What a suprise! Stainless steel prices increase steadily last week. As China continues to untie the policy against COVID-19, more stainless steel producers are getting confident about the future market and production. It is predicted that in December, the expected stainless steel output reduction will decrease. LME nickel remained the increasing tendency last week which also gave a chance for the stainless steel sellers to work on the prices. About the sea freight, some lines such as Shanghai to Australia/New Zealand increased significantly because the shippping companies reduce the capacity to avoid the sea freight to go any lower. It seems that it is working. More about the Stainless Steel Market Summary in China, please keep reading.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,675 |

26 |

1.03% |

|

Foshan |

2,720 |

26 |

1.02% |

||

|

Hongwang |

Wuxi |

2,610 |

32 |

1.30% |

|

|

Foshan |

2,610 |

35 |

1.42% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,515 |

41 |

1.73% |

|

Foshan |

2,545 |

20 |

0.85% |

||

|

316L/2B |

TISCO |

Wuxi |

4,325 |

35 |

0.84% |

|

Foshan |

4,400 |

29 |

0.68% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,175 |

35 |

0.87% |

|

Foshan |

4,220 |

20 |

0.50% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,540 |

0 |

0.00% |

|

Foshan |

1,525 |

22 |

1.57% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,445 |

0 |

0.00% |

|

Foshan |

1,445 |

23 |

1.77% |

||

|

430/2B |

TISCO |

Wuxi |

1,245 |

-9 |

-0.77% |

|

Foshan |

1,245 |

-1 |

-0.13% |

TREND||Santa Claus rally in Stainless steel market?

Most of the spot prices of the stainless-steel series went up last week. Hot-rolled stainless steel 201 and stainless steel 304 faced up. The most traded contract price of stainless steel rose by US$83 to US$2660/MT while stainless steel 430 had dropped after stabilizing last Friday.

Stainless steel 300 series: Nickle and Stainless steel growing strong.

The spot price of cold-rolled 4-foot mill-edge stainless steel 304 rose by US$36 to US$2570/MT, and hot-rolled stainless steel 304 quoted US$2520/MT with a US$44 raise. Some of the traders recorded US$2690/MT for the base price of cold-rolled stainless steel. LME Nickel and ShFE Nickel were trending upward lately due to the chain reaction caused by the loosened policy on COVID restriction.

The price of ferronickel had a US$15 increase to US$1290/MT(with 50% chromium), and the theoretical production cost rose US$17 to US$2580/MT.

Stainless steel 200 series: Market tunning warm as the price rose a little.

The spot price of the 200 series remained a strong trend. The base price of cold rolled stainless steel 201 remained unchanged, quoted at US$1510/MT. The base price of cold-rolled stainless steel 201J2 is also flatted at US$1415/MT. The price of hot rolled 5-foot stainless steel rose US$22 to US$1445/MT.

The transaction heated up last Monday as the Nickle price and future price surged, then the market quieted down a day after.

Stainless steel 400 series: spot inventory dropped; price remained weak

The guidance price of stainless steel 430/2B stabilized at US$1380/MT and US$1335/MT, quoted by TISCO and JISCO respectively.

The quoted price of 430/2B at the Wuxi market stabilized then turned weak last week, closing at between US$1240/MT-US$ 1245/MT, a US$7 drop.

The EXW price of high chromium closed at US$1290/MT-US$1320/MT(with 50% chromium) with US$$15 increase. The spot price of chrome ore had gained what it lost on Friday while the coke price trended upward.

In summary:

Stainless steel 300 series: The production capacity had limited by the up raising production cost, the output, therefore, was unable to increase. The future price and spot price of stainless price are projected to trend upward.

Stainless steel 200 series: Traders at Foshan and Wuxi are issuing the invoice and announcing the holiday schedule, indicating that the sales period is coming to an end. Hence, the production cut and the loosening of COVID restrictions also led to an uprising in market performance.

Stainless steel 400 series: The digestion in inventory had accelerated as the pandemic restriction is easing off and more transactions finalized at the lower profit margin.

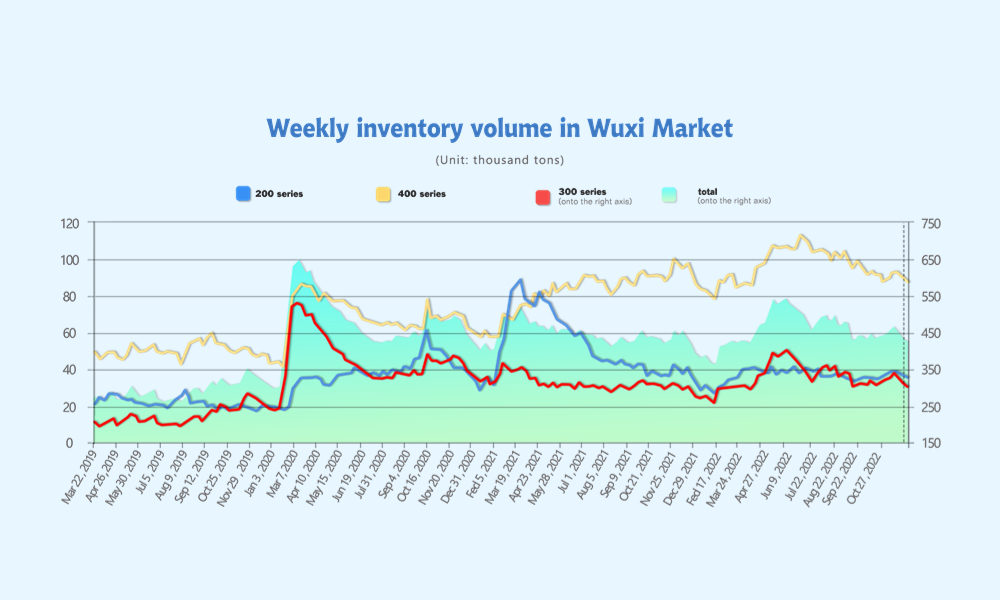

INVENTORY|| Price surge, the inventory level goes in a different direction

The inventory level at the Wuxi sample warehouse fell by 9,979 tons to 424,616 tons (as of 8th December).

the breakdown is as followed:

200 series: 878 tons down to 35,450 tons

300 Series: 7,782 tons down to 301,815 tons

400 series: 1,319 tons down to 87,351 tons

Stainless steel 200 series: inventory slightly drops

The inventory of 200 series had dropped for three consecutive weeks, and cold-rolled stainless steel took most of the reduction. The inventory level is estimated to continue to shrink due to the production reduction.

Stainless steel 300 series: Distribution dropped, and inventory follow suit.

The preposition warehouse had the most of the 7,800 tons consumption of series 300 inventory. Producers like Tsingshan and Delonghad set limits on their distribution amount earlier this month, but the latter resumed their normal distribution.

Stainless steel 400 series: inventory reduces

The supply pressure is easing off as the production cut on stainless steel across series is underway, but the demand remains at a low level although the steel mills are narrowing down their profit margin to lower their inventory down. The digestion of inventory is still promising in the later times this year as China is progressing in easing off the COVID restriction.

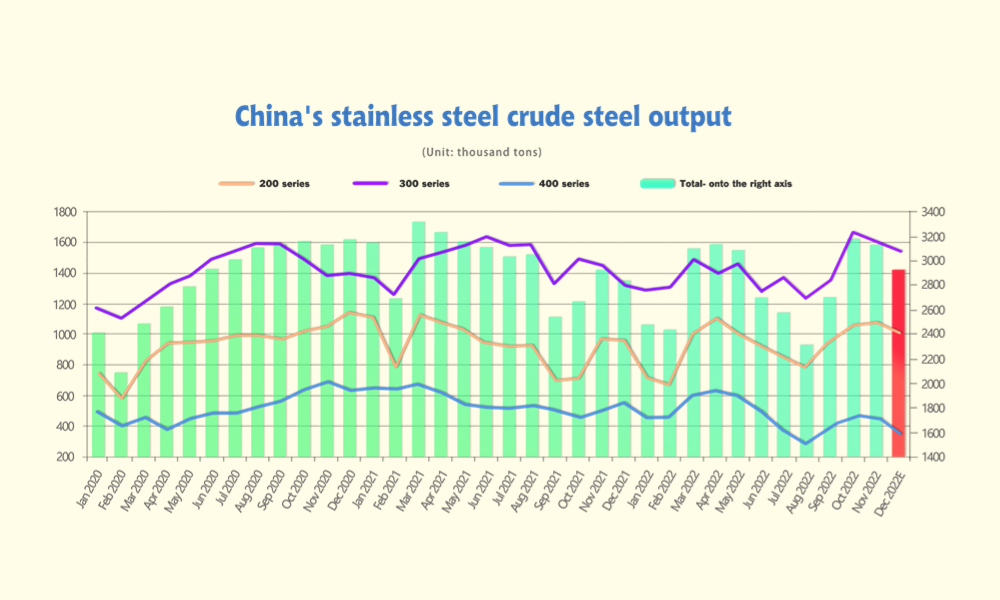

Crude stainless steel: Output is lower than what the market expected

The production of crude stainless steel in November was totaling 3,129,500 tons, 47,200 tons (1.49%) lesser than last month, 209,600 tons (7.18%) increment compared to the same period last year.

Here is the breakdown:

Series 200 Production: 1,070,800 tons, 12,000 (1.13%) tons more than last month, 101,800 tons (10.51%) more than the same period last year.

Series 300 Production: 1,600,800 tons, 54,000 (3.26%) tons lesser than last month, 155,400 tons (10.75%) more than the same period last year.

Series 400 Production: 457,900 tons, 5,200 (1.12%) tons lesser than last month, 47,600 tons (9.42%) lesser than the same period last year.

As China waves goodbye to COVID control, the market is turning warm and production activities are gradually back to normal. The total production volume of crude stainless steel so far in December is about 3,020,000 tons, 100,000 tons lesser than last month, 300 series had 60,000 tons down to 1,540,000 tons, 200 series fall 40,000 tons to 1,030,000 tons; 400 series fall 5,000 tons to 450,000 tons.

As a whole, the production is lower than the market expectation despite the production recovery from the COVID restriction. The future price of stainless steel had climbed up to US$2600/MT as the inventory pressure is worn off in Wuxi and Foshan.

RAW MATERIALS|| The price of ore went up

Nickle: LME Nickel surged to US$32,230/MT

Intercontinental Exchange Inc. approached to buy the LME earlier this year from owner Hong Kong Exchanges & Clearing Ltd., according to people familiar with the matter. While ICE was rebuffed it may try again in the future, said the people, who asked not to be identified discussing private information. CME Group Inc. doesn’t believe the LME is for sale and is focusing on its own metals business, but it may be interested in bidding for the LME in the future, said people familiar with its thinking. China's nickel buyers, the world's biggest purchasers of the metal, have asked producers to switch to SHFE contracts to price their supplies next year. LME’s position in world metal trading would further diminish. LME Nickle spike 10% on 7th December to US$32,230/MT, the highest record since May. Affecting the dramatic rise in London, ShFE Nickle also rose significantly by US$1535/MT to US$32,070/MT.

On 8th December, Nickel prices continued to hike as the US dollar was weakening. China had announced 10 new COVID-easing steps in managing to recover the economy. Indonesia is considering withdrawing the nickel export ban and enabling taxation. The global nickel inventory bottomed at a historical low as the supply and demand were both weakened.

Chrome:The Power outage interrupted the Nickel export

The price of chrome ore spiked last week due to the increasing freight rate in China and the major power outage in South Africa. Commencing on the 2nd of December afternoon, the biggest power supplier in South Africa, Eskom repeated the worst power cut level on record, and the situation could be worsening. It is becoming the X-factor in the supply of chrome ore and ferronickel.

SEAFREIGHT|| Freight rate got a slight bounce back

The sluggish situation of China's container transportation market was continuing as the demand was still laying low. The decline of freight rates on multiple sea routes is slowed and begins to bounce back as the loosening COVID restriction in China. Until 2nd December, the Shanghai Containerized Freight Index was downed by 2.8% to 1138.09.

Europe/ Mediterranean: According to Eurostat, retail sales fell by 1.8% during the month, down from a gain of 0.8% in September. Economists had predicted the figure would decline by 1.7%.

Until 9th December, the freight rate slowed down the declining. The freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1047/TEU, an 3.5% decrease. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1841/TEU, down by 0.8%

North America: The Initial jobless claims rose to 230,000 last week from 226,000 the week before, the Bureau of Labor Statistics said on Thursday. That took the rolling average for initial claims over the last four weeks up to 230,000 - the highest it's been since September. The figures appear unlikely to change the Federal Reserve's opinion that further interest rate rises will be needed to take the heat out of a labor market where unemployment is still at a historically low level while there are still over 1.7 vacancies for every unemployed person.

On 9th December, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,430/FEU and US$3,290/FEU, 0.5% and 4.3% fall accordingly.

The Persian Gulf and the Red Sea: The freight rate dropped last week. On 9th December, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 1.1% fall from last week's posted US$1171/TEU.

Australia/ New Zealand: The freight rate had bounced back. On 9th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$705/TEU, significantly went up by 17.1% from the previous week.

South America: The imbalanced supply-demand curve and high inflation rate dragged the freight rate down. On 11th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1834/TEU, down by 9.4% from the previous week.