year, down by 26.12%.

In July, South Africa continued high-level power outages for nearly two weeks. Although it is expected to end soon, its influence on the production of chrome ore and ferrochromium production will become tangible. Therefore, the domestic supply of chromium ore will be limited and ease the continuous drop in price. However, as long as the demand maintains bearish, the price of chromium ore will stay weak.

FREIGHT|| Sea freight cools down.

The SCFI on July 29th slightly decreased to 3887.85, declining by 2.7% on-week basis.

Europe/ Mediterranean: The PMI of July of Eurozone declines to 49.4, showing a slight recession of manufacturing and the service industry. On July 29th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$5,416/TEU, down by 2.8% from last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$5,971/TEU, down by 3.7% from the previous week.

North America: The US’s GDP continues to decline in the second quarter and the inflation remains. The economic recovery is facing greater challenges. On July 29th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$6,694/FEU and US$9,348/FEU, respectively, down by 0.4% and 1.0% from the previous week.

The Persian Gulf and the Red Sea: The demand is weakening. On July 29th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$2,789/TEU, decreasing by 6.1% from the last week.

Australia/ New Zealand: On July 29th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$2,997/TEU, down by 4.6% from the previous week.

South America: After weeks of increase in sea freight, last week, the service of this route finally cooled down a bit. Influenced by the Fed rate hike, the local economy has been fluctuating. The sea shipping is now in the traditional peak season. The spot market booking price continued to rise. On July 29th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$9,439 /TEU, down by 0.5% from the previous week.

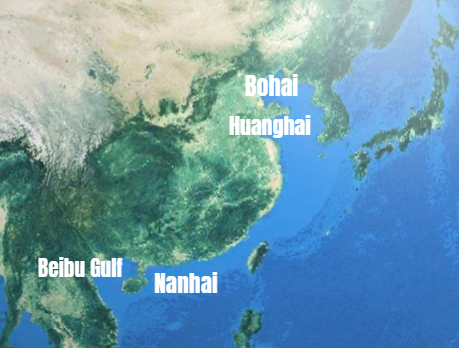

Outbreak: Congestion risk and postponed delivery amid navy trainings.

China's major waters continue to be closed due to military missions and other reasons. Please keep abreast of relevant information.

From August 2nd to August 14th, many China’s sea areas such as the Bohai Sea, the Yellow Sea, the South China Sea, and the Beibu Gulf were banned due to military missions. It may have a certain impact on the delay of the ship schedule, and the ship will open late and arrive late.